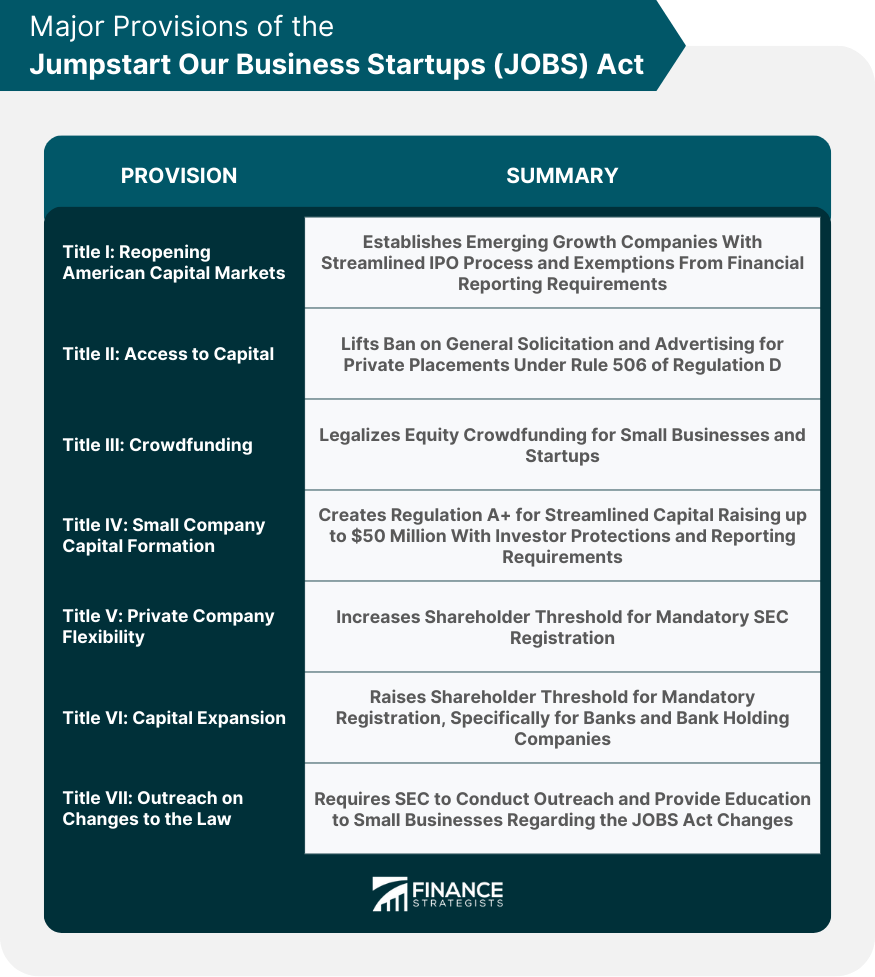

The JOBS Act is a U.S. federal law enacted in 2012, designed to ease regulatory requirements for small businesses and startups seeking to raise capital. The legislation aims to stimulate economic growth and job creation by making it easier for these companies to access funding from a broader range of investors. In response to the 2008 financial crisis and the subsequent challenges faced by small businesses seeking capital, Congress passed the JOBS Act with bipartisan support. Signed into law by President Barack Obama on April 5, 2012, the act aimed to revitalize the U.S. economy by fostering entrepreneurship and innovation. The JOBS Act seeks to achieve several objectives, including simplifying the regulatory framework for small businesses, expanding investment opportunities for the general public, and promoting job creation through the growth of startups and small enterprises. Title I of the JOBS Act establishes the category of Emerging Growth Companies (EGCs), which are businesses with annual gross revenues of less than $1 billion. This provision provides EGCs with a streamlined IPO process and temporary exemptions from certain financial reporting and disclosure requirements. Title II lifts the ban on general solicitation and advertising for private placements under Rule 506 of Regulation D, as long as all investors are accredited. This change allows businesses to reach a wider range of investors, potentially increasing access to capital. Title III, also known as the CROWDFUND Act, legalizes and regulates equity crowdfunding, allowing small businesses and startups to raise funds from non-accredited investors through online platforms, subject to certain limitations and requirements. Title IV amends Regulation A, creating Regulation A+, which allows companies to raise up to $50 million in a 12-month period through a streamlined, less burdensome process. Regulation A+ offerings are subject to investor protections and ongoing reporting requirements. Title V increases the threshold for mandatory registration with the Securities and Exchange Commission (SEC) under the Securities Exchange Act of 1934, enabling private companies to have more shareholders without becoming public companies. Title VI further raises the shareholder threshold for mandatory registration, specifically for banks and bank holding companies, encouraging capital formation in the banking sector. Title VII requires the SEC to conduct outreach and provide education to small businesses regarding the changes brought about by the JOBS Act and the potential benefits of these changes. The JOBS Act has significantly impacted capital raising by legalizing and regulating equity crowdfunding, allowing small businesses and startups to raise funds from a broader range of investors. This new funding avenue has opened doors for entrepreneurs who may have struggled to access traditional financing. The introduction of Regulation A+ has enabled businesses to raise larger amounts of capital through a simplified process, making it an attractive alternative to traditional IPOs and private placements. By lifting the ban on general solicitation and advertising for private placements, the JOBS Act has expanded the pool of potential investors, making it easier for businesses to access capital and grow. The JOBS Act has made it easier for small businesses and startups to access capital by simplifying regulatory requirements and opening up new funding avenues. This increased access to funding has supported the growth and expansion of these companies, driving innovation and economic growth. By legalizing equity crowdfunding and lifting the ban on general solicitation, the JOBS Act has democratized investment opportunities, allowing non-accredited investors to participate in the growth of startups and small businesses. This democratization has led to a more inclusive investment landscape and greater participation in the startup ecosystem. The JOBS Act has increased the flexibility of private companies by raising the shareholder threshold for mandatory registration, enabling them to grow without triggering the costs and regulatory burdens associated with becoming public companies. By facilitating capital formation for small businesses and startups, the JOBS Act has contributed to job creation and economic growth. Successful startups can create employment opportunities, foster innovation, and drive economic development. Critics of the JOBS Act argue that its provisions, particularly those related to equity crowdfunding and Regulation A+, may expose investors to higher levels of risk and potential exploitation. By easing regulatory requirements and allowing non-accredited investors to participate, the act may increase the likelihood of fraud or financial scams. The JOBS Act has been criticized for potentially increasing the risk of fraud and financial scams, given the reduced regulatory oversight and the involvement of non-accredited investors. To mitigate these risks, the SEC has implemented investor protection measures, such as investment limits and disclosure requirements. Implementing the provisions of the JOBS Act has posed significant regulatory challenges for the SEC, as it balances the goals of easing capital formation with the need to protect investors. The SEC has faced criticism for the pace at which it has implemented certain provisions and the perceived complexity of the resulting regulations. The Jumpstart Our Business Startups (JOBS) Act has significantly impacted the U.S. startup ecosystem and capital markets since its enactment in 2012. By easing regulatory requirements and introducing new funding avenues such as equity crowdfunding and Regulation A+ offerings, the act has increased access to capital for small businesses and startups, fostering innovation and economic growth. Additionally, the JOBS Act has democratized investment opportunities, enabling a broader range of investors to participate in the growth of startups and small enterprises. While the JOBS Act has achieved notable successes, it also faces criticisms and concerns related to investor exploitation, fraud risks, and regulatory challenges. As the startup ecosystem continues to evolve, further amendments and regulatory changes may be necessary to address emerging challenges and opportunities. The global influence of the JOBS Act also highlights the potential for similar legislation to be adopted worldwide, further transforming the landscape of capital formation and startup growth.What Is the Jumpstart Our Business Startups (JOBS) Act?

Major Provisions of the JOBS Act

Title I: Reopening American Capital Markets to Emerging Growth Companies

Title II: Access to Capital for Job Creators

Title III: Crowdfunding

Title IV: Small Company Capital Formation (Regulation A+)

Title V: Private Company Flexibility and Growth

Title VI: Capital Expansion

Title VII: Outreach on Changes to the Law

Impact of the JOBS Act on Capital Raising

Equity Crowdfunding

Regulation A+ Offerings

Expansion of Private Placement Opportunities

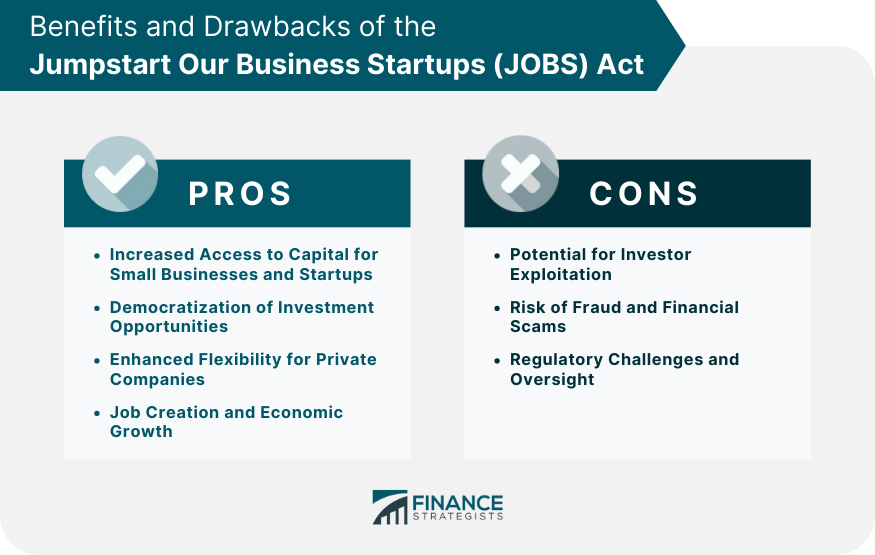

Benefits of the JOBS Act

Increased Access to Capital for Small Businesses and Startups

Democratization of Investment Opportunities

Enhanced Flexibility for Private Companies

Job Creation and Economic Growth

Drawbacks of the JOBS Act

Potential for Investor Exploitation

Risk of Fraud and Financial Scams

Regulatory Challenges and Oversight

Conclusion

Jumpstart Our Business Startups (JOBS) Act FAQs

The JOBS Act is a law passed by the United States Congress in 2012 that aimed to make it easier for startups and small businesses to raise capital through crowdfunding and other means.

The JOBS Act included several key provisions, including the creation of a new type of crowdfunding called Regulation Crowdfunding, which allows companies to raise up to $5 million from investors. It also eased restrictions on general solicitation and advertising for certain private securities offerings.

The JOBS Act has had a significant impact on the crowdfunding industry by making it easier for startups and small businesses to raise capital from a wider range of investors. It has also led to the creation of new crowdfunding platforms and increased competition in the industry.

Critics of the JOBS Act argue that it has weakened investor protections and increased the risk of fraud by allowing unaccredited investors to participate in certain private securities offerings. There are also concerns about the potential for increased volatility in the markets as a result of increased access to capital for startups and small businesses.

Title III of the JOBS Act is also known as the "crowdfunding exemption," which allows non-accredited investors to invest in private companies through crowdfunding platforms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.