Crowdfunding investments refer to the practice of raising funds for projects or ventures by collecting small amounts of money from a large number of people, typically via the internet. This innovative approach to raising capital has become increasingly popular in recent years. It allows entrepreneurs and businesses to access financing from diverse investors while enabling individuals to invest in projects that align with their interests or values. Crowdfunding investments have experienced significant growth in recent years, becoming a viable alternative to traditional financing methods such as bank loans, venture capital, or angel investing. This growth can be attributed to several factors, including advances in technology, increased internet connectivity, and changing attitudes toward investing. As a result, crowdfunding investments have transformed how entrepreneurs raise capital, allowing them to access funding from around the world while also providing investors with new opportunities to diversify their portfolios. In exploring the diverse landscape of crowdfunding, it is essential to understand the various types of investment platforms that cater to different funding needs and objectives. Reward-based crowdfunding offers a unique approach to raising funds, where backers contribute to projects in exchange for non-monetary rewards or perks. Kickstarter is a popular reward-based crowdfunding platform that enables creators to raise funds for their projects in exchange for rewards, which are typically products, services, or experiences related to the project. This platform has helped fund a wide range of creative projects, including art, design, film, music, and technology. It has become a go-to resource for entrepreneurs seeking to bring their innovative ideas to life. Indiegogo is another well-known reward-based crowdfunding platform that allows entrepreneurs to raise funds for their projects by offering backers various rewards or perks. Similar to Kickstarter, Indiegogo supports a wide range of projects, from technological innovations to creative endeavors. The platform also offers flexible funding options, allowing creators to choose between fixed and flexible funding models. Equity-based crowdfunding enables investors to support innovative startups and businesses by purchasing equity shares and providing capital in exchange for potential ownership and returns. SeedInvest is an equity-based crowdfunding platform that allows accredited and non-accredited investors to invest in early-stage startups in exchange for equity shares. By providing entrepreneurs with access to a broad range of investors, SeedInvest helps startups raise the capital they need to grow their businesses while offering investors the opportunity to participate in potentially high-growth ventures. Crowdcube is a leading equity crowdfunding platform based in the United Kingdom that enables investors to buy shares in startups and established businesses. The platform provides a user-friendly interface for investors to browse investment opportunities, review detailed company information, and make informed investment decisions. CircleUp is an equity-based crowdfunding platform that focuses on consumer and retail companies. The platform connects entrepreneurs with a network of accredited investors, providing startups with access to the capital they need to grow and scale their businesses. Debt-based crowdfunding presents an alternative financing solution, connecting borrowers and investors through a platform that facilitates loans in exchange for interest payments. LendingClub is a debt-based crowdfunding platform that connects borrowers with investors who are willing to fund loans. The platform provides a marketplace for personal and business loans, allowing investors to earn interest on their investments while providing borrowers with access to affordable financing options. Prosper is another debt-based crowdfunding platform that offers personal loans funded by individual investors. The platform enables borrowers to receive competitive interest rates while allowing investors to earn attractive returns on their investments. Funding Circle is a debt-based crowdfunding platform that specializes in small business loans. The platform connects small businesses with investors who are willing to fund their loans, providing businesses with the capital they need to grow and succeed. Understanding the mechanics behind crowdfunding investments is crucial, as it involves a series of steps and interactions between project creators, investors, and the crowdfunding platform. Below is the process for crowdfunding investment: The crowdfunding investment process begins with the creation of a campaign, during which entrepreneurs or project creators develop a detailed plan outlining their project, funding goals, and timeline. This plan typically includes a description of the product or service, market analysis, financial projections, and information about the project team. Additionally, creators often develop promotional materials such as videos, images, and other content to help convey their vision and generate interest among potential investors. Once the campaign is live, entrepreneurs must actively promote their projects to attract investors. This may involve leveraging social media, email marketing, public relations efforts, and other promotional strategies to increase visibility and generate buzz around the project. A successful marketing campaign can help build credibility, generate interest among potential investors, and ultimately increase the likelihood of reaching the project's funding goal. Potential investors review the campaign during the funding stage and decide whether to invest in the project. Depending on the type of crowdfunding investment platform, investors may receive rewards, equity shares, or interest payments in exchange for their contributions. Once the funding goal is reached or surpassed, the project creator typically receives the funds minus any fees charged by the platform. After the funding has been secured, the project creator is responsible for executing the project as outlined in the campaign. This may involve developing the product, launching the service, or pursuing other activities necessary to achieve the project's objectives. Investors who have backed the project will typically receive updates on its progress and may receive rewards, equity shares, or interest payments as previously agreed upon. Investors play a crucial role in the crowdfunding investment process, as they provide the necessary capital for projects to succeed. In exchange for their financial contributions, investors may receive various forms of returns, such as rewards, equity shares, or interest payments. Investors also play a role in evaluating the viability and potential of projects, helping to ensure that only those with strong prospects receive funding. Project creators are responsible for developing and executing their crowdfunding campaigns, which involves creating a compelling and detailed plan, promoting the project to potential investors, and ultimately, delivering on the promises made during the campaign. Project creators must also maintain open lines of communication with their investors, providing regular updates on the project's progress and addressing any concerns or issues that may arise. The following are the pros and cons of crowdfunding investments: The advantages of crowdfunding investments are numerous, offering benefits such as increased access to capital, market validation, and increased exposure for entrepreneurs seeking to fund their ventures. Crowdfunding investments provide entrepreneurs with access to a diverse pool of investors, making it easier to secure the necessary capital to launch or grow their businesses. This approach can be particularly advantageous for projects that may not qualify for traditional financings, such as bank loans or venture capital. Crowdfunding investments can serve as a form of market validation, as a successful campaign demonstrates that there is interest and demand for a product or service. This can help entrepreneurs refine their offerings and increase the likelihood of success in the marketplace. Crowdfunding campaigns can generate significant project exposure, helping raise awareness and attract potential customers, partners, or additional investors. This increased visibility can be particularly beneficial for early-stage startups looking to establish a presence in the market. While crowdfunding investments can offer significant benefits, there are also potential disadvantages and risks that investors and project creators should be aware of. Investing in crowdfunding projects can be risky, as there is always the possibility that a project may not succeed or deliver on its promises. Investors must carefully evaluate the potential risks and rewards before committing their funds to a particular project. Sharing detailed information about a project during a crowdfunding campaign can expose entrepreneurs to intellectual property risks, as competitors may attempt to copy or steal their ideas. To mitigate these risks, project creators should consider protecting their intellectual property through patents, trademarks, or other legal Managing a crowdfunding campaign can be a time-consuming and resource-intensive process, particularly for entrepreneurs who must balance the demands of promoting their project with the ongoing operation of their business. This may detract from the time and resources available for other critical tasks, such as product development or business expansion. As crowdfunding investments continue to gain traction, it is important to consider the legal and regulatory implications of investing in these opportunities. Regulations surrounding crowdfunding investments vary depending on the type of crowdfunding platform and the jurisdiction in which it operates. In many countries, reward-based crowdfunding platforms face fewer regulatory hurdles than equity or debt-based platforms, which may be subject to more stringent securities regulations. In the United States, the Securities and Exchange Commission (SEC) oversees equity and debt-based crowdfunding investments under the Jumpstart Our Business Startups (JOBS) Act of 2012. The JOBS Act established a regulatory framework for crowdfunding investments, setting forth requirements for both crowdfunding platforms and issuers of securities. These requirements include limits on the amount that can be raised, disclosure requirements for issuers, and restrictions on the amount that non-accredited investors can invest in crowdfunding projects. Crowdfunding investment platforms must comply with a range of legal and regulatory requirements to protect investors and project creators. This may involve obtaining necessary licenses, implementing investor protection measures, and adhering to anti-money laundering (AML) and know-your-customer (KYC) regulations. Compliance with these requirements can help maintain the integrity of crowdfunding investment platforms and foster trust among users. Navigating the world of crowdfunding investments can be challenging, but with the right strategy, investors can maximize their chances of success. Before investing in a crowdfunding project, conducting thorough research and due diligence on the project and its creators is essential. This may involve reviewing the campaign materials, assessing the project's financial projections, and evaluating the team's experience and capabilities. Additionally, investors should consider the potential risks associated with the project and weigh these against the potential rewards. As with any investment, diversification is critical when investing in crowdfunding projects. By allocating funds across a range of projects, investors can reduce their exposure to risk and increase the likelihood of achieving positive returns. Diversification can be achieved by investing in projects across different industries, stages of development, or investment types (e.g., reward-based, equity-based, or debt-based). Investors should carefully assess each crowdfunding investment opportunity's potential returns and risks. This may involve considering factors such as the project's growth potential, competitive landscape, and financial projections. Additionally, investors should consider their own risk tolerance and investment objectives when evaluating crowdfunding projects. As crowdfunding investments continue to evolve, emerging trends and technological advancements will likely shape this industry's future. As crowdfunding investments continue to evolve, several emerging trends may shape the future of this industry. These trends include the increasing adoption of blockchain technology for crowdfunding platforms, the rise of niche crowdfunding platforms targeting specific industries or causes, and the potential integration of crowdfunding investments with other financial products and services. Technological advancements, particularly in areas such as artificial intelligence (AI), machine learning, and big data analytics, may have significant implications for the future of crowdfunding investments. These technologies could help streamline the investment process, improve risk assessment and due diligence, and enable more accurate forecasting of project outcomes. The crowdfunding investment landscape will likely face several challenges and opportunities in the coming years. Potential challenges may include increased regulatory scrutiny, heightened competition among crowdfunding platforms, and concerns over investor protection. At the same time, opportunities may arise from technological advancements, increased global connectivity, and the ongoing democratization of access to capital. As the crowdfunding investment industry continues to evolve, it will be essential for platforms, project creators, and investors to adapt to these changes and seize new opportunities for growth and success. Crowdfunding investments have emerged as a transformative force in the world of finance, offering entrepreneurs and businesses a viable alternative to traditional financing methods while providing investors with unique opportunities to diversify their portfolios. Individuals can make informed decisions about their investment strategies by understanding the different types of crowdfunding investment platforms, the roles of investors and project creators, and the advantages and disadvantages associated with crowdfunding investments. As crowdfunding investments continue to evolve, emerging trends, technological advancements, and potential challenges will shape the future landscape of this industry. To navigate this complex environment and maximize the potential benefits of crowdfunding investments, investors must conduct thorough research, practice diversification, and carefully assess potential risks and rewards. Considering the complexities and ever-changing landscape of crowdfunding investments, seeking professional guidance from a wealth management expert can be a prudent decision.What Are Crowdfunding Investments?

Types of Crowdfunding Investment Platforms

Reward-Based Crowdfunding

Kickstarter

Indiegogo

Equity-Based Crowdfunding

SeedInvest

Crowdcube

CircleUp

Debt-Based Crowdfunding

LendingClub

Prosper

Funding Circle

How Crowdfunding Investments Work

Crowdfunding Investment Process

Campaign Creation

Promotion and Marketing

Funding and Investment

Project Execution and Returns

Role of Investors in Crowdfunding Investments

Role of Project Creators in Crowdfunding Investments

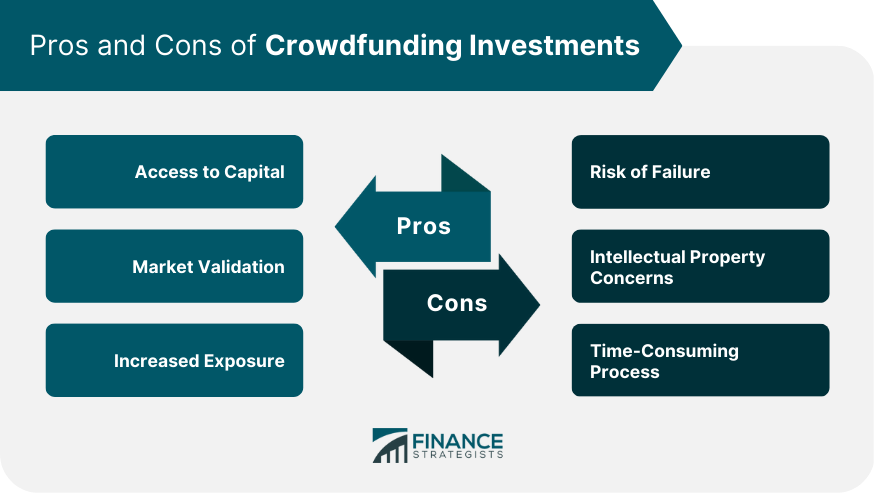

Advantages and Disadvantages of Crowdfunding Investments

Advantages of Crowdfunding Investments

Access to Capital

Market Validation

Increased Exposure

Disadvantages of Crowdfunding Investments

Risk of Failure

Intellectual Property Concerns

Time-Consuming Process

Legal and Regulatory Aspects of Crowdfunding Investments

Overview of Crowdfunding Investment Regulations

Securities and Exchange Commission (SEC) and Crowdfunding Investments

Compliance with Crowdfunding Investment Platforms

Tips for Successful Crowdfunding Investments

Research and Due Diligence

Diversification in Crowdfunding Investments

Assessing the Potential for Returns and Risks

Future of Crowdfunding Investments

Emerging Trends in Crowdfunding Investments

Impact of Technology on Crowdfunding Investments

Potential Challenges and Opportunities in the Crowdfunding Investment Landscape

Conclusion

Crowdfunding Investments FAQs

Crowdfunding investment is a funding method that involves raising capital from a large group of individuals or investors through an online platform. Investors can support projects they believe in by providing capital in exchange for rewards, equity shares, or interest payments.

Three main types of crowdfunding investment platforms are reward-based, equity-based, and debt-based. Each platform type operates differently, and investors should carefully consider the advantages and disadvantages of each before making investment decisions.

Crowdfunding investments offer several advantages, including access to a diverse pool of investors, market validation, and increased exposure. Additionally, crowdfunding investments can be a viable alternative to traditional financing methods for businesses and entrepreneurs.

Investing in crowdfunding projects can be risky, as there is always the possibility that a project may not succeed or deliver on its promises. Other potential risks include intellectual property concerns and the time-consuming nature of managing a crowdfunding campaign.

To maximize the potential benefits of crowdfunding investments, investors should conduct thorough research and due diligence on potential projects, practice diversification by investing in a range of opportunities, and carefully assess each investment opportunity's potential risks and rewards. Seeking professional guidance from a wealth management expert can also be beneficial in navigating the complexities of crowdfunding investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.