An annuity is a financial product that is designed to provide a guaranteed stream of income for a specified period or for the lifetime of the annuitant. An annuity contract is usually offered by an insurance company, and it involves the annuitant making a lump-sum payment or a series of payments to the insurer in exchange for regular payments at a later date. While annuities are primarily designed as a retirement income planning strategy, they may also have a death benefit component that provides protection for the annuitant's beneficiaries. The death benefit of an annuity is a provision that allows the annuitant's beneficiaries to receive a lump-sum payment if the annuitant dies before the end of the annuity contract. The amount of the death benefit varies depending on the type of annuity, the age of the annuitant at the time of death, and the amount of money that was invested in the annuity. In most cases, the death benefit is equal to the difference between the total payments that the annuitant received during their lifetime and the total amount that was invested in the annuity. For example, if an annuitant invested $100,000 in an annuity and received $80,000 in payments before passing away, the death benefit would be $20,000. However, the calculation of the death benefit can vary depending on the specific terms of the annuity contract. Some annuities may guarantee a minimum death benefit, regardless of the payments received by the annuitant. Additionally, annuities with a stepped-up death benefit may increase the death benefit based on the annuity's performance over time. There are different types of death benefits that may be available with annuities. One common type is the guaranteed minimum death benefit (GMDB), which ensures that the beneficiary will receive a minimum amount of money, regardless of how the annuity has performed. Another type is the stepped-up death benefit, which guarantees that the beneficiary will receive a higher amount of money if the annuity has performed well over time. Annuities come in various types, and some of them offer a death benefit. The three most common types of annuities that offer a death benefit are fixed annuities, variable annuities, and indexed annuities. These are a type of annuity that offers a fixed interest rate for a specified period. They are typically low-risk and provide a predictable stream of income. Fixed annuities that offer a death benefit usually come with a GMDB. On the other hand, variable annuities are a type of annuity that allows the annuitant to invest in a variety of sub-accounts, which are similar to mutual funds. Variable annuities that offer a death benefit usually come with a GMDB or a stepped-up death benefit. These are a type of annuity that offers a return that is linked to a stock market index, such as the S&P 500. They are designed to provide the annuitant with the potential for higher returns while limiting the downside risk. Indexed annuities that offer a death benefit usually come with a GMDB. When choosing an annuity with a death benefit, there are several factors that investors should consider: Annuities with a death benefit are primarily designed to provide a retirement income and a death benefit for beneficiaries. Investors should consider whether the annuity aligns with their investment goals and whether it meets their income needs in retirement. The risk tolerance of the investor is also an important factor to consider. Fixed annuities are low-risk, while variable annuities and indexed annuities are more complex and carry higher risks due to market fluctuations. Investors should choose an annuity that aligns with their risk tolerance and investment objectives. The financial strength of the insurance company offering the annuity is an essential factor to consider when choosing an annuity with a death benefit. Investors should research the financial stability and reputation of the insurance company before making an investment. Annuities come with fees and expenses, including administrative fees, investment management fees, and surrender charges. Investors should carefully review the fees and expenses associated with the annuity, as they can reduce the overall returns of the investment. Annuities with a death benefit may also offer optional riders or features that can enhance the death benefit or provide additional protections for beneficiaries. Here are some of the most common riders or features: This rider provides additional funds to cover the cost of long-term care for the annuitant, which can reduce the burden on the annuitant's beneficiaries. This rider guarantees that the beneficiary will receive the full amount of the annuity's principal if the annuitant dies before receiving the full value of the annuity. This option allows the annuitant to designate a beneficiary to receive payments after their death, which can provide additional protection for the annuitant's spouse or other dependents. The tax implications of annuities with a death benefit depending on the specific terms of the annuity contract and the tax laws in the jurisdiction where the annuity is issued. Generally, the death benefit is paid out to the beneficiary tax-free if it is received as a lump sum. However, if the beneficiary chooses to receive payments over time, the payments may be subject to income tax. Estate tax considerations may also apply to annuities with a death benefit, depending on the value of the annuity and the applicable estate tax laws. Investors should consult with a tax professional to fully understand the tax implications of an annuity with a death benefit. Annuities with a death benefit have several advantages that can make them a valuable investment for retirees or investors seeking a guaranteed income stream and protection for their beneficiaries. Annuities with a death benefit offer a guaranteed stream of income for the annuitant, regardless of market fluctuations or other economic conditions. This can provide a reliable source of income in retirement and help the annuitant plan for their financial future. In the event of the annuitant's death, the death benefit provides valuable protection for beneficiaries. This can help ensure that the annuitant's loved ones are taken care of after their passing. Annuities with a death benefit can be customized with optional riders or features to meet the investor's needs. For example, a long-term care rider can provide additional funds to cover the cost of long-term care while a return of premium rider guarantees that the beneficiary will receive the full amount of the annuity's principal if the annuitant dies before receiving the full value of the annuity. Annuities with a death benefit have several disadvantages that investors should carefully consider before making an investment decision. Annuities can be complex financial products, and annuities with a death benefit can have additional contract terms and provisions that may be difficult to understand. Additionally, annuities can carry high fees and expenses, such as administrative fees, investment management fees, and surrender charges, which can reduce the overall returns of the investment. The annuity may not perform as expected, which can reduce the death benefit. This can happen if the investments held in the annuity do not perform well or if the annuity's fees and expenses erode the value of the investment. Withdrawals from annuities with a death benefit may be subject to surrender charges, which can limit the investor's flexibility. This means that if the investor needs to access their funds before the end of the annuity's term, they may be charged a penalty for early withdrawal. Annuities with a death benefit can be a valuable investment for retirees or investors seeking a guaranteed income stream and protection for their beneficiaries. Investors should carefully consider their investment goals, risk tolerance, and the financial stability of the insurance company before choosing an annuity with a death benefit. Optional riders or features can provide additional protections or enhance the death benefit, while tax implications and the pros and cons of annuities should also be taken into account. It is important for investors to consult with a qualified insurance broker before investing in an annuity with a death benefit to fully understand the product's features and limitations and how it fits into their overall financial plan. By fully understanding the features and limitations of annuities with a death benefit, investors can make informed decisions and ensure that their investment aligns with their financial goals.Do Annuities Have a Death Benefit?

How Do Death Benefits Work in Annuities?

Calculation of the Death Benefit

Types of Death Benefits

Types of Annuities that Offer Death Benefit

Fixed Annuities

Variable Annuities

Indexed Annuities

Factors to Consider When Choosing an Annuity with a Death Benefit

Investment Goals

Risk Tolerance

Financial Stability of the Insurance Company

Fees and Expenses

Optional Riders or Features for Enhancing Death Benefits

Long-Term Care Rider

Return of Premium Rider

Joint and Survivor Annuity Option

Tax Implications of Death Benefits

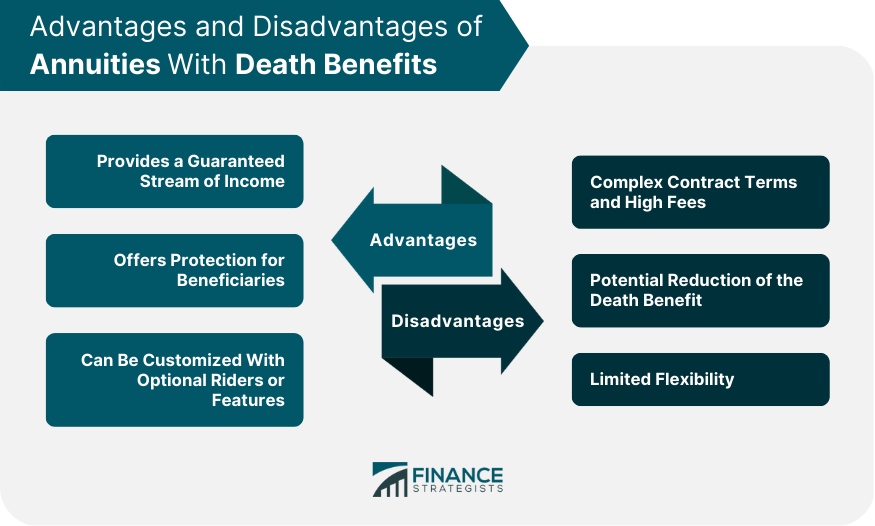

Advantages of Annuities With Death Benefits

Provides a Guaranteed Stream of Income

Offers Protection for Beneficiaries

Can Be Customized With Optional Riders or Features

Disadvantages of Annuities with Death Benefits

Complex Contract Terms and High Fees

Potential Reduction of the Death Benefit

Limited Flexibility

Final Thoughts

Do Annuities Have a Death Benefit? FAQs

Annuities with a death benefit are a type of financial product that provides a guaranteed stream of income for both the annuitant and their beneficiaries. In the event of the annuitant's death, the beneficiary receives a lump sum payment or regular payments.

Fixed annuities, variable annuities, and indexed annuities are the most common types of annuities that offer a death benefit. Each type of annuity has its own features and benefits, so it is important to understand the differences before making an investment.

The death benefit of an annuity provides protection for the annuitant's beneficiaries in the event of the annuitant's death. The amount of the death benefit varies depending on the type of annuity, the age of the annuitant at the time of death, and the amount of money invested in the annuity.

Investors should consider factors such as their investment goals, risk tolerance, the financial stability of the insurance company offering the annuity, and the fees and expenses associated with the annuity. Additionally, optional riders or features can provide additional protections or enhance the death benefit.

The main advantage of annuities with a death benefit is that they provide a guaranteed stream of income for the annuitant and their beneficiaries. However, these annuities can be complex and carry high fees and expenses. Additionally, the annuity may not perform as expected, which can reduce the death benefit.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.