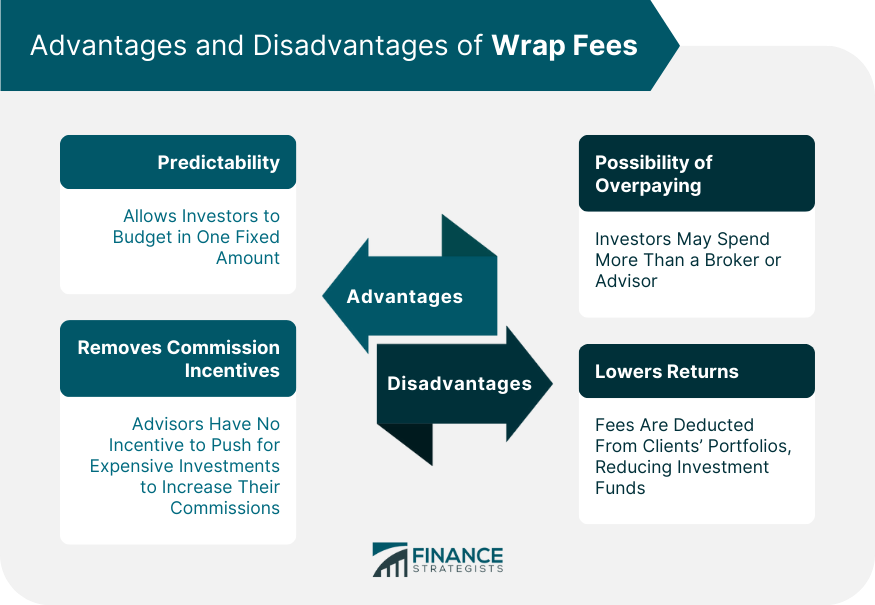

A wrap fee program is a service that provides investment advice and portfolio management to clients for one all-inclusive fee. The fee pays for the services provided to the client, including but not limited to securities transactions, portfolio management, research, brokerage, and administrative services. Wrap fee programs also provide an understanding of a client's financial goals and objectives; research and selection of assets; implementation of investment decisions; account statements, and access to real-time financial data. The Investment Advisers Act of 1940 regulates investment advisors when they offer these wrap fee programs and requires them to provide comprehensive disclosure documents before investing. This act helps ensure clients have access to all important information that affects their investment decisions. With a traditional advisory fee, you will not only have to pay the financial advisor's cost, but also the costs of account management and administration separately. In contrast, when it comes to wrap fee programs, your advisor includes several of their fees and services in order to cover all expenses within one payment. The main goal of a wrap fee program is to give investors access to an experienced investment advisor who can provide them with a multitude of services without the hassle of having to pay numerous fees and expenses. The singular fee can cover a wide range of advisory services, from regular portfolio reviews and advice on dividing assets to more comprehensive financial planning services. Depending on the needs of each client, the wrap fee may also cover the brokerage costs that come with putting investment advice into action. This could include selling and buying stocks, managing cash reserves, or any other kind of transaction that the advisor initiates on behalf of their client. This fee could also pay for things like keeping your account up to date and paying a custodian. Some wrap programs charge extra fees for services not covered by the base fee. Before signing up for a program, investors should make sure they know what is covered. The wrap fee could include costs like stamp duty or taxes related to investing and trading commissions needed to make trades. Some advisors will charge extra for mutual fund fees and other expenses. Wrap fee programs may also cover fees and expenses associated with third-party service providers. These fees could include research or data costs related to executing trades away from the advisor's platform. Additionally, advisors may charge a separate fee for transactions traded away from their platform. Wrap fee is an all-inclusive fee applied to an investment account when advisors offer a client a number of services other than just investment advice. They typically range from 1% to 3% of the managed assets, although some firms have higher fees depending on the type of investments in the portfolio. The average wrap fee will depend on the individual’s needs, risk tolerance, and investing style. For example, a high-risk portfolio may have higher associated fees than one that is lower risk. In contrast, a more passive investor with fewer transactions may have lower wrap fees overall. While the exact fee varies depending on the offered services and their arrangement, wrap fees are typically designed to cover transition and ongoing services that save investors from the hassle of paying multiple fees separately. Some advantages of wrap fee programs include the predictability of costs and the removal of commission incentives. One of the main advantages of investing through a wrap fee program is that it allows investors to budget for their entire portfolio in one fixed amount. This makes it easier to plan ahead and manage cash flow since there will be no unexpected fees or charges. Keep in mind, however, that there may be additional charges or services that are not included in the specified fee. Investment firms are obligated to provide you with an informative wrap fee brochure, ensuring that you know precisely what services and fees are included in the cost. Since the fee is flat, advisors have no incentive to push for expensive investments to increase their commissions. This ensures that the advice given is always in the client's best interest and not the advisor's gain. There are also potential drawbacks with wrap fees that you need to consider, including the possibility of overpaying and the potential lowering of your investment returns. Although a wrap fee program can be beneficial for investors looking for predictability, there is always the possibility of overpaying. Depending on the structure and services included in each program, an investor could end up spending significantly more than they would with a traditional advisor or broker. For example, passive investors may be spending too much for services that they do not ever intend to use. In this scenario, opting for a pay-as-you-go plan might be a better choice. For conservative investors, the 1 to 3% wrap fee may be taking a large chunk of their annual returns. Since these fees are often taken directly out of the client's portfolio, they reduce the amount available for investing. This can be especially problematic in a down market where returns are already low. When considering a wrap fee, it is important to understand the implications for your investment portfolio. You should carefully weigh the advantages and disadvantages of investing with a wrap fee to determine if it is right for you. Essentially, investing with a wrap fee should be based on your personal goals and needs as an investor. The biggest advantage of investing with a wrap fee is that it allows you to have an entire portfolio professionally managed at once, saving time and money in the process. This can be especially useful for those who do not have the resources or expertise to manage their own investments. Additionally, wrap fees can provide greater diversification in your portfolio, making it less likely to suffer from significant losses due to any one investment. On the other hand, it might be better to go the traditional route and opt for a regular financial advisor if you are looking for more personalized advice. Wrap fees also tend to be significantly more expensive than a regular financial advisor, and the fee might not be worth it if your investment goals are modest or you do not need a large portfolio. For many investors, the benefits of professional portfolio management via a wrap fee may be worth the additional cost. However, if you are comfortable managing your investments without additional help, this fee structure may not be right for you. By thoroughly researching your options, you can make an informed decision about whether or not a wrap fee is right for you. Check the brochure presented to you by your financial advisor to see all the services and fees associated with the program before signing up. Regardless of whether or not you decide to enroll in a wrap fee program, it is essential to remember that all investments—even those with low fees—are subject to risk. For this reason, investors should periodically check the progress of their investments and work with a fiduciary financial advisor. A wrap fee program provides a comprehensive approach to investing by combining financial planning, asset management, and other services into one all-encompassing fee. It is a type of investment program designed for investors who are looking for a comprehensive portfolio management service. It combines all the administrative, research, and trading services into one package. The average fee for the program is approximately 1% to 3% of the amount invested in the managed assets and can be higher or lower depending on several factors. The benefits of this program include a portfolio management service that combines administrative, research, and trading services. It gives investors access to highly specialized investments. It can also disclose investment costs and fees. However, wrap fee programs may cost more than separate services for each package component. Investment performance and protection from market fluctuations and poor investment decisions are not guaranteed. A wrap fee program can be a beneficial option for investors who want a comprehensive portfolio management service and access to specialized investments they may not have otherwise. However, investors should carefully consider the fees associated with this program and research their options before deciding if it is worth it.What Is a Wrap Fee Program?

Services & Fees Typically Included in a Wrap Fee

Investment Advice

Brokerage Costs

Administrative Expenses

Other Fees & Expenses

Third-Party Service Provider Costs & Trading Away

Average Wrap Fee

Pros of Wrap Fees

Predictability

Removes Any Commission Incentives

Cons of Wrap Fees

Possibility of Overpaying

Lowers Your Returns

Is a Wrap Fee Worth It?

Final Thoughts

Wrap Fee Program FAQs

Wrap fees vary depending on the services provided by the advisor and the number of assets being managed. Generally speaking, wrap fees are typically 1-3% of total assets under management annually.

A wrap fee is calculated based on the number of assets being managed, the services provided by the advisor, and any additional fees associated with those services.

The cost of wrap fees differs based on the services your advisor offers and the size of assets they are managing. On average, expect to pay anywhere from 1-3% per annum for their management service.

The biggest benefit of using a wrap fee is that it lets you have your entire portfolio managed by a professional at once, saving you both time and money. This can be especially helpful for those who lack the means or know-how to manage their own investments.

Common services and fees covered in a wrap fee program usually include portfolio management, financial planning, investment research, transaction execution, and monitoring. Outside mutual fund providers are often not covered in a wrap fee and will therefore be charged as additional fees.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.