Lottery annuities refer to a financial product that is used as a method of paying out lottery winnings over an extended period. When a lottery winner chooses the annuity option, they receive their prize money in a series of payments over a specified period of time, typically spanning over 20 to 30 years. The exact structure of the annuity can vary depending on the lottery organization and the specific terms of the prize. Nonetheless, the annuity payments are usually made in the form of fixed installments, which are predetermined and set at the time of winning. The main advantage of choosing a lottery annuity is that it provides a consistent stream of income over an extended period. This can help winners manage their newfound wealth more effectively, avoiding the risk of reckless spending or mismanagement. Additionally, annuity payments may have certain tax advantages, as they are subject to taxation on an annual basis, potentially resulting in lower overall tax liability. The larger the winnings, the larger each annuity payment will be, assuming the same annuity duration. This is a straightforward, linear relationship: if you win a $100 million lottery and choose a 20-year annuity, each annual payment will be substantially larger than if you win a $50 million lottery and select the same annuity term. Longer durations mean that the total winnings are divided into more payments, which subsequently reduces the size of each individual payment. If you imagine spreading a fixed amount of butter over a piece of bread, the larger the bread, the thinner the layer of butter. It's the same with annuity payments: the "butter" (total winnings) is spread over the "bread" (years of payment). Longer payment durations will thin out the annual payment amount, while shorter durations will lead to thicker, or higher, annual payments. Federal taxes apply to all lottery winnings in the U.S., and state taxes may also apply depending on where the winner lives. High tax rates can take a significant chunk out of each annuity payment, reducing the amount that actually ends up in the winner's bank account. Furthermore, changes in tax laws can affect future payments for those who opt for an annuity payout. If tax rates increase in the future, the after-tax value of the payments could decrease. Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. This means that a dollar today will buy less in the future. If inflation rates are high during the annuity period, the purchasing power of each annuity payment decreases over time, effectively reducing the real value of the payouts. Interest rates at the time the annuity is purchased can influence the amount of each annuity payment. Generally, higher interest rates lead to larger annuity payments. This is because the lottery commission, or whichever entity is paying the annuity, can invest the lump-sum amount at this higher rate, leading to more significant earnings and, hence, larger payments to the winner. However, this is more relevant for annuities purchased separately as an investment, as some lottery commissions may have a pre-determined annuity schedule irrespective of current interest rates. Some lotteries dictate the distribution schedule strictly, requiring annual payments for annuity winners. Others might provide more flexibility, allowing for monthly or even quarterly payments. It's important to note that this frequency is usually set at the outset and generally cannot be changed later. Understanding these regulations is the first step towards understanding how frequently you can expect to receive your annuity payouts. Although the lottery regulations may set the broad parameters, within those boundaries, the winner often has some flexibility to determine the payout frequency. This choice will depend on the winner's individual needs and financial goals. For instance, some winners may prefer monthly payments to align with regular expenses like bills, mortgage payments, and daily living costs. Others might prefer an annual payment to fund larger projects or investments, or to coincide with a specific time of year for tax planning purposes. While most lottery annuities adhere to a standard annual payment schedule, if a winner has the choice and decides to purchase a different type of annuity with their winnings, they may have different options available. For example, immediate annuities start paying out right away and can often be structured to provide monthly, quarterly, or annual payments. Deferred annuities, on the other hand, begin payouts at a later date chosen by the winner. It's crucial to understand the terms and options of the specific annuity product to fully grasp how frequently you can expect payments. It involves the winner receiving the entirety of their winnings at once. Choosing a lump sum payout provides immediate access to a large sum of money. This can prove invaluable if the winner wants to make significant investments, clear outstanding high-interest debts, or cater to substantial immediate financial needs like buying a house. However, lump-sum payouts come with their own set of potential pitfalls. For starters, receiving a large sum of money all at once can be overwhelming and lead to mismanagement or reckless spending. Stories abound of lottery winners who have squandered their winnings and ended up in financial difficulty. Additionally, taking a lump sum could push the winner into a higher tax bracket for the year they receive their winnings, potentially leading to a larger portion of the winnings being eaten up by taxes. Hybrid models represent a middle ground between lump-sum and annuity payments. In a hybrid model, a portion of the winnings is taken as a lump sum, and the remainder is paid out as an annuity over a specified period. For instance, a winner might decide to take 40% of their winnings upfront to clear debts and make substantial investments, while the remaining 60% is received as annual payments over 20 years. This approach can provide a balance between immediate financial needs and long-term financial security. The primary advantage of hybrid models is their flexibility. They provide some immediate access to funds, which can be crucial for winners with immediate financial needs or investment opportunities. At the same time, they ensure a regular income stream in the future, offering a form of financial security and making budgeting easier. Moreover, they can also offer some tax advantages by spreading out the income over several years, which could potentially keep the winner in a lower tax bracket compared to taking the entire amount as a lump sum. However, like the other options, hybrid models come with their own challenges. There may be more complexity involved in managing two types of payments, and the tax implications can be more complex. Also, depending on the size of the lump-sum portion, the annual annuity payments might be reduced significantly compared to a full annuity option. Even with a sizable and regular income from lottery annuity payments, maintaining a budget is essential. It's easy to adjust to a higher standard of living, and without a budget, expenses can quickly get out of hand. Plan for your essential expenses first – housing, food, utilities, healthcare, and other necessities. Then budget for other commitments, like investments, debts, and savings. Finally, designate an amount for discretionary spending, which includes things like leisure activities, hobbies, and luxury purchases. Lottery winnings, including annuity payouts, are subject to taxes, and it's vital to understand these obligations. Work with a tax professional to understand your annual tax liabilities, and budget accordingly to ensure you have sufficient funds to cover your taxes when they're due. Annuity payouts can provide a regular income stream, but they also offer an opportunity to grow your wealth through investments. Diversifying your investments can help to spread risk and increase potential returns. Consider a mix of low-risk investments (like government bonds or high-yield savings accounts) and higher-risk but potentially higher-return investments (like stocks or real estate). Even with regular annuity payments, unexpected expenses can arise. Having an emergency fund can help you manage these unexpected costs without disrupting your budget or dipping into your investments. Aim to set aside enough to cover three to six months of living expenses. If you have high-interest debts, such as credit card debts, it may be beneficial to use some of your annuity payments to pay these off. The interest rate on these debts is likely higher than what you can earn through most investments, making it financially advantageous to clear these debts as soon as possible. Your financial situation and goals may change over time, and your financial plan should adapt accordingly. Regularly review your budget, investments, and financial goals. As you receive your annuity payments, reassess your financial plan to ensure it continues to serve your needs and help you reach your financial goals. Managing substantial wealth can be complex, and professional advice can be invaluable. Consider working with financial advisors, tax professionals, and even lawyers to help manage your wealth, plan for the future, and navigate any legal implications. Professionals can provide advice tailored to your specific situation, helping you make the most of your lottery annuity payments. Lottery annuity payouts offer a structured approach to managing lottery winnings, providing winners with a consistent stream of income over an extended period. Choosing a lottery annuity provides advantages such as effective wealth management and potential tax benefits. The amount of annuity payments is influenced by factors such as the total winnings, annuity duration, tax rates, inflation, and interest rates. On the other hand, payout frequency is affected by lottery regulations, the winner’s choice, and annuity type. Alternatives to lottery annuity payouts include lump sum and hybrid models. Managing lottery annuity payouts requires careful planning and financial discipline. It is important to create a budget, understand tax obligations, and make wise investment decisions. Regularly reviewing and adjusting financial plans, building an emergency fund, and paying off high-interest debts are also crucial. Seeking professional advice from financial experts can provide tailored guidance to maximize the benefits of lottery annuities. By implementing these best practices and considering the various factors involved, lottery winners can effectively manage their annuity payments and work towards their long-term financial goals.Lottery Annuity: Overview

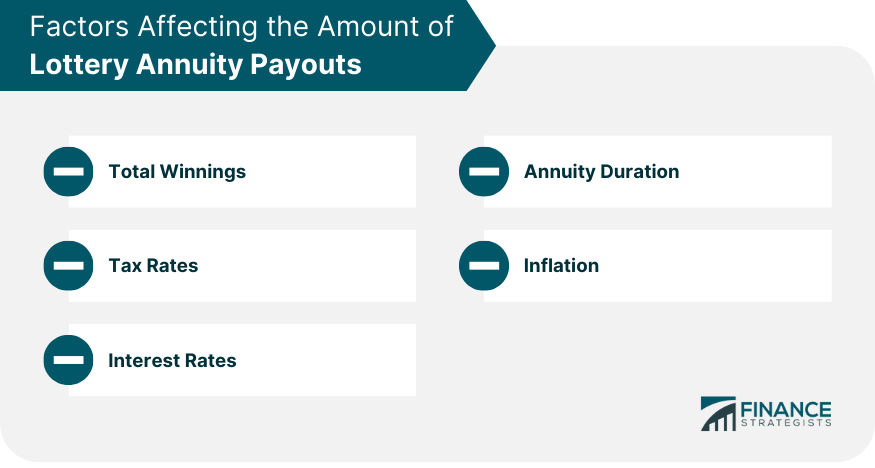

Factors Affecting the Amount of Lottery Annuity Payouts

Total Winnings

Annuity Duration

Tax Rates

Inflation

Interest Rates

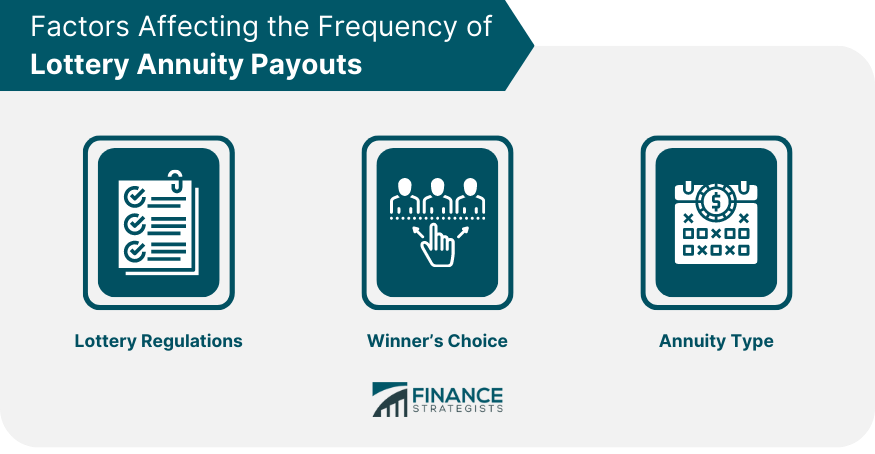

Factors Affecting the Frequency of Lottery Annuity Payouts

Lottery Regulations

Winner’s Choice

Annuity Type

Alternatives to Lottery Annuity Payouts

Lump Sum Payout

Hybrid Models

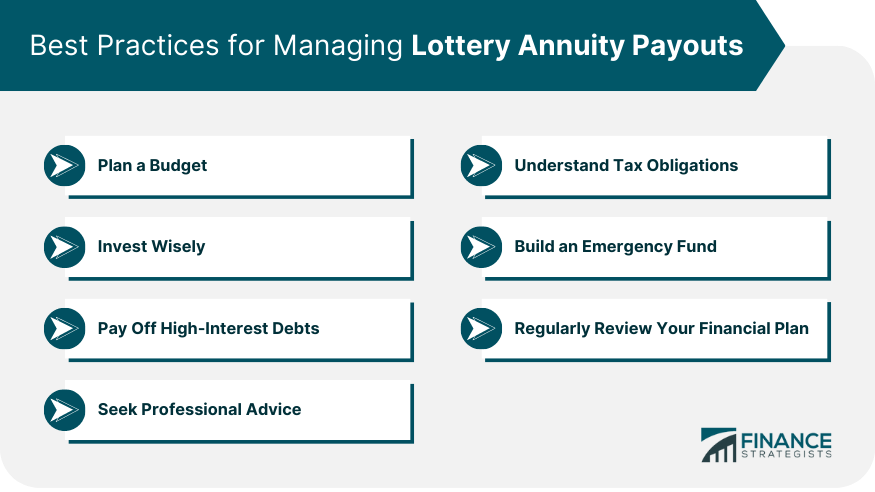

Best Practices for Managing Lottery Annuity Payouts

Plan a Budget

Understand Tax Obligations

Invest Wisely

Build an Emergency Fund

Pay Off High-Interest Debts

Regularly Review Your Financial Plan

Seek Professional Advice

Final Thoughts

Lottery Annuity Payout FAQs

Choosing a lottery annuity payout provides winners with a consistent stream of income over an extended period, which can help manage their newfound wealth more effectively and avoid reckless spending. Additionally, annuity payments may have certain tax advantages and can potentially result in lower overall tax liability.

The amount of annuity payments is influenced by factors such as the total winnings, annuity duration, tax rates, inflation, and interest rates. The frequency of annuity payouts is usually determined by lottery regulations, although winners may have some flexibility within those parameters.

One potential drawback is that annuity payments may be subject to inflation, which reduces the purchasing power of each payment over time. Additionally, changes in tax laws can affect future payments, and high tax rates can significantly reduce the amount that ends up in the winner's bank account.

Yes, seeking professional advice from financial advisors, tax professionals, and lawyers is highly recommended. Managing substantial wealth can be complex, and professionals can provide guidance tailored to individual circumstances, helping winners make informed decisions and maximize the benefits of their lottery annuity payments.

In most cases, the frequency of annuity payments is set at the outset and cannot be changed later. Lottery regulations and the terms of the specific annuity product determine the payout frequency. It is important to understand these regulations and terms before making a decision on the frequency of annuity payments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.