A Roth IRA and annuity can be used together to enhance retirement planning. A Roth IRA offers tax-free withdrawals and growth, while annuities provide regular payments for a specified period or lifetime. Combining them creates a powerful retirement tool with guaranteed income and tax advantages. It allows for flexibility in structuring retirement income and shields against future tax increases. However, this approach requires understanding the complexities and potential drawbacks. Utilizing a Roth IRA and annuity in tandem can significantly impact your retirement strategy. The tax-free growth and withdrawals of a Roth IRA, combined with an annuity's stability and regular income, create a formidable tool for securing your financial future. While stocks, bonds, and mutual funds are common choices within Roth IRAs, annuities are another viable investment option. Annuities can provide an additional retirement security layer by offering regular, predictable payments. They can be purchased within a Roth IRA, marrying the tax advantages of Roth IRAs with the income stability of annuities. Several types of annuities can be incorporated into a Roth IRA. Each one offers different benefits and considerations: These provide a guaranteed interest rate over a specified period. Conservative investors often favor them due to the predictability of returns. These annuities allow individuals to invest in subaccounts (similar to mutual funds) with the potential for higher returns based on the performance of these investments. These offer returns based on a specific equity-based index, such as the S&P 500. They often include a guaranteed minimum return but cap the maximum return. This refers to your ability to endure losses in pursuit of potential gains. If you have a low-risk tolerance, a fixed annuity may be more suitable, while those with a higher risk tolerance may opt for a variable or indexed annuity. Your expected income needs during retirement can guide your annuity choice. If you need a predictable income, a fixed annuity may be better. However, a variable or indexed annuity may be a good fit if you want growth potential and are willing to accept some uncertainty in your income. Since Roth IRAs offer tax-free distributions, including an annuity can provide a tax-efficient source of retirement income. However, you should consider your overall tax situation, including your expected tax rate in retirement. Annuity contracts can be complex. Understanding all the terms and conditions, including the fees, surrender charges, and any penalties for early withdrawal, is essential. One of the significant advantages of Roth IRAs is tax-free growth. As the funds within a Roth IRA grow, they do so without taxes. This advantage also applies to annuities held within a Roth IRA, offering a significant potential benefit. Since Roth IRAs are funded with after-tax dollars, qualified distributions are typically tax-free. This applies to distributions from annuities held within a Roth IRA, potentially providing a tax-efficient source of retirement income. The tax treatment of Roth IRAs makes them an appealing option for investors considering a Roth conversion strategy. This strategy involves converting a traditional IRA or a 401(k) into a Roth IRA. However, these conversions have tax implications that should be carefully evaluated. Including annuities in a Roth IRA can offer diversification benefits and help manage risk. Annuities can provide a steady income stream that is largely unaffected by stock market volatility, offering a cushion against market downturns. One of the most appealing benefits of annuities is the ability to provide a guaranteed income stream during retirement. This can give retirees the confidence of knowing they have a reliable source of income to help cover essential expenses. Annuities within a Roth IRA can also play a role in estate planning. Beneficiaries of Roth IRAs generally receive the assets free from income tax, which can be an attractive feature for individuals planning their estates. Despite their potential benefits, annuities often come with costs and fees, which can be substantial. These costs include surrender charges, mortality and expense risk charges, administrative fees, etc. Many annuities impose surrender charges if you withdraw funds within a certain period after purchase, typically ranging from 5 to 10 years. Additionally, withdrawals from a Roth IRA before age 59½ may be subject to a 10% early withdrawal penalty, although some exceptions exist. Roth IRAs have annual contribution limits, which may limit the amount you can invest in an annuity within a Roth IRA. Similarly, annuities often have withdrawal restrictions, which can limit the liquidity of your investment. Before purchasing an annuity, it's essential to evaluate the financial stability of the annuity provider. Companies with a higher financial rating are generally more likely to meet their long-term obligations to policyholders. Annuities can be complex products with various features, options, and fees. Understanding these details is vital to making an informed investment decision and ensuring the annuity aligns with your retirement goals. Given the wide range of annuities available, comparing options can help you find the best fit for your needs. Consider factors such as the annuity type, the provider's financial strength, fees, and the potential return on your investment. An annuity in a Roth IRA is an investment strategy that combines the tax advantages of a Roth IRA with the income guarantees of an annuity. This combination can provide a powerful tool for retirement planning, providing tax-efficient, guaranteed income in retirement. Investing in annuities within a Roth IRA offers a blend of tax efficiency, income guarantees, and potential diversification benefits. However, these advantages must be weighed against annuities' costs, limitations, and complexities. Given the complexities and potential drawbacks, incorporating annuities into a Roth IRA should be done with careful consideration. Key factors to consider include your retirement goals, tax situation, risk tolerance, and understanding of annuity contracts. With the complexity of annuities and the potential tax implications of Roth IRAs, professional financial advice can be invaluable. A financial advisor can help evaluate your situation, understand the potential risks and benefits, and guide you in making an informed decision.Overview of Annuity in Roth IRA

How Annuities as an Investment Option in Roth IRAs Work

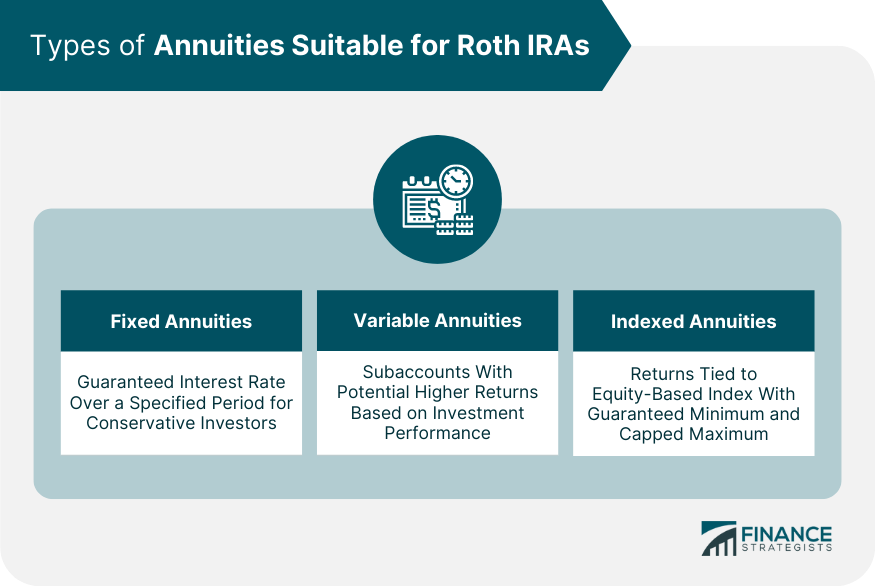

Types of Annuities Suitable for Roth IRAs

Fixed Annuities

Variable Annuities

Indexed Annuities

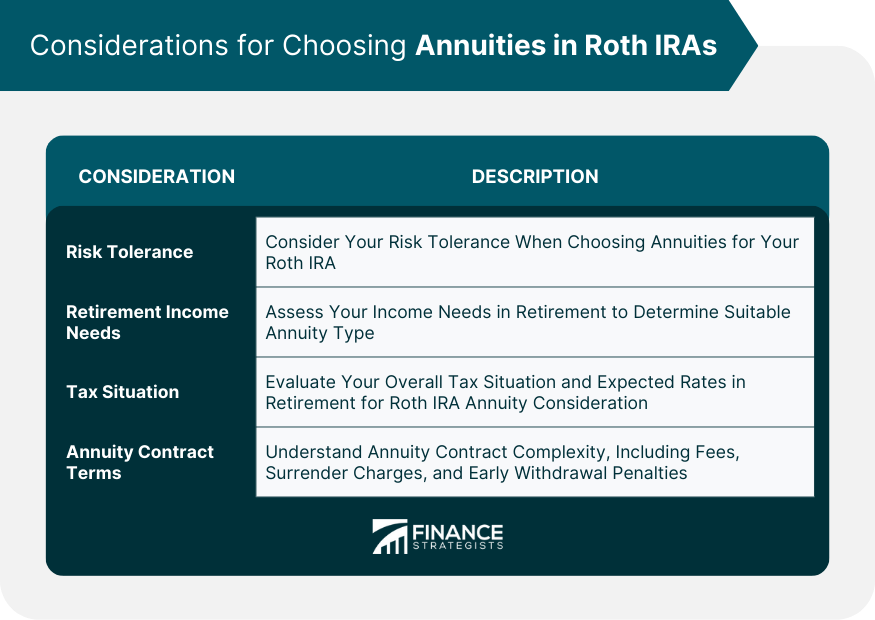

Considerations for Choosing Annuities in Roth IRAs

Risk Tolerance

Retirement Income Needs

Tax Situation

Terms and Conditions of the Annuity Contract

Tax Treatment of Annuities in a Roth IRA

Tax-Free Growth in Roth IRAs

Taxation of Annuity Distributions in Roth IRAs

Roth IRA Conversion Strategies With Annuities

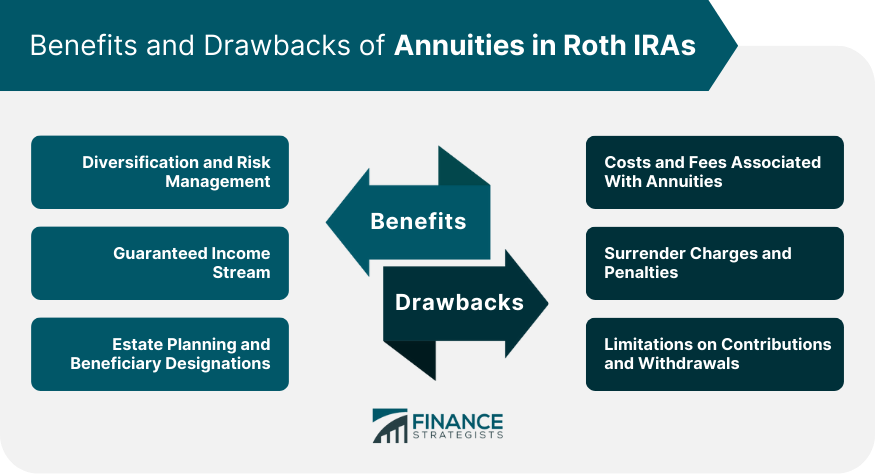

Benefits of Annuities in Roth IRAs

Diversification and Risk Management

Guaranteed Income Stream

Estate Planning and Beneficiary Designations

Drawbacks and Considerations

Costs and Fees Associated With Annuities

Surrender Charges and Penalties

Limitations on Contributions and Withdrawals

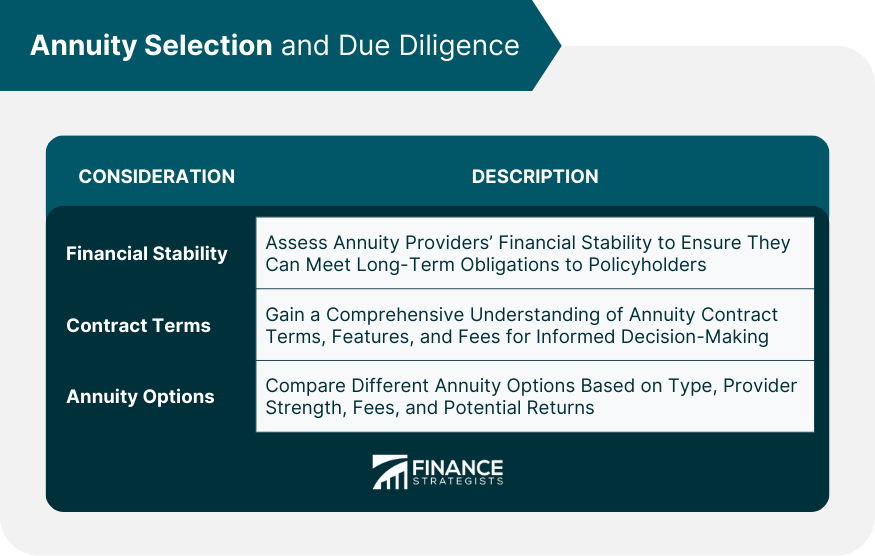

Annuity Selection and Due Diligence

Evaluating the Financial Stability of Annuity Providers

Understanding Annuity Contract Terms and Features

Comparing Annuity Options and Shopping for the Best Fit

Conclusion

Annuity in Roth IRA FAQs

Yes, like any investment, annuities in a Roth IRA carry risk. Depending on the type of annuity, a person may lose money if the investments backing the annuity perform poorly.

Yes, Roth IRAs have income eligibility limits. For 2023, individuals with modified adjusted gross incomes above certain limits cannot contribute to a Roth IRA.

Yes, annuities often have surrender charges if you withdraw money within a certain period after purchase. Additionally, Roth IRAs may impose a 10% early withdrawal penalty for distributions before age 59½, although exceptions exist.

Upon a person’s death, the assets in their Roth IRA, including annuities, can pass to their designated beneficiaries. Generally, beneficiaries receive these assets free from income tax.

Not necessarily. The appropriateness of an annuity in a Roth IRA depends on many factors, including your financial situation, risk tolerance, retirement goals, and tax situation. Consult a professional financial advisor to explore the best strategies for your circumstances.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.