An annuity is a series of cash flows occurring over time. There are different types of annuities, but they all share the same concept: systematic future inflow followed by systematic future outflow. The two most common forms of annuities are ordinary annuity and annuity due. Have questions about Ordinary Annuity and Annuity Due? Click here. An ordinary (or straight line) annuity has equal payments that occur at regular intervals, with the first payment made immediately. An example would be $100 per month for 3 years beginning at age 21, where each payment is made at the end of the month. The first payment starts 1 month after turning 21 years old. Each subsequent monthly payment continues to occur 1 month after the end of each previous month. An annuity due has unequal payments occurring at regular intervals, with the first payment occurring immediately. A common example would be $100 per month for 3 years beginning today, where each payment is made at the beginning of the month. The first payment starts one month from today. Each subsequent monthly payment continues to occur 1 month after the beginning of each prior month. Here are some key differences to take note in order to distinguish an ordinary annuity from an annuity due: The main difference between an ordinary annuity and an annuity due is in the payment schedule. With an ordinary annuity, payments are evenly spaced out over time, with the first payment due at the end of the period. With an annuity due, payments are unevenly spaced out over time, with the first payment made immediately at the start of the period. In addition to the different payment schedules for an ordinary annuity and an annuity due, there is also a difference between calculating their present value. Because of inflation, the value of a dollar today is higher compared to a dollar at a later date. This makes the value of payments made via ordinary annuity less than the value of payments made via annuity due. This is because in order to receive the same purchasing power at a later date, you would need more payments with an annuity due than with an ordinary annuity. Ordinary annuities are best used for payments because they have a lower present value than an annuity due. This is because payments made through ordinary annuity are more exposed to inflation. An annuity due is best used for receipts because they have a higher present value than an ordinary annuity. Ordinary annuity is ideal for mortgage payments, while annuity due is ideal for insurance premiums. The prevailing interest rate and inflation are two factors that greatly affect the present value of an annuity. Below are the formulas on how to compute the present value for each type of annuity: All else equal, the present value of payments made through ordinary annuity will always be lesser than that of an annuity due. Annuities are a series of cash flows occurring over time. Annuities have two types: ordinary annuity and annuity due. With an ordinary annuity, the first payment is made after a period of time. With an annuity due, the first payment is made at the beginning of a period. An ordinary annuity has a lower value compared to an annuity due because payments through ordinary annuities are more exposed to inflation. Thus, in general, it is best used for making cash flows/payments while an annuity due is best used for receiving cash flows/payments when looking at them from a present value perspective.What Is an Annuity?

What Is an Ordinary Annuity?

What Is an Annuity Due?

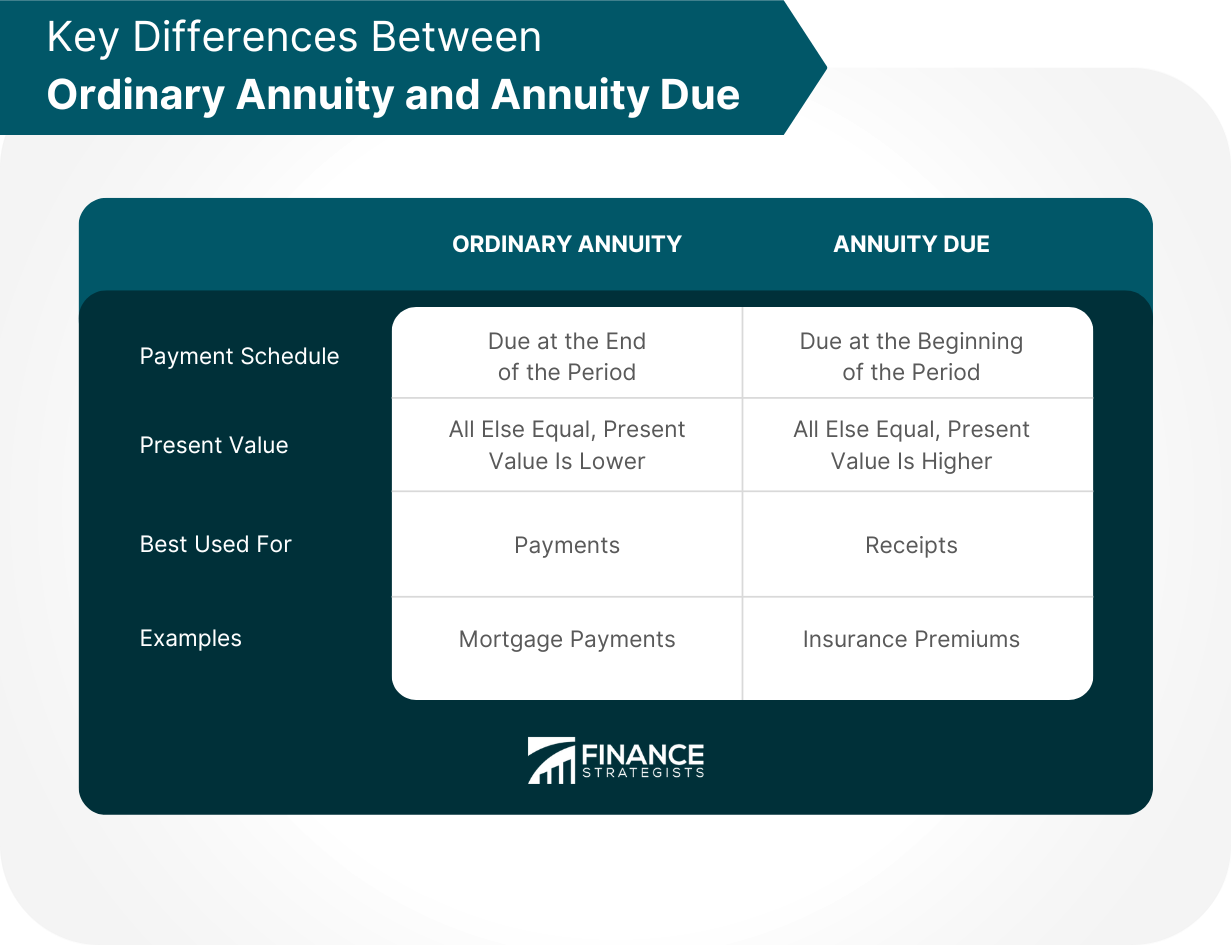

Key Differences Between Ordinary Annuity and Annuity Due

Payment Schedule

Present Value

Best Used For

Examples

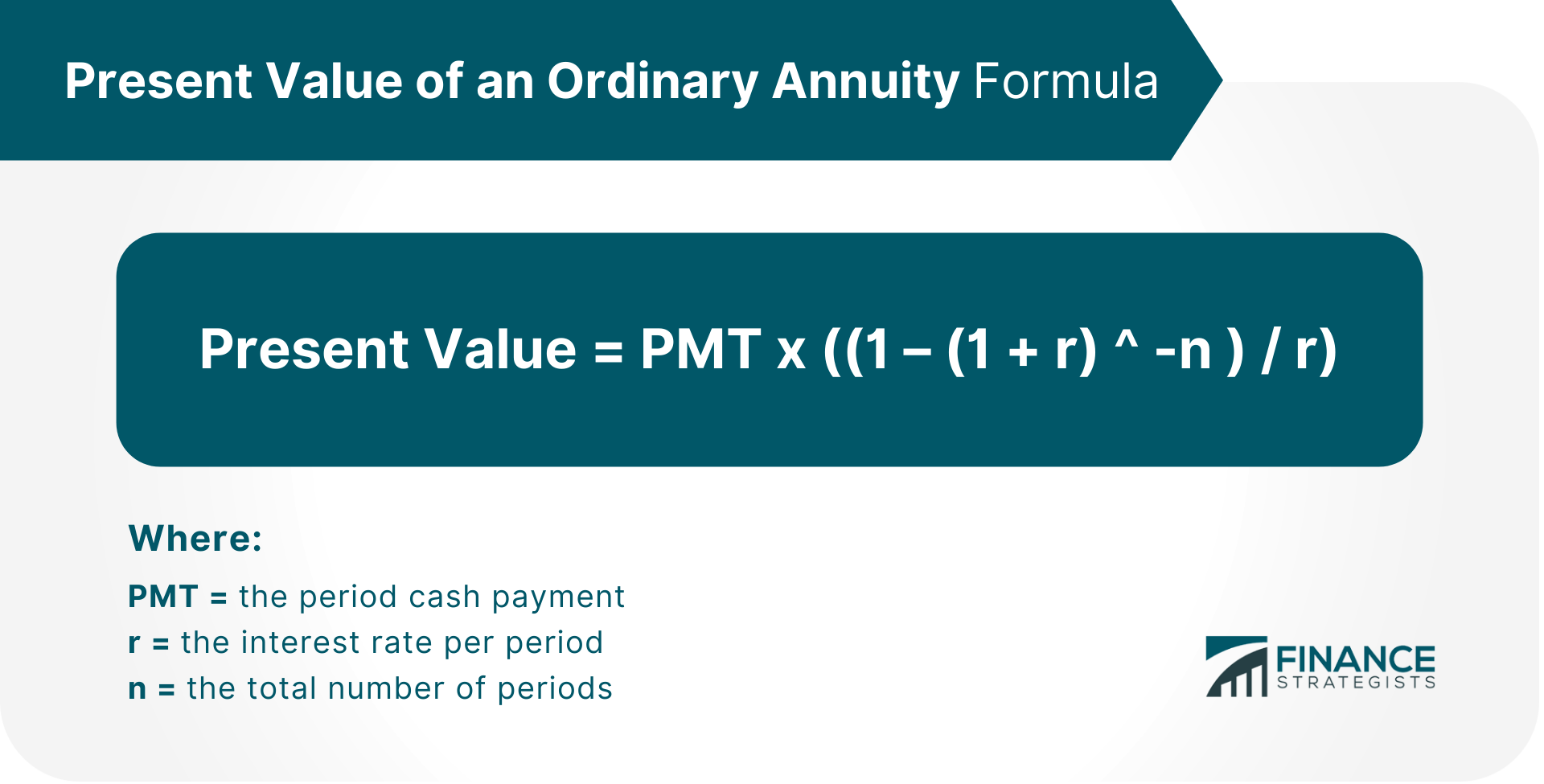

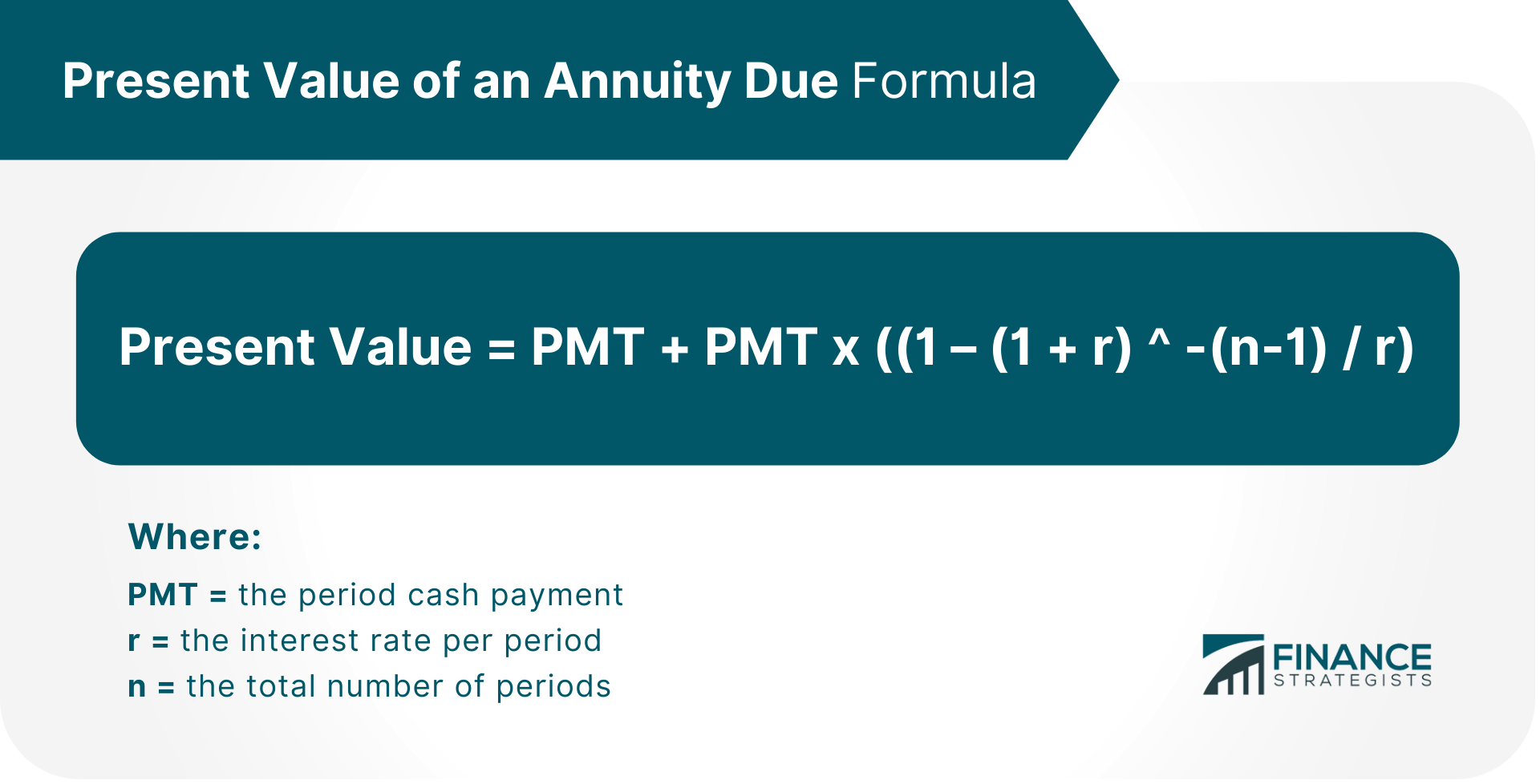

Present Value Calculation

Present Value of an Ordinary Annuity

Present Value of an Annuity Due

The Bottom Line

Difference Between Ordinary Annuity and Annuity Due FAQs

Inflation is the rate at which the general level of prices for goods and services rises. If the inflation rate is high, the value of the dollar will be low. Conversely, a low inflation rate means a strong dollar. When it comes to annuities, inflation affects the present value of payments made through ordinary annuity versus those made through an annuity due. This is because if inflation is high, then payments made via ordinary annuity have a lower purchasing power compared to those made via an annuity due which have a higher purchasing power for the same period covered by the payment or receipt.

Present Value allows you to compare and decide between multiple options on their relative values right now. Basically, present value tries to estimate how much something is worth today rather than later or in the future if we were offered it right now.

The present value of an annuity due is higher because payments through annuity due are not as exposed to inflation as payments through ordinary annuity.

Interest refers to a fee charged for borrowing money from a lender. The lender receives back less money than lent, but this arrangement provides them with income and encourages them to lend more in the future. Interest rates are often used as an indicator of how expensive it is for companies and individuals to borrow money.

The prevailing interest rate and inflation are two factors that greatly affect the present value of an annuity. These factors determine how much money a person would need today in order to receive a given sum of money in the future.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.