Annuity and Certificate of Deposit (CD) are two popular financial products that offer investors a guaranteed return and principal protection. While both products are safe options, they differ significantly in their features, benefits, and drawbacks. An annuity is an insurance product that provides a steady stream of income over a period. It is designed to help investors save for retirement, and it offers several customization options, including fixed, variable, immediate, and deferred. Conversely, a CD is a financial product offered by credit unions and banks which provides a guaranteed rate of return over a fixed period, ranging from a few months to several years. While annuities and CDs are both safe options for investors seeking a low-risk investment, they differ in terms of fees, returns, and flexibility. Deciding between an Annuity and a Certificate of Deposit? Click here. An annuity is a contractual agreement between an investor and an insurance company that ensures a guaranteed income stream for a specified period. There are four main types of annuities: Fixed Annuity. This type of annuity differs from a variable annuity in that it offers a fixed rate of return, and the income payments are guaranteed for life. Variable Annuity. A variable annuity offers investors the flexibility to invest in a range of investment options, including stocks, bonds, and mutual funds. The income payments may vary based on the performance of the underlying investments. Immediate annuity. An immediate annuity enables investors to immediately convert a lump sum of money into a guaranteed income stream. Deferred Annuity. A deferred annuity allows investors to save for retirement by investing money over a period. The income payments are deferred until a future date, typically retirement. An annuity offers several benefits to the investor. These include: One of the most significant benefits of an annuity is the guarantee of a steady income stream for life. Unlike other investment products, such as mutual funds or stocks, an annuity provides a fixed amount of income every month, regardless of market conditions. For retirees with a limited income and a desire to avoid the risk of depleting their savings, this can be an especially beneficial option. Another advantage of an annuity is that the investment gains grow tax-deferred. This means that the investor does not have to pay taxes on the gains until they withdraw the money. This can be beneficial for individuals who want to delay paying taxes and potentially reduce their tax burden in retirement when their income may be lower. Annuities offer customizable features to meet the unique needs of investors. For example, a death benefit can be added to an annuity, which will pay out a certain amount to the beneficiary if the investor dies before the annuity is fully paid out. One of the main drawbacks of getting an annuity is that it can be expensive. Investors typically pay an annual fee, which can range from 1% to 3% of the account value. This fee can significantly reduce the overall return on the investment. Annuities typically have high commission rates, which can reduce investment returns. The commission can vary from 1% to 8%, depending on the type of annuity. Annuities typically have surrender charges that apply if the investor withdraws money before a certain period. These fees can be significant and can deter investors from accessing their money when needed. A certificate of deposit is a type of savings account that pays interest in exchange for a commitment to leave the invested amount in the account for a set period of time. If money is withdrawn before the end of the term, there may be a penalty that results in a loss of interest or even a loss of principal. CDs can have fixed or variable rates, with fixed rates being more common, and longer-term CDs typically offer higher interest rates. Deposit requirements vary, but higher deposit amounts generally result in higher interest rates. CDs are popular among investors who value stable, interest-bearing investments and can afford to lock up their money for a period. It is important for individuals to understand how and when to use CDs to achieve their financial goals as part of their financial literacy. CDs offer several benefits to investors who prefer low-risk investments. Here are some of the pros of using a Certificate of Deposit: Investing in CDs is a secure option since they are backed by the Federal Deposit Insurance Corporation (FDIC), which insures deposits of up to $250,000 per depositor per insured bank. This means that if the bank where the investor has deposited the money fails, the investor will still get their money back up to the insured limit. A CD is a savings account that usually pays a higher interest rate than a standard savings account. The interest rate offered by CDs can be higher than the interest rate offered by a regular savings account, but it varies depending on the type of account and the bank. CD accounts offer a fixed interest rate, which means the rate does not change during the term of the CD. This feature provides savers with a guaranteed return on their investment, which can be particularly attractive for individuals who are risk-averse and want to avoid market fluctuations. CD laddering is a savings plan in which an individual purchases several CDs with varying maturity dates and interest rates. This technique offers adaptability and reduces the chances of losing out on better rates in the future. While there are benefits to using CDs to save money, there are also drawbacks that individuals should be aware of before investing in them. One of the main disadvantages of CDs is that the saver is locked into the maturity term, and withdrawing money before maturity can result in penalty fees equal to some or all of the interest earned. Inflation is another concern with CDs, as rising inflation can reduce the purchasing power of savings. This can be problematic as the interest rate on CDs may not keep pace with inflation. While CDs offer some benefits, such as guaranteed returns and safety, they may not provide the same level of potential returns as other investments like stocks or mutual funds. CDs are often seen as a conservative investment option, with lower potential returns but also less risk. CDs have limited liquidity, which can be a disadvantage for savers who need quick access to their money. Unlike savings or money market accounts, CDs have a set maturity date and withdrawing funds before maturity can result in penalty fees. However, CD laddering can offer a solution to this problem. By purchasing CDs with staggered maturity dates, savers can have access to some of their funds on a regular basis without incurring early withdrawal penalties. Despite the benefits of CD laddering, savers should still be aware of the restrictions of each CD in their ladder, including the interest rates and maturity dates. When considering investment options, it is important to understand the differences between annuities and CDs. While annuities are exempt from lawsuit claims in some states, CDs are not. Annuities are intended to provide a continuous flow of payments over a period, whereas CDs provide a one-time payment upon reaching maturity. FDIC insurance covers bank CDs up to $250,000, making them a safe investment, while annuities are insured by the issuing insurance company and state guaranty associations, but not the federal government. Annuities offer tax-deferred growth. This means that the money invested in an annuity grows without being subject to taxes until it is withdrawn. This can be advantageous, as the interest earned on the funds can compound, leading to greater earnings over time. On the other hand, CDs are not tax-deferred investments, and any earnings they generate are subject to annual taxation. More specifically, when you invest in a CD, the interest you earn is considered income and is subject to income tax. This means that you have to report the interest you earn each year on your tax return and pay taxes on that income. In contrast, with an annuity, you do not have to pay taxes on the earnings until you start taking withdrawals, which may be years or even decades in the future. This can help to maximize the growth potential of your investment, especially over the long term. Compared to CDs, annuities have less flexibility and higher penalties for early withdrawals, which typically apply to withdrawals exceeding 10 percent of the contract value. Meanwhile, closing a CD earlier than scheduled results in a lower penalty than withdrawing funds early from an annuity. Additionally, while penalties for early withdrawals from CDs typically increase with each renewal, annuity penalties are fixed. However, annuity owners under 59 ½ must also pay the IRS a 10 percent penalty for early withdrawal, in addition to any penalties imposed under the annuity contract. While annuities offer the potential for higher returns than CDs, they also come with more risk due to their investment in the stock market. This means that returns can be volatile, and investors may experience losses. On the other hand, CDs offer a guaranteed rate of return, which means that the return is known ahead of time, and investors do not face market risks. If the owner of certificates of deposit does not put them in a trust that is either living or irrevocable, then the heirs will have to go through probate in case the owner dies. Such a process can be complex and time-consuming. Moreover, annuity beneficiaries are not required to go through probate court to claim their benefits, providing a smoother and faster process. Before deciding whether to invest in a CD or an annuity, it is essential to consider your needs and preferences. If you are looking for a steady stream of retirement income, an annuity may be the obvious choice. However, it is important to note that annuities also allow you to receive your principal and interest in a lump sum, just like CDs. Your decision may be influenced by other factors, such as whether you want your investment to be backed by the federal government or an insurance company, the duration of your investment, your plans for the money once you receive it and the diversity of your portfolio. Additionally, annuity contracts may offer customizations like long-term care riders to meet your unique needs. It is critical to discuss your needs and expectations with your financial advisor before committing a significant portion of your savings to any investment. Annuities and certificates of deposit (CDs) are both safe investment options that offer guaranteed returns and principal protection, but they differ in terms of fees, returns, and flexibility. Annuities are a type of insurance product that provides a steady stream of income over a period, while CDs are savings accounts that offer a fixed interest rate for a specified period. Annuities provide guaranteed regular income, grow tax-deferred, and offer personalized features. CDs, on the other hand, offer higher rates, guaranteed returns, and flexibility due to CD laddering. However, annuities can be expensive with annual fees and high commission rates, while CDs have penalties for early withdrawal. If you are looking for assistance in managing your finances and making the most of your investments, consider speaking to a financial advisor. Annuity vs Certificate of Deposit: Overview

What Is an Annuity?

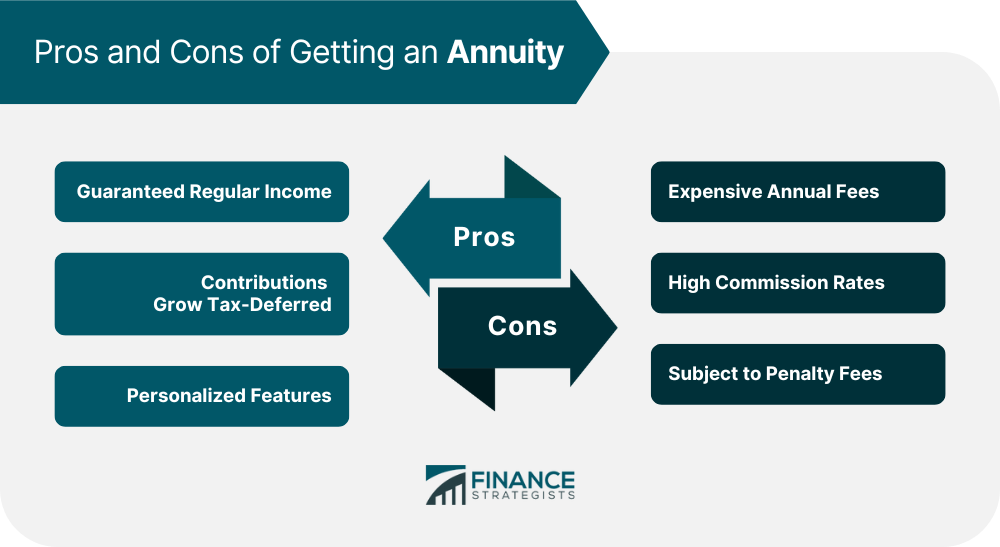

Pros of Getting an Annuity

Guaranteed Regular Income

Contributions Grow Tax-Deferred

Personalized Features

Cons of Getting an Annuity

Expensive Annual Fees

High Commission Rates

Subject to Penalty Fees

What Is a Certificate of Deposit (CD)?

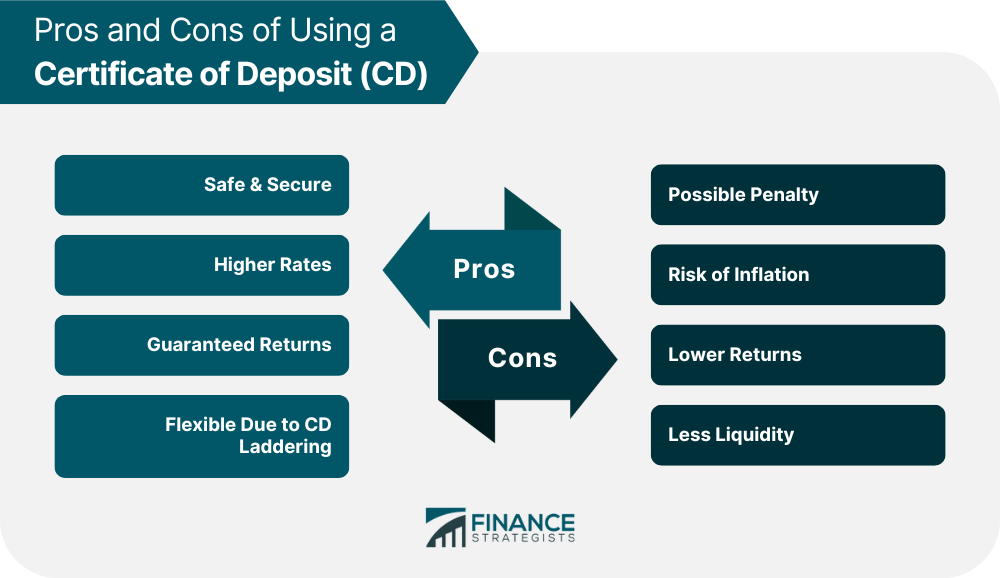

Pros of Using a Certificate of Deposit (CD)

Safe & Secure

Higher Rates

Guaranteed Returns

Flexible Due to CD Laddering

Cons of Using a Certificate of Deposit (CD)

Possible Penalty

Risk of Inflation

Lower Returns

Less Liquidity

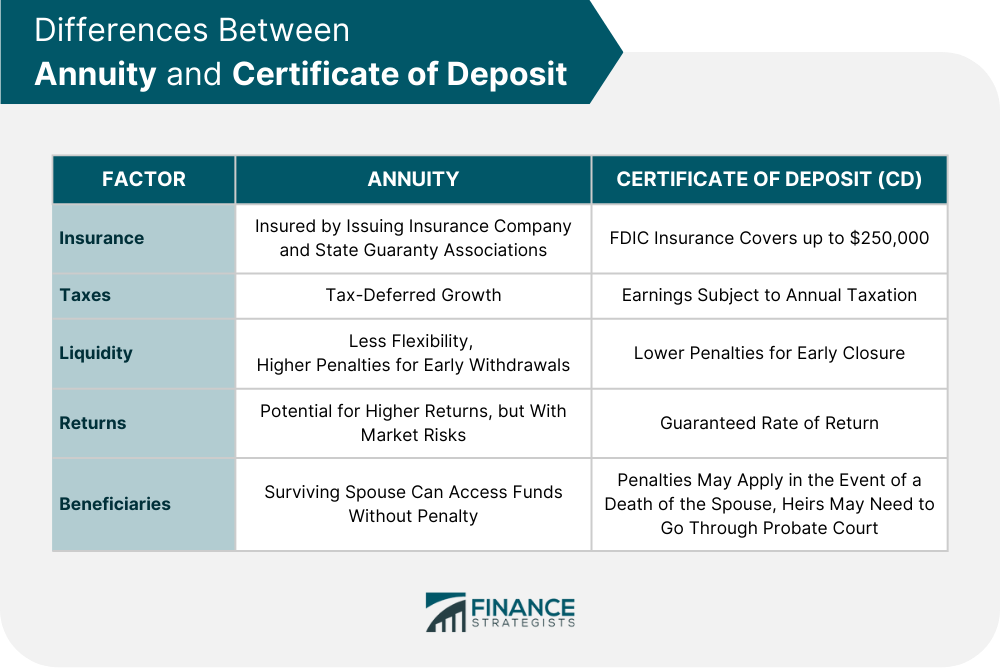

Differences Between Annuity and Certificate of Deposit (CD)

Insurance

Taxes

Liquidity and Penalties

Returns

Beneficiaries

Annuity vs CD: Which Should You Choose?

Final Thoughts

Annuity vs Certificate of Deposit (CD) FAQs

An annuity is a financial product that pays out a fixed sum of money at regular intervals, typically over the course of the lifetime of a person. Annuities are usually purchased from insurance companies and are often used as a way to save for retirement or to provide a guaranteed income stream during retirement.

A certificate of deposit is a financial product that allows an individual to deposit a specific amount of money for a fixed period of time, usually ranging from three months to five years. CDs typically offer a higher interest rate than traditional savings accounts but require the individual to keep the money in the account for the duration of the term in order to earn the stated interest rate.

Yes, an individual can invest in both annuities and CDs. In fact, having a diversified portfolio that includes a mix of different types of investments, including annuities and CDs, can help mitigate risk and provide a more stable financial outlook.

The fees associated with annuities and CDs can vary depending on the specific product and the financial institution offering it. Annuities often have higher fees than CDs, as they are typically sold by insurance companies and may include charges for administrative expenses, mortality and expense risk charges, and surrender charges if the annuity is terminated early. CDs typically have lower fees but may include penalties for early withdrawal.

Choosing between an annuity and a CD depends on individual financial goals and circumstances. Annuities may be more suitable for individuals who are looking for a guaranteed income stream during retirement or who want to protect their principal investment from market risk. CDs may be more suitable for individuals who want a relatively safe and stable investment option with a guaranteed return but are willing to accept lower interest rates and less flexibility in accessing their funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.