A lottery annuity refers to the long-term payout option provided to lottery winners as an alternative to a lump-sum payment. When someone wins the lottery, they can choose to receive a large one-time cash payment or smaller payments over a predetermined period, typically 20 to 30 years. This series of smaller payments is referred to as an annuity. The annuity option provides a consistent income stream over time. Payments can be set to increase by a set percentage each year to account for inflation and cost of living adjustments. The legality surrounding lottery annuities and inheritance can be complex, mainly because laws governing these aspects vary significantly from state to state. Broadly, a lottery annuity can be passed on to heirs in the event of the policyholder's death. However, the details of this transfer and the subsequent tax implications can greatly depend on the specific state law and the terms outlined in the lottery annuity agreement.

If a lottery winner who has opted for an annuity payout passes away, the remaining payments typically go to their estate and subsequently to any heirs or beneficiaries. This process is governed by the annuity contract's specific terms and any legal will the deceased person has left. The probate is a legal process where a court validates the will of the deceased, pays off their debts, and distributes the remaining assets to the beneficiaries. If the deceased left a will, the executor named would initiate the probate process by filing with the probate court. If there's no will, the court will appoint an administrator, often a next of kin, to handle the estate. The lottery annuity, like the other assets, will typically be part of the probate process unless the deceased has named a direct beneficiary prior. In many jurisdictions, if a beneficiary is named on the annuity contract, the annuity bypasses probate and is distributed directly to them. However, this can vary depending on state laws and the specific terms of the annuity contract. Once probate (if required) is complete, the next step is for the beneficiary to claim the annuity. This process usually involves providing the annuity company with a copy of the death certificate and completing a claim form. The company will then retitle the annuity in the name of the beneficiary. If there are multiple beneficiaries, the annuity payments will be split according to the deceased's wishes. If no specific instructions were left, the payments would be divided equally among the beneficiaries. The Internal Revenue Service (IRS) treats inherited lottery annuity payments as income, not capital gains. This distinction means that the beneficiary must report the income on their tax return and pay the associated income tax. The rate at which these payments are taxed depends on the beneficiary's overall income and federal tax bracket. The rules vary when it comes to inherited annuities. Some states treat these as taxable income, just like the federal government, while others do not. It's crucial to consult with a tax professional or financial advisor in your state to understand the specific implications. The taxation of inherited annuity payments is quite different from the usual inheritance tax. Generally, inheritance tax applies to the value of the deceased's estate, whereas income tax on an annuity applies to the payments received by the beneficiary. This nuance underscores the importance of professional tax advice when dealing with inherited annuities. One of the main advantages of inheriting a lottery annuity is the provision of a consistent income stream. This income can serve as a financial safety net, especially for beneficiaries who may not have other reliable income sources. Depending on the initial lottery amount and the remaining term of the annuity, this could mean significant annual payments that can help cover living expenses, savings, or investment opportunities. The structure of most lottery annuities includes an annual increment to account for inflation and to maintain the buying power of the annuity payouts. This increment means that beneficiaries can expect their annual income from the annuity to grow over time. Thus, it ensures that beneficiaries will always have a somewhat inflation-protected income, preserving their purchasing power and ability to maintain their current lifestyle. Depending on the state laws, annuities can offer a level of protection from creditors and lawsuits that other assets may not provide. Should the beneficiary find themselves facing financial troubles, the annuity payments might be exempt from seizure by creditors. This protection can provide an additional level of financial security to beneficiaries, ensuring that they continue to receive their annuity payments even in adverse situations. Large lump-sum inheritances often come with the temptation to spend the money all at once, leading to potential financial issues down the line. By contrast, an annuity breaks down this amount into smaller, consistent payments, discouraging excessive spending and promoting more financially responsible behavior. This gradual payout mechanism encourages beneficiaries to plan their finances carefully and avoid hasty decisions that could negatively impact their long-term financial health. One of the main drawbacks of inheriting a lottery annuity is the tax obligation that comes with it. Each annuity payment received by the beneficiary is considered income by the IRS, which means it's subject to income tax. Furthermore, the tax implications are not just at the federal level; some states also tax these annuity payments, adding to the beneficiary's tax burden. Unlike other assets, such as real estate or stocks, beneficiaries have very little control over annuity payments. They are typically bound by the original terms of the annuity, including the payment schedule and amount. The beneficiary cannot usually adjust these terms to suit their financial needs or goals. For instance, they cannot access the principal amount if they suddenly require a large sum of money. While annuity payments are often structured to account for inflation, economic downturns or periods of hyperinflation can erode the purchasing power of future annuity payments. The loss in value might not be immediate or apparent, but over the long term, it can significantly impact the beneficiary's financial situation. The first thing to do when you find out that you've inherited a lottery annuity is to verify your status as a beneficiary. The annuity company or the executor of the estate should provide you with a detailed explanation of your beneficiary status. You need to familiarize yourself with the terms and conditions of the annuity. These may include the payment schedule, the annual payout amount, and how long the payments will continue. It is critical to have a thorough understanding of these terms to ensure that you know exactly what to expect from the annuity and how to plan your finances accordingly. For instance, if you require money for an immediate financial need, you may consider selling your future annuity payments to a third-party company for a lump sum. Alternatively, if a steady, long-term income stream aligns more with your goals, you may keep receiving the annuity payments as scheduled. Either way, it's important to align your decision with your financial situation and update your plans accordingly. You should keep a record of all your annuity payments, tax documents, and any correspondence related to your annuity. These records are not only important for tax purposes, but they can also be beneficial for future financial planning or if any issues arise with your annuity payments. Laws and regulations pertaining to financial and tax matters can change over time. Regularly reviewing these matters or working with professionals who can keep you updated can help you avoid potential pitfalls and ensure that you're making the most of your inheritance. Given the complexities and significant financial implications involved in inheriting a lottery annuity, seeking professional advice is a key consideration. Financial advisors, tax professionals, and estate planning lawyers can provide valuable guidance tailored to your circumstances. They can help you navigate the probate process, understand tax implications, plan for your financial future, and make informed decisions about your inheritance. This expertise can be invaluable in ensuring that you manage your inheritance in the most beneficial way possible. Lottery annuities can be inherited, but the legality surrounding lottery annuities and inheritance is complex and varies from state to state. Generally, when a lottery winner with an annuity option passes away, the remaining payments typically go to their estate and then to heirs or beneficiaries based on the terms outlined in the annuity contract and any legal will. Inheriting a lottery annuity comes with benefits such as a steady income stream, potential for growth to combat inflation, and asset protection in certain cases. However, drawbacks include tax obligations, limited control over the annuity terms, and the possibility of the annuity's value eroding over time due to economic factors. Managing an inherited lottery annuity requires verifying beneficiary status, understanding the annuity's terms, considering financial needs and goals, keeping thorough records, and staying informed about changes in laws and regulations. Lastly, it is crucial to seek guidance from financial advisors, tax professionals, and estate attorneys. These professionals can help in navigating the probate process, understanding tax implications, and making informed decisions to maximize the benefits of the inheritance.Lottery Annuity: Overview

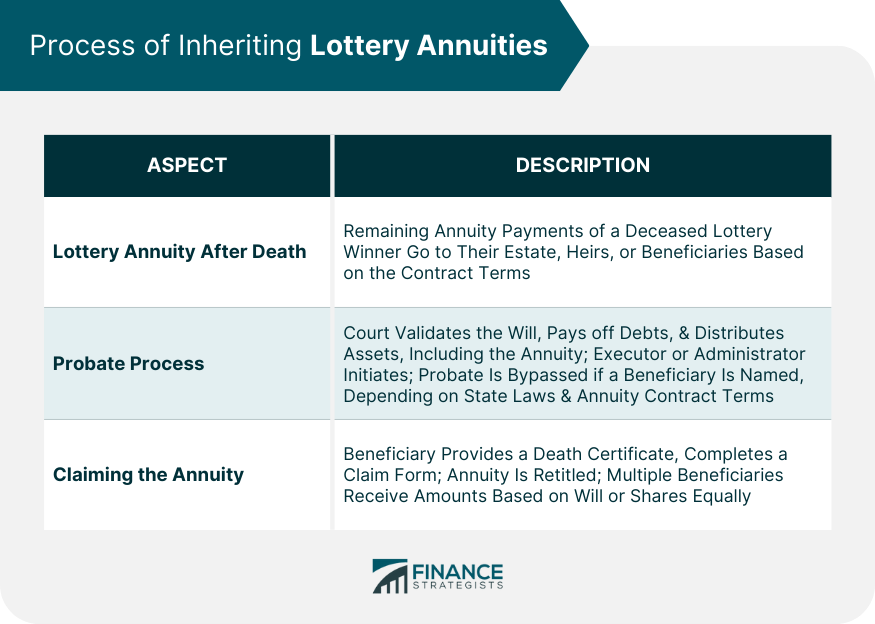

Process of Inheriting Lottery Annuities

Lottery Annuity After Death

Probate Process

Claiming the Annuity

Tax Implications of Inheriting a Lottery Annuity

Federal Tax

State Tax

Inheritance vs Income Tax Considerations

Benefits of Inheriting a Lottery Annuity

Steady Income Stream

Potential for Growth

Asset Protection

Minimized Spending Temptations

Drawbacks of Inheriting a Lottery Annuity

Tax Obligations

Lack of Control

Potential for Loss

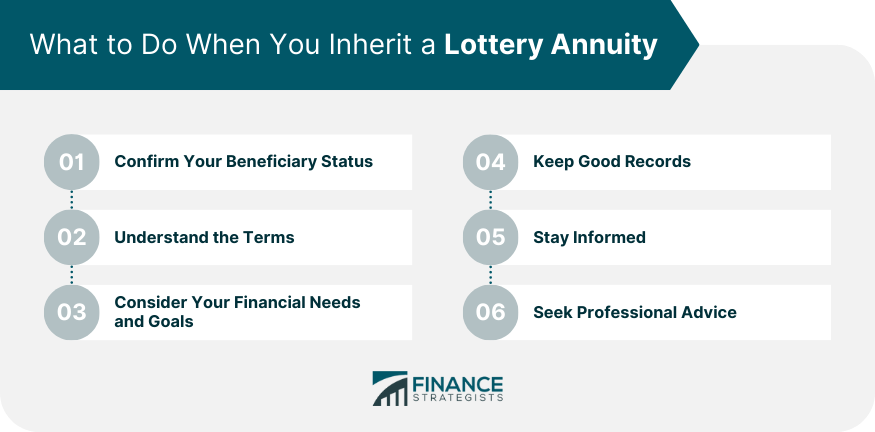

What to Do When You Inherit a Lottery Annuity

Confirm Your Beneficiary Status

Understand the Terms

Consider Your Financial Needs and Goals

Keep Good Records

Stay Informed

Seek Professional Advice

Final Thoughts

Can a Lottery Annuity Be Inherited? FAQs

The legal requirements and restrictions for inheriting a lottery annuity can vary depending on the specific state laws and the terms outlined in the annuity agreement. It is important to consult with a legal professional or estate attorney to understand the applicable laws and requirements in your jurisdiction.

Yes, inherited lottery annuity payments are considered taxable income by the Internal Revenue Service (IRS). The beneficiary is required to report the income on their tax return and pay the associated income tax. State tax rules regarding inherited annuities may also apply, so it's advisable to consult with a tax professional to understand the specific tax implications.

Generally, the terms of a lottery annuity cannot be changed after inheritance. The beneficiary is typically bound by the original terms of the annuity, including the payment schedule and amount. It is important to review the annuity agreement and understand the terms before inheriting to avoid any surprises.

If you inherit a lottery annuity, it is advisable to verify your beneficiary status with the annuity company or the executor of the estate. Familiarize yourself with the terms and conditions of the annuity, including the payment schedule and duration. Consider your financial needs and goals, keep good records of the annuity payments and related documents, stay informed about tax laws and regulations, and seek professional advice from financial advisors, tax professionals, or estate attorneys to make informed decisions and manage your inheritance effectively.

Yes, it is possible to sell your inherited lottery annuity. In some cases, beneficiaries may choose to sell some or all of their future annuity payments to a third-party company in exchange for a lump sum of cash. This option can provide immediate access to funds and can be beneficial if you have pressing financial needs or prefer a different financial strategy. However, it's important to carefully consider the terms of the sale and seek professional advice before making a decision to ensure it aligns with your long-term financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.