A single premium immediate annuity (SPIA) is an insurance product that requires the policyholder to make a one-time, lump-sum payment to an insurance company. In return, the insurer provides the policyholder with a series of regular income payments, starting immediately or shortly after the initial payment. SPIAs play a significant role in retirement planning as they help individuals create a reliable income stream that can last for their lifetime or a specified period. This guaranteed income provides financial stability and predictability, which can be particularly useful for retirees who may no longer have a steady paycheck from employment. SPIAs offer various options to customize the annuity according to the policyholder's needs, including the choice of income payment frequency, duration, and beneficiary options. The key features of SPIAs include guaranteed income, simplicity, tax advantages, and protection from longevity risk. To purchase a SPIA, the policyholder must make a one-time, lump-sum payment to the annuity provider. This payment is often made using funds from retirement savings accounts, such as a 401(k) or an IRA. The annuity start date refers to when the policyholder begins receiving income payments from the annuity. This can be immediately after the purchase or within one year of the purchase date. SPIAs offer a variety of income payment options to suit the policyholder's needs and preferences. Some common options include: Under a life-only option, the annuity provider makes income payments to the policyholder for the remainder of their life. Payments stop upon the policyholder's death, with no benefits paid to any beneficiaries. A joint life annuity provides income payments for the lives of two people, usually spouses or partners. When the first person dies, the annuity continues to provide income to the surviving individual. The payments may continue at the same rate or be reduced, depending on the terms of the annuity contract. With a period certain annuity, the policyholder receives guaranteed income payments for a specified period, such as 10, 15, or 20 years. If the policyholder dies before the end of the specified period, the remaining payments are made to a designated beneficiary. A life with period certain annuity combines features of both life-only and period certain annuities. The policyholder receives income payments for life, but if they die before the end of the specified period, their beneficiary receives the remaining payments. Several factors can influence the amount of income a policyholder receives from a SPIA: Generally, older policyholders receive higher income payments because they have a shorter life expectancy. Men typically receive higher income payments because women tend to live longer. Higher interest rates usually result in higher income payments. The financial strength of the annuity provider can impact the safety and reliability of the income payments. To choose the right SPIA, individuals should consider the following factors: Before purchasing a SPIA, it is essential to assess one's financial needs and goals, including desired retirement income, expenses, and potential emergencies. SPIA buyers should consider their risk tolerance and time horizon when choosing an annuity. Those with a lower risk tolerance and a longer time horizon may prefer the guaranteed income provided by a SPIA over other, riskier investments. When selecting a SPIA, it is crucial to compare different annuity providers based on factors such as financial strength ratings, payout rates, fees, and charges. Choose providers with high financial strength ratings, indicating their ability to meet their financial obligations and make timely income payments. Compare the payout rates offered by different providers to maximize the income received from the SPIA. Be aware of any fees or charges associated with purchasing and maintaining the annuity. Consulting with a financial advisor or retirement planning professional can help individuals make informed decisions about SPIAs and other retirement income options. There are several alternatives to SPIAs for those seeking retirement income: Deferred annuities begin paying income at a later date, allowing the invested funds to grow tax-deferred until payments start. Variable annuities offer the potential for higher returns by allowing policyholders to invest in a variety of investment options, such as stocks and bonds. Fixed-Index annuities provide income based on the performance of a specified market index, offering the potential for growth with some level of protection against market downturns. Retirees can also consider strategies such as systematic withdrawals from investment accounts, reverse mortgages, or rental income from real estate. There are several advantages to using an SPIA for retirement income: One of the primary benefits of an SPIA is the guaranteed income it provides. Policyholders can have peace of mind knowing they will receive a steady stream of income for the rest of their lives or a specified period, depending on the terms of the annuity. SPIAs are relatively simple and easy to understand compared to other retirement income products. Once the policyholder makes the initial lump-sum payment, they do not need to actively manage the annuity or make investment decisions. SPIAs offer tax advantages, particularly when funded with pre-tax retirement savings. A portion of each income payment is considered a return of the policyholder's original investment and is not subject to income tax. SPIAs protect policyholders from the risk of outliving their savings, which is a common concern among retirees. With a life-only or life with period certain annuity, the policyholder receives income payments for the rest of their life, regardless of how long they live. Compared to other conservative investments, such as bonds or certificates of deposit, SPIAs may offer higher payouts, particularly for older policyholders. Despite their benefits, SPIAs also have some potential drawbacks that should be considered before purchasing: Once a policyholder makes the initial lump-sum payment, they typically cannot access the funds invested in the SPIA. This lack of liquidity can be a concern for individuals who may need access to their savings for emergencies or other unexpected expenses. SPIA payments are generally fixed and do not adjust for inflation. Over time, the purchasing power of the income payments may decrease, which can be a significant concern for retirees with long life expectancies. SPIAs offer limited growth potential compared to other investments, such as stocks or mutual funds. Policyholders may miss out on the potential for higher returns, particularly during strong market conditions. When purchasing a SPIA, policyholders relinquish control over their investment to the annuity provider. This loss of control may be undesirable for some individuals who prefer to actively manage their investments. Under a life-only annuity option, there is no death benefit, and payments stop upon the policyholder's death. While other payment options may include a death benefit, they typically come with lower income payments during the policyholder's lifetime. Single Premium Immediate Annuities (SPIAs) hold significant importance in retirement planning due to their ability to provide guaranteed income and financial stability for retirees. As with any financial product, it is crucial to balance the benefits and drawbacks of SPIAs in the context of one's individual needs and goals. Some of the main advantages of SPIAs include guaranteed income for life, simplicity, tax advantages, and protection from longevity risk. However, potential drawbacks such as lack of liquidity, inflation risk, limited growth potential, and loss of control over investment should be carefully considered. Making informed decisions about SPIAs and other retirement options is essential for creating a comprehensive retirement plan that addresses individual financial needs and objectives. Comparing different annuity providers, assessing risk tolerance and time horizon, and evaluating financial needs and goals are all important steps in the decision-making process. Seek professional guidance from a financial advisor, insurance broker, or retirement planning expert who can help individuals navigate the complexities of retirement planning and make well-informed choices.What Is a Single Premium Immediate Annuity (SPIA)?

How Single Premium Immediate Annuity (SPIA) Works

Lump-Sum Payment

Annuity Start Date

Income Payment Options

Life-Only

Joint Life

Period Certain

Life With Period Certain

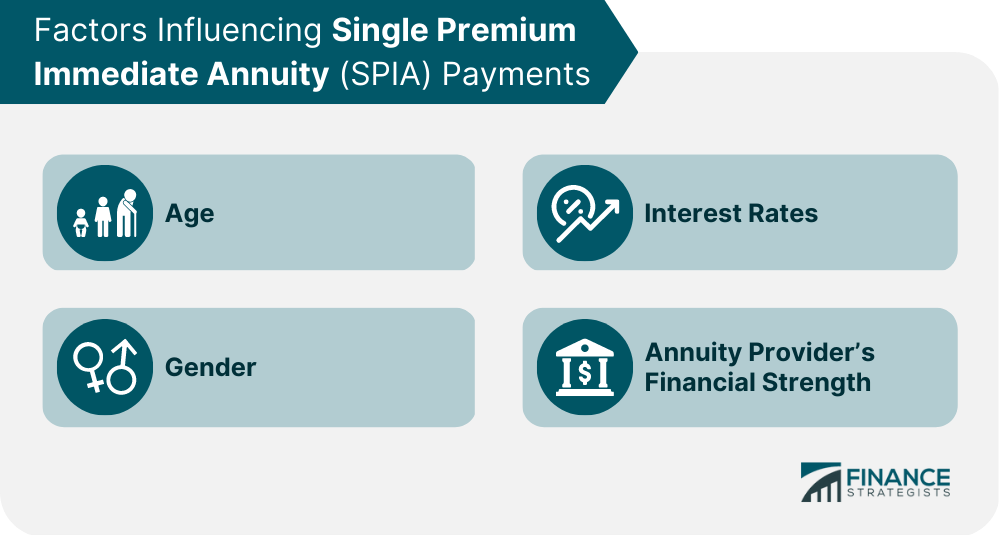

Factors Influencing Single Premium Immediate Annuity (SPIA) Payments

Age

Gender

Interest Rates

Annuity Provider's Financial Strength

Choosing the Right Single Premium Immediate Annuity (SPIA)

Evaluating Financial Needs and Goals

Assessing Risk Tolerance and Time Horizon

Comparing Annuity Providers

Seeking Professional Guidance

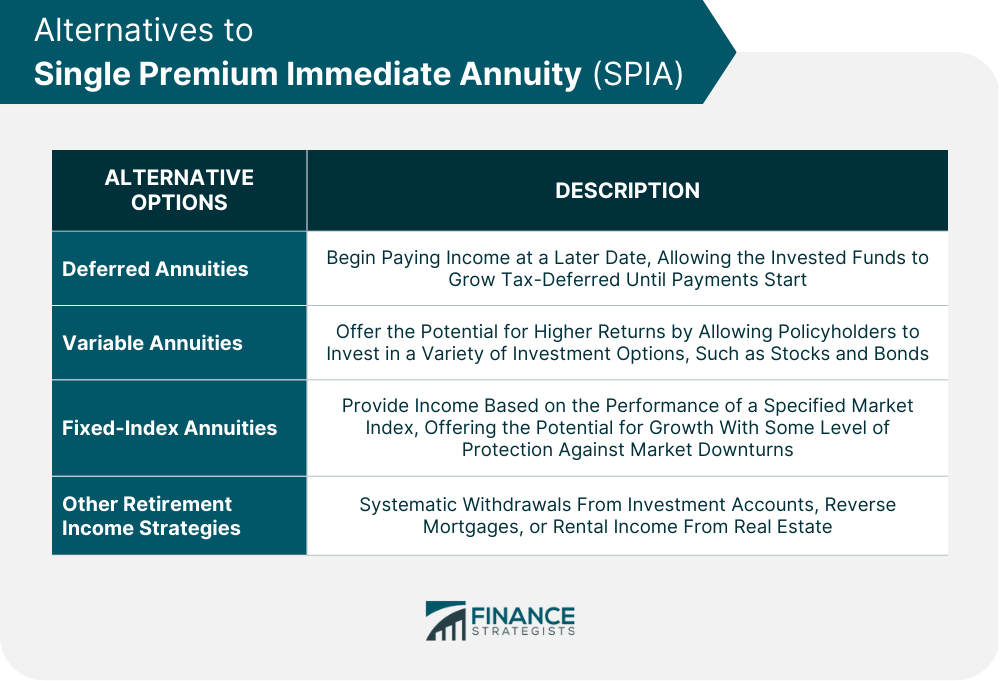

Alternatives to Single Premium Immediate Annuity (SPIA)

Deferred Annuities

Variable Annuities

Fixed-Index Annuities

Other Retirement Income Strategies

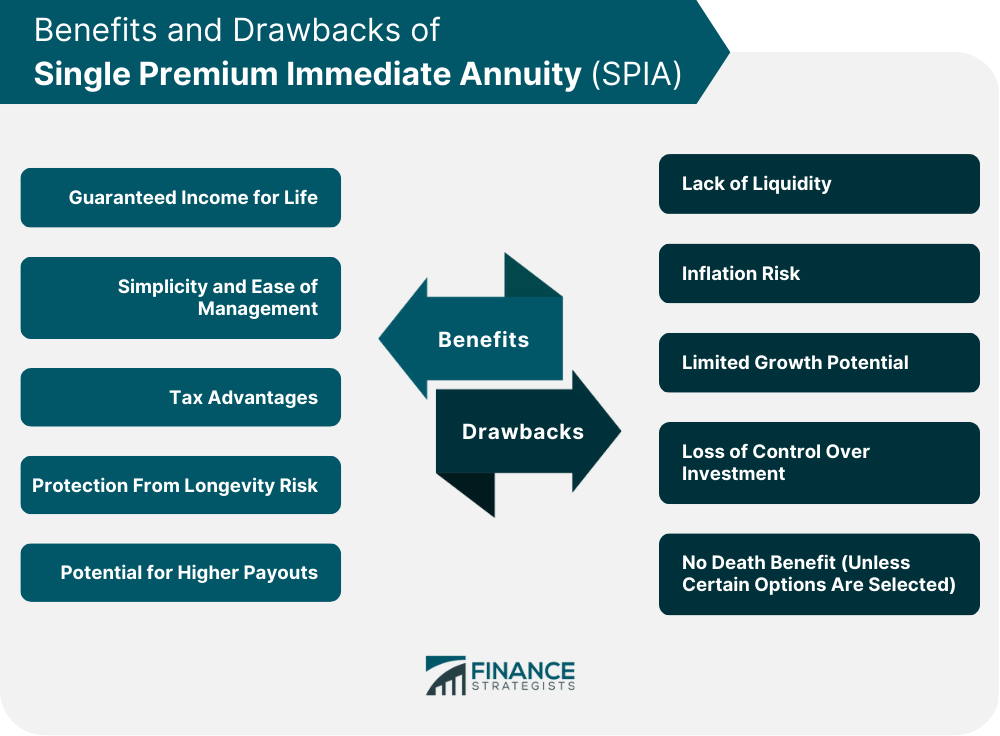

Benefits of Single Premium Immediate Annuity (SPIA)

Guaranteed Income for Life

Simplicity and Ease of Management

Tax Advantages

Protection From Longevity Risk

Potential for Higher Payouts

Drawbacks of Single Premium Immediate Annuity (SPIA)

Lack of Liquidity

Inflation Risk

Limited Growth Potential

Loss of Control Over Investment

No Death Benefit (Unless Certain Options Are Selected)

Bottom Line

Single Premium Immediate Annuity (SPIA) FAQs

A single premium immediate annuity is a type of annuity in which an individual makes a lump-sum payment to an insurance company in exchange for a guaranteed stream of income payments starting immediately or within a year.

Individuals who want a guaranteed source of income during their retirement years can benefit from purchasing a single premium immediate annuity. It is also suitable for those who have received a lump sum of money and wish to generate a regular stream of income from it.

Unlike other types of annuities, a single premium immediate annuity starts paying out immediately or within a year of purchase. It also offers a guaranteed source of income for life, regardless of market fluctuations.

Before purchasing a single premium immediate annuity, individuals should consider their retirement income needs, their financial goals, the payout rate offered by the insurance company, and the fees and charges associated with the annuity.

The benefits of purchasing a single premium immediate annuity include a guaranteed stream of income payments for life, regardless of market fluctuations, protection against outliving your savings, and potential tax advantages. It also removes the risk of investment management and provides peace of mind knowing that a steady income stream is guaranteed for life.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.