What Is the 5-Year Certain Annuity?

A 5-Year Certain Annuity is a specialized form of an annuity contract, categorized under fixed period or certain term annuities, that commits to delivering consistent payments to the annuitant for a set duration of five years.

Like all annuities, it's a financial product that insurance companies design, largely to support individuals in creating a reliable income stream, often serving as an integral part of retirement planning.

The unique aspect of a 5-Year Certain Annuity is the guaranteed payment schedule, which spans a predetermined five-year window. Importantly, this payment schedule is maintained regardless of the annuitant's life status.

This means that the income disbursements will continue to be issued for the full five-year period, even in the unfortunate circumstance of the annuitant's passing.

In essence, a 5-Year Certain Annuity offers security, predictability, and peace of mind in the financial planning landscape.

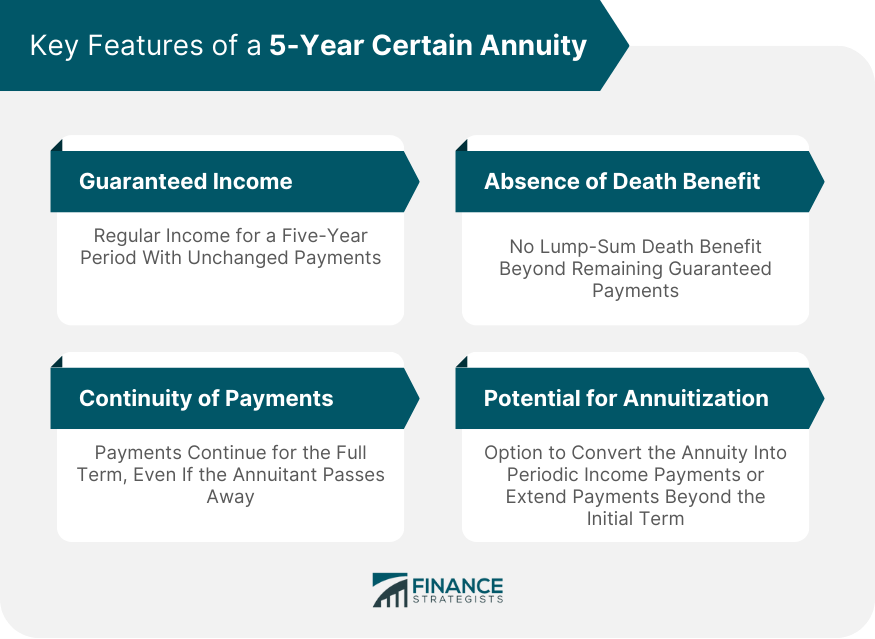

Key Features of a 5-Year Certain Annuity

Guaranteed Income for a Five-Year Period

The most fundamental feature of a certain 5-year annuity is its guarantee of regular income for a five-year period. This regular payment, known as the annuity payment, is set at the inception of the contract and remains unchanged throughout the term.

This fixed payment structure provides predictability, allowing the annuitant to plan their finances with confidence over the contract's duration.

Continuity of Payments Despite Annuitant's Death

A distinguishing characteristic of the 5-year certain annuity lies in the assurance that payments will continue for the entire five-year period, even if the annuitant passes away before the term ends.

In such a case, the remaining payments are transferred to the annuitant's designated beneficiary or estate. This feature adds an element of posthumous financial security for the annuitant's dependents.

Absence of a Death Benefit Beyond Remaining Payments

While the 5-year certain annuity guarantees the continuity of payments in case of the annuitant's premature death, it's important to note that there is no death benefit beyond the remaining guaranteed payments.

Unlike certain life insurance products, the annuity does not pay a lump-sum death benefit. The only funds transferred to the beneficiaries are the payments that would have been made to the annuitant during the remainder of the five-year period.

Potential for Annuitization at Term End

Another noteworthy feature of the 5-year certain annuity is the potential for annuitization at the end of the term. Annuitization is the process of converting an annuity investment into a series of periodic income payments.

Depending on the terms of the contract and the annuity provider's offerings, an annuitant might have the option to convert the contract into another annuity product or continue receiving payments beyond the initial five-year term.

This feature can provide extended income stability if the annuitant requires income for a longer period.

How a 5-Year Certain Annuity Works

To illustrate how a 5-year certain annuity works, consider this example. Suppose an individual purchases a 5-year certain annuity for $100,000 with an insurance company.

The insurance company might calculate the annuity payments based on various factors like the interest rate, the individual's age, and life expectancy.

Let's assume the calculated annual payment is $21,000. This means the individual (annuitant) will receive $21,000 every year for the next five years. If the annuitant were to pass away after three years, the remaining two years' worth of payments would go to the designated beneficiary.

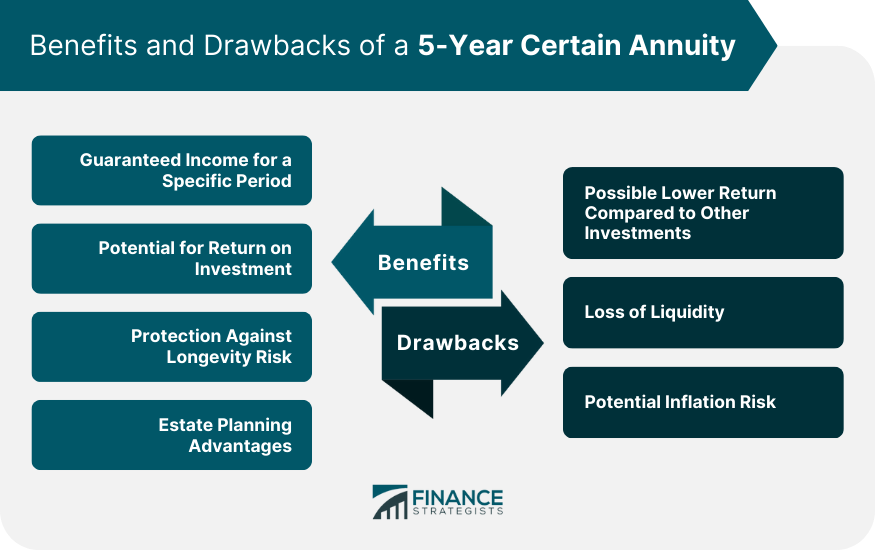

Benefits of a 5-Year Certain Annuity

Guaranteed Income for a Specific Period

One of the significant advantages of a 5-year certain annuity is the certainty it provides. When you buy this annuity, you know exactly how much income you will receive and for how long.

This certainty can be especially beneficial if you are planning a large expense in five years, like purchasing a house or funding a child's college education.

Potential for Return on Investment

A 5-year certain annuity can provide a solid return on investment, especially in a high-interest-rate environment.

Insurance companies typically invest the premium received in relatively safe fixed-income securities, which can offer decent returns when interest rates are high. These returns are passed on to the annuitant in the form of higher annuity payments.

Protection Against Longevity Risk

While a 5-year certain annuity does not protect against longevity risk to the same extent as lifetime annuities, it does offer a degree of protection. If the annuitant lives beyond the expected lifespan, the payments stop after five years.

However, if the annuitant dies within the five-year period, the remaining payments are transferred to the beneficiary, providing financial protection for the annuitant's dependents.

Estate Planning Advantages

From an estate planning perspective, a 5-year certain annuity can also have benefits.

Since the remaining payments are transferred to a designated beneficiary if the annuitant dies within the five years, this can be a way of passing wealth to the next generation without the complexities and costs of probate.

Drawbacks of a 5-Year Certain Annuity

Possible Lower Return Compared to Other Investments

Like other annuities, the return on investment for a 5-year certain annuity might be lower than what you could achieve with other types of investments, such as stocks or mutual funds.

This is because insurance companies typically invest in lower-risk, lower-return assets to ensure they can meet their payment obligations.

Loss of Liquidity

When you purchase a certain 5-year annuity, you generally cannot withdraw your funds during the term without incurring penalties. This lack of liquidity can be a disadvantage if you need access to your money for emergencies or unexpected expenses.

Potential Inflation Risk

Inflation can erode the purchasing power of fixed annuity payments over time. For example, if the annual inflation rate is 2%, a payment of $1,000 will only be worth approximately $980 in real terms after one year.

This risk is particularly relevant for longer-term annuities but can also affect a 5-year certain annuity if inflation is high during the term.

Evaluating the 5-Year Certain Annuity for Your Financial Plan

Determine Your Financial Goals and Risk Tolerance

Before you consider purchasing a 5-year certain annuity, it's crucial to assess your financial goals and risk tolerance. Your financial objectives might include saving for retirement, funding a child's education, or preparing for a large expense.

Understanding these goals will help you determine if a 5-year certain annuity aligns with your financial plan.

Risk tolerance involves understanding how much financial risk you are comfortable taking. If you're a conservative investor looking for guaranteed returns and stability, a 5-year certain annuity could be an appealing option.

Assess the Role of a 5-Year Certain Annuity in Your Retirement Plan

If you're approaching retirement or already retired, a 5-year certain annuity can play a significant role in your retirement plan. While it will not provide lifelong income, it can supplement other retirement income sources for a short period.

If you have certain financial obligations or plans within the first few years of your retirement, such as paying off a mortgage or traveling, a 5-year certain annuity can effectively cover these expenses.

Compare a 5-Year Certain Annuity With Other Investment Options

Before purchasing a 5-year certain annuity, it's prudent to compare it with other investment options. Consider the potential return, risk level, liquidity, and tax implications of various investments.

Understanding the trade-offs will help you make an informed decision about whether a 5-year certain annuity is right for you.

Buying a 5-Year Certain Annuity

Choose the Right Insurance Company

Selecting a reputable insurance company is paramount when buying a 5-year certain annuity.

Look for a company with a strong financial rating, positive customer reviews, and a history of reliable annuity payments. The financial strength of an insurance company is crucial because it determines the company's ability to fulfill its obligations to you, the annuitant.

Understand Contract Terms and Conditions

Before you sign the annuity contract, make sure you understand all its terms and conditions. Pay attention to details such as the annuity payment amount, payment frequency, fees and charges, and what happens if you die before the end of the term.

If there's anything you don't understand, don't hesitate to ask the insurance company or a financial advisor for clarification.

Tips for Purchasing a 5-Year Certain Annuity

Diversify Your Annuity Investments

When it comes to buying a 5-year certain annuity, diversification is a key strategy. Instead of putting all your money into an annuity with a single insurance company, consider spreading your investment across annuities from different companies.

This strategy works similarly to diversifying an investment portfolio, helping to spread risk and providing additional protection.

If an insurance company you've invested in runs into financial trouble, having annuities with other companies ensures that a portion of your annuity income is safe.

In choosing your insurance companies, consider their financial strength ratings, customer service reputation, and the terms of their annuity products.

Take Your Health and Life Expectancy Into Account

Your health status and life expectancy are also important factors to consider when purchasing a 5-year certain annuity. If you're in excellent health and have a family history of longevity, you may outlive the payout period of a 5-year certain annuity.

In this case, a different type of annuity that provides lifetime income may be more suitable.

Annuities that continue payments for life, such as life annuities, can provide income no matter how long you live. These types of annuities may be more appropriate for those with longer life expectancies.

However, keep in mind that the payments for life annuities are typically smaller than those for certain annuities, given the longer potential payout period.

Consult With a Financial Advisor

Purchasing an annuity is a significant financial decision, and it can be beneficial to consult with a financial advisor. They can provide personalized advice based on your financial situation, retirement goals, and risk tolerance.

They can also help you understand the intricacies of different annuity products, ensuring that you make a well-informed decision.

Managing Your 5-Year Certain Annuity

Understanding Your Payout Options

Before the payout phase begins, you have to decide on the payout option that best suits your financial needs.

You could choose to receive the payments over the five years or opt for a lump-sum payout at the end of the term, depending on the terms of your contract and the offerings of your insurance company.

Strategies for Maximizing Your 5-Year Certain Annuity

To maximize your 5-year certain annuity, consider deferring the start of payments if you don't need the income immediately. This deferral could result in higher payments when they begin.

Additionally, consider reinvesting the payments if you don't need the income for living expenses. Reinvestment can help grow your wealth over time.

Handling Changes in Your Financial Situation

Life is unpredictable, and your financial situation can change unexpectedly. If you encounter financial hardship during the term of the 5-year certain annuity, you may be able to withdraw a portion of the funds, although penalties often apply.

If you come into a windfall, you might consider purchasing an additional annuity to increase your guaranteed income. Remember, any changes should align with your overall financial plan and goals.

Final Thoughts

A 5-year certain annuity is a financial product that guarantees a regular income for a specific period of five years.

Its key features include consistent payments for the term, the continuation of payments to a beneficiary if the annuitant passes away during the term, and potential annuitization at the end of the term.

Like any financial instrument, a 5-year certain annuity comes with its own set of pros and cons.

It offers the stability of guaranteed income and protection against longevity risk, but it also comes with potential downsides such as lower return compared to other investments, loss of liquidity, and inflation risk.

To make the most of a 5-year certain annuity, it's essential to assess your financial goals, risk tolerance, and retirement plan. If in doubt, consult with a financial advisor or insurance broker to help guide your decision.

5-Year Certain Annuity FAQs

A 5-Year Certain Annuity is a type of annuity contract that guarantees a regular income for a five-year period.

The key features include guaranteed income for five years, continuity of payments even if the annuitant passes away before the end of the term, absence of a death benefit beyond remaining payments, and the potential for annuitization at the end of the term.

A 5-Year Certain Annuity works by the annuitant paying a lump-sum premium to an insurance company in return for a series of payments over a five-year term. If the annuitant dies before the term ends, the remaining payments go to a designated beneficiary.

The pros include guaranteed income, protection against longevity risk, and potential estate planning advantages. The cons include a possible lower return compared to other investments, loss of liquidity, and potential inflation risk.

Strategies include diversifying your investment among different insurance companies, considering your health and life expectancy when purchasing, and potentially deferring payments or reinvesting them if you don't immediately need the income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.