The savings ratio is a measure of the proportion of an individual's or a nation's income that is saved rather than spent on consumption. It is expressed as a percentage and indicates the financial health and stability of an individual or a country. Understanding the savings ratio is vital for individuals to manage their personal finances effectively and for policymakers to gauge the economic stability of a country. A high savings ratio signifies that individuals are financially secure and can afford to invest in their future, whereas a low ratio may indicate financial strain and limited capacity for investment. A variety of factors can influence an individual's or a country's savings ratio, such as income levels, cultural values, access to financial services, economic stability, and government policies. The savings ratio is composed of two main components: gross income and savings. Understanding these components is essential for accurate calculation and interpretation of the savings ratio. Earned income refers to the money individuals receive as compensation for their work, such as salaries, wages, bonuses, and commissions. Unearned income is money received from sources other than employment, such as dividends, interest, rental income, and capital gains. Savings can be accumulated in various forms, including bank deposits, investments in stocks and bonds, retirement accounts, and real estate. Savings play a vital role in personal financial planning, as they provide a safety net for emergencies, enable individuals to achieve financial goals, and contribute to long-term financial stability. The savings ratio is calculated by dividing total savings by gross income and multiplying the result by 100 to obtain a percentage. A higher savings ratio indicates a greater proportion of income being saved, while a lower ratio signifies more income being spent on consumption. Savings ratios can vary significantly across countries, reflecting diverse cultural, economic, and political factors. Differences in savings ratios across countries can be attributed to various factors, such as income levels, cultural attitudes towards savings, access to financial services, and government policies. Cultural values and economic conditions also play a significant role in shaping a country's savings ratio. For example, countries with strong cultural emphasis on saving, such as China and Japan, tend to have higher savings ratios than countries with a more consumption-oriented culture, like the United States. Savings ratios can be used to analyze several key economic indicators, including Gross Domestic Product (GDP), consumer spending, investment, and disposable income. A higher savings ratio may contribute to higher GDP, as savings can be invested in productive assets, fueling economic growth. Conversely, a lower savings ratio may result in lower GDP, as it indicates higher consumption and reduced investment. A higher savings ratio usually indicates lower consumer spending, as individuals save more of their income instead of spending it on goods and services. Lower consumer spending may have a negative impact on economic growth in the short term. Conversely, a lower savings ratio suggests higher consumer spending, which may boost economic growth in the short term but may not be sustainable in the long run. A higher savings ratio can promote investment, as individuals and businesses have more resources available for investment in productive assets. This can contribute to economic growth and development. On the other hand, a lower savings ratio may lead to a decline in investment, potentially harming long-term economic growth. Disposable income refers to the income available for spending and saving after accounting for taxes and other mandatory deductions. A higher savings ratio indicates a larger portion of disposable income is being saved, while a lower savings ratio implies more disposable income is being spent on consumption. Incorporating the savings ratio into personal financial planning can help individuals set savings goals, develop strategies to improve their savings ratio, and ensure long-term financial stability. Establishing clear savings goals is essential for effective personal financial planning. These goals should be tailored to an individual's unique financial needs, priorities, and circumstances. Various strategies can be employed to improve an individual's savings ratio, such as increasing income, reducing expenses, automating savings, and investing in assets that generate passive income. Financial advisors can play a critical role in helping individuals develop personalized financial plans, set savings goals, and implement strategies to improve their savings ratio. Policymakers use the savings ratio to inform fiscal and monetary policies aimed at promoting economic growth and stability. Fiscal policies refer to government actions related to taxation, spending, and public debt management. Policymakers may implement fiscal policies that encourage savings, such as tax incentives for retirement accounts or reduced taxes on investment income. Monetary policies involve the management of a country's money supply and interest rates. Central banks may use monetary policies to influence savings ratios by adjusting interest rates, which can affect both the cost of borrowing and the return on savings. While economic policies can influence savings ratios, they may have unintended consequences or face limitations due to global economic factors, political considerations, or other constraints. The savings ratio is a crucial indicator of personal financial health and a vital component of a nation's economic well-being. Understanding the various factors that influence the savings ratio, as well as its impact on economic indicators, personal financial planning, and economic policies, is essential for individuals and policymakers alike. As the global economy continues to evolve, the importance of understanding and managing savings ratios at both the individual and national levels will remain crucial. By focusing on savings ratios, individuals can ensure long-term financial stability, while policymakers can develop strategies to promote economic growth and stability. Working with a financial advisor can significantly improve an individual's savings ratio by providing personalized financial advice, setting realistic savings goals, and developing tailored strategies to optimize income.What Is Savings Ratio?

Components of Savings Ratio

Gross Income

Savings

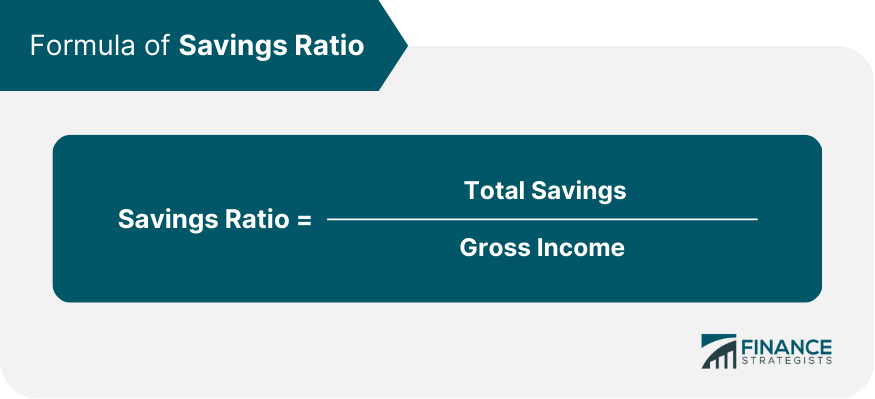

Calculation of Savings Ratio

Variations in Savings Ratios Across Countries

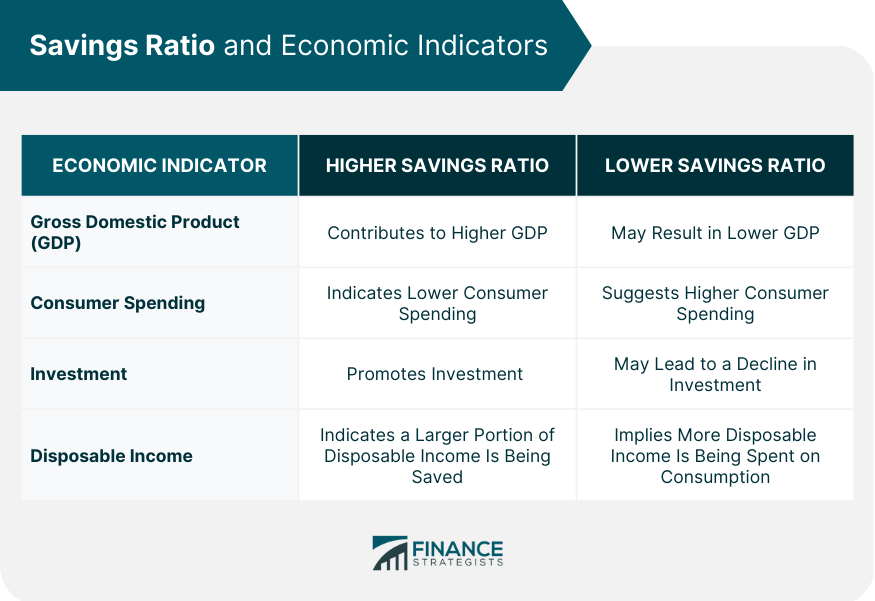

Savings Ratio and Economic Indicators

Gross Domestic Product (GDP)

Consumer Spending

Investment

Disposable Income

Savings Ratio in Personal Financial Planning

Savings Ratio in Economic Policies

Fiscal Policies

Monetary Policies

Policy Implications and Limitations

Final Thoughts

This metric is influenced by several factors, including income levels, consumer behavior, and economic policies, and has a significant impact on economic indicators such as GDP, inflation, and interest rates.

Savings Ratio FAQs

The savings ratio is the proportion of an individual's or a nation's income saved rather than spent on consumption. It is a crucial indicator of financial health, helping individuals manage their finances effectively and policymakers gauge economic stability.

To calculate the savings ratio, divide total savings by gross income and multiply by 100. A higher savings ratio indicates more income being saved, while a lower ratio signifies more income spent on consumption.

Factors influencing the savings ratio include income levels, cultural values, access to financial services, economic stability, and government policies.

Savings ratios vary across countries due to differences in income levels, cultural attitudes towards savings, access to financial services, and government policies that encourage or discourage saving.

Individuals can use the savings ratio to set savings goals, develop strategies to improve their savings ratio, and ensure long-term financial stability in their personal financial planning.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.