Guaranteed Minimum Accumulation Benefits (GMAB) is a type of optional rider or additional feature that can be added to a variable annuity contract. GMAB guarantees that the policyholder's account value will be at least a certain amount after a specified period, regardless of the performance of the underlying investment options. This provides a safety net for policyholders against market downturns while still allowing for potential growth. Variable annuities are insurance contracts that allow policyholders to invest their premium payments into various subaccounts, typically consisting of mutual funds or other investment options. The future payout of a variable annuity is based on the performance of these underlying investments. GMAB is designed to provide a minimum level of protection, ensuring that the policyholder's account value does not fall below a predetermined amount, even if the investments perform poorly. GMAB can be an attractive option for investors seeking a balance between growth potential and financial security. It can provide peace of mind for long-term investors by ensuring a minimum return on their investment, regardless of market fluctuations. The primary feature of GMAB is the minimum accumulation guarantee, which assures the policyholder that their account value will be at least a certain amount after a specified guarantee period. This amount is typically calculated as a percentage (e.g., 100% or 120%) of the initial investment or premium paid into the annuity. The guarantee period is the length of time during which the GMAB guarantee applies. This can vary from one policy to another, but it is generally between 10 and 20 years. At the end of the guarantee period, the insurer will make up the difference if the account value is below the guaranteed minimum amount. Many GMAB policies include reset provisions, which allow the policyholder to lock in gains and establish a new, higher guaranteed minimum amount. Resets can typically be requested at regular intervals (e.g., annually or every five years) and may be subject to certain conditions, such as a minimum account value. Adding a GMAB rider to a variable annuity usually comes with additional fees and charges. These may include a separate rider fee, which is typically a percentage of the account value, and higher expense ratios for the underlying investment options. Policyholders should carefully consider these costs when evaluating the benefits of a GMAB. Guaranteed Minimum Income Benefit (GMIB) is a rider that guarantees a minimum level of lifetime income for the policyholder, regardless of the performance of the underlying investments. While both GMAB and GMIB provide protection against market risk, GMIB focuses on ensuring a stable income stream, whereas GMAB guarantees a minimum account value. Guaranteed Minimum Withdrawal Benefit (GMWB) is a rider that guarantees a minimum amount of withdrawals from the annuity, typically expressed as a percentage of the initial investment. Unlike GMAB, which guarantees a minimum account value at the end of the guarantee period, GMWB focuses on providing a predictable withdrawal amount during the policyholder's lifetime. Guaranteed Minimum Death Benefit (GMDB) is a rider that guarantees a minimum death benefit for the policyholder's beneficiaries, regardless of the performance of the underlying investments. While GMAB protects the account value during the policyholder's lifetime, GMDB ensures that beneficiaries receive at least a predetermined amount upon the policyholder's death. When deciding which type of guaranteed benefit is appropriate, policyholders should consider their financial objectives, risk tolerance, and time horizon. Factors to consider include: 1. Desired level of income or account value protection 2. Importance of providing for beneficiaries 3. Willingness to pay additional fees for the guarantee 4. Investment strategy and desired level of diversification Before purchasing a GMAB policy, policyholders should research the financial strength of the issuing insurance company. Credit rating agencies, such as A.M. Best, Standard & Poor's, and Moody's, can provide insight into the insurer's financial stability and ability to meet its obligations. It is crucial for policyholders to understand the fees and charges associated with GMAB policies, including rider fees, expense ratios for underlying investments, and any other additional costs. Comparing fees across different policies can help determine whether the benefits of the guarantee justify the added expenses. Policyholders should carefully review the available investment options within a GMAB policy and any restrictions on their investment choices. They should ensure that the policy allows for adequate diversification and aligns with their investment strategy and risk tolerance. Understanding the reset provisions and guarantee period of a GMAB policy is essential. Policyholders should evaluate how often they can reset the guaranteed minimum amount, any conditions associated with resets, and the length of the guarantee period to determine if the policy meets their long-term financial objectives. One of the primary benefits of GMAB is the protection it offers against market downturns. If the underlying investments in a variable annuity perform poorly during the guarantee period, the GMAB ensures that the policyholder's account value will not fall below the guaranteed minimum amount. Variable annuities with GMAB allow policyholders to invest in a range of subaccounts, providing the flexibility to create a diversified investment portfolio tailored to their risk tolerance and financial goals. This can help policyholders achieve the growth potential they seek while still enjoying the security of a guaranteed minimum return. While GMAB provides a floor for the account value, it does not limit the potential for gains. If the investments within the variable annuity perform well, the policyholder's account value can grow beyond the guaranteed minimum amount, providing an opportunity for higher returns. GMAB can offer peace of mind for long-term investors, knowing that their investment is protected against market fluctuations. This assurance can help investors stay committed to their long-term financial plan and focus on their overall investment strategy. Adding a GMAB rider to a variable annuity typically results in higher fees and expenses, including rider fees and potentially higher expense ratios for the underlying investments. These additional costs can erode the overall returns and may outweigh the benefits of the guarantee for some investors. While GMAB guarantees a minimum account value, this guarantee comes at a cost. The additional fees and expenses associated with GMAB can reduce the overall returns on the investment, potentially leaving policyholders with less money than they would have earned through a non-guaranteed variable annuity. Some GMAB policies may impose restrictions on the investment options available within the variable annuity, such as limiting the allocation to more aggressive or volatile investments. These limitations can affect the policyholder's ability to achieve their desired level of diversification and growth potential. The guarantees provided by GMAB are only as strong as the financial health of the insurance company issuing the policy. If the insurer becomes insolvent, the guarantees may not be fully honored, potentially leaving policyholders with less than the promised minimum account value. When policyholders begin receiving annuity income, the earnings portion of the payments is generally subject to ordinary income tax. The taxation of annuity income may impact the overall returns on the investment and should be considered when evaluating a GMAB policy. Withdrawals from a variable annuity before the age of 59½ may be subject to a 10% federal tax penalty in addition to ordinary income tax on the earnings portion of the withdrawal. Policyholders should be aware of these potential tax penalties when considering their investment strategy. When a policyholder exercises the reset provision in a GMAB policy, it may be considered a taxable event, depending on the specific policy terms and applicable tax laws. Policyholders should consult a tax professional to understand the potential tax implications of using the reset provision. Guaranteed Minimum Accumulation Benefits can be a valuable tool for retirement planning, providing a safety net against market fluctuations and ensuring a minimum return on investment. By carefully evaluating the benefits, risks, and costs associated with GMAB policies, investors can make informed decisions about whether this type of guarantee is appropriate for their financial objectives. While GMAB offers certain advantages, such as protection against market downturns and potential for growth, it also comes with risks and limitations, including higher fees and potential restrictions on investment choices. Policyholders should carefully weigh these factors when considering a GMAB policy. Given the complexities and potential pitfalls associated with GMAB and other variable annuity guarantees, investors need to work with a qualified financial professional. If you are interested in learning more about GMAB policies, speak with an insurance broker who can provide expert guidance and help you make informed decisions.What Are Guaranteed Minimum Accumulation Benefits (GMAB)?

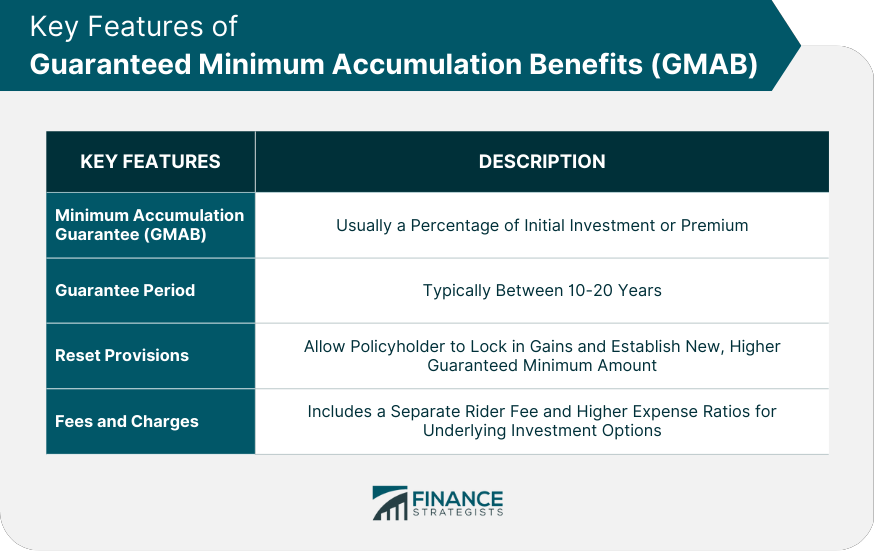

Key Features of GMAB

Minimum Accumulation Guarantee

Guarantee Period

Reset Provisions

Fees and Charges Associated With GMAB

Comparing GMAB With Other Guaranteed Benefits

Guaranteed Minimum Income Benefit (GMIB)

Guaranteed Minimum Withdrawal Benefit (GMWB)

Guaranteed Minimum Death Benefit (GMDB)

Factors to Consider When Choosing the Right Guaranteed Benefit

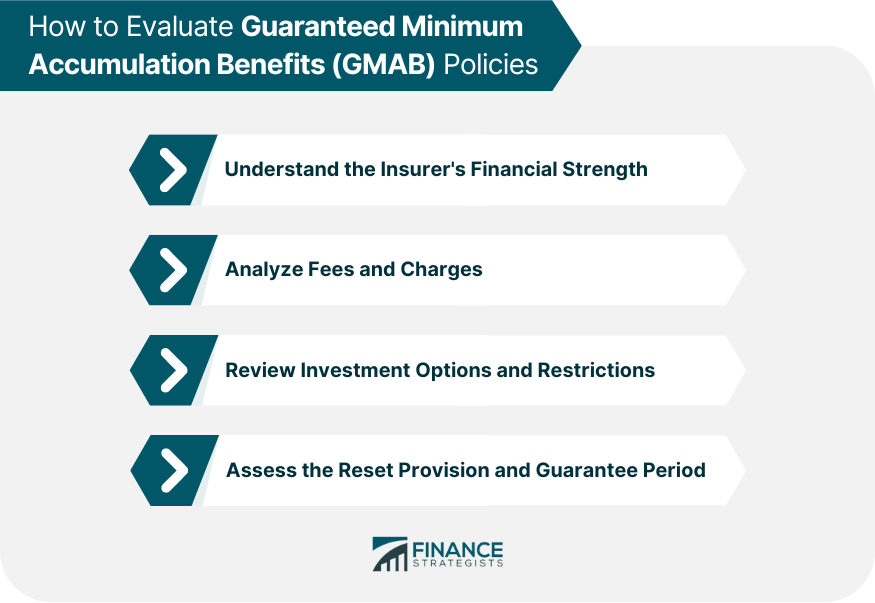

How to Evaluate GMAB Policies

Understanding the Insurer's Financial Strength

Analyzing Fees and Charges

Reviewing Investment Options and Restrictions

Assessing the Reset Provision and Guarantee Period

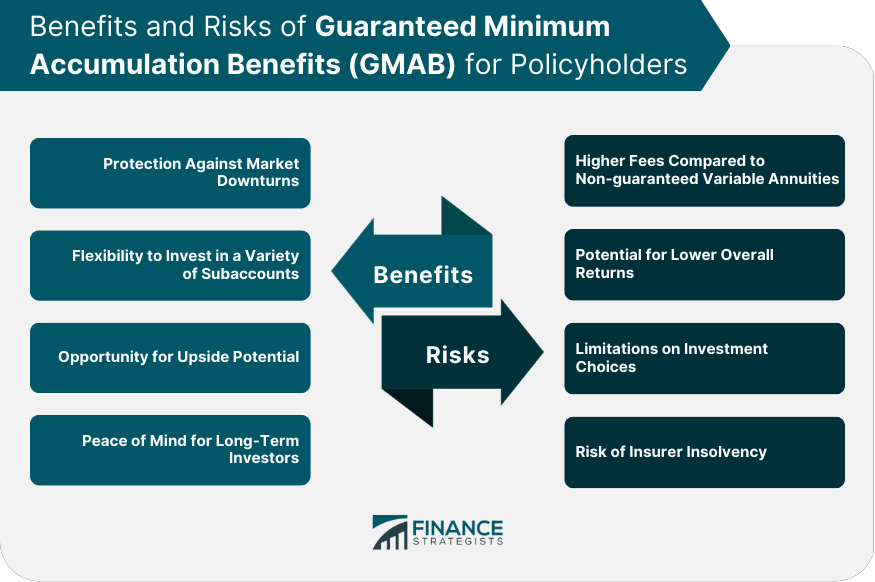

Benefits of GMAB for Policyholders

Protection Against Market Downturns

Flexibility to Invest in a Variety of Subaccounts

Opportunity for Upside Potential

Peace of Mind for Long-Term Investors

Risks and Limitations of GMAB

Higher Fees Compared to Non-guaranteed Variable Annuities

Potential for Lower Overall Returns

Limitations on Investment Choices

Risk of Insurer Insolvency

Tax Implications of GMAB

Taxation of Annuity Income

Tax Penalties for Early Withdrawals

Tax Implications of the Reset Provision

Final Thoughts

Guaranteed Minimum Accumulation Benefits (GMAB) FAQs

GMAB is a type of optional rider or additional feature that can be added to a variable annuity contract. It guarantees that the policyholder's account value will be at least a certain amount after a specified period, regardless of the performance of the underlying investment options.

GMAB provides protection against market downturns, flexibility to invest in a variety of subaccounts, the opportunity for upside potential, and peace of mind for long-term investors.

The risks and limitations of GMAB include higher fees compared to non-guaranteed variable annuities, the potential for lower overall returns, limitations on investment choices, and the risk of insurer insolvency.

Policyholders can evaluate GMAB policies by understanding the insurer's financial strength, analyzing fees and charges, reviewing investment options and restrictions, and assessing the reset provision and guarantee period.

GMAB can be a valuable tool for retirement planning, providing a safety net against market fluctuations and ensuring a minimum return on investment. However, investors should carefully weigh the benefits and risks of GMAB policies and work with a qualified financial professional to develop a comprehensive retirement plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.