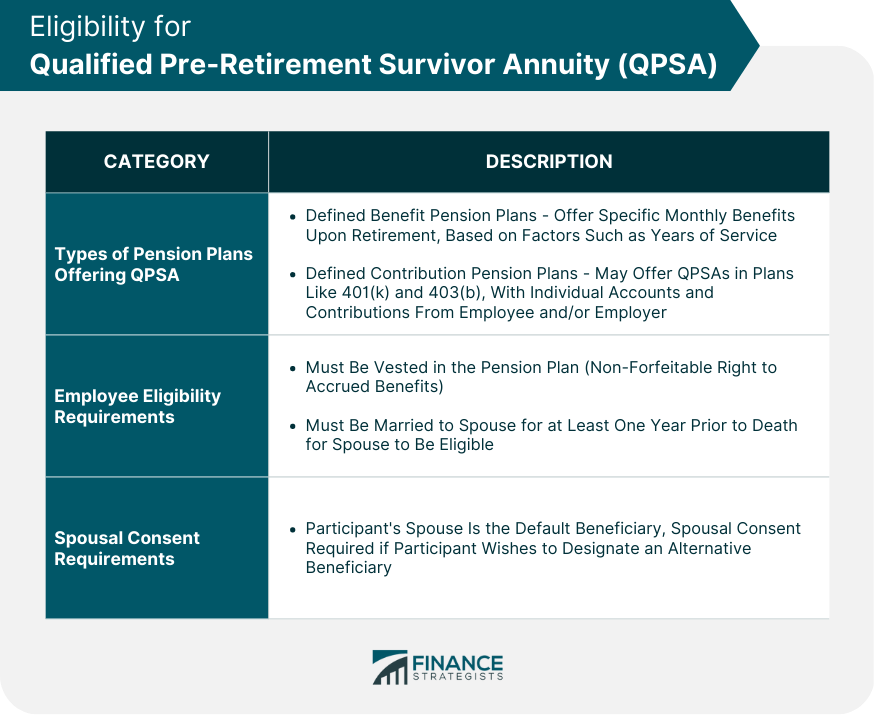

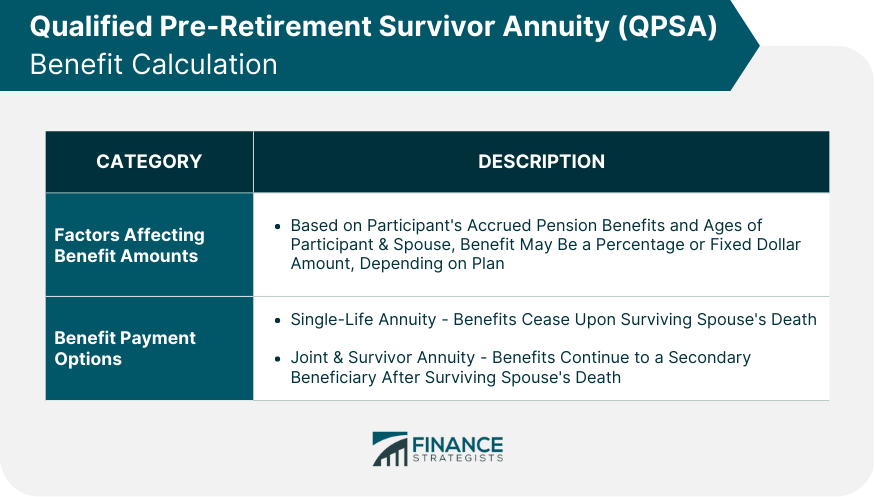

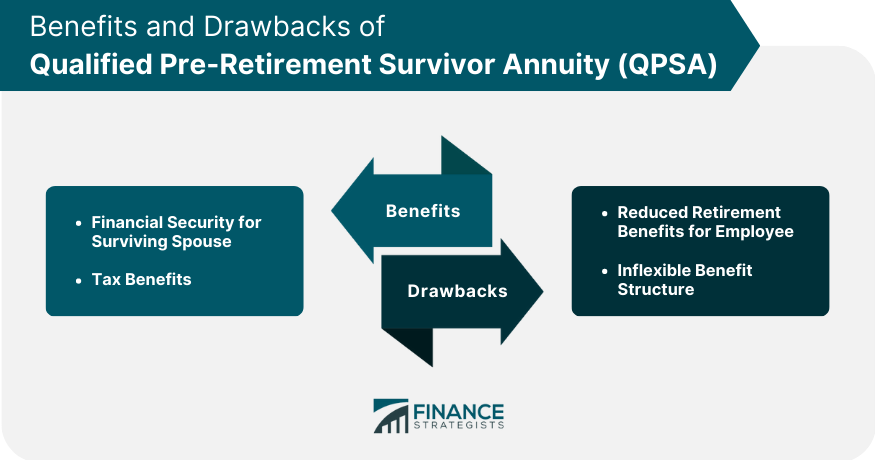

QPSA is a financial product offered by certain pension plans, which provides a lifetime income stream to the surviving spouse of a plan participant who dies before retirement. QPSA benefits are designed to protect the financial well-being of the surviving spouse and ensure that they receive a portion of the participant's pension benefits. The primary purpose of a QPSA is to offer financial security for the surviving spouse by ensuring a steady income stream after the participant's death. QPSAs also help to preserve the tax advantages associated with pension plans by allowing for continued tax-deferred growth of the pension assets. QPSAs are regulated under the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code (IRC). These regulations mandate that certain pension plans offer QPSAs to vested participants and establish the rules for eligibility, benefit calculation, and opting out. QPSAs are typically offered within defined benefit plans, which promise participants a specific monthly benefit upon retirement, based on factors such as years of service and salary. Some defined contribution plans, such as 401(k) and 403(b) plans, may also offer QPSAs. In these plans, participants have individual accounts with contributions from the employee and/or employer, and the retirement benefit is based on the account balance at retirement. To be eligible for a QPSA, the plan participant must be vested in the pension plan, meaning they have earned a non-forfeitable right to their accrued benefits based on their years of service. The participant must also be married to their spouse for at least one year prior to their death for the spouse to be eligible for QPSA benefits. In general, the participant's spouse is the default beneficiary for QPSA benefits, and spousal consent is required if the participant wishes to designate an alternative beneficiary. The QPSA benefit amount is typically calculated based on the participant's accrued pension benefits and the age of the participant and surviving spouse. The benefit may be a percentage of the participant's pension or a fixed dollar amount, depending on the plan provisions. QPSA benefits may be paid in several forms, such as a single-life annuity (benefits cease upon the surviving spouse's death) or a joint and survivor annuity (benefits continue to a secondary beneficiary after the surviving spouse's death). QPSAs provide financial security for the surviving spouse by ensuring a steady income stream after the participant's death. QPSA benefits allow for continued tax-deferred growth of the pension assets, preserving the tax advantages associated with pension plans. Since a portion of the participant's pension benefits are designated for the QPSA, this may result in reduced retirement benefits for the participant. QPSAs often have an inflexible benefit structure, which may not meet the unique needs of some individuals or families. To opt out of QPSA benefits, the plan participant must obtain written consent from their spouse. This consent allows the participant to waive the QPSA benefits or designate an alternative beneficiary. In some cases, participants may choose to opt out of the QPSA in favor of alternative beneficiary arrangements, such as life insurance or a different type of annuity, which may offer more flexibility or better suit their financial goals. To opt out of QPSA benefits, the participant must complete the required forms and provide any necessary documentation, such as proof of spousal consent and information about the alternative beneficiary. Participants must generally opt out of QPSA benefits within a specified time frame, usually before they reach the plan's normal retirement age or a specific date before their death. Divorce can have a significant impact on QPSA eligibility. Depending on the terms of the divorce settlement, the former spouse may no longer be entitled to QPSA benefits, or their share of the benefits may be reduced. During a divorce, QPSA benefits may be divided between the plan participant and their former spouse through a Qualified Domestic Relations Order (QDRO). A QDRO is a legal document that specifies the division of pension benefits and ensures that the former spouse remains eligible for their share of the benefits. A QDRO can designate the former spouse as an "alternate payee" for QPSA benefits, ensuring that they continue to receive their share of the benefits upon the participant's death. The QDRO must meet specific requirements under ERISA and the IRC to be considered valid. Upon the death of a plan participant, it is essential to notify the pension plan administrator as soon as possible to initiate the QPSA benefit process. The surviving spouse or other beneficiaries may need to provide documentation, such as a death certificate and proof of marriage or beneficiary status, to the pension plan administrator to begin receiving QPSA benefits. Once the necessary documentation has been provided and reviewed, the pension plan administrator will begin paying QPSA benefits to the surviving spouse or designated beneficiary. QPSA benefits typically continue for the lifetime of the surviving spouse or until the designated beneficiary's death, depending on the plan provisions and benefit payment options. Understanding QPSA options is crucial for plan participants and their spouses, as it can impact their financial security and well-being in the event of the participant's death. By knowing the ins and outs of QPSA benefits, individuals can make informed decisions about their pension plan and retirement strategy. Both employees and spouses should carefully consider their unique financial needs and goals when evaluating QPSA options. This may involve discussing alternative beneficiary arrangements, understanding the impact of divorce on QPSA benefits, and considering the long-term financial security provided by QPSAs. It is also important to be aware of the eligibility requirements, benefit calculations, and the potential advantages and limitations of benefits. QPSAs play a vital role in ensuring financial protection for surviving spouses of pension plan participants. By familiarizing themselves with QPSA options and considering their specific financial situations, plan participants and their spouses can make informed decisions to secure their financial futures. It is essential to consult with a financial advisor or insurance broker to clarify doubts and ensure a comprehensive understanding of QPSA benefits and implications.What Is a Qualified Pre-Retirement Survivor Annuity (QPSA)?

Eligibility for Qualified Pre-Retirement Survivor Annuity (QPSA)

Types of Pension Plans Offering QPSA

Defined Benefit Pension Plans

Defined Contribution Pension Plans

Employee Eligibility Requirements

Vesting Status

Marriage Duration

Spousal Consent Requirements

Qualified Pre-Retirement Survivor Annuity (QPSA) Benefits

Benefit Calculation

Factors Affecting Benefit Amounts

Benefit Payment Options

Advantages of QPSA

Financial Security for Surviving Spouse

Tax Benefits

Limitations of QPSA

Reduced Retirement Benefits for Employee

Inflexible Benefit Structure

Opting Out of Qualified Pre-Retirement Survivor Annuity (QPSA)

Opt-Out Conditions

Spousal Consent

Alternative Beneficiary Arrangements

Opt-Out Process

Required Forms and Documentation

Deadline for Opting Out

Qualified Pre-Retirement Survivor Annuity (QPSA) and Divorce

Impact of Divorce on QPSA Eligibility

Division of QPSA Benefits

QPSA and Qualified Domestic Relations Orders (QDRO)

Qualified Pre-Retirement Survivor Annuity (QPSA) and Death of Employee

Procedures Following the Death of an Employee

Notification of Pension Plan Administrator

Required Documentation

Commencement of QPSA Benefits

Duration of QPSA Benefits

Final Thoughts

Qualified Pre-Retirement Survivor Annuity (QPSA) FAQs

A QPSA is a type of pension plan benefit that provides a lifetime income stream to the surviving spouse of a plan participant who dies before retirement.

To be eligible for QPSA benefits, the plan participant must be vested in the pension plan and be married to their spouse for at least one year prior to their death. Spousal consent is also required if the participant wishes to designate an alternative beneficiary.

QPSA benefits are typically calculated based on the participant's accrued pension benefits and the age of the participant and surviving spouse. The benefit may be a percentage of the participant's pension or a fixed dollar amount, depending on the plan provisions.

Yes, participants can opt out of QPSA benefits by obtaining written consent from their spouse and completing the required forms and documentation. Participants may choose alternative beneficiary arrangements, such as life insurance or a different type of annuity, which may offer more flexibility or better suit their financial goals.

Divorce can have a significant impact on QPSA eligibility. Depending on the terms of the divorce settlement, the former spouse may no longer be entitled to QPSA benefits, or their share of the benefits may be reduced. QPSA benefits may be divided between the plan participant and their former spouse through a Qualified Domestic Relations Order (QDRO).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.