A Guaranteed Lifetime Withdrawal Benefit (GLWB) is a type of variable annuity that offers lifetime withdrawals. It guarantees you'll have access to your money no matter what happens in the market for as long as you live, without any risk of losing value. You may choose to receive monthly payments from the annuity or a lump sum at any time. How much you get and how often depends on the pricing and your life expectancy, as well as the contract's provisions. Have questions about Guaranteed Lifetime Withdrawal Benefits? Click here. A GLWB is ideal for retirees who want to plan for their future health care expenses. You can get a guaranteed lifetime income stream that helps you manage inflation risk while protecting the value of your savings from market downturns. If you're healthy and live longer than average, your premiums are likely to be lower, which could make the GLWB a more cost-effective option than other lifetime income products. When you buy a GLWB, you're essentially transferring the investment risk of your annuity to the insurance company. In exchange, you receive a guaranteed income stream for life. The company invests your money in a variety of assets, including stocks, bonds, and money market funds. The goal is to provide growth potential while protecting against downside risk. You can choose to receive payments for a set number of years, or for as long as you live. If you die before the contract expires, your beneficiaries will receive the remaining balance. There are several benefits of owning a GLWB: There are a few drawbacks to owning a GLWB: If you're interested in finding out if your company offers a GLWB, contact your benefits administrator or HR department. They should be able to tell you whether the plan is available and provide more information about how it works. A GLWB can be a valuable tool for retirees who want to protect their savings from market downturns and ensure a lifetime income stream. However, it's important to weigh the pros and cons before deciding whether this type of annuity is right for you. If you're thinking about purchasing a GLWB, consult with an experienced financial advisor.Who Needs a GLWB?

How Does It Work?

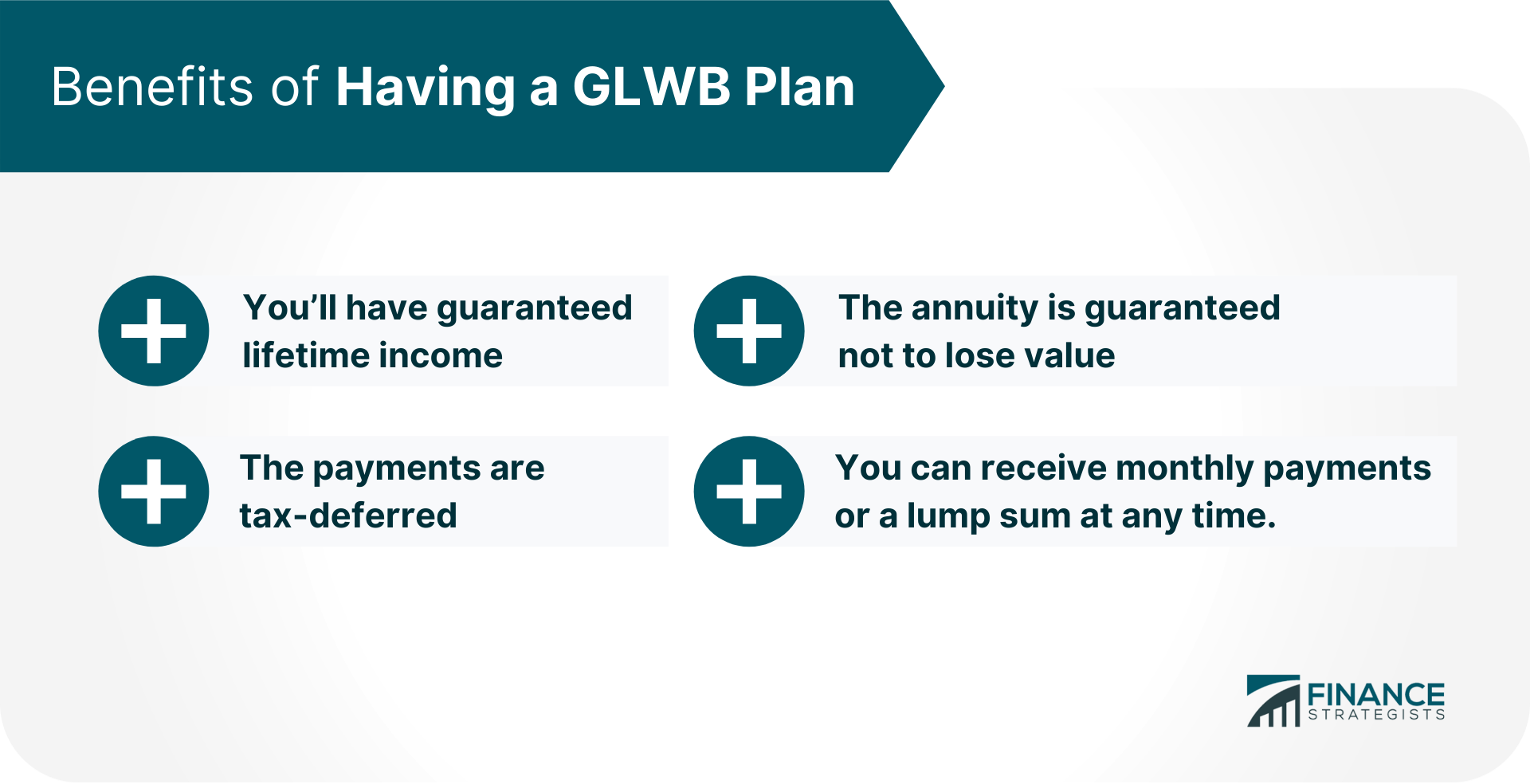

Benefits of Having a GLWB Plan

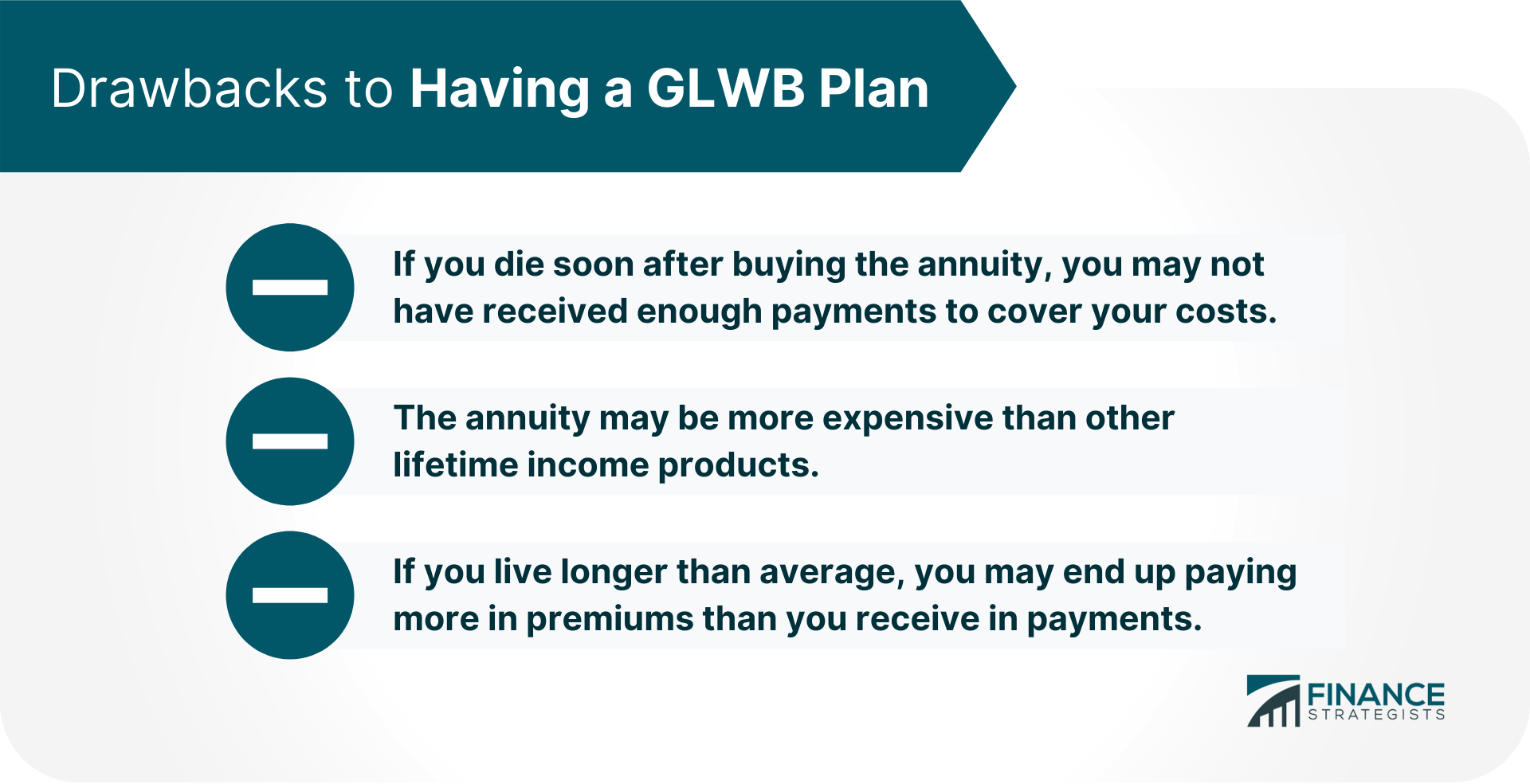

Drawbacks to Having a GLWB Plan

How to Find Out if Your Company Offers This Benefit

The Bottom Line

Guaranteed Lifetime Withdrawal Benefit (GLWB) FAQs

A Guaranteed Lifetime Withdrawal Benefit (GLWB) is a type of variable annuity that offers lifetime withdrawals. It guarantees you'll have access to your money no matter what happens in the market for as long as you live, without any risk of losing value.

A GLWB is ideal for retirees who want to plan for their future health care expenses. It can provide a guaranteed lifetime income stream that helps you manage inflation risk while protecting the value of your savings from market downturns.

When you buy a GLWB, you're essentially transferring the investment risk of your annuity to the insurance company. In exchange, you receive a guaranteed income stream for life. The company invests your money in a variety of assets, including stocks, bonds, and money market funds. The goal is to provide growth potential while protecting against downside risk. You can choose to receive payments for a set number of years, or for as long as you live. If you die before the contract expires, your beneficiaries will receive the remaining balance.

There are several benefits of owning a GLWB: You'll have guaranteed lifetime income, which can help you plan for your future health care expenses. The payments are tax-deferred, so you won't have to pay taxes on them until you withdraw them. The annuity is guaranteed not to lose value, no matter how the market performs. You can receive monthly payments or a lump sum at any time.

There are a few drawbacks to owning a GLWB: If you die soon after buying the annuity, you may not have received enough payments to cover your costs. The annuity may be more expensive than other lifetime income products. If you live longer than average, you may end up paying more in premiums than you receive in payments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.