Indexed annuities are a type of financial product that offers potential for growth tied to the performance of a market index while providing protection for the principal invested. Indexed annuities are a type of financial product that combines features of fixed and variable annuities. They offer the potential for growth tied to the performance of an underlying market index, such as the S&P 500 or Dow Jones Industrial Average, while also providing protection for the principal invested. This is accomplished through a combination of fixed and variable interest rates, with the fixed rate providing a minimum guarantee and the variable rate tied to the index's performance. Indexed annuities are typically offered by insurance companies and are marketed as a way to grow retirement savings while providing a measure of protection against market downturns. Understanding the mechanics of indexed annuities is essential for making informed investment decisions. This section will discuss the key components and features of indexed annuities, including participation rates, interest rate caps, interest rate floors, point-to-point indexing, and the annual reset feature. Participation rates determine the proportion of index gains that an investor will receive in their indexed annuity. Typically, higher participation rates result in greater potential for returns, but may also come with higher fees or lower interest rate caps. It is important for investors to consider the balance between potential returns and associated costs when evaluating indexed annuities. Interest rate caps limit the maximum interest that an indexed annuity can earn in a given period. While caps can protect investors from excessive losses in a declining market, they may also limit potential gains in a rising market. Investors should carefully review the cap structure of an indexed annuity to understand how it may impact their overall returns. Interest rate floors ensure a minimum return on an indexed annuity, providing a measure of downside protection for investors. Floors can vary among products and insurance companies, so it is important for investors to compare different options to find an indexed annuity that best meets their risk tolerance and financial objectives. Indexed annuities offer several advantages that can make them an attractive option for certain investors. One of the main benefits of indexed annuities is the potential for higher returns compared to traditional fixed annuities. By linking returns to a market index, investors have the opportunity to participate in market gains without directly investing in equities. However, it is important to remember that potential returns may be limited by factors such as participation rates and interest rate caps. Indexed annuities provide a measure of principal protection, as they typically guarantee a minimum return or the return of the initial investment. This feature can be particularly appealing to risk-averse investors or those nearing retirement who are looking for a stable source of income without the volatility of directly investing in the stock market. Like other annuity products, indexed annuities offer tax-deferred growth. This means that interest earned within the annuity is not subject to taxes until it is withdrawn, allowing investments to grow at a faster rate. Investors should consider the tax implications of their investments and how tax-deferred growth may fit into their overall financial strategy. While indexed annuities offer a number of benefits, they also come with certain risks and limitations. In this section, we will explore capped gains, complex fee structures, limited liquidity, surrender charges, and insurance company credit risk. One of the most notable limitations of indexed annuities is capped gains, meaning that an investor's potential returns are limited by the interest rate cap. This can result in lower returns during periods of strong market performance compared to directly investing in the underlying index. Indexed annuities can have complex fee structures, including surrender charges, administrative fees, and riders. Investors should carefully review and understand these fees, as they can impact the overall returns and suitability of the annuity for their financial goals. Indexed annuities typically have limited liquidity, with surrender charges applied if an investor withdraws funds early. This lack of liquidity can be a significant drawback for investors who may need access to their funds in the short term or face unforeseen financial needs. Surrender charges are fees applied if an investor withdraws funds from an indexed annuity before the end of the surrender period. These charges can be substantial, and investors should consider their potential need for liquidity before committing to an indexed annuity. Indexed annuities are backed by the financial strength of the issuing insurance company. If the company were to experience financial difficulties or fail, it could impact the investor's ability to receive their guaranteed benefits. Investors should research the financial stability of the insurance company before purchasing an indexed annuity. Investors should evaluate several factors when determining if an indexed annuity is suitable for their financial goals. Indexed annuities may be appropriate for investors with a moderate risk tolerance who are seeking potential market gains while still maintaining principal protection. Investors with a high risk tolerance may find indexed annuities too conservative, while those with a low risk tolerance might prefer traditional fixed annuities. Indexed annuities are typically best suited for investors with a long-term investment horizon, as they may have surrender charges and limited liquidity in the short term. Investors with shorter time horizons or who anticipate needing access to their funds should carefully consider whether an indexed annuity is the right choice. Investors should evaluate their financial goals, such as retirement planning, wealth accumulation, or legacy planning, to determine if an indexed annuity aligns with their objectives. Each investor's unique circumstances will dictate the suitability of an indexed annuity. Inflation can erode the purchasing power of an investor's savings over time. When evaluating indexed annuities, investors should consider whether the potential returns will be sufficient to outpace inflation and maintain their desired lifestyle in retirement. Before selecting an indexed annuity, investors should compare it to other investment options, such as stocks, bonds, mutual funds, and traditional fixed annuities, to ensure they are making the best choice for their financial needs and goals. The regulatory and legal environment plays a crucial role in protecting investors and maintaining the integrity of the indexed annuity market. The SEC is the primary federal agency responsible for regulating securities markets in the United States. While indexed annuities are typically considered insurance products, they may also be subject to SEC regulation if they meet certain criteria. In 2010, the SEC issued a rule known as Rule 151A that would have required indexed annuities to be registered as securities. However, this rule was later vacated by a federal appeals court, and indexed annuities continue to be regulated primarily by state insurance departments. State insurance departments are the primary regulatory bodies responsible for overseeing indexed annuities. Each state has its own insurance department, and they are responsible for licensing insurance companies and agents, approving insurance products, and regulating the insurance industry within their respective states. State insurance departments also have the authority to investigate consumer complaints and take enforcement action against insurance companies and agents that violate state insurance laws and regulations. The NAIC is a voluntary organization of state insurance commissioners that works to develop and promote uniform insurance regulation and best practices across the United States. The NAIC has developed several model laws and regulations related to indexed annuities, including the Suitability in Annuity Transactions Model Regulation, which provides guidelines for ensuring that annuities are suitable for the needs of the consumer. FINRA is a self-regulatory organization that oversees the activities of broker-dealers and their associated persons in the United States. While FINRA does not have direct oversight of indexed annuities, it does regulate the activities of brokers who sell these products. FINRA has established rules related to the sale of annuities, including the requirement that brokers make suitable recommendations to their clients based on their financial needs and objectives. Indexed annuities are a type of financial product that offer potential for growth tied to the performance of an underlying market index, while also providing protection for the principal invested. They work by combining fixed and variable interest rates, with the fixed rate providing a minimum guarantee and the variable rate tied to the index's performance. While indexed annuities offer potential benefits such as higher returns, principal protection, tax-deferred growth, lifetime income options, and death benefit provisions, they also come with risks and limitations such as capped gains, complex fee structures and limited liquidity. Factors to consider when evaluating indexed annuities as an investment option include an investor's risk tolerance, investment time horizon, financial goals, inflation considerations, and comparison to other investment options. It is important for investors to work with a qualified insurance broker who can help ensure that their investment strategy aligns with their financial goals and risk tolerance. They can also provide valuable insights into the various indexed annuity products available.What Are Indexed Annuities?

How Does Indexed Annuity Work?

Participation Rates

Interest Rate Caps

Interest Rate Floors

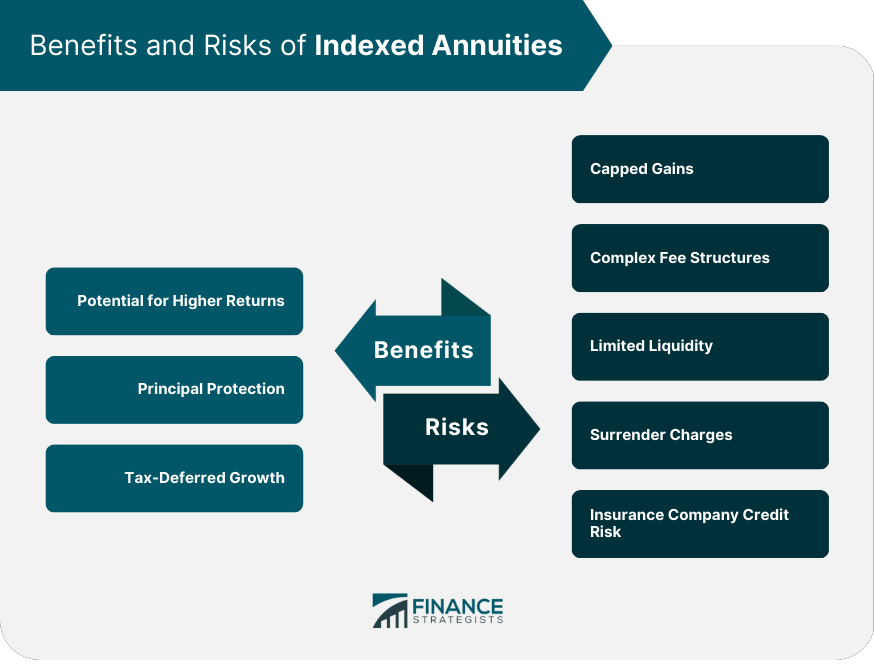

Benefits of Indexed Annuities

Potential for Higher Returns

Principal Protection

Tax-Deferred Growth

Risks and Limitations of Indexed Annuities

Capped Gains

Complex Fee Structures

Limited Liquidity

Surrender Charges

Insurance Company Credit Risk

Indexed Annuity Suitability and Considerations

Risk Tolerance

Investment Time Horizon

Financial Goals

Inflation Considerations

Comparison to Other Investment Options

Regulatory and Legal Environment

Securities and Exchange Commission (SEC) Oversight

State Insurance Regulation

National Association of Insurance Commissioners (NAIC) Guidelines

Financial Industry Regulatory Authority (FINRA) Rules

Final Thoughts

Indexed Annuities FAQs

An indexed annuity is a type of financial product that offers potential for growth tied to the performance of an underlying market index while providing protection for the principal invested.

Indexed annuities offer a measure of principal protection, as they typically guarantee a minimum return or the return of the initial investment. However, investors should carefully evaluate the risks and limitations associated with indexed annuities, including capped gains, complex fee structures, limited liquidity, surrender charges, and insurance company credit risk.

Indexed annuities work by combining fixed and variable interest rates, with the fixed rate providing a minimum guarantee and the variable rate tied to the performance of an underlying market index. This allows investors to participate in market gains without directly investing in equities.

Indexed annuities offer several benefits, including potential for higher returns, principal protection, tax-deferred growth, lifetime income options, and death benefit provisions.

Indexed annuities may be a suitable investment option for some investors, but they are not appropriate for everyone. Investors should carefully evaluate their financial goals, risk tolerance, and investment time horizon before investing in an indexed annuity. It is also important to work with a qualified financial professional who can provide guidance and recommendations tailored to their individual needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.