Student loan refinancing involves obtaining a new loan with more favorable terms to replace an existing loan. This process can help borrowers save money on interest payments, lower monthly payments, or reduce the loan term, ultimately paying off the debt faster. Refinancing can provide multiple benefits, such as reduced interest rates, lower monthly payments, and shorter repayment terms. These benefits can ease the financial burden on borrowers and help them achieve their financial goals more efficiently. Before refinancing, borrowers should carefully evaluate their financial situation, credit score, and current loan terms. It's essential to consider the potential loss of federal benefits, the new loan terms, and the reputation of the refinancing lender before proceeding. Federal student loans are funded by the U.S. Department of Education and offer a variety of repayment, deferment, and forgiveness options. These loans often have lower interest rates and more flexible repayment terms than private loans. Direct Subsidized Loans are need-based loans for undergraduate students. The federal government pays the interest on these loans while the student is in school, during the grace period, and during deferment periods, reducing the overall cost for the borrower. Direct Unsubsidized Loans are available to undergraduate, graduate, and professional students, regardless of financial need. Unlike subsidized loans, the borrower is responsible for the interest that accrues during all periods, including while in school and during deferment. Direct PLUS Loans are available to graduate or professional students and parents of dependent undergraduate students. These loans have higher interest rates and fees compared to Direct Subsidized and Unsubsidized Loans but can cover the entire cost of attendance, minus other financial aid received. Private student loans are provided by private lenders, such as banks and credit unions. These loans typically have higher interest rates and less flexible repayment options compared to federal loans. Variable-rate loans have interest rates that can fluctuate over time, based on market conditions. This can lead to lower initial interest rates, but there is a risk that the rate will increase over time, potentially raising the borrower's monthly payment. Fixed-rate loans have an interest rate that remains constant throughout the life of the loan. This provides stability and predictability for borrowers, as the monthly payment amount will not change. Credit score plays a significant role in determining eligibility for refinancing. Borrowers with higher credit scores are more likely to qualify for lower interest rates and better loan terms, as they are perceived as lower-risk borrowers. Lenders typically require proof of stable income and employment before approving a refinancing application. Having a consistent income source demonstrates the borrower's ability to repay the loan and increases the chances of approval. The debt-to-income (DTI) ratio is a key factor in refinancing eligibility. A lower DTI ratio indicates a better balance between the borrower's debt obligations and income, making them more likely to be approved for refinancing. Borrowers with lower credit scores or insufficient income may have the option to use a co-signer to improve their chances of approval. A co-signer with strong credit and income can help the borrower qualify for better loan terms. Interest rates are a crucial aspect of refinancing, as they directly impact the cost of the loan. Borrowers should carefully compare fixed and variable interest rates to determine which option best suits their financial situation and goals. Fixed-rate loans offer stability, as the interest rate remains constant throughout the loan term. This allows borrowers to plan for consistent monthly payments and ensures that the interest expense will not increase over time. Variable-rate loans can offer lower initial interest rates, but these rates may fluctuate based on market conditions. While there is potential for interest rate savings, borrowers should be prepared for the possibility of increased payments if rates rise. Repayment terms affect the duration of the loan and the total interest paid. Borrowers should consider whether a shorter repayment term with higher monthly payments or a longer term with lower payments is more appropriate for their financial situation. Monthly payments are a significant factor for borrowers when refinancing. Lower monthly payments can provide immediate financial relief, while higher payments can lead to faster debt repayment and overall interest savings. Refinancing can result in significant savings, particularly if the borrower qualifies for a lower interest rate. It's essential to weigh the potential savings against the costs associated with refinancings, such as origination fees or the loss of federal benefits. Choosing a reputable lender with strong customer service are crucial when refinancing. Borrowers should research lenders, read customer reviews, and consider factors such as transparency, responsiveness, and user-friendly loan management tools. Refinancing federal loans with a private lender may result in the loss of specific federal protections and benefits. Borrowers should carefully consider the potential consequences before refinancing. Income-driven repayment (IDR) plans allow borrowers to adjust their monthly payments based on their income and family size. Refinancing a federal loan with a private lender may eliminate the option to use IDR plans, which could increase the borrower's monthly payment. Public Service Loan Forgiveness (PSLF) is a federal program that forgives the remaining balance on eligible federal loans after 120 qualifying payments for borrowers working in public service. Refinancing federal loans with a private lender makes borrowers ineligible for PSLF. Federal loans offer deferment and forbearance options, allowing borrowers to temporarily pause or reduce their payments during financial hardships. Private lenders may not provide these options or may have more restrictive eligibility criteria, limiting borrower flexibility. Loan consolidation involves combining multiple federal loans into one loan with a fixed interest rate while refinancing replaces one or more existing loans with a new private loan. Borrowers should consider the benefits and drawbacks of each option before making a decision. Before refinancing federal loans, borrowers should weigh the potential benefits, such as lower interest rates and reduced monthly payments, against the potential loss of federal protections and benefits. This evaluation helps borrowers make informed decisions that align with their financial goals. To find the best refinancing options, borrowers should research various lenders and compare their offerings, interest rates, and terms. This step ensures that borrowers select a lender that meets their specific needs and preferences. Borrowers should obtain quotes from multiple lenders and compare interest rates, fees, and loan terms. This process helps borrowers identify the most competitive offers and select the refinancing option that best suits their financial situation. Before applying for refinancing, borrowers should gather the necessary documents, such as proof of income, employment verification, and current loan statements. Having these documents readily available can streamline the application process. Once a lender is selected, borrowers should complete the application process by submitting their personal and financial information. After approval, the borrower will need to sign the loan agreement, and the new lender will pay off the existing loans. After refinancing, borrowers should monitor their loan progress, make timely payments, and communicate with the lender as needed. Staying proactive helps borrowers stay on track with their repayment goals and maintain a strong credit history. Loan forgiveness programs, such as PSLF or Teacher Loan Forgiveness, can eliminate some or all of a borrower's federal loan debt. Borrowers should explore these programs as an alternative to refinancing, especially if they work in qualifying professions. IDR plans offer borrowers with federal loans an alternative to refinancing, as they can help reduce monthly payments based on income and family size. These plans may also lead to loan forgiveness after a certain number of qualifying payments. Federal loan consolidation allows borrowers to combine their federal loans into a single loan with a fixed interest rate. This option can simplify loan management and may qualify borrowers for certain loan forgiveness or repayment programs. Some employers offer student loan repayment assistance as a benefit to employees. Borrowers should inquire about these programs, as they can provide additional financial support without refinancing or consolidating their student loans. Student loan refinancing can offer significant benefits, including lower interest rates, reduced monthly payments, and shorter repayment terms. However, borrowers should carefully consider the potential loss of federal benefits and weigh the pros and cons before making a decision. It's crucial for borrowers to evaluate their personal financial situation and goals when considering refinancing. By thoroughly analyzing their current loans, credit scores, and income, borrowers can make informed decisions about whether refinancing is the right choice for them. Making informed decisions regarding student loan refinancing is essential to ensure that borrowers achieve their financial objectives without sacrificing valuable federal benefits. Researching lenders, comparing offers, and understanding the potential consequences of refinancing can help borrowers make the best choices for their unique circumstances. Borrowers should consider seeking the guidance of a financial advisor to navigate the complexities of refinancing and make well-informed decisions. What Is Student Loan Refinancing?

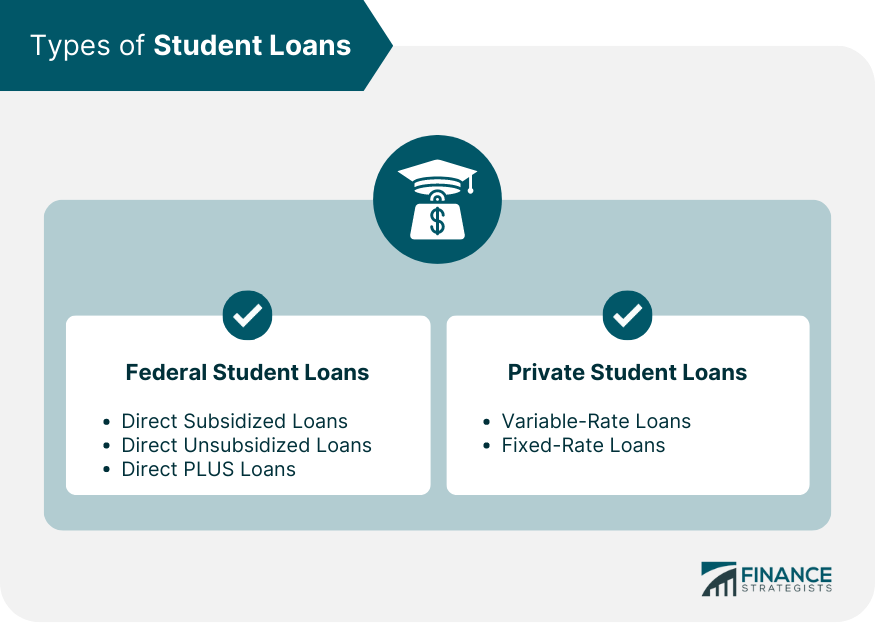

Types of Student Loans

Federal Student Loans

Direct Subsidized Loans

Direct Unsubsidized Loans

Direct PLUS Loans

Private Student Loans

Variable-Rate Loans

Fixed-Rate Loans

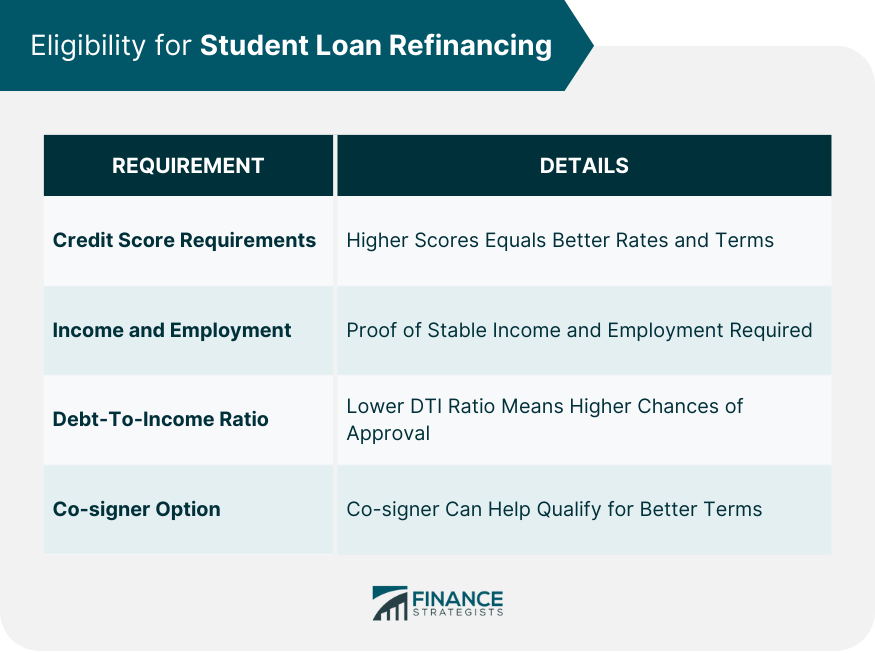

Eligibility for Student Loan Refinancing

Credit Score Requirements

Income and Employment

Debt-To-Income Ratio

Co-signer Option

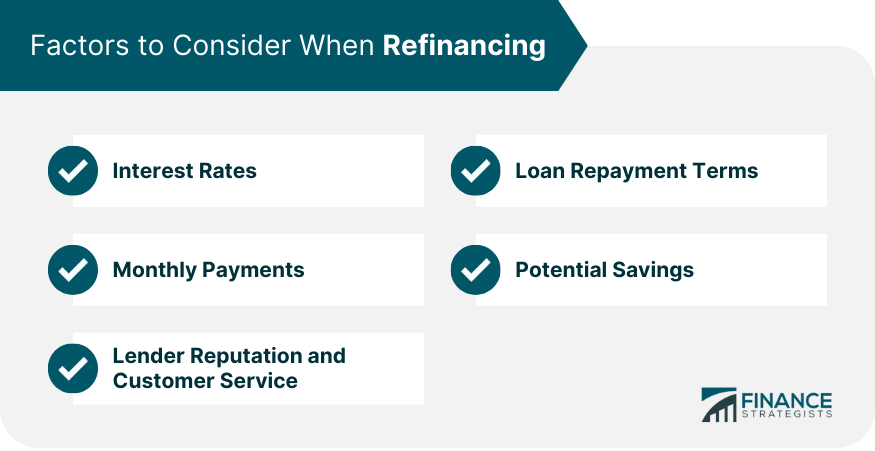

Factors to Consider When Refinancing

Interest Rates

Fixed Rates

Variable Rates

Loan Repayment Terms

Monthly Payments

Potential Savings

Lender Reputation and Customer Service

Impact of Refinancing on Federal Loans

Loss of Federal Protections

Income-Driven Repayment Plans

Public Service Loan Forgiveness

Deferment and Forbearance Options

Consolidation vs Refinancing

Weighing the Pros and Cons

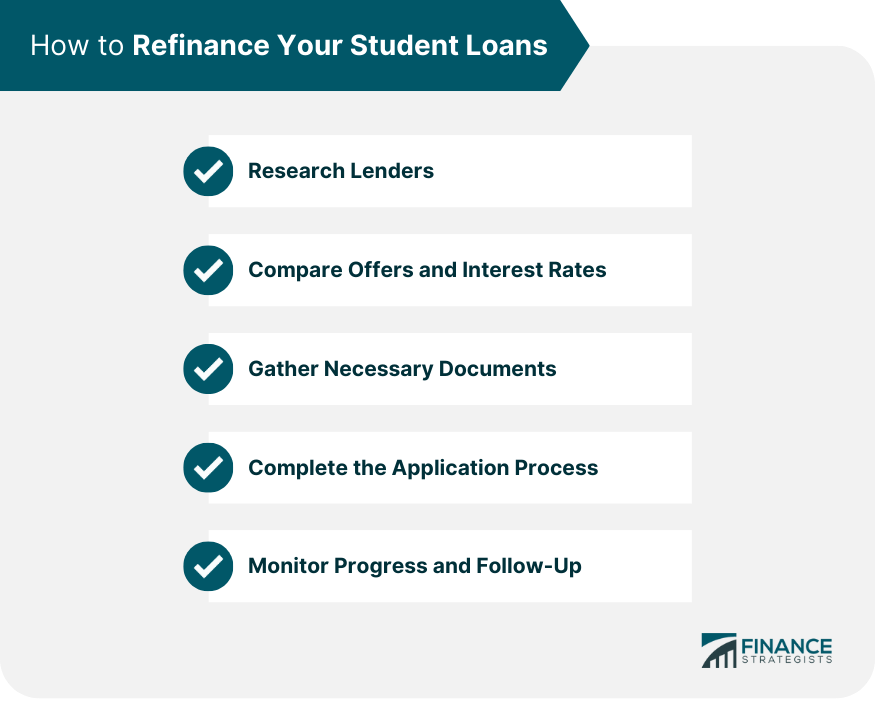

How to Refinance Your Student Loans

Research Lenders

Compare Offers and Interest Rates

Gather Necessary Documents

Complete the Application Process

Monitor Progress and Follow-Up

Alternatives to Refinancing

Loan Forgiveness Programs

Income-Driven Repayment Plans

Federal Loan Consolidation

Employer-Sponsored Repayment Assistance Programs

Final Thoughts

Student Loan Refinancing FAQs

Student loan refinancing is the process of obtaining a new loan with more favorable terms to replace an existing loan. It can benefit borrowers by offering lower interest rates, reduced monthly payments, and shorter repayment terms, potentially easing the financial burden and helping them achieve their financial goals more efficiently.

Refinancing federal loans with a private lender may result in the loss of certain federal benefits and protections, such as income-driven repayment plans, Public Service Loan Forgiveness, and deferment and forbearance options. Borrowers should carefully consider the potential consequences before refinancing their federal loans.

When selecting a lender for student loan refinancing, borrowers should consider factors such as interest rates (fixed or variable), loan repayment terms, monthly payments, potential savings, and the lender's reputation and customer service. Comparing multiple lenders and their offerings can help borrowers find the best fit for their needs.

Eligibility requirements for student loan refinancing typically include a strong credit score, stable income and employment, a favorable debt-to-income ratio, and potentially a co-signer if the borrower's credit or income is insufficient. Meeting these criteria can help borrowers qualify for better loan terms and lower interest rates.

Alternatives to student loan refinancing include loan forgiveness programs (such as Public Service Loan Forgiveness), income-driven repayment plans for federal loans, federal loan consolidation, and employer-sponsored repayment assistance programs. Borrowers should explore these options before refinancing to ensure they make the most informed decision for their financial situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.