Guaranteed Minimum Income Benefits (GMIB) are features within annuity contracts designed to provide a stable income during retirement. An annuity contract is a financial product issued by insurance companies to provide individuals with a steady income stream during retirement. Annuities can be either immediate or deferred, and they can be structured to provide fixed or variable payments. They are designed to help retirees meet their financial needs by offering a reliable source of income. GMIB serves as a safety net for retirees by guaranteeing a minimum level of income, regardless of market performance. This feature ensures that retirees can maintain their desired lifestyle without worrying about the impact of market fluctuations on their retirement savings. GMIB can also help address longevity risk, as it guarantees income for a specified period or for the retiree's lifetime. Guaranteed Minimum Income Benefits come with a range of features that make them attractive for retirement planning, including a guaranteed income stream, protection against market volatility, investment flexibility, and withdrawal options. A key feature of GMIB is the guaranteed income it provides to retirees, which can be for a specified period or for the retiree's lifetime. This minimum income is determined at the inception of the annuity contract and is usually based on a percentage of the initial investment. The income stream helps retirees plan their finances more effectively and can be adjusted to account for inflation or other factors. GMIB offers a layer of protection against market volatility, ensuring that retirees receive a minimum income regardless of market performance. This feature can be particularly valuable during periods of economic uncertainty when investments may not perform as expected. By guaranteeing a minimum income, GMIB helps retirees maintain their desired lifestyle even during market downturns. GMIB allows retirees to choose from a variety of investment options, enabling them to tailor their investment strategy to their individual risk tolerance and financial goals. This flexibility allows retirees to potentially benefit from market growth while still enjoying the protection of a guaranteed income. However, some restrictions may apply to the investment choices available within the annuity contract. There are several types of GMIB, each designed to cater to different needs and preferences of retirees. These include single life GMIB, joint life GMIB, and GMIB with inflation protection. A single life GMIB provides a guaranteed income for the life of the annuitant only. This type of GMIB is suitable for individuals without a spouse or partner who would need ongoing financial support after their death. The income stream from a single life GMIB typically ceases upon the annuitant's death, and no further benefits are paid to beneficiaries. A joint life GMIB is designed for couples, providing a guaranteed income for the lifetime of both individuals. This type of GMIB ensures that the surviving spouse or partner continues to receive an income after the death of the first annuitant, offering financial security and peace of mind. The income stream may be reduced upon the death of the first annuitant, depending on the terms of the annuity contract. GMIB with inflation protection is designed to help retirees maintain their purchasing power in the face of rising prices. This type of GMIB includes periodic adjustments to the guaranteed income based on changes in the Consumer Price Index (CPI) or another inflation measure. Inflation protection can help ensure that retirees' income keeps pace with the cost of living, providing them with financial stability throughout their retirement years. Guaranteed Minimum Income Benefits offer several advantages for retirees, such as ensuring sufficient retirement income, mitigating longevity risk, reducing anxiety about market fluctuations, and providing a stable foundation for financial planning. GMIB guarantees a minimum level of income for retirees, allowing them to meet their financial needs during retirement. This income stream can be a crucial component of a retiree's financial plan, helping them maintain their desired lifestyle and cover essential expenses such as housing, healthcare, and daily living costs. Longevity risk refers to the possibility of outliving one's retirement savings. GMIB addresses this concern by providing a guaranteed income for a specified period or the lifetime of the annuitant, ensuring that retirees will not exhaust their savings prematurely. Market fluctuations can significantly impact retirees' investment portfolios and their ability to generate sufficient income. GMIB helps alleviate this concern by providing a guaranteed minimum income regardless of market performance. This feature allows retirees to maintain their lifestyle and financial stability even during periods of market volatility. While GMIB offers several benefits, there are also costs and considerations that retirees should be aware of, including fees and expenses, tax implications, and potential limitations on investment choices. GMIB often comes with additional fees and expenses, such as mortality and expense risk charges, fees for investment management, and rider fees. These costs can reduce the overall return on investment and should be carefully considered when evaluating the suitability of GMIB for a retirement plan. The income generated from GMIB may be subject to taxes, depending on the type of annuity and the retiree's individual tax situation. It is essential for retirees to understand the tax implications of GMIB and consult with a tax professional to ensure they are prepared for any potential tax liabilities. While GMIB offers investment flexibility, there may be some restrictions on the available investment options within the annuity contract. These limitations can affect the potential for market growth and should be considered when evaluating the overall benefits of GMIB for a retirement plan. GMIB is just one of several guaranteed income products available to retirees. It is essential to compare GMIB with other options such as Guaranteed Minimum Withdrawal Benefits (GMWB), Lifetime Income Benefit Riders (LIBR), and Immediate Annuities to determine the most suitable solution for individual retirement needs. GMWB guarantees a minimum withdrawal amount from an annuity contract, providing retirees with a steady income stream while preserving their principal investment. While similar to GMIB, GMWB does not guarantee lifetime income and may be more suitable for individuals who prioritize principal protection over guaranteed income for life. LIBR is an optional feature within annuity contracts that guarantees a lifetime income stream, similar to GMIB. However, LIBR is often associated with variable annuities, and the income stream may be subject to market performance. Retirees should carefully consider the differences between GMIB and LIBR when selecting a guaranteed income product for their retirement plan. Immediate annuities provide a guaranteed income stream immediately upon purchase, with payments typically beginning within 30 days. While immediate annuities offer a reliable income source, they may not provide the same level of investment flexibility or market protection as GMIB. Retirees should weigh the advantages and disadvantages of immediate annuities compared to GMIB when determining the best fit for their retirement needs. Guaranteed Minimum Income Benefits can play a crucial role in retirement planning, offering retirees financial security, stability, and peace of mind. Each retiree has unique financial needs and goals that should be considered when evaluating GMIB as a retirement income solution. Factors such as desired retirement lifestyle, current and future expenses, risk tolerance, and existing retirement savings should be taken into account to determine if GMIB is a suitable option. While GMIB offers several benefits, it also comes with associated costs and potential limitations. Retirees should carefully assess the fees, expenses, tax implications, and investment restrictions related to GMIB, comparing them to other guaranteed income products to determine the most appropriate solution for their retirement needs. Given the complexity of retirement planning and the range of available financial products, it is advisable for retirees to seek professional advice from an insurance broker. These professionals can help retirees navigate their options, evaluate the suitability of GMIB, and develop a comprehensive retirement plan tailored to their individual needs and goals.Overview of Guaranteed Minimum Income Benefits (GMIB)

Features of Guaranteed Minimum Income Benefits

Guaranteed Income Stream

Protection Against Market Volatility

Investment Flexibility

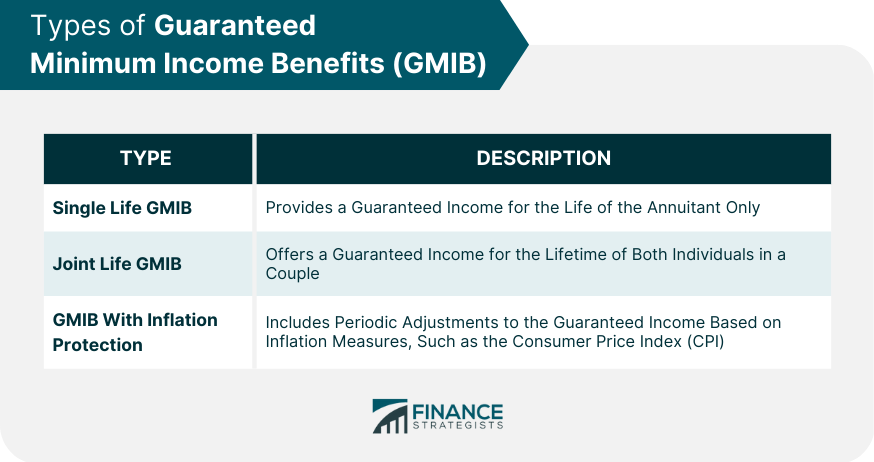

Types of GMIB

Single Life GMIB

Joint Life GMIB

GMIB with Inflation Protection

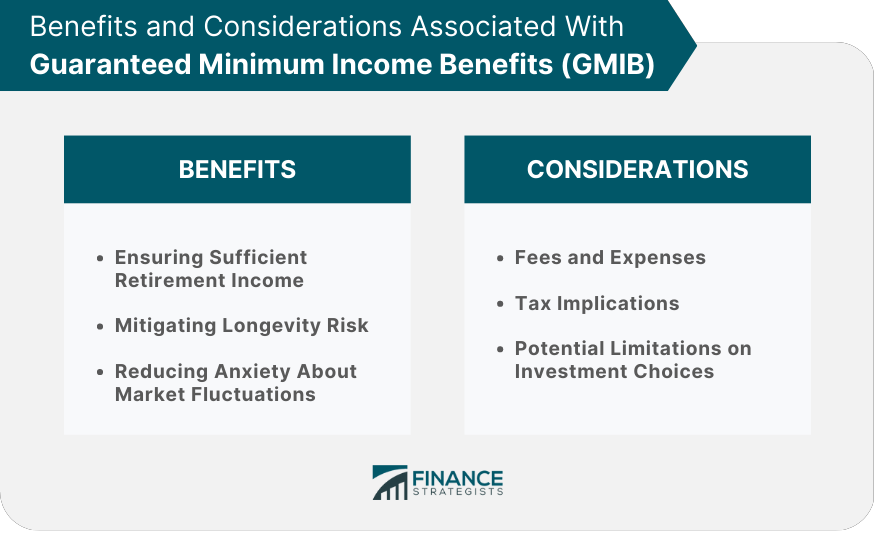

Benefits of GMIB for Retirees

Ensuring Sufficient Retirement Income

Mitigating Longevity Risk

Reducing Anxiety About Market Fluctuations

Costs and Considerations Associated With GMIB

Fees and Expenses

Tax Implications

Potential Limitations on Investment Choices

Comparison With Other Guaranteed Income Products

Guaranteed Minimum Withdrawal Benefits (GMWB)

Lifetime Income Benefit Riders (LIBR)

Immediate Annuities

Final Thoughts

Guaranteed Minimum Income Benefits (GMIB) FAQs

Guaranteed Minimum Income Benefits (GMIB) are features within annuity contracts that guarantee a minimum level of income for retirees, regardless of market performance. GMIB helps retirees maintain their desired lifestyle, protect against market fluctuations, and address longevity risk by ensuring a stable income for a specified period or the retiree's lifetime.

The main features of GMIB include a guaranteed income stream, protection against market volatility, investment flexibility, and withdrawal options. These features allow retirees to enjoy a stable income while potentially benefiting from market growth and tailoring their investment strategy to their individual needs and risk tolerance.

There are several types of GMIB, such as single life GMIB, joint life GMIB, and GMIB with inflation protection. Single life GMIB provides income for the annuitant's life, joint life GMIB offers income for both individuals in a couple, and GMIB with inflation protection includes periodic adjustments based on inflation measures to maintain retirees' purchasing power.

Benefits of GMIB include ensuring sufficient retirement income, mitigating longevity risk, reducing anxiety about market fluctuations, and providing a stable foundation for financial planning. However, retirees should also consider the associated costs (fees and expenses), tax implications, potential limitations on investment choices, and comparisons with other guaranteed income products.

GMIB guarantees a minimum level of income and offers market protection, while GMWB provides a minimum withdrawal amount and principal protection without guaranteed lifetime income. LIBR guarantees a lifetime income stream, but the income may be subject to market performance and is often associated with variable annuities. Immediate annuities offer an immediate income source but lack investment flexibility and market protection. Retirees should carefully weigh the advantages and disadvantages of each product when choosing the best fit for their retirement needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.