A fixed annuity is a long-term contract between an individual and an insurance company, where the individual makes premium payments, and in return, the insurance company guarantees a fixed interest rate on the premiums. Upon reaching the distribution phase, the insurance company provides a steady stream of income for a specified period or the annuitant's lifetime. Fixed annuities are primarily used as a retirement planning tool, offering individuals a guaranteed income source, protecting their principal, and allowing them to accumulate earnings on a tax-deferred basis. Fixed annuities differ from variable and indexed annuities in that they guarantee a fixed interest rate. In contrast, variable and indexed annuities have returns tied to the performance of underlying investment portfolios or market indices, respectively. Fixed annuities have two distinct phases: the accumulation phase and the distribution phase. During the accumulation phase, the individual (annuitant) makes either a lump-sum or periodic premium payment to the insurance company. The insurance company guarantees a fixed interest rate on the premiums paid, which accumulates on a tax-deferred basis. This means that the earnings are not taxed until they are withdrawn or distributed. The tax-deferred growth allows the value of the annuity to compound faster because taxes do not reduce earnings during accumulation. When the annuitant reaches the distribution phase, typically at retirement, they can start receiving income from the annuity. The annuitant can choose to annuitize the contract, which means converting the accumulated value into a guaranteed stream of income payments. Depending on the chosen option, these payments can last for a specified period or the annuitant's lifetime. Alternatively, the annuitant can opt for systematic withdrawals, periodically taking out a specified amount without annuitizing the contract. The annuitant can also withdraw the accumulated value as a lump sum, but this option may result in significant tax liabilities and loss of income guarantees. Various types of fixed annuities are available, catering to different needs and preferences. An immediate fixed annuity is a contract where the annuitant makes a single premium payment, and the income payments begin immediately or within a short period, typically within a year. This type of annuity is suitable for individuals seeking an immediate income source in retirement. Deferred fixed annuities involve the accumulation phase, where the annuitant makes premium payments, and the income payments begin at a later date, often coinciding with retirement. This type allows individuals to accumulate earnings and defer taxes during their working years. A multi-year guaranteed annuity (MYGA) is a type of deferred fixed annuity that guarantees a fixed interest rate for a specified term, usually between 3 and 10 years. At the end of the term, the annuitant can renew the contract, withdraw the funds, or annuitize the contract. Fixed indexed annuities are a hybrid of fixed and indexed annuities. They offer a guaranteed minimum interest rate and the potential for additional earnings tied to the performance of a market index, such as the S&P 500. This type of annuity provides a balance between the safety of a fixed annuity and the growth potential of an indexed annuity. Before investing in a fixed annuity, it is essential to consider various factors to determine if it aligns with your financial goals and risk tolerance. Fixed annuities are best suited for individuals seeking predictable income and principal protection in retirement. Those looking for higher growth potential or more flexibility in their investments may prefer other investment vehicles or types of annuities. Fixed annuities typically have surrender charges, which are fees imposed if the annuitant withdraws funds before a specified period. It is crucial to consider your liquidity needs and the surrender charge schedule before investing in a fixed annuity. Fixed annuities may have various fees and expenses, such as administrative fees, mortality and expense risk charges, and rider fees for additional features. Understanding these fees and their impact on your overall returns is essential. The guarantees provided by fixed annuities depend on the financial strength of the issuing insurance company. Therefore, reviewing the insurer's credit ratings and financial stability is crucial to ensure they can fulfill their obligations. Fixed annuities offer tax benefits during accumulation, but withdrawals and distributions are subject to taxation. Earnings in a fixed annuity grow on a tax-deferred basis, meaning taxes are not due until the funds are withdrawn or distributed. This allows for faster compounding of earnings. Withdrawals and distributions from fixed annuities are taxed as ordinary income. The portion of the payment that represents earnings is subject to taxation, while the portion representing the initial investment (principal) is tax-free. Withdrawals made before the age of 59½ may be subject to a 10% early withdrawal penalty in addition to ordinary income taxes. Fixed annuities can play a significant role in retirement planning by providing guaranteed income, diversifying an investment portfolio, and offering protection against market volatility and longevity risk. Fixed annuities provide a guaranteed income stream, which can help retirees cover their basic living expenses and reduce the risk of outliving their savings. Including fixed annuities in an investment portfolio can help diversify the assets and reduce overall risk, as they are not directly correlated with stock or bond market performance. Fixed annuities offer principal protection and guaranteed interest rates, which can help shield retirees from market volatility and ensure a stable income source. By offering lifetime income options, fixed annuities help manage the risk of outliving one's savings, providing financial security in retirement. Fixed annuities have advantages and disadvantages that individuals should weigh before investing. 1. Predictable Income: Fixed annuities provide a guaranteed and stable income stream, ensuring financial stability in retirement. 2. Principal Protection: The principal investment in a fixed annuity is protected from market fluctuations, offering a safe investment option. 3. Tax Benefits: The tax-deferred growth of earnings in fixed annuities allows for faster compounding and tax savings during the accumulation phase. 1. Limited Growth Potential: The fixed interest rates of fixed annuities may limit their growth potential compared to other investments or types of annuities. 2. Inflation Risk: The fixed income payments may not keep up with inflation, eroding the purchasing power of the annuitant over time. 3. Liquidity Constraints: Fixed annuities typically have surrender charges and penalties for early withdrawals, making them less liquid compared to other investment options. Fixed annuities can serve as a valuable retirement planning tool for individuals seeking a guaranteed income stream and principal protection. They offer tax-deferred growth, diversification, and protection against market volatility and longevity risk. However, before investing, their limited growth potential, inflation risk, and liquidity constraints should be considered. It is essential to align your financial goals, risk tolerance, and liquidity needs with the features and limitations of fixed annuities. Consult with an insurance broker to determine if a fixed annuity is suitable for your retirement planning strategy and to navigate the available options.What Are Fixed Annuities?

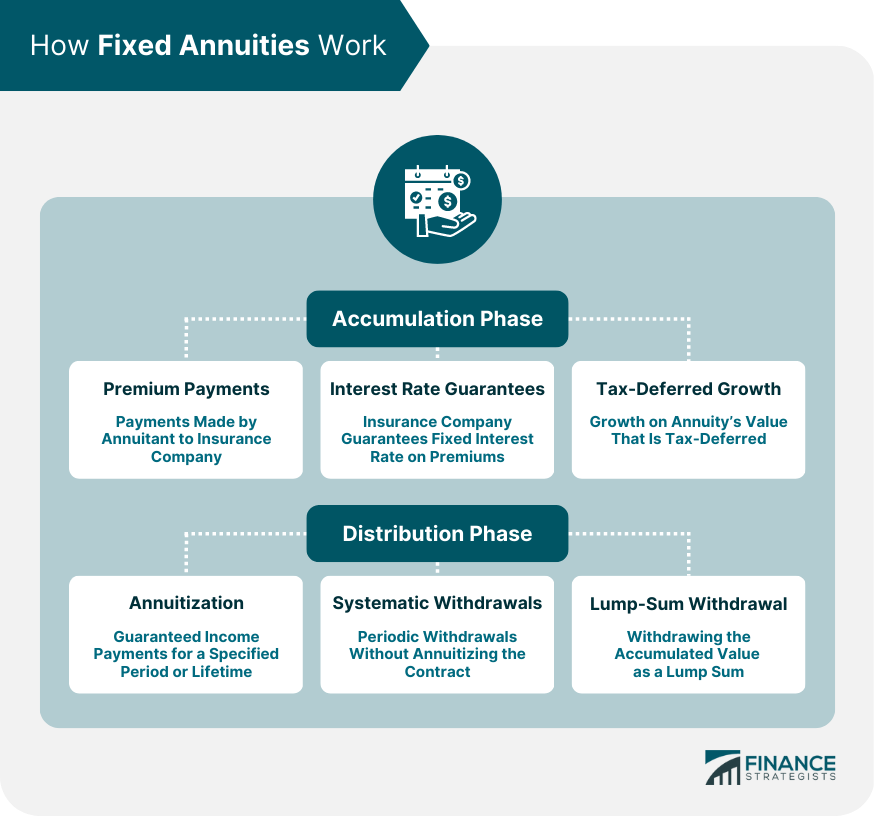

How Fixed Annuities Work

Accumulation Phase

Premium Payments

Interest Rate Guarantees

Tax-Deferred Growth

Distribution Phase

Annuitization

Systematic Withdrawals

Lump-Sum Withdrawal

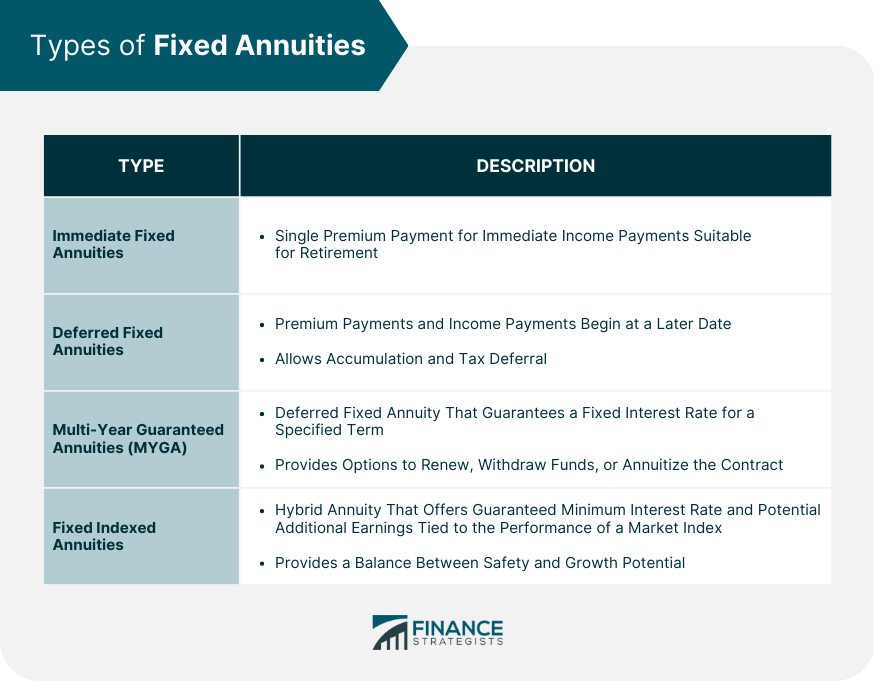

Types of Fixed Annuities

Immediate Fixed Annuities

Deferred Fixed Annuities

Multi-Year Guaranteed Annuities (MYGA)

Fixed Indexed Annuities

Factors to Consider Before Investing in Fixed Annuities

Financial Goals and Risk Tolerance

Liquidity Needs and Surrender Charges

Fees and Expenses

Insurance Company's Financial Strength and Credit Ratings

Tax Implications of Fixed Annuities

Tax-Deferred Growth

Taxation of Withdrawals and Distributions

Tax Penalties for Early Withdrawals

Role of Fixed Annuities in Retirement Planning

Guaranteed Income Stream

Diversification of Investment Portfolio

Protection Against Market Volatility

Longevity Risk Management

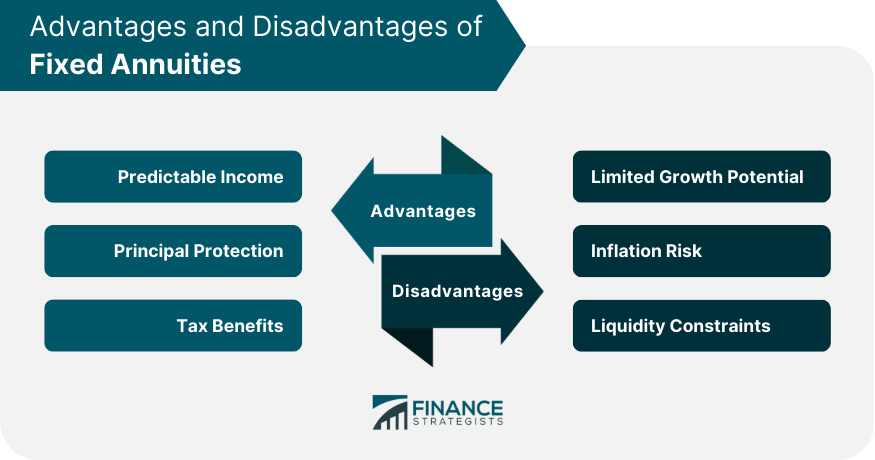

Pros and Cons of Fixed Annuities

Advantages of Fixed Annuities

Disadvantages of Fixed Annuities

Final Thoughts

Fixed Annuities FAQs

A fixed annuity is a long-term contract between an individual and an insurance company, where the individual makes premium payments, and in return, the insurance company guarantees a fixed interest rate on the premiums. Upon reaching the distribution phase, the insurance company provides a steady stream of income for a specified period or the annuitant's lifetime.

Fixed annuities have two distinct phases: the accumulation phase and the distribution phase. During the accumulation phase, the individual (annuitant) makes either a lump-sum or periodic premium payments to the insurance company. The insurance company guarantees a fixed interest rate on the premiums paid, which accumulates on a tax-deferred basis. When the annuitant reaches the distribution phase, they can start receiving income from the annuity either through annuitization or systematic withdrawals.

The types of fixed annuities include Immediate Fixed Annuities, Deferred Fixed Annuities, Multi-Year Guaranteed Annuities (MYGA), and Fixed Indexed Annuities.

Before investing in a fixed annuity, it is essential to consider factors such as financial goals and risk tolerance, liquidity needs, fees and expenses, and the insurance company's financial strength and credit ratings.

The pros of fixed annuities include predictable income, principal protection, and tax benefits. The cons include limited growth potential, inflation risk, and liquidity constraints.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.