Annuities are crucial to retirement strategy because they provide a reliable, steady income stream in the retirement years, essentially functioning as a private pension plan. When a retiree invests in an annuity, they receive periodic payments over a specified period of time, which can be for a few years or even for life. This can significantly reduce the risk of outliving one's savings, a concern prevalent among retirees. Annuities also allow for tax-deferred growth, which means you don't pay taxes on the income and investment gains from your annuity until you withdraw the funds. This tax advantage can help retirees build up a larger nest egg over the long term. Annuities provides income security, tax-deferred growth, the potential for lifetime income, and beneficiary considerations. One of the main advantages of annuities is the security they provide. With an annuity, you have a guaranteed income for a certain period or for your entire life, depending on the type of annuity you choose. The growth of the investment within an annuity is tax-deferred, meaning you won't pay taxes on the growth until you start taking withdrawals. This can be a significant advantage if you expect to be in a lower tax bracket in retirement. One of the most attractive features of an annuity is the possibility of a lifetime income. This means that, regardless of how long you live, you will continue to receive payments. Annuities can also offer a death benefit. If you die before you start receiving payments, your beneficiary can receive a specified amount. Before purchasing an annuity, consider your financial goals, risk tolerance, anticipated retirement income, and the costs associated with annuities. What are your financial goals for retirement? Do you need a steady stream of income, or are you looking for a potential return on investment? Understanding your goals can help you determine which type of annuity is right for you. Are you comfortable with risk, or do you prefer a guaranteed return? Variable annuities and indexed annuities carry more risk but potentially higher returns, while fixed annuities offer a guaranteed return but lower potential growth. Consider your anticipated retirement income from all sources. Will you have income from a pension or Social Security? How does an annuity fit into your overall retirement income plan? Annuities can have various costs, including mortality and expense risk charges, administrative fees, and surrender charges. Be sure to understand all the costs associated with an annuity before making a purchase. Annuities are just one piece of the retirement puzzle. They should be considered alongside other retirement strategies like 401(k)s, IRAs, Social Security benefits, and pensions. Annuities can be a supplement to retirement savings in a 401(k) or IRA. Unlike these accounts, annuities provide a guaranteed income stream and do not have annual contribution limits. Social Security benefits alone may not provide enough income in retirement. Annuities can supplement these benefits by providing additional guaranteed income. Pensions are less common today, but if you have one, it functions similarly to an annuity by providing a guaranteed income. Annuities can provide additional income if your pension income isn't sufficient. Like any financial product, annuities have both advantages and disadvantages. It's essential to understand both sides to make an informed decision. Annuities provide stability, regular payments, and tax deferral. They can provide a steady income for life and can be a valuable tool for retirement planning. Additionally, the tax deferral feature allows your money to grow more efficiently than it would in a taxable investment. On the flip side, annuities can be complex and have potential fees and charges. They also lack liquidity, meaning they can be challenging to withdraw money from without incurring penalties. It's important to thoroughly understand these potential drawbacks before investing in an annuity. It's important to understand the regulations and safeguards in place for annuities. These include insurance companies and state guaranty associations, the Financial Industry Regulatory Authority (FINRA), and the Securities and Exchange Commission (SEC). Annuities are backed by the financial strength of the issuing insurance company. If the insurance company fails, state guaranty associations can provide a certain level of coverage, but it's important to choose a financially stable insurance company for your annuity. FINRA oversees the sales of variable annuities. They require brokers to provide full disclosures about the benefits and risks of variable annuities and ensure that the annuities sold are suitable for the investor based on their age, financial situation, risk tolerance, and financial objectives. The SEC oversees the sales of variable annuities and ensures that all information provided to potential investors is accurate and not misleading. Annuities play a crucial role in retirement strategies by offering a steady stream of income, tax-deferred growth, and the potential for lifetime earnings. They can provide income security, giving retirees peace of mind in their golden years. However, while these advantages can make annuities an appealing option, it's important to balance these benefits against the potential drawbacks. Annuities can lack liquidity, may entail substantial fees, and their complexity can be daunting. Therefore, when contemplating annuities as a retirement strategy, consider your financial objectives, risk tolerance, and anticipated retirement income. By doing so, you can make an informed decision that aligns with your retirement goals and expectations. In essence, annuities can be a robust tool in retirement planning, but their efficacy depends on your unique financial circumstances.What Is the Importance of Annuities to Retirement Strategy?

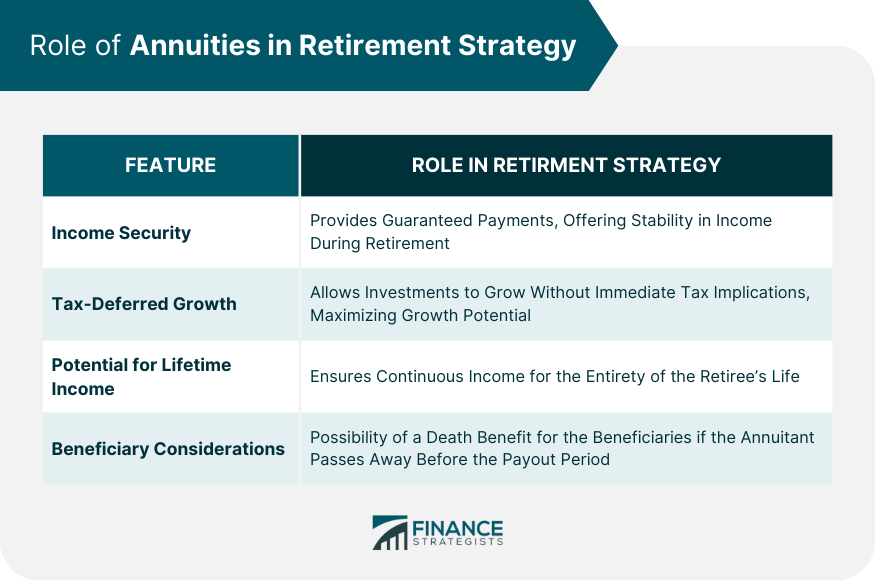

Role of Annuities in Retirement Strategy

Income Security

Tax-Deferred Growth

Potential for Lifetime Income

Beneficiary Considerations

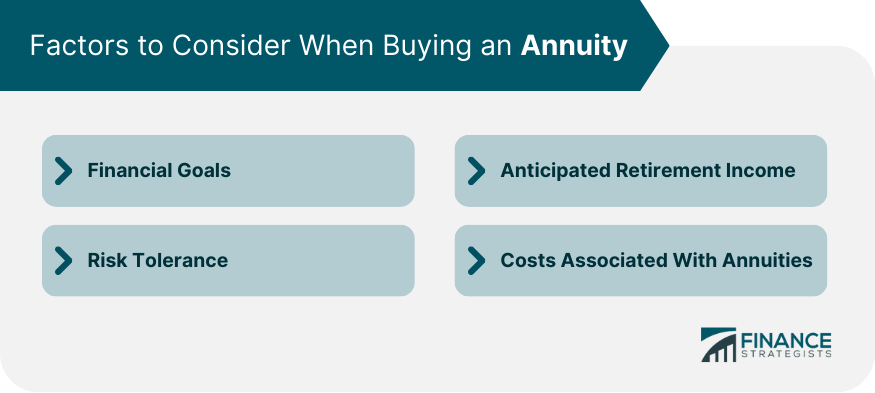

Factors to Consider When Buying an Annuity

Financial Goals

Risk Tolerance

Anticipated Retirement Income

Costs Associated With Annuities

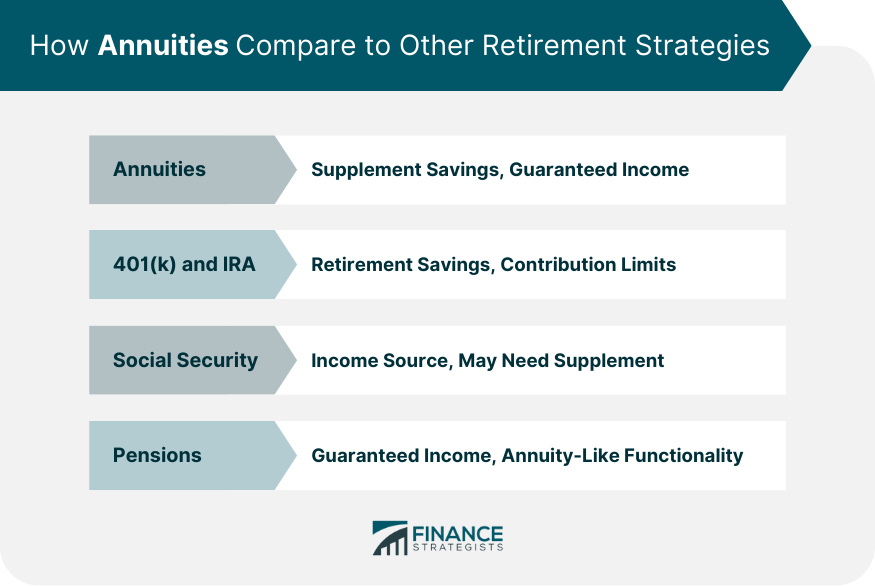

How Annuities Compare to Other Retirement Strategies

Annuities vs 401(k) and IRA

Annuities vs Social Security Benefits

Annuities vs Pensions

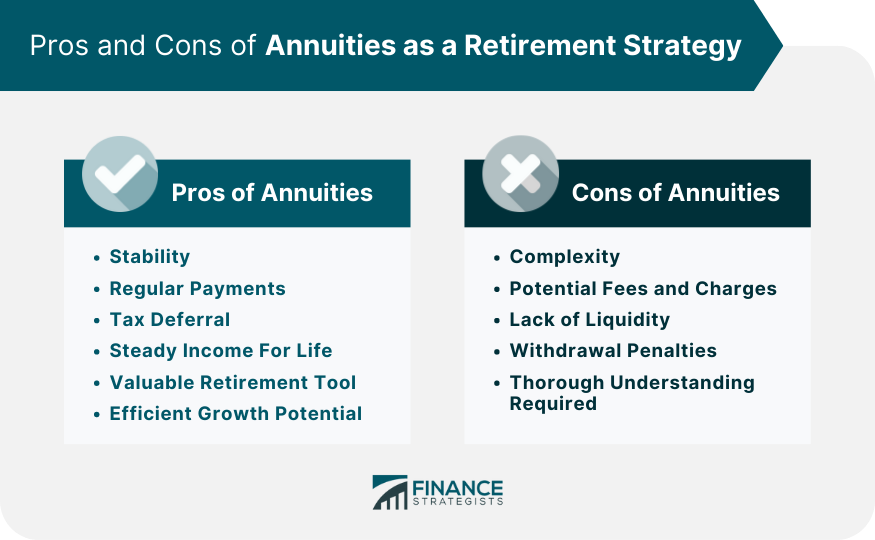

Pros and Cons of Annuities as a Retirement Strategy

Pros of Annuities

Cons of Annuities

Regulations and Safeguards

Insurance Companies and State Guaranty Associations

Role of the Financial Industry Regulatory Authority (FINRA)

Role of the Securities and Exchange Commission (SEC)

Conclusion

Annuities as a Retirement Strategy FAQs

Annuities can provide several benefits as a retirement strategy, including providing a steady and guaranteed income stream, offering tax-deferred growth, and potential for a lifetime income. Moreover, depending on the type of annuity, it could also offer a death benefit for your beneficiaries.

While annuities have numerous benefits, they also come with some drawbacks. They can be complex to understand, with potential fees and charges. They also have a lack of liquidity, meaning there could be significant penalties for early withdrawal.

Annuities can complement other retirement strategies like 401(k)s and IRAs. Unlike these accounts, annuities provide a guaranteed income stream and do not have annual contribution limits. However, 401(k)s, and IRAs have their own advantages, such as potential employer matching contributions and tax-deductible contributions.

Before choosing annuities as a retirement strategy, you should consider your financial goals, risk tolerance, anticipated retirement income, and the costs associated with the annuity. It's also vital to understand the type of annuity you're considering, whether fixed, variable, or indexed.

Yes, there are several safeguards in place for annuities. They are regulated by various authorities, including the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC). Moreover, they are backed by the financial strength of the insurance company issuing them, and in case of company failure, state guaranty associations can provide a certain level of coverage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.