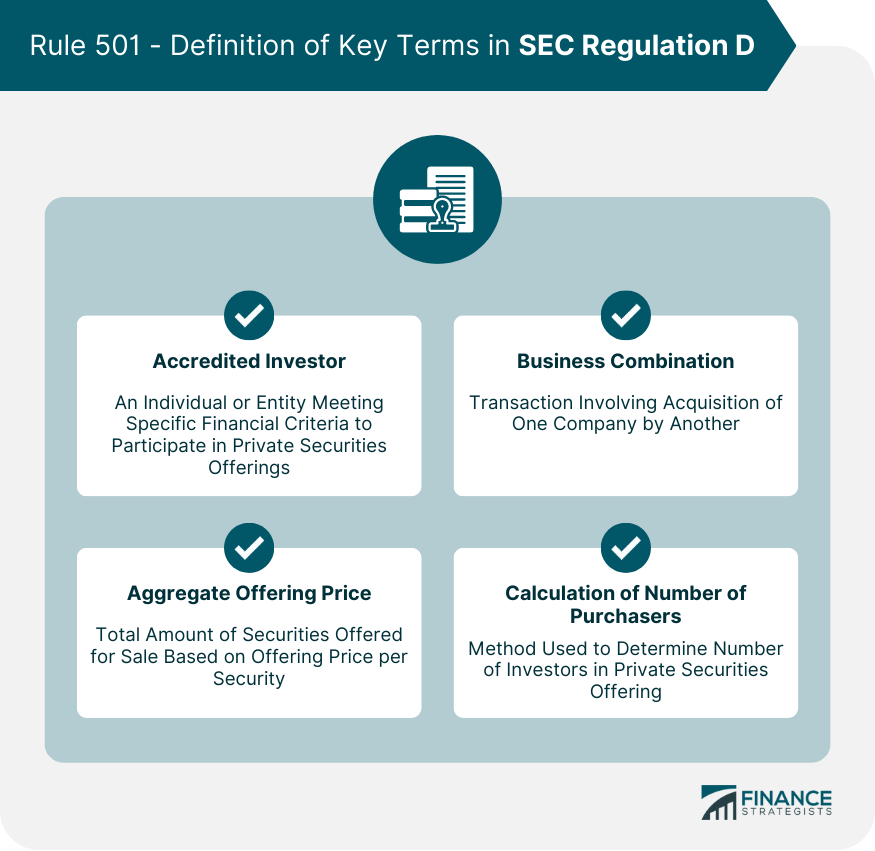

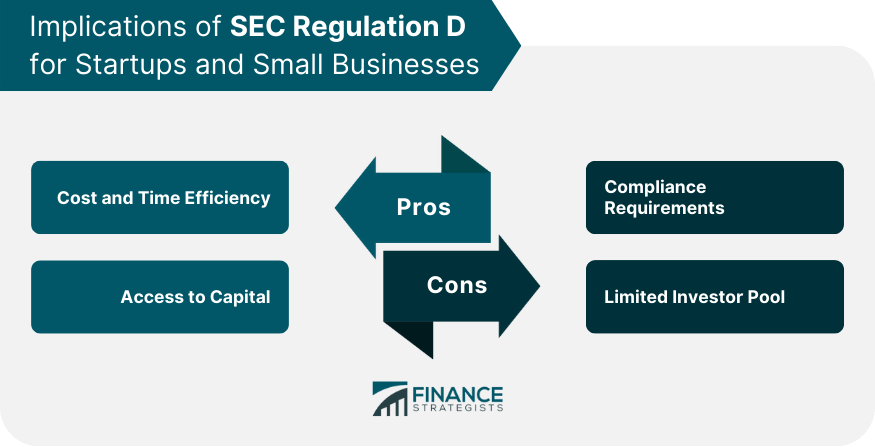

Regulation D is a set of rules implemented by the U.S. Securities and Exchange Commission (SEC) that allows companies to raise capital through the sale of securities without having to register them, provided certain conditions are met. Regulation D was designed to streamline the fundraising process, lower costs, and provide access to capital for startups and small businesses, while still maintaining a level of investor protection. In the securities market, Regulation D plays a crucial role in facilitating capital formation for smaller companies. It offers exemptions from the registration requirements of the Securities Act of 1933, allowing issuers to privately raise funds without the need for a public offering. The Securities Act of 1933 was enacted to protect investors and maintain transparency in the securities market. While the Act requires companies to register their securities before they can be offered to the public, Regulation D provides specific exemptions, enabling issuers to raise capital without registration, as long as they comply with the rules. Rule 501 of Regulation D outlines the definitions of key terms used in the regulation. Some important definitions include: Accredited investor: An individual or entity that meets specific financial criteria, such as a minimum net worth or income level, allowing them to participate in private securities offerings. Aggregate offering price: The total amount of securities offered for sale, based on the offering price per security. Business combination: A transaction involving the acquisition of one company by another, such as a merger or consolidation. Calculation of number of purchasers: The method used to determine the number of investors in a private securities offering. Rule 502 outlines the general conditions that must be met for an offering to qualify for a Regulation D exemption. These conditions include: Integration: The concept that multiple securities offerings may be treated as a single offering if they are made within a certain time frame and share similar characteristics. Information requirements: The disclosure obligations for issuers in Regulation D offerings, which vary depending on the type of investor and the specific exemption being claimed. Limitation on resale: Securities sold under Regulation D are generally subject to restrictions on resale, meaning they cannot be immediately resold in the public market. Rule 503 mandates that issuers must file a notice of sales on Form D with the SEC within 15 days of the first sale of securities in a Regulation D offering. Issuers are also required to file amendments to the Form D in certain circumstances, such as when the information provided in the original form becomes inaccurate. Rule 504 provides an exemption for limited offerings and sales of securities that do not exceed an aggregate offering price of $5 million within a 12-month period. There are restrictions and limitations on the use of general solicitation and advertising, as well as state-level regulation that may apply. Although Rule 505 has been repealed since May 22, 2017, it previously allowed issuers to raise an unlimited amount of capital from an unlimited number of accredited investors and up to 35 non-accredited investors. Rule 505 also imposed specific disclosure requirements for offerings involving non-accredited investors. Rule 506 provides two exemptions that allow issuers to raise an unlimited amount of capital without regard to the dollar amount of the offering: Rule 506(b) permits issuers to raise capital from an unlimited number of accredited investors and up to 35 sophisticated non-accredited investors, provided that general solicitation or advertising is not used. "Sophisticated investor" refers to an investor who has sufficient knowledge and experience in financial and business matters to evaluate the merits and risks of the investment. Introduced under the JOBS Act, Rule 506(c) allows issuers to use general solicitation and advertising to raise capital, provided that all purchasers in the offering are accredited investors, and the issuer takes reasonable steps to verify their accredited status. Regulation D offers several advantages for startups and small businesses looking to raise capital: Cost and time efficiency: By providing exemptions from the registration requirements, Regulation D allows companies to avoid the time-consuming and expensive process of registering securities with the SEC. Access to capital: Regulation D helps businesses access a larger pool of potential investors, including accredited investors who can invest larger amounts, enabling them to raise the necessary capital for growth. Despite the benefits, there are challenges and risks associated with using Regulation D: Compliance requirements: Companies must ensure they meet all the conditions of the applicable Regulation D exemptions, which may involve additional administrative work and legal expenses. Limited investor pool: Regulation D offerings may be restricted to accredited investors or a limited number of non-accredited investors, potentially narrowing the investor base. SEC Regulation D is a critical component of the securities market, as it offers exemptions that enable startups and small businesses to raise capital without undergoing the time-consuming and expensive process of registration. By striking a balance between investor protection and capital formation, this regulation fosters economic growth, innovation, and the overall development of the financial ecosystem. As the market continues to evolve and technology increasingly influences the way companies raise funds, Regulation D is expected to adapt and change to remain relevant and effective. By staying abreast of these developments, both issuers and investors can better navigate the private securities landscape and capitalize on the opportunities that Regulation D provides.What Is SEC Regulation D?

Background and Purpose

Role in the Securities Market

Connection to the Securities Act of 1933

Key Components of SEC Regulation D

Rule 501 - Definitions

Rule 502 - General Conditions to Be Met

Rule 503 - Filing of Notices

Exemptions Under Regulation D

Rule 504 - Exemption for Limited Offerings and Sales of Securities

Rule 505 - Exemption for Limited Offers and Sales Without Regard to Dollar Amount of Offering

Rule 506 - Exemption for Limited Offers and Sales Without Regard to Dollar Amount of Offering

Rule 506(b)

Rule 506(c)

Implications of SEC Regulation D for Startups and Small Businesses

Advantages

Challenges and Risks

Conclusion

SEC Regulation D FAQs

SEC Regulation D is a Securities and Exchange Commission (SEC) rule that provides exemptions from the registration requirements of the Securities Act of 1933 for certain types of private placements of securities.

There are three types of offerings under Regulation D: Rule 504, Rule 506(b), and Rule 506(c). Rule 504 is for offerings up to $5 million, while Rule 506 has no dollar limit. Rule 506(b) allows for up to 35 non-accredited investors, while Rule 506(c) only allows accredited investors.

The primary advantage of using Regulation D is the ability to raise capital without having to go through the time-consuming and expensive process of registering with the SEC. Additionally, Regulation D offerings can be structured to allow for greater flexibility in the terms of the offering.

Rule 506(b) prohibits general solicitation or advertising to attract investors, while Rule 506(c) allows general solicitation but requires that all investors be accredited. Rule 504 allows for general solicitation but only if certain conditions are met, such as disclosing information about the offering to non-accredited investors.

Yes, Rule 506 of Regulation D allows for offerings of unlimited size. However, the offering must be sold only to accredited investors and no more than 35 non-accredited investors who meet certain financial suitability standards.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.