Annuities are financial products commonly offered by insurance companies. They serve as a means for individuals to invest and accumulate funds over time. Once the annuity reaches the annuitization stage, it transforms into a source of regular payments to the individual. This steady stream of payments is typically scheduled for the individual's retirement years, ensuring a reliable cash flow during that period. The annuity process begins with the individual contributing funds, either in a lump sum or through regular payments, to the annuity account. These funds are then invested by the insurance company to generate returns over time. The growth of the annuity is tax-deferred, meaning taxes on the earnings are postponed until the funds are withdrawn. When discussing "highest paying annuities," this refers to annuity products that have the potential to provide a higher income stream to the annuitant compared to other investment options. These annuities are structured in a way that maximizes the periodic payments, be it monthly, quarterly, or annually, received by the investor. However, the term "highest paying" does not denote a universal best choice for all investors. In fact, it's often a relative term, as the payout from an annuity product depends heavily on an array of individual-specific and market-driven factors. To begin with, each investor has a unique financial scenario, risk tolerance, life expectancy, and retirement goals, which significantly influence the annuity's suitability and hence, its perceived value. Furthermore, the payout from an annuity is influenced by the specifics of the contract, such as the initial investment amount, annuity type (fixed, variable, or indexed), the age of the annuitant at the start of the annuity, and the term of the annuity. High annuity payouts are the result of a complex interplay of various factors. It's a combination of individual-specific attributes, market conditions, and contract terms. Let's delve into each of these key contributors. As annuities serve as an income source for life, the age and gender of the annuitant significantly impact the payout. Typically, the older you are when you purchase an annuity, the higher your payments will be. This is because the insurance company expects to make fewer payments due to a shorter life expectancy. Additionally, gender plays a role because women tend to live longer than men, so annuities might pay out slightly less per period for women than men of the same age. Annuity payouts are also influenced by the current interest rates when the contract is signed. Higher interest rates usually translate into higher annuity payments because the insurance company can earn more on the funds you invest with them. This is particularly true for fixed annuities. However, variable and indexed annuities, which are linked to market performance, may be less affected by interest rates and more by the returns of their underlying investments. The specifics of the annuity contract, such as the period of guarantee, any riders for enhanced income or death benefits, and the type of annuity (single life vs joint life, immediate vs deferred), play a significant role in determining the payouts. Typically, contracts that include additional guarantees or benefits may have lower payouts as these features come at a cost. Some annuity products, like impaired life or enhanced annuities, take into account the health status of the annuitant. These products offer higher payouts to those with certain medical conditions or lifestyle factors that may lower their life expectancy. Immediate annuities are often among the highest-paying, as they start paying out immediately after the annuity contract is purchased with a lump-sum payment. The income from an immediate annuity can be fixed or variable, depending on the contract terms. Deferred annuities accumulate money for a longer period before they start paying out, leading to higher payouts in the future. These annuities can be fixed, indexed, or variable. Variable annuities can offer higher potential payouts due to their connection to the performance of underlying investments (like a portfolio of mutual funds). However, this also introduces a higher level of risk. Fixed index annuities provide returns based on a specific equity-based index. They can result in higher payouts if the index performs well, though they also typically include a guaranteed minimum return to protect the annuitant. One of the main advantages of highest paying annuities is the reliable income stream they provide. This can be particularly beneficial during retirement, as it ensures a steady flow of income for covering living expenses. Highest paying annuities offer the potential for higher returns compared to other fixed-income investments. This is particularly true for variable and indexed annuities, which link payouts to the performance of underlying investments or indexes. Annuities also come with tax advantages. The investment growth within an annuity is tax-deferred, meaning you don't pay taxes on the gains until you start receiving payments. One of the main concerns with annuities is their lack of liquidity. Early withdrawal from an annuity can result in hefty penalties and surrender charges, which could erode your initial investment. Inflation risk is another crucial consideration. If your annuity income is fixed, it may lose purchasing power over time due to inflation. Finally, the financial stability of the insurance company selling the annuity is vital. If the company runs into financial troubles or goes bankrupt, your annuity payments could be at risk. Deciding to invest in the highest paying annuity requires a thorough understanding of your financial landscape, clear goals, and some expert help. Here's a detailed look at what this process involves: Start with a clear idea of your financial goals and retirement plans. How much income will you need to sustain your lifestyle in retirement? Do you have other income sources like pensions or investments? Will your expenses change significantly post-retirement? The answers to these questions will help determine how much income you need from your annuity. Carefully review the terms of the annuity contract. This includes understanding the type of annuity (immediate, deferred, fixed, variable, or indexed), the period of guarantee, potential riders, and payout options. Some contracts may offer high payouts but come with restrictive terms or high fees. Evaluate the potential returns of different annuity products. High paying annuities often involve higher risk, particularly in the case of variable or indexed annuities. Ensure you're comfortable with the level of risk involved and that it aligns with your risk tolerance. Consider the tax implications of the annuity payments. Annuities offer tax-deferred growth, but the payments are taxed as ordinary income. Depending on your income bracket in retirement, the tax impact can be significant. Finally, check the financial strength of the insurance company issuing the annuity. High payouts won't mean much if the company isn't around to make them. Look for insurers with strong financial ratings. Navigating the annuity market can be complex, and this is where a trusted financial advisor comes in. Here's how they can assist: Financial advisors have the expertise and experience to guide you through the complexities of annuities. They can explain the pros and cons of different products and help you understand contract terms and features. A financial advisor can provide recommendations tailored to your specific situation. They take into account your financial goals, risk tolerance, life expectancy, and other individual factors to recommend the right annuity product. Choosing an annuity is not a one-time decision. As your circumstances change, your financial advisor can help reassess your needs and adjust your financial plan accordingly. They can also help you keep track of changes in the annuity market that may impact your investment. Annuities are financial products that allow individuals to invest and accumulate funds over time, providing a source of regular payments during retirement. The highest paying annuities refer to those that offer a higher income stream to the annuitant compared to other investment options. Factors such as the age and gender of the annuitant, prevailing interest rates, terms of the annuity contract, and health status can influence the payouts. Immediate annuities start paying out immediately after purchase, while deferred annuities accumulate funds for a longer period before payments begin. Variable annuities are linked to the performance of underlying investments, while fixed index annuities provide returns based on an equity-based index. Highest paying annuities offer reliable income streams, potential for higher returns, and tax advantages. However, they also come with risks such as lack of liquidity, inflation risk, and insurance company stability. When choosing the highest paying annuity, it's important to consider financial goals, contract terms, potential returns, tax implications, and the financial strength of the insurance company. Seeking guidance from a financial advisor can provide expert recommendations and ongoing support in navigating the complexities of annuities.Definition and Basics of Annuities

Concept of Highest Paying Annuities

Understanding the Term

Factors Contributing to High Payouts

Age and Gender of the Annuitant

Prevailing Interest Rates

Terms of the Annuity Contract

Health Status of the Annuitant

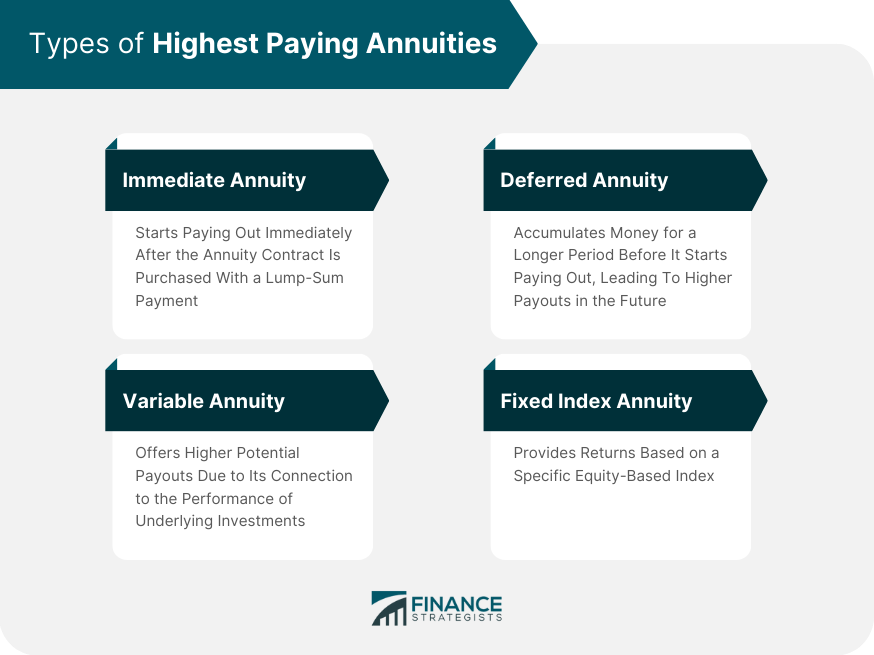

Types of Highest Paying Annuities

Immediate Annuities

Deferred Annuities

Variable Annuities

Fixed Index Annuities

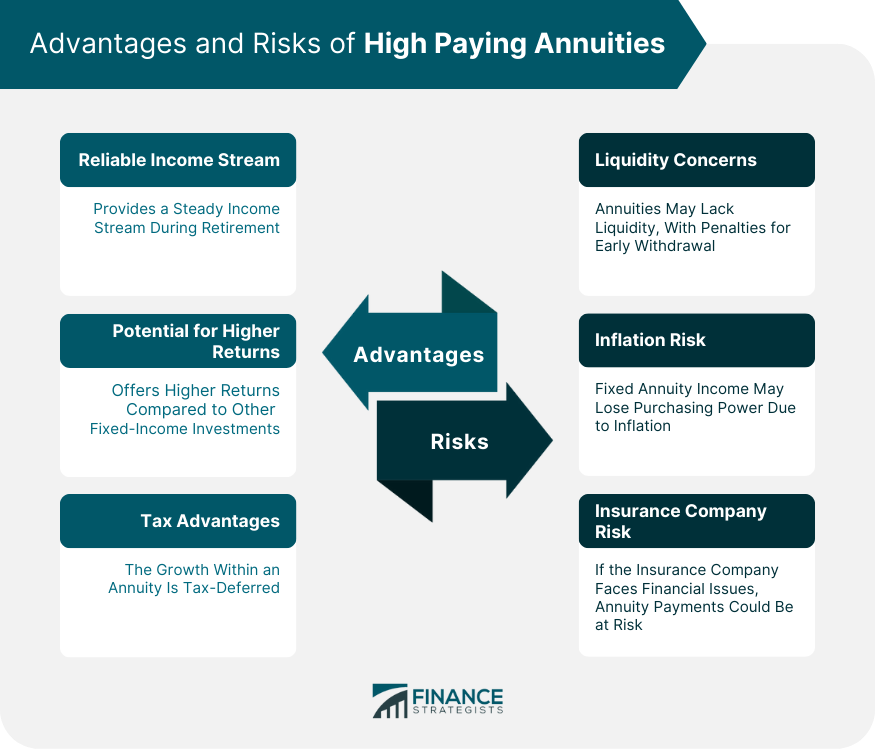

Advantages of Highest Paying Annuities

Reliable Income Stream

Potential for Higher Returns

Tax Advantages

Risks and Considerations With Highest Paying Annuities

Liquidity Concerns

Inflation Risk

Insurance Company Risk

How to Choose Highest Paying Annuities

Factors to Consider

Financial Goals and Retirement Plans

Contract Terms

Potential Returns

Tax Implications

Financial Strength of the Insurance Company

Role of Financial Advisors

Expert Guidance

Tailored Recommendations

Ongoing Support

Conclusion

Highest Paying Annuities FAQs

The highest paying annuities are financial products that provide the greatest potential income stream to the annuitant. This could include certain types of immediate, deferred, variable, and fixed indexed annuities. However, the specific payout depends on various factors like the annuitant's age, gender, interest rates, and the terms of the annuity contract.

To find the highest paying annuities, it's often best to work with a financial advisor who can guide you through the complexities of annuities. They can compare different annuity products, help you understand the contract terms, and find the option that offers the highest potential payout for your specific circumstances.

While highest paying annuities can be attractive, they are not necessarily the best choice for everyone. High payouts often come with higher risk, so it's important to consider your risk tolerance and overall financial goals. Also, the annuity's terms, potential penalties for early withdrawal, and the financial strength of the insurance company are all important factors to consider.

The payouts of the highest paying annuities are influenced by several factors, including the age and gender of the annuitant, prevailing interest rates, the type of annuity and its contract terms, and the health status of the annuitant. All these factors interplay to determine the amount of regular income an annuity can generate.

Yes, there are risks associated with the highest paying annuities. These can include liquidity concerns, inflation risk, and insurance company risk. For instance, if you need to withdraw funds early, you may face substantial penalties. Therefore, it's crucial to consult with a financial advisor before investing in an annuity with a high payout rate.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.