An annuity is a financial contract between an individual and an insurance company that provides a series of payments to the individual over a specified period, typically for life or a fixed number of years. An individual can either make a lump sum payment or a series of payments to the insurance company in exchange for regular payments later on. Annuities can be used as an investment tool to provide a steady income stream during retirement. There are four main types of annuities: fixed, variable, indexed, and immediate annuities. Fixed annuities provide a guaranteed fixed interest rate for a specified period, while variable annuities allow the owner to invest in a range of mutual funds, stocks, and bonds. Indexed annuities are a hybrid between fixed and variable annuities, offering a guaranteed minimum interest rate with the potential for higher returns based on market performance. Immediate annuities provide regular payments starting immediately after the annuity is purchased. Each type of annuity has its own benefits and drawbacks, and the best option depends on the individual's financial goals and risk tolerance. Annuity inheritance is the process by which a beneficiary receives the remaining payments of an annuity after the death of the annuity owner. The answer to the question of whether annuities can be inherited is yes, but it depends on the type of annuity. Immediate annuities, which provide payments for life or a fixed number of years, cannot be inherited. It is because the payments stop when the annuity owner passes away, and there is nothing left to pass on to a beneficiary. On the other hand, deferred annuities can be inherited. When the annuity owner passes away, the remaining balance is passed on to the designated beneficiary or beneficiaries. The beneficiaries can choose to receive the remaining payments in a lump sum or continue receiving payments over a specified period, depending on the terms of the annuity contract. When it comes to inheriting annuities, beneficiaries typically have two options: receive the remaining payments in a lump sum or continue receiving payments over a specified period. This option provides the beneficiary with a one-time payment of the remaining balance of the annuity. It can benefit individuals who want to invest the funds in other investments or who need a lump sum of money for a specific expense. Also known as stretch payments, these allow the beneficiary to continue receiving regular payments from the annuity over a specified period. The payments can continue for the rest of the beneficiary's life or a fixed number of years. This option can be beneficial for individuals who want a steady stream of income for an extended period. When deciding how to inherit an annuity, beneficiaries should consider several factors, including age, tax bracket, and overall financial goals. It is an essential factor to consider because it can impact the tax implications of annuity inheritance. Younger beneficiaries may benefit from taking the payments over a more extended period, as they will likely be in a lower tax bracket. Older beneficiaries may prefer to receive the payments in a lump sum to avoid the hassle of Beneficiaries in a higher tax bracket may prefer to receive the payments over a more extended period to avoid pushing themselves into a higher tax bracket. In contrast, beneficiaries in a lower tax bracket may benefit from taking the payments in a lump sum to avoid future tax increases. Beneficiaries who need a large sum of money for a specific expense, such as paying off debt or buying a home, may prefer to take the payments in a lump sum. On the other hand, beneficiaries who want a steady stream of income for an extended period may prefer continuing payments. Inheriting an annuity also comes with tax implications, which can vary depending on the type of annuity and the beneficiary's tax bracket. Generally, the beneficiary must pay taxes on the annuity payments they receive as income. The SECURE Act also made changes to the rules governing annuity inheritance. One of the significant changes is that non-spouse beneficiaries are now required to withdraw the entire balance of an inherited annuity within ten years of the annuity owner's death. Inheriting an annuity can be a complex and confusing process, particularly when it comes to taxes. The taxation of an inherited annuity depends on a range of factors, including the type of annuity, the age of the original annuity owner, and the distribution options chosen by the beneficiary. If the annuity was a non-qualified annuity, meaning it was purchased with after-tax dollars, the beneficiary will typically only be required to pay income taxes on any earnings or interest accrued on the account since the original owner purchased it. However, if the annuity was a qualified annuity, such as one purchased with pre-tax dollars through an employer-sponsored retirement plan, the entire amount of the annuity will be subject to income taxes upon inheritance. Additionally, beneficiaries may face tax penalties if they take distributions from the annuity before a certain age or fail to take the required minimum distributions. It is important for individuals who inherit annuities to work closely with a financial advisor or tax professional to understand their tax implications and develop a plan for managing the annuity in a way that minimizes their tax liability. There are several strategies that can be used to minimize taxes on an inherited annuity. One approach is to take advantage of the "stretch" provision, which allows beneficiaries to take distributions from the annuity over a period of time rather than as a lump sum. By stretching out the distributions, beneficiaries can reduce their overall tax liability by spreading out the income over multiple years, potentially keeping them in a lower tax bracket. Another option is to consider a "life-expectancy" payout method, which calculates distributions based on the beneficiary's life expectancy rather than a fixed term. This can also help minimize taxes by reducing the income received in any given year. Additionally, beneficiaries may want to consider transferring the annuity into an inherited IRA, which allows for additional tax-deferred growth opportunities and more flexible distribution options. Ultimately, the best way to minimize taxes on an inherited annuity will depend on the specific circumstances of the inheritance and the beneficiary's financial goals and tax situation. Annuities can be inherited, but it depends on the type of annuity. Immediate annuities cannot be inherited, while deferred annuities can be. Inheriting an annuity also comes with tax implications, which can vary depending on the type of annuity and the beneficiary's tax bracket. Beneficiaries typically have two options for inheriting an annuity: receiving the remaining payments in a lump sum or continuing payments over a specified period. Beneficiaries can minimize their tax liability by using strategies such as stretching distributions over time, using life-expectancy payout methods, or transferring the annuity into an inherited IRA. When deciding how to inherit an annuity, beneficiaries should consider their age, tax bracket, and overall financial goals. Consulting a financial advisor or insurance expert is crucial when making this decision to ensure it fits into an individual’s overall financial plan.Overview of Annuities

Can Annuities Be Inherited?

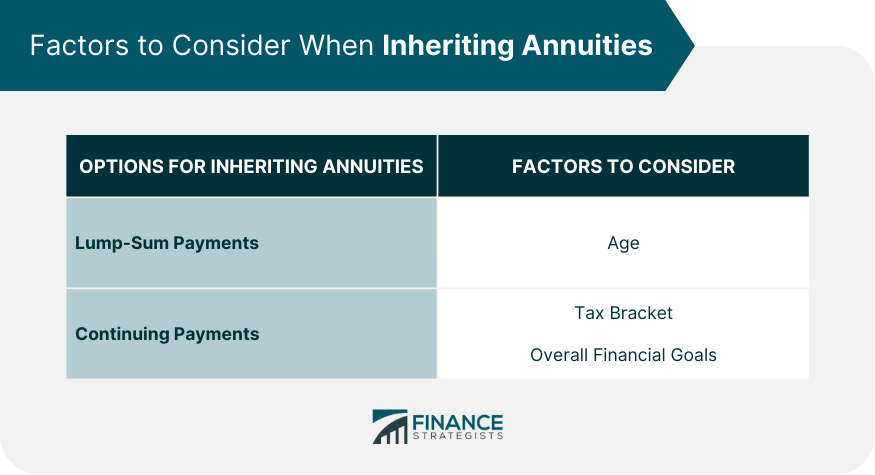

Options for Inheriting Annuities

Lump-Sum Payments

Continuing Payments

Factors to Consider When Inheriting Annuities

Age

Tax Bracket

Overall Financial Goals

Rules and Regulations Governing Annuity Inheritance

Taxes on Inherited Annuity

Minimize Taxes on Inherited Annuity

The Bottom Line

Can Annuities Be Inherited? FAQs

No, only deferred annuities can be inherited. Immediate annuities cannot be inherited because the payments stop when the annuity owner passes away, and there is nothing left to pass on to a beneficiary.

When the annuity owner passes away, the remaining balance is passed on to the designated beneficiary or beneficiaries. The beneficiaries can choose to receive the remaining payments in a lump sum or continue receiving payments over a specified period, depending on the terms of the annuity contract.

Yes, inheriting an annuity comes with tax implications, which can vary depending on the type of annuity and the beneficiary's tax bracket. The beneficiary will need to pay taxes on the annuity payments they receive as income.

Beneficiaries typically have two options when inheriting an annuity: receiving the remaining payments in a lump sum or continuing payments over a specified period. The option to choose may depend on the terms of the annuity contract.

Factors to consider when inheriting an annuity include the beneficiary's age, tax bracket, and overall financial goals. It is important to consult with a financial advisor to understand the tax implications of each option and how it fits into the beneficiary's overall financial plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.