A period certain annuity is a type of annuity that provides a guaranteed income stream for a predetermined period, such as 10, 15, or 20 years. This contrasts with other annuities, like lifetime annuities, which pay out for the remainder of the annuitant's life, or deferred annuities, which begin payments at a later specified date. Period Certain Annuities is designed to provide guaranteed income for a specific period. This type of annuity is suitable for those who want to ensure financial stability for a defined timeframe, such as during the initial years of retirement. One of the primary characteristics of a period certain annuity is that it provides a guaranteed income stream for a predetermined period, such as 10, 15, or 20 years. Once the period is over, the payments cease. In the event of the annuitant's death before the end of the specified period, the remaining payments can be transferred to a designated beneficiary. This feature offers a level of financial protection for the annuitant's loved ones. Period certain annuities offer flexibility in terms of payment frequency. Annuitants can choose to receive their payments monthly, quarterly, semi-annually, or annually, based on their financial needs and preferences. The tax treatment of period certain annuities depends on several factors, such as the type of annuity and the source of funds used for the purchase. Generally, the portion of each payment that represents earnings is subject to income tax. Fixed period certain annuities offer a guaranteed interest rate, and the payments remain consistent throughout the specified term. This type of annuity provides predictability and stability for the annuitant. The primary advantage of a fixed period certain annuity is the guaranteed income and protection against market fluctuations. However, one potential drawback is that the fixed interest rate may not keep pace with inflation, potentially eroding the purchasing power of the payments over time. Variable period certain annuities allow annuitants to invest in a range of investment options, such as mutual funds or stock portfolios. The performance of these investments determines the annuity payments, which can vary over time. Before selecting a period certain annuity, it is essential to evaluate your financial objectives and determine how this type of annuity fits within your overall financial plan. Consider the length of time you require guaranteed income when choosing a period certain annuity. This should align with your expected retirement duration or other financial milestones Assess your risk tolerance when deciding between a fixed or variable period certain annuity. If you prefer stable, predictable income, a fixed annuity may be more suitable, while a variable annuity may be more appropriate for those willing to take on additional risk for potentially higher returns. Understand the fees and charges associated with period certain annuities, including management fees, surrender charges, and other administrative costs. Comparing fees among different providers can help you make a more informed decision. Research the financial strength and reputation of the insurance company offering the period certain annuity. A financially stable company is more likely to fulfill its obligations and provide the guaranteed income you expect. Start by researching and comparing various annuity providers. Consider factors such as financial strength, fees, and customer service when making your decision. Consulting an insurance broker can be helpful in navigating the complexities of the period of certain annuities and determining whether this product aligns with your financial goals. They can also assist you in finding a suitable annuity provider and plan. Once you have selected a period certain annuity, complete the application process, which typically involves providing personal and financial information. Be prepared to submit relevant documents as required by the insurance company. Lifetime annuities provide guaranteed income for the remainder of the annuitant's life, rather than for a fixed period. This type of annuity can be a suitable alternative for those seeking lifelong financial security. Deferred annuities allow the annuitant to postpone the start of income payments until a later date. This type of annuity can be beneficial for those who want to accumulate more funds before beginning to receive payments. Immediate annuities start paying income shortly after the purchase, usually within a year. They can be an alternative for those seeking immediate income during retirement. Apart from annuities, consider other investment options such as stocks, bonds, mutual funds, and real estate to diversify your portfolio and achieve your financial goals. Period certain annuities can provide guaranteed income for a specific period, offering financial stability and flexibility in payment frequency. They come in two main types: fixed and variable, each with its advantages and disadvantages. It is crucial to evaluate your financial goals, risk tolerance, and time horizon when considering a period of certain annuity. Working with a financial advisor and researching different annuity providers can help you make an informed decision. Period certain annuities can play a significant role in retirement planning by providing a reliable income stream for a specified duration. However, it is essential to weigh the benefits and drawbacks of this financial product and explore alternative investment options to create a comprehensive retirement strategy.What Is a Period Certain Annuity?

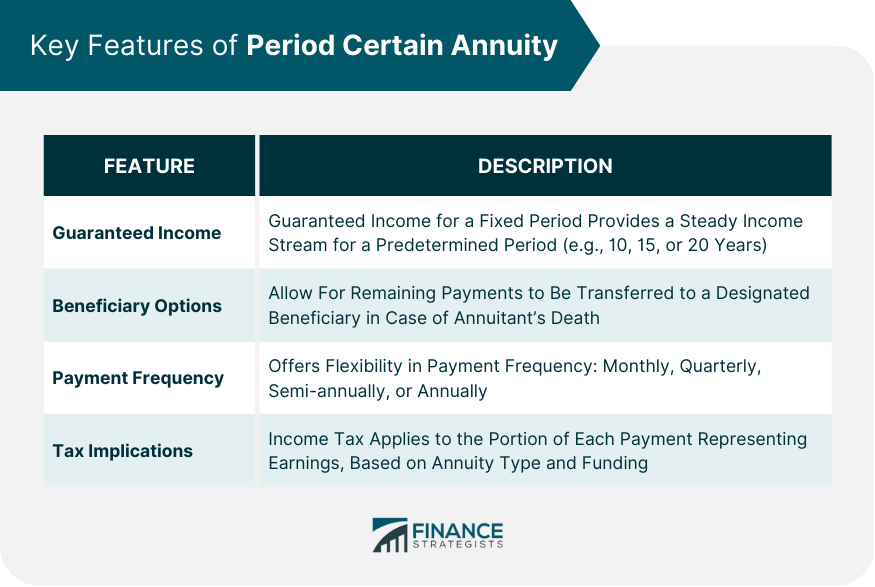

Key Features of Period Certain Annuity

Guaranteed Income for a Fixed Period

Beneficiary Options

Flexibility in Payment Frequency

Tax Implications

Types of Period Certain Annuities

Fixed Period Certain Annuity

Variable Period Certain Annuity

Variable period certain annuities offer the potential for higher returns compared to fixed annuities, as well as the opportunity to participate in market gains.

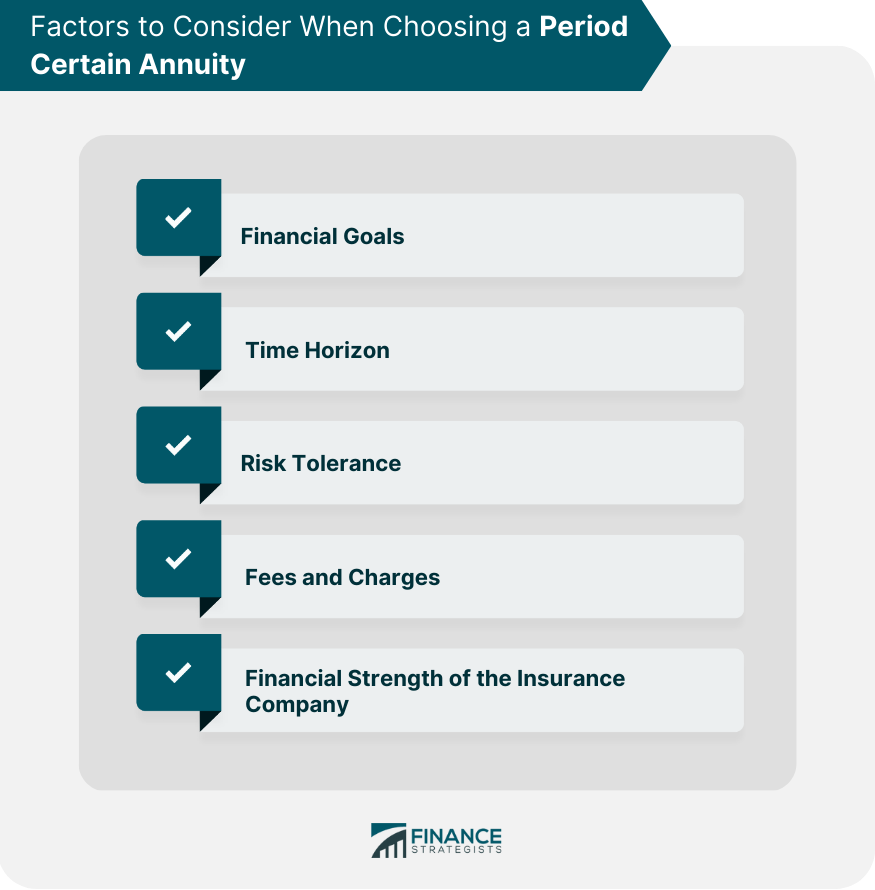

However, they also come with a higher level of risk, as the payments can fluctuate based on investment performance.Factors to Consider When Choosing a Period Certain Annuity

Financial Goals

Time Horizon

Risk Tolerance

Fees and Charges

Financial Strength of the Insurance Company

How to Purchase a Period Certain Annuity

Researching and Comparing Annuity Providers

Working With an Insurance Broker

Application Process and Requirements

Alternatives to Period Certain Annuities

Lifetime Annuities

Deferred Annuities

Immediate Annuities

Other Investment Options

Conclusion

Period Certain Annuity FAQs

A period certain annuity is a type of annuity that provides a guaranteed income stream for a predetermined period, such as 10, 15, or 20 years. This contrasts with other annuities, like lifetime annuities, which pay out for the remainder of the annuitant's life, or deferred annuities, which begin payments at a later specified date.

The key features of a period certain annuity include guaranteed income for a fixed period, flexibility in payment frequency (monthly, quarterly, semi-annually, or annually), beneficiary options in case of the annuitant's death, and specific tax implications depending on the type of annuity and the source of funds used for the purchase.

The two main types of period certain annuities are fixed period certain annuities and variable period certain annuities. Fixed period certain annuities offer guaranteed interest rates and consistent payments throughout the specified term, while variable period certain annuities allow for investment in various options, with payments determined by the performance of these investments.

When selecting a period certain annuity, consider factors such as your financial goals, time horizon, risk tolerance, fees and charges associated with the annuity, and the financial strength of the insurance company offering the product.

Consulting an insurance broker when purchasing a period certain annuity can provide valuable guidance in navigating the complexities of the product and finding a suitable plan. An insurance broker can help you evaluate your financial goals, compare different providers, and answer questions related to fees, features, and tax implications, ensuring you make an informed decision that aligns with your unique financial objectives.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.