The accumulation phase is a pivotal period in an individual's financial journey. It refers to the time when one is working, earning, and investing, with an aim to grow their wealth. This phase often spans several decades, beginning when an individual starts their career and continues until they retire. During this time, the focus is on earning and investing as much as possible to build a substantial nest egg for the future. This financial concept is crucial in both insurance and annuity contexts. In order to optimize the growth potential of investment during the accumulation phase, it's crucial to take several variables into account: The ability and willingness to endure the possibility of losses. It's crucial to remember that various insurance and annuity products present distinct risk profiles and potential returns. This pertains to the duration you plan to invest before taping into funds. The time horizon influences the types of investment vehicles that might be appropriate. Longer time horizons typically allow for more aggressive investment strategies, given that there's more time to recover from potential market downturns. Every investor has unique financial goals. These objectives could encompass a range of needs, such as building a nest egg for retirement, funding a child's college education, or accumulating wealth for other specific needs. Understanding how different investment options are taxed is integral to optimizing net returns. Different insurance and annuity products have varied tax implications, and the right choice can help enhance after-tax returns, thereby increasing investment efficiency. Being aware of the cost structure associated with different investment options is essential. Fees and charges can significantly affect the net return and, consequently, the overall growth of the portfolio. To make the most of the accumulation phase, consider the following strategies: Consistently making premium payments helps keep the policy in force and allows the cash value to grow. This involves investing a fixed amount regularly, regardless of market conditions. Over time, this can potentially lower the average cost per share of investments. This is the process of realigning the weightings of a portfolio to maintain a desired asset allocation. Riders are additional benefits that can be added to a policy for a cost, providing added protection or functionality. Transitioning from the accumulation phase to the distribution phase is a critical step in one's financial journey. This transition is usually linked to retirement when one starts to withdraw funds to cover living expenses. Several factors need to be considered during this transition: Retirement Age: The age at which one plans to retire can impact how long they have to accumulate wealth and how long their savings need to last. Income Needs: This refers to the amount of money one needs to cover living expenses during retirement. Other Sources of Income: These can include Social Security, pensions, and any other income sources. Tax Implications: Different distribution options have different tax consequences, which can impact net retirement income. When transitioning from the accumulation phase to the distribution phase, individuals have multiple options to access their accumulated funds. The choice depends largely on their personal needs, financial goals, and the specific provisions of their insurance policy or annuity contract. Here are the key distribution methods: Annuities are designed to provide a steady stream of income during retirement. Depending on the terms of the contract, this income can be guaranteed for a specified period, such as 10 or 20 years, or the annuitant's lifetime. This ensures a predictable income that can't be outlived, providing financial security in retirement. In the context of life insurance, the cash value that has been accumulated over time can be accessed through policy loans or withdrawals. Policy loans are borrowed amounts that don't need to be repaid, but they do reduce the death benefit unless repaid. Withdrawals, however, directly reduce the cash value and possibly the death benefit. These options provide flexibility in accessing funds when needed. Some insurance policies and annuity contracts allow for a lump-sum payout. This could be the cash value in a life insurance policy or the accumulated value in an annuity. While this provides immediate access to a large amount of money, it's essential to consider the potential tax implications of such a payout. This strategy involves taking out a fixed amount regularly from the accumulated funds, much like receiving a paycheck. This provides a predictable and regular income stream during retirement. The amount and frequency can often be adjusted based on personal needs, providing flexibility in managing retirement income. Insurance policies that offer accumulation features allow policyholders to build cash value over time. Here are the common types of such policies: Whole Life Insurance: These policies provide guaranteed death benefits and cash value that grows over time at a guaranteed rate. Universal Life Insurance: This is a more flexible variant, allowing policyholders to adjust their premium payments and death benefits while accumulating cash value. Variable Life Insurance: These policies offer investment options where the cash value and death benefit can fluctuate based on the performance of the investment subaccounts selected by the policyholder. Indexed Universal Life Insurance: This type combines the flexibility of universal life insurance with the potential for higher returns linked to a market index yet provides a certain level of downside protection. The accumulation phase in insurance involves several elements: Premiums: These are payments made by the policyholder to the insurance company. Cash Value: This is the savings component of the policy that grows over time. Interest and Investment Returns: These are earnings on the cash value based on the policy’s terms. Policy Loans: These are loans that policyholders can take against the cash value of their policies. The accumulation phase in insurance offers several advantages: Tax-Deferred Growth: The cash value grows tax-deferred until it is withdrawn. Policy Loans and Withdrawals: Policyholders can borrow or withdraw from the cash value for any purpose. Enhanced Death Benefit: Some policies allow the cash value to be added to the death benefit. Supplemental Retirement Income: The accumulated cash value can be a supplemental income source during retirement. During the accumulation phase in annuities, individuals can choose from various types of annuities, including fixed annuities, variable annuities, and indexed annuities. Each type has its own characteristics and benefits. Fixed annuities offer a guaranteed interest rate, providing stability and security. Variable annuities offer the potential for higher returns by allowing investment in different market-based options. Indexed annuities provide the opportunity to earn returns linked to the performance of a specific index, such as the S&P 500. The benefits of the accumulation phase in annuities include tax-deferred growth, allowing the invested funds to compound over time without being taxed. This can result in accelerated growth compared to taxable investments. Additionally, annuities often offer a death benefit that guarantees a payout to beneficiaries if the annuity owner passes away during the accumulation phase. Several factors should be considered during the accumulation phase of annuities. These include the individual's financial goals, risk tolerance, and time horizon. It's important to determine how much to contribute regularly or as a lump sum and to select the most suitable annuity type based on individual preferences and circumstances. The fees associated with annuities, such as surrender charges or administrative fees, should also be considered. Evaluating the financial strength and reputation of the insurance company offering the annuity is crucial to ensure the reliability of future payments during the distribution phase. Seeking guidance from a financial advisor can help individuals make informed decisions and maximize the benefits of the accumulation phase in annuities. The accumulation phase is a vital period in one's financial journey, serving as the wealth-building stage in both insurance and annuity contracts. In insurance, it allows policyholders to grow cash value over time, offering potential advantages like tax-deferred growth and supplemental retirement income. Similarly, annuities during the accumulation phase offer tax-deferred growth with flexibility in premium payments and diversified investment options. Key factors to consider during this period include risk tolerance, investment objectives, tax considerations, and time horizon. Understanding these elements provides a strategic foundation for maximizing wealth growth and securing a comfortable retirement. Ultimately, the accumulation phase is a powerful tool in wealth creation and financial planning.Definition of Accumulation Phase

Factors to Consider During the Accumulation Phase

Risk Tolerance

Time Horizon

Investment Objectives

Tax Considerations

Fees and Charges

Strategies to Maximize the Accumulation Phase

Regular Premium Payments

Dollar-Cost Averaging

Rebalancing

Utilizing Riders

Transition From the Accumulation Phase to the Distribution Phase

Factors to Consider in the Transition

Options for Distributions

Annuity Payouts

Policy Loans and Withdrawals

Lump-Sum Payouts

Systematic Withdrawals

Accumulation Phase in Insurance

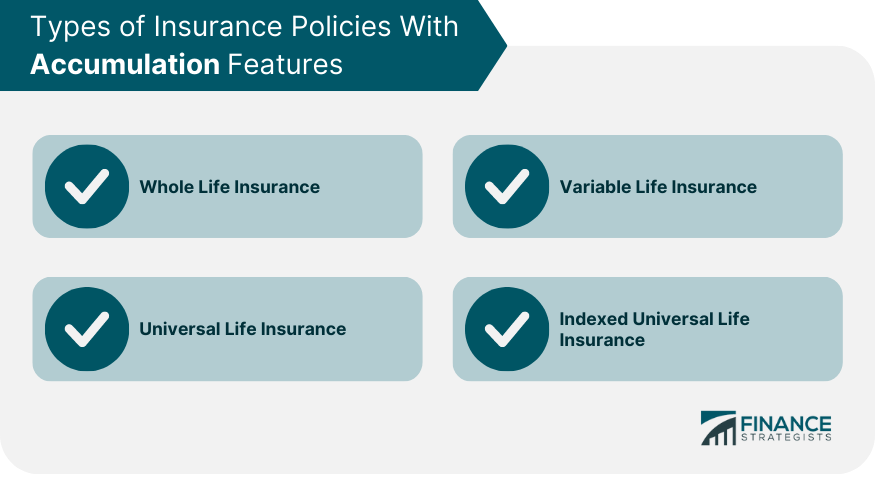

Types of Insurance Policies With Accumulation Features

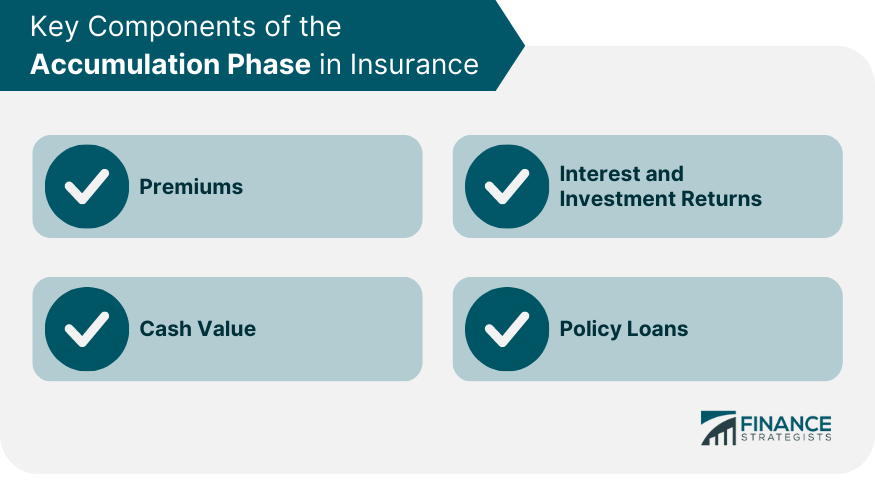

Key Components of the Accumulation Phase in Insurance

Benefits of the Accumulation Phase in Insurance

Accumulation Phase in Annuities

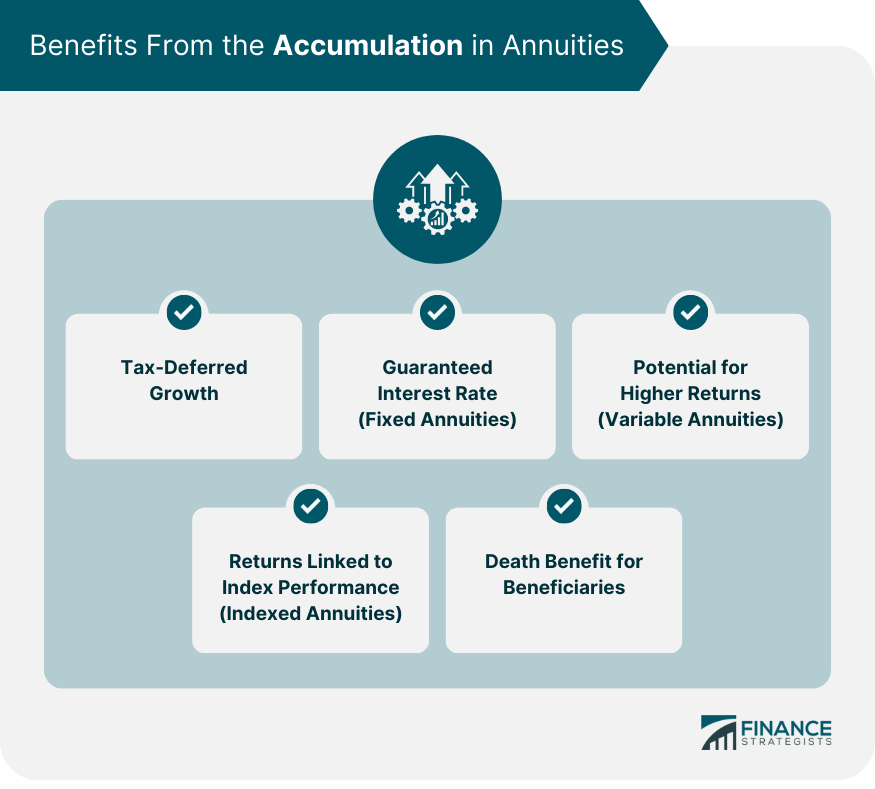

Types of Annuities To Choose From

Benefits of Accumulation Phase of Annuities

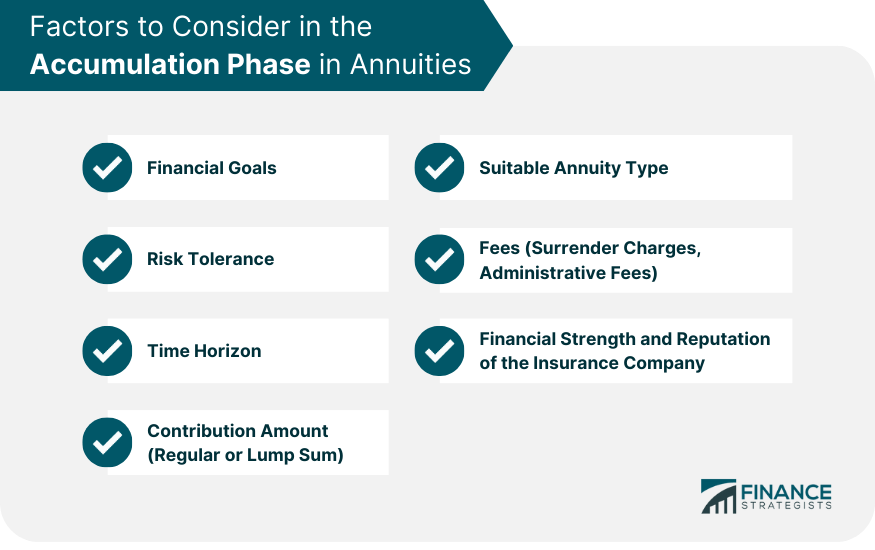

Factors to Consider in the Accumulation Phase of Annuities

Conclusion

Accumulation Phase FAQs

The accumulation phase refers to the period when an individual is actively contributing to their insurance or annuity contracts, allowing the value of their policy or annuity to grow. It usually starts when the policy is issued and continues until the policyholder starts withdrawing funds, typically at retirement.

The accumulation phase in an insurance policy allows for tax-deferred growth of cash value, access to policy loans and withdrawals, the potential for enhanced death benefits, and the possibility of supplemental retirement income.

In annuities, the accumulation phase involves making premium payments into the annuity contract, which then grows over time based on interest and investment returns. The accumulation phase lasts until the annuitant starts receiving income payments from the annuity.

Strategies to maximize the accumulation phase include making regular premium payments, utilizing dollar-cost averaging, periodically rebalancing the investment portfolio, and leveraging policy riders for additional benefits.

The transition typically happens when the policyholder or annuitant retires and starts to withdraw funds for living expenses. Factors to consider during this transition include the individual's retirement age, income needs, other sources of income, and tax implications. Distribution options can include annuity payouts, policy loans and withdrawals, lump-sum payouts, or systematic withdrawals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.