An annuity due is a type of annuity that is commonly used in personal finance and investing. An annuity is a contract between an individual and an insurance company or financial institution in which the individual pays a lump sum or periodic payments in exchange for a guaranteed stream of income in the future. An annuity due differs from other types of annuities in that payments are made at the beginning of each period rather than at the end. This can significantly impact the amount of income generated by the annuity and is a key feature that differentiates annuity due from other types of annuities. The characteristics of an annuity due make it a useful investment tool for individuals looking for a reliable source of income in retirement or for other financial goals. As previously mentioned, the timing of payments is one of the key characteristics distinguishing annuity due from other types of annuities. With an annuity due, payments are made at the beginning of each period, such as at the start of each month or year. This means the first payment is made immediately after the contract is signed, and subsequent payments are made at regular intervals thereafter. The calculation of payments for an annuity due is similar to other types of annuities, except for the timing of payments. The payments are typically calculated based on several factors, including the initial investment amount, the annuity length, the interest rate, and the timing of payments. The interest rate is a particularly important factor, as it determines the rate of return on the investment and, ultimately, the income generated by the annuity. Interest rates for annuities can vary widely depending on a number of factors, including the prevailing interest rate environment, the creditworthiness of the insurance company or financial institution issuing the annuity, and the length of the annuity. In general, annuity due payments will be higher than payments for other types of annuities with the same investment amount, interest rate, and term because the payments are made at the beginning of each period, so the investor has the use of the funds for the entire period. There are three main types of an annuity due are: fixed, variable, and indexed. A fixed annuity due is an annuity that provides a fixed rate of return over a specific period. The interest rate is typically guaranteed for a set period, such as five or ten years, and the payments are made at the beginning of each period. Fixed annuities are generally less risky than other types of annuities, as they provide a predictable stream of income. A variable annuity due is an annuity that allows the investor to choose from a range of investment options, such as stocks, bonds, and mutual funds. The payments are made at the beginning of each period and are based on the performance of the underlying investments. Variable annuities are generally considered riskier than fixed annuities, as the return on the investment can vary widely depending on the performance of the underlying investments. An indexed annuity due is an annuity that provides a return linked to a specific market index, such as the S&P 500. The interest rate is typically based on the index's performance over a specific period, and the payments are made at the beginning of each period. Indexed annuities are generally less risky than variable annuities, as they provide a degree of protection against market downturns. Before investing in an annuity due, it is important to consider factors such as your financial goals, age and life expectancy, risk tolerance, and investment portfolio. Before investing in an annuity due, it is crucial to consider your financial goals and how an annuity fits into your overall financial plan. Annuities are created to offer a dependable stream of income, making them a suitable option for individuals seeking a consistent source of income in retirement or to meet other financial objectives. However, there may be better options for annuities, particularly if you have a high-risk tolerance and are looking for higher returns. Another vital factor to consider is your age and life expectancy. Annuities are generally designed to provide income over a specific period, and the length of the annuity can impact the amount of income generated. For example, a longer annuity term may provide more income and require a larger initial investment. Risk tolerance is another critical factor to consider before choosing an annuity due. Annuities are generally considered less risky than other types of investments, such as stocks or mutual funds, but a degree of risk is still involved. It is essential to consider your risk tolerance and investment goals when deciding whether an annuity is right for you. When considering investing in an annuity due, it's crucial to consider your overall investment portfolio. While annuities can help generate income, they shouldn't be the sole investment in your portfolio. To minimize risk and maximize returns, it's essential to diversify your investments across various asset classes. There are several ways to purchase annuity due, including through an insurance company, working with a financial professional, or conducting independent research to find and compare different options. One of the most common ways to purchase an annuity due is through an insurance company. Insurance companies offer a range of annuity products, including fixed, variable, and indexed annuities. It is important to research different insurance companies and their products before purchasing, as fees and other factors can vary widely. Consulting a financial professional can be beneficial in selecting the annuity due that best aligns with your needs. A financial expert can provide valuable guidance on the various types of annuities available and help you make an informed decision. They can also provide information on fees, surrender charges, and other factors to consider before investing in an annuity. Finally, it is vital to research and compares different options before investing in an annuity due. This may involve researching different types of annuities, comparing interest rates and returns, and analyzing fees and other charges. It is also important to consider the reputation and financial stability of the insurance company or financial institution offering the annuity. There are advantages and disadvantages to annuity due that should be carefully considered when investing. Predictable Income: One of the key advantages of an annuity due is that it provides a predictable stream of income, which can be useful for individuals looking for a reliable source of income in retirement or for other financial goals. Inflation Protection: Many annuities are designed to provide inflation protection, which means that the payments increase over time to keep up with inflation. Tax-Deferred Growth: Another advantage of an annuity due is that the investment grows tax-deferred. Lower Returns Compared to Other Investments: Annuities are typically designed to provide a guaranteed stream of income, which means that they may offer lower returns than other types of investments, such as stocks or mutual funds. Limited Liquidity: Annuities are generally less liquid than other types of investments, which means it can be challenging to access the funds before the end of the annuity term. Potential Fees: Annuities may come with various fees, including administrative fees, mortality and expense fees, and surrender charges. Annuity due can be a useful investment tool for individuals looking for a reliable source of income in retirement or for other financial goals. Its unique characteristics, including payments made at the beginning of each period, make it a popular option for those seeking a guaranteed income stream. However, weighing the advantages and disadvantages of an annuity due is essential, considering factors like financial goals, age, risk tolerance, and portfolio before making an investment decision. Additionally, understanding the different types of an annuity due can help to select the best option that fits your financial needs. Therefore, working with an insurance broker who can guide you through the various annuity options and provide unbiased advice tailored to your financial situation is recommended. So, if you're considering investing in an annuity due, don't hesitate to reach out to an insurance broker for expert advice and guidance.Definition of Annuity Due

Characteristics of Annuity Due

Timing of Payments

Calculation of Payments

Interest Rates and Returns

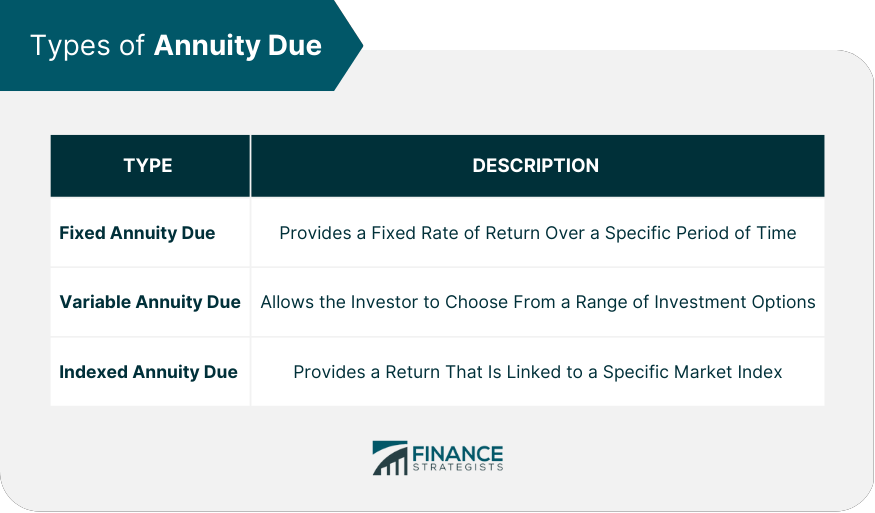

Types of Annuity Due

Fixed Annuity Due

Variable Annuity Due

Indexed Annuity Due

Factors to Consider Before Choosing Annuity Due

Financial Goals

Age and Life Expectancy

Risk Tolerance

Investment Portfolio

How to Purchase Annuity Due

Through an Insurance Company

Working With a Financial Professional

Researching and Comparing Options

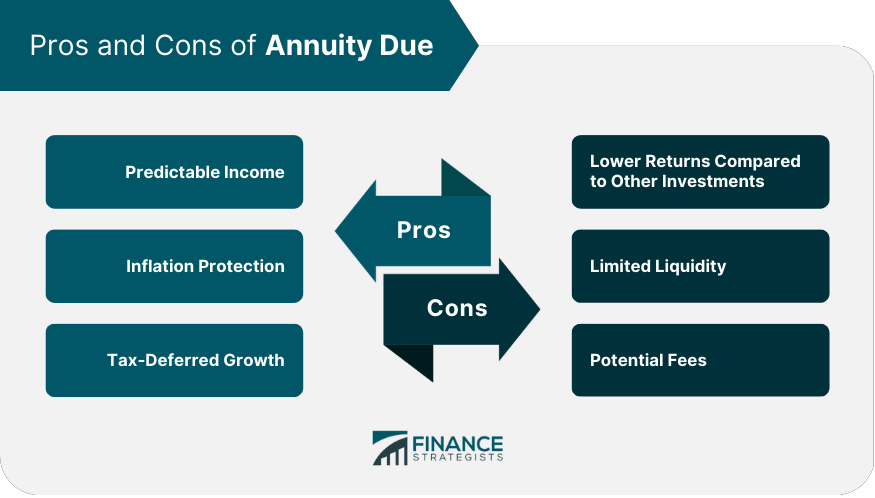

Pros and Cons of Annuity Due

Pros

This can be especially important for individuals who are planning for retirement, as it can help to ensure that their income keeps pace with the rising cost of living.

This means that the investor can only pay taxes on the investment gains once they start receiving payments, which can help to maximize the investment return.Cons

The investment is designed to be less risky and more predictable.

This can be a disadvantage for individuals who may need to access the funds for unexpected expenses or emergencies.

These fees can reduce the overall return on the investment and should be carefully considered before investing in an annuity.Final Thoughts

Annuity Due FAQs

Annuity due is a type of annuity that makes payments at the beginning of each period, providing a predictable and reliable stream of income.

Annuity due offers a guaranteed stream of income, which can be useful for individuals seeking a reliable source of income in retirement or for other financial goals.

The three main types of an annuity due are fixed, variable, and indexed, each offering unique features and benefits.

Before investing in an annuity due, factors such as financial goals, age and life expectancy, risk tolerance, and investment portfolio should be considered.

Yes, working with a financial professional, such as an insurance broker, can provide valuable guidance on the different types of an annuity due available and help you choose the product that best aligns with your financial needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.