An annuity fund is a kind of fund that invests your money in annuities. Annuities are an investment vehicle available to you through annuity funds. An annuity fund is a pool of assets that annuity providers invest in annuities. An annuity provider manages annuity funds to ensure they have enough money to provide stable and consistent annuities for those who invest in annuity funds. An annuity is a contract between an annuitant and annuity provider where the annuitant receives guaranteed payment for as long as he lives, typically after retirement age. As such, annuities are retirement incomes, which annuity providers invest specifically to help annuitants meet their annuity payments. Annuities are popular investment products because annuitants receive predictable income even when the value of annuity assets rises or falls. Unlike a pension annuity, annuity funds provide annuities only to those who have enough money for investment. For example, an annuity fund might require investors to contribute a minimum of $5,000. After you meet the minimum requirement, annuity providers invest your capital in annuities according to your selected returns and life expectancy annuity annuitization. Annuity providers might invest your money in annuities that guarantee you $100 monthly until you are 65 years old. The annuities pay out the monthly income for as long as you live if annuitized. Note: If annuitized, an annuity is typically used to generate lifetime annuities. If annuitized, annuity providers may annuitize annuity contracts when annuitants are between their late 60s and 73 years old. However, annuities can be annuitized as early as age 50 if there is a substantial payment to the annuity provider. Annuities are low-risk investments, which means annuity providers guarantee annuitants receive their annuity payments for as long as annuitants live if annuitized. Unlike other retirement accounts that use stocks or mutual funds to guarantee annuity payments, annuities guarantee annuity payments for life. Annuities are guaranteed investments because annuitants receive annuity payments as long as they live if annuitized. When you invest in an annuity fund, annuities provide guaranteed lifetime income that varies according to your selected returns and annuity annuitization. When you invest annuity funds through annuity providers, annuitants receive guaranteed lifetime payments. However, annuities provide annuitants with flexible withdrawal options because annuitants can withdraw capital at any time without penalty. An annuity provides flexibility to annuitants because annuity providers do not have to annuitize annuities when annuitants are under 59.5 years old. As such, annuity funds provide significant flexibility in terms of withdrawal options for annuitants who want to withdraw their investment at any time without penalty. Unlike mutual fund annuities, annuity funds do not charge annuitants' fees. As such, annuity funds provide significant savings for annuitants who otherwise would have to pay fees on market gains and for annuitization that annuity providers offer. When you invest in an annuity fund through annuity providers, annuitants receive all investment earnings minus annuity annuitization fees with no charges or annuity fees. When you invest in annuity funds, annuities provide guaranteed lifetime income and returns on annuitants' investments for as long as they live if annuitized. Unlike other retirement accounts that entail risks, annuities provide annuitants with a fixed annuity that guarantees annuitants receive annuity payments for as long as they live if annuitized. Also unlike other retirement accounts, annuity funds have lower fees and do not charge annuities. As such, investing in an annuity fund through annuity providers provides significant benefits for annuitants. The annuities only annuitize annuities when annuitants are between ages 59.5 and 75 years old. As such, annuities require annuitants to pay annuity annuitization fees if or when annuities decide to perform or annuitize annuities. Unlike a variable annuity that invests annuitants' annuity investments in a range of stocks or mutual funds, annuities only invest annuity capital in a single company's annuity contract. In this case, annuities may result in decreased investment returns for annuitants. When you invest annuity funds through annuity providers, annuitants receive guaranteed lifetime payments from annuities annuitization. However, annuities annuitize annuities at different rates. An annuity fund is a low-risk investment that provides annuitants with guaranteed lifetime payments, flexible withdrawal options, and low fees. However, you may have to pay annuitization fees if or when annuities decide to perform or annuitize your funds. As such, you must choose the correct return for an investment in an annuities fund.

Have questions about Annuity Funds? Click here.How It Works

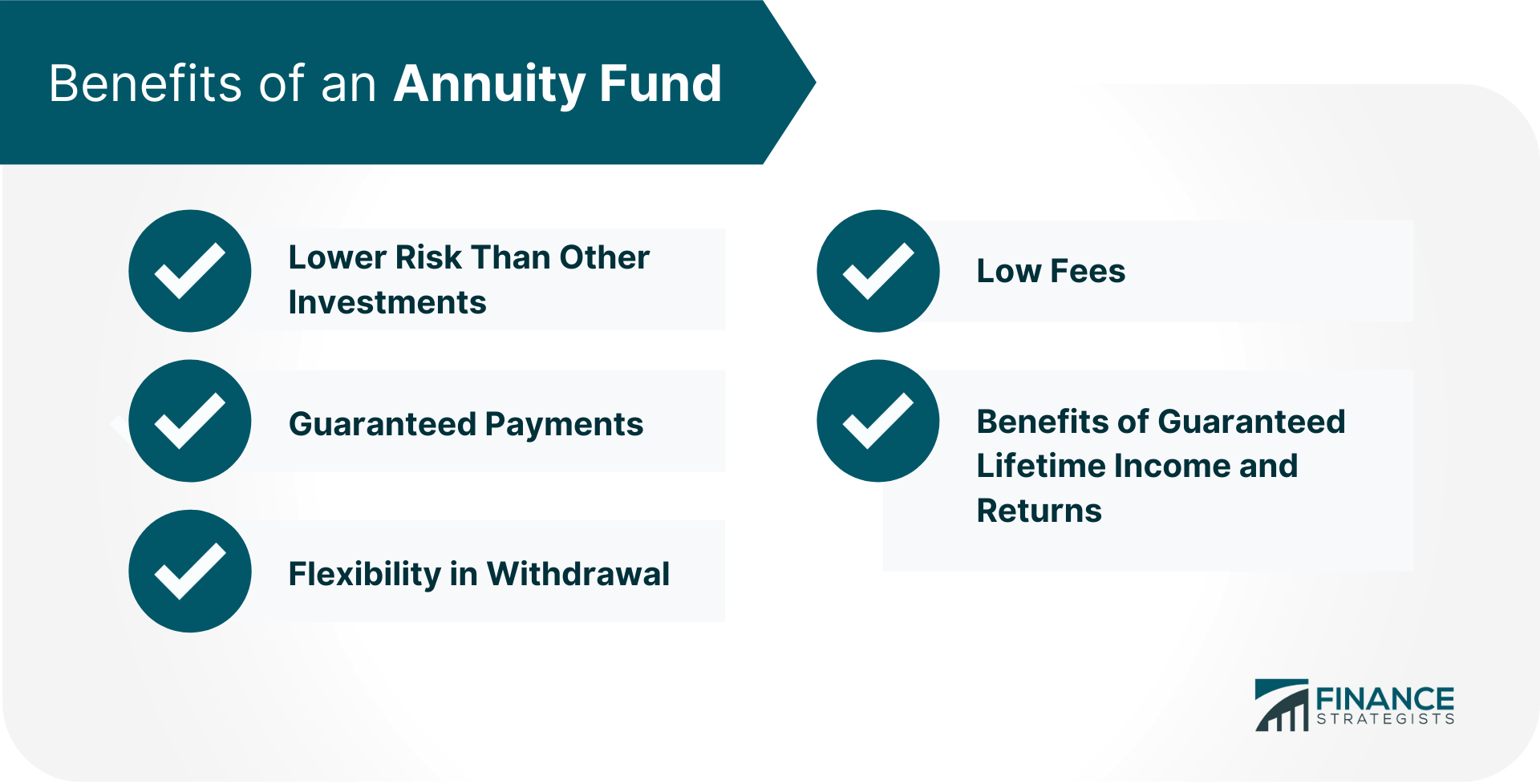

The Benefits of an Annuity Fund

1. Lower Risk Than Other Investments

2. Guaranteed Payments

3. Flexibility in Withdrawal

4. Low Fees

5. Benefits of Guaranteed Lifetime Income and Returns

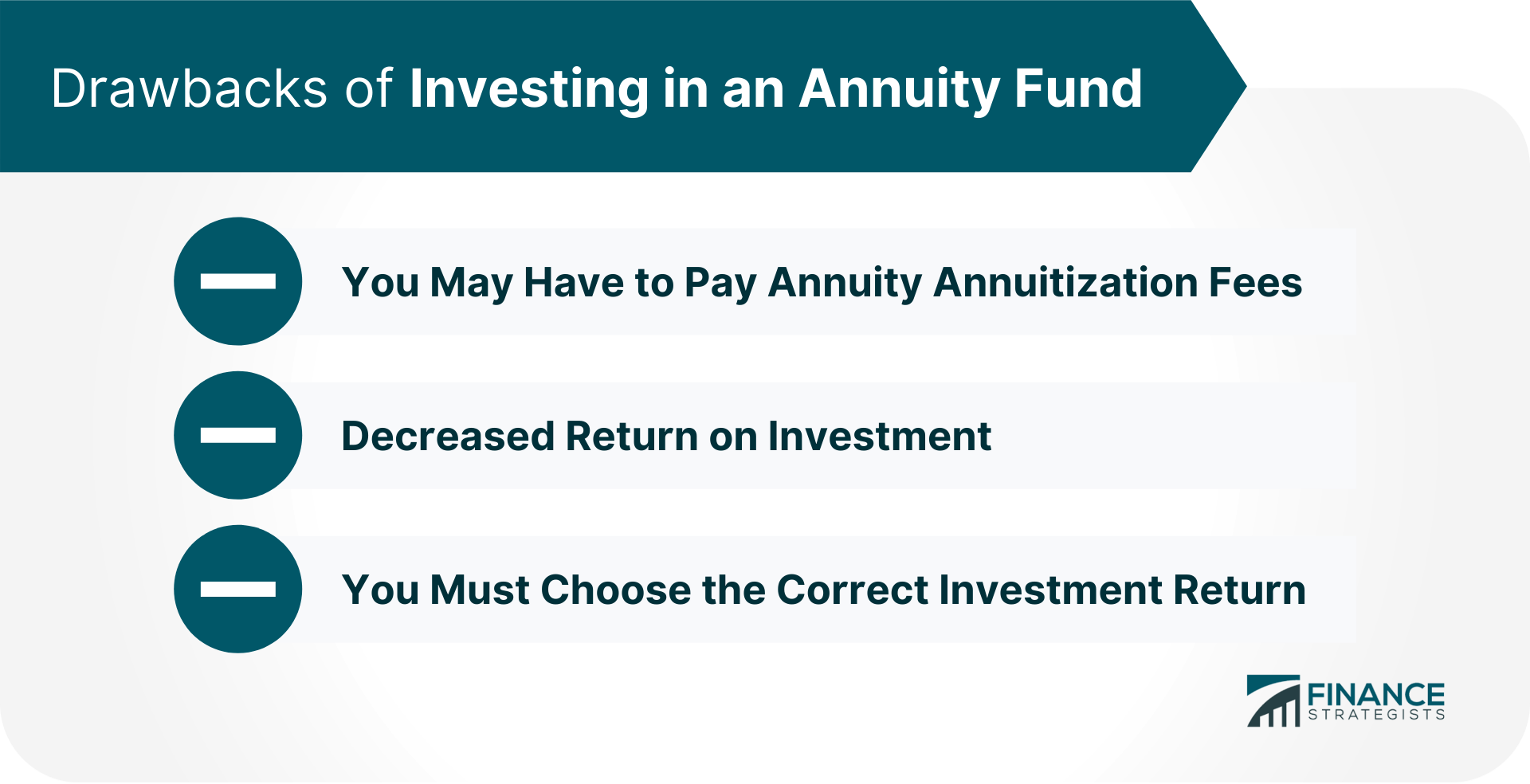

Drawbacks of Investing in an Annuity Fund

1. You May Have to Pay Annuity Annuitization Fees

2. Decreased Return on Investment

3. You Must Choose the Correct Investment Return

The Bottom Line

Annuity Fund FAQs

An annuity fund is a kind of fund that invests your money in annuities. Annuities are an investment vehicle available to you through annuity funds.

Annuities provide annuitants with guaranteed payments and returns on their investments for as long as they live if annuitized.

An annuity provider manages annuity funds to ensure they have enough money to provide stable and consistent annuities for those who invest in annuity funds.

You should consider investing in annuity funds when annuity return provides the most benefits for you over other types of investment options that provide lifetime payments or guaranteed income.

When annuitants annuitize annuities, annuities may have annuity fees that annuitants must pay. Additionally, annuity funds provide lower rates of return for annuitants than other types of retirement accounts such as variable annuities that invest in a range of stocks or mutual funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.