A variable annuity death benefit is a provision within certain variable annuity contracts, ensuring that beneficiaries receive at least a minimum payout upon the annuity holder's death. This feature is a safeguard, guaranteeing a set payout despite any potential market downturns that may negatively affect the annuity's value. Essentially, this death benefit promises that the beneficiaries will still receive a predetermined amount, providing financial security in an otherwise unpredictable investment climate. It offers peace of mind and stability for loved ones, ensuring their financial well-being remains intact when it matters most. A variable annuity is a contract between you and an insurance company under which you make a lump-sum payment or series of payments. In return, the insurer agrees to make periodic payments to you immediately or later. You can choose to invest your payments in various investment options, typically mutual funds. Variable annuities differ from their fixed counterparts in the potential for growth and risk. Your investment in a variable annuity grows tax-deferred as long as the funds remain in the account. However, the return on investment depends on the performance of the investment options chosen. The death benefit is the amount payable upon the annuity owner's death. The size of the death benefit typically depends on the highest value of the account or the amount invested, whichever is higher, at the time of death. The death benefit guarantees to protect your investment for your beneficiaries. It ensures that even if the market performs poorly and the value of your investment drops, your beneficiaries will receive at least a minimum amount. Standard death benefits typically guarantee the return on your investment or the account's highest value. Enhanced death benefits, which come at an additional cost, may offer more attractive features like a stepped-up death benefit. The Return of Premium (ROP) death benefit is a basic form of death benefit commonly included in variable annuity contracts. Under this arrangement, the insurance company guarantees that, upon the annuity owner's death, beneficiaries will receive at least the amount of the initial investment made into the annuity, irrespective of how the underlying investments perform. If the market performs poorly and the value of the annuity falls below the initial investment, the beneficiaries will still receive the total amount of the original investment. The Stepped-Up death benefit is a feature that allows for the potential lock-in of investment gains. This feature can increase the value of the death benefit if the value of the annuity contract is higher on a predetermined date, often the contract's anniversary. The "step-up" refers to the ability to lock in the annuity's value at this higher amount. Consequently, even if the annuity's value subsequently decreases due to poor market performance, the death benefit would still be based on the stepped-up (higher) value. The Earnings Enhanced death benefit provides beneficiaries with a payout that includes the initial investment and a certain percentage of the investment gains. This percentage is typically specified in the annuity contract. This feature can be attractive if the annuity has performed well, resulting in substantial investment gains. However, it's important to note that this enhanced death benefit often comes at an additional cost and may have specific requirements or restrictions. A lump-sum payment is one of the ways a variable annuity death benefit can be paid out. Under this method, the entire death benefit is paid out in a single payment to the beneficiary upon the annuity owner's death. This option provides the beneficiary with immediate access to the full death benefit, which they can then use according to their needs or investment preferences. With the annuity payout option, instead of a lump-sum payment, the death benefit is distributed over a specified period, providing a stream of income to the beneficiary. The exact terms, such as the length of the payout period or the size of each payment, can typically be customized based on the beneficiary's needs or wishes. In some cases, payments can be set up to last for the remainder of the beneficiary's lifetime, providing a guaranteed source of income. Spousal continuation is a unique payout option that may be available if the beneficiary of the variable annuity is the deceased owner's spouse. In this case, the spouse may have the option to continue the annuity contract, essentially stepping into the shoes of the deceased owner. The contract continues at the higher of the current value of the annuity or the guaranteed death benefit amount. This allows the spouse to potentially benefit from future growth in the value of the annuity's investments while still having the death benefit amount as a guaranteed floor. The taxation of variable annuity death benefits is crucial for beneficiaries to understand. Generally, the portion of the death benefit that represents the earnings or gains in the annuity contract is subject to income tax when received by the beneficiary. However, the death benefit portion equal to the original investment (the cost basis) is not taxed, as those funds were typically invested with after-tax dollars. When it comes to inherited assets, the concept of a "step-up in basis" is often relevant. However, it's important to note that variable annuities do not receive a step-up on a basis upon death. This means that the beneficiary's cost basis in an inherited variable annuity is the value of the annuity on the date of the owner's death. Any growth in the annuity's value beyond that amount, when withdrawn, is subject to income tax at the beneficiary's regular income tax rate. In certain situations, variable annuity death benefits may be excluded from immediate taxation. For example, if the spouse of the annuity owner is the designated beneficiary, they may have the option to continue the contract as the new owner. If the spouse elects this spousal continuation, the death benefit isn't immediately paid out, so it's not subject to tax at that time. Instead, the tax-deferred status of the annuity continues until the spouse withdraws from the contract. This part is a comparative analysis of the variable annuity death benefit and how it stands against the death benefits provided by other types of annuities, including fixed, immediate, and indexed annuities. Fixed annuities are a type of annuity that offers a guaranteed rate of return over a specified period. This predictability extends to the death benefits they offer as well. Upon the annuity owner's death, the death benefit typically exceeds the account value or the amount invested. Hence, beneficiaries can rely on a known minimum amount they will receive, providing a certain level of financial security. As the name suggests, immediate annuities start making payouts soon after the initial investment is made, typically within one year. These annuities can be structured in various ways, some providing income for a specific period (period certain) and some for the annuitant's life. If the annuity owner dies before all the scheduled payments are made, the remaining payments become the death benefit. It's important to note that if the annuity is life-only and the owner dies, there may be no death benefit. Indexed annuities offer a return tied to a specific market index, such as the S&P 500. This allows for potential gains during market upswings while providing a floor or a minimum return to protect against market losses. In terms of death benefits, they can vary based on the contract terms. Typically, it could be the greater of the account value, the minimum guaranteed contract value, or the total premium paid. Variable annuities stand apart due to their direct link to the performance of underlying investments. They offer the potential for higher returns and, thus, potentially higher death benefits, but they also come with increased risk. If the investments perform well, the death benefit can be significant. However, if the investments perform poorly, the death benefit may be less, though some contracts offer a guaranteed minimum death benefit. One of the primary steps when considering an investment in a variable annuity, or any financial product for that matter, is to evaluate your financial goals. A clear understanding of your goal will guide your decision-making process. For example, an annuity can be an appropriate tool if your goal is to secure a steady income stream during retirement. If leaving a financial legacy to your beneficiaries is a key goal, a variable annuity with a robust death benefit could be a powerful mechanism to ensure your loved ones are financially secure after your death. Thus, aligning your investment choices with your financial goals is crucial to successful financial planning. Variable annuities expose investors to market risks, as their value fluctuates with the performance of the underlying investments. Therefore, before investing in variable annuities, it is essential to assess your risk tolerance. A variable annuity may be suitable if you can afford to take on more risk to achieve higher returns. If the thought of your investment value going down causes you stress, a fixed or indexed annuity might be more appropriate. In either case, understanding your risk tolerance can help you choose an investment product that matches your comfort level. Age and health status are two other critical factors to consider when choosing a variable annuity with a death benefit. Generally, the cost of a death benefit may increase as you age, as the risk to the insurance company grows. Your health status can also impact the cost and usefulness of an annuity. For example, if you're in poor health, you may receive a higher annuity payout, but the utility of a long-term death benefit may be less beneficial. If you're in excellent health and have longevity in your family, a variable annuity with a death benefit could provide a significant legacy for your heirs. Variable annuities, with their death benefit provision, can serve as a valuable component of a well-rounded estate plan. The death benefit can provide a guaranteed minimum amount to be passed to your heirs, irrespective of market performance. This certainty can be a significant advantage in estate planning, providing you with peace of mind about the financial security of your loved ones. Additionally, if your variable annuity investments perform well, your beneficiaries could receive an even larger payout. Variable annuities can be used alongside other estate planning tools to create a comprehensive and effective estate plan. They can complement tools such as life insurance, wills, and trusts. For example, while life insurance can provide a tax-free lump sum upon your death, a variable annuity can offer a continuing income stream to your beneficiaries, possibly even increasing if the investments perform well. On the other hand, while wills and trusts provide mechanisms to distribute assets according to your wishes, the death benefit from a variable annuity provides an added layer of financial provision that is independent of probate processes. While variable annuities offer potential growth and a guaranteed death benefit, they are not without drawbacks. One of the main challenges is the fees associated with variable annuities. These may include surrender charges, administrative fees, mortality, and expense risk charges, and fees for optional features. Additionally, the death benefits from a variable annuity are subject to income tax, unlike life insurance payouts, which are typically tax-free. The value of a variable annuity can fluctuate based on market performance, which adds a degree of risk. If the market performs poorly, your investment value can decrease, though the death benefit provides some protection against this risk. In the United States, the regulation of variable annuities falls under the purview of several regulatory bodies. At the state level, insurance commissioners oversee the insurance aspects of variable annuities. They ensure that insurance companies follow the laws and regulations designed to protect consumers. At the federal level, since variable annuities involve investment risks, the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) are also involved. These bodies work to ensure transparency, fairness, and integrity in the securities industry, including the sale of variable annuities. As a consumer, you have certain rights and protections regarding variable annuities. First and foremost, you have the right to clearly and accurately disclose all information about the annuity. This includes details about all fees and expenses, the risks involved, and the key features of the annuity, including the death benefit. Additionally, you're protected under state and federal laws from fraudulent or deceptive practices in the sale and management of variable annuities. Insurance companies are required to explain the terms and conditions of the annuity contract clearly, and they must answer any questions you may have. If an insurance company fails to comply with these requirements, it can face penalties from regulatory bodies. If you have a dispute concerning your variable annuity or feel your rights as a policyholder have been violated, several redress mechanisms are available. You can file a complaint with your state's insurance department if your issue is with the insurance aspects of the variable annuity. For issues related to the investment aspects of the variable annuity, you may turn to FINRA's arbitration program. Arbitration is a dispute resolution process that is quicker and typically less expensive than going to court. In some cases, you might also have the option of seeking redress through the courts. Consulting with an attorney specializing in securities or insurance law can be a good starting point if you feel you've been a victim of fraud or deceptive practices. A variable annuity with a death benefit offers growth potential, tax-deferred earnings, and a guaranteed minimum payment to beneficiaries upon death. It provides additional financial security and complements estate planning. However, variable annuities carry risks due to market volatility. While the death benefit protects against market downturns, the investment value can fluctuate, and there are associated costs and potential tax implications. Before deciding, assess financial goals, risk tolerance, age, health, and personal circumstances. Consulting a financial advisor or insurance professional can help navigate the annuity landscape. Evaluate the benefits, trade-offs, and alignment with your financial strategy. Remember, variable annuities can be customized to suit your needs. With the right advice and planning, you can leverage these tools to create a robust financial plan that serves your best interests now and in the future.What Is a Variable Annuity Death Benefit?

How Variable Annuities Work

Understanding the Variable Annuity Death Benefit

Definition of Death Benefit

Role of Death Benefits in a Variable Annuity

Standard vs Enhanced Death Benefits

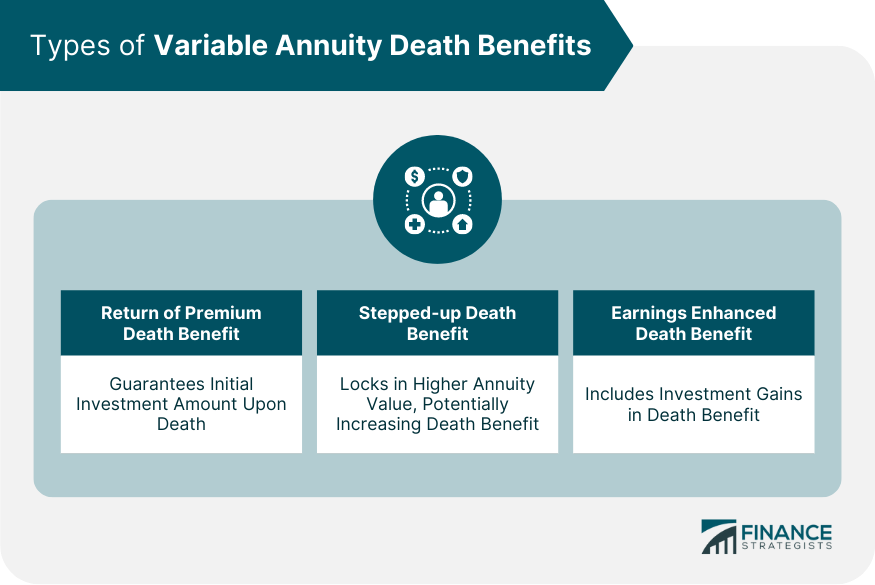

Types of Variable Annuity Death Benefits

Return of Premium Death Benefit

Stepped-up Death Benefit

Earnings Enhanced Death Benefit

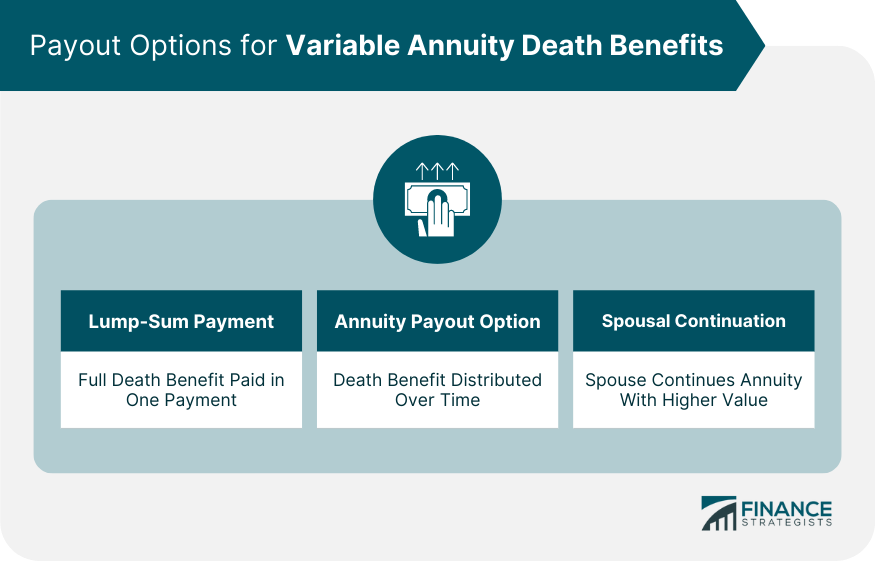

How Variable Annuity Death Benefits Are Paid Out

Lump-Sum Payment

Annuity Payout Option

Spousal Continuation

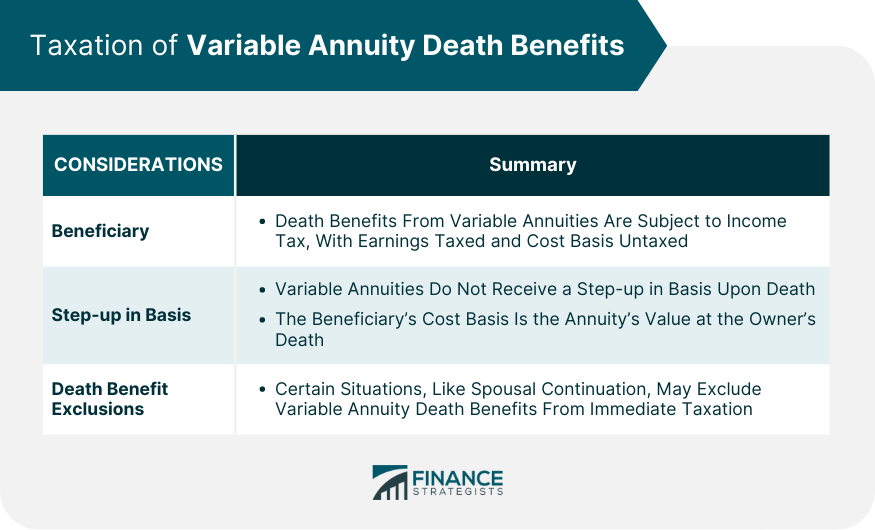

Taxation of Variable Annuity Death Benefits

Beneficiary

Step-up in Basis

Death Benefit Exclusions and Exceptions

Comparing Variable Annuity Death Benefits to Other Annuities

Fixed Annuity Death Benefits

Immediate Annuity Death Benefits

Indexed Annuity Death Benefits

Variable Annuity Death Benefits

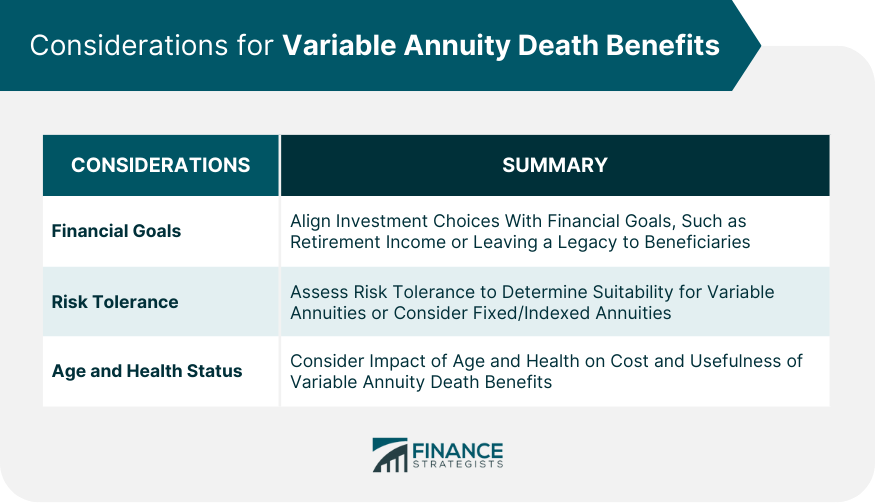

Considerations When Choosing Variable Annuity Death Benefits

Financial Goals

Risk Tolerance

Age and Health Status

Role of Variable Annuity Death Benefits in Estate Planning

Incorporating Annuities in Estate Planning

Interaction With Other Estate Planning Tools

Potential Pitfalls and Benefits

Regulation and Consumer Protection for Variable Annuity Death Benefits

Regulatory Bodies Overseeing Annuities

Consumer Rights and Protections

Redress Mechanisms for Policyholders

Conclusion

Variable Annuity Death Benefit FAQs

A variable annuity death benefit is a provision in certain annuity contracts that guarantees a minimum payout to beneficiaries upon the annuity holder's death.

If the annuity holder passes away, the death benefit ensures that beneficiaries receive at least a predetermined amount, regardless of market fluctuations that may have affected the annuity's value.

The purpose of the death benefit is to provide financial security to loved ones by guaranteeing a minimum payout, even in the event of market downturns.

Yes, including a death benefit in a variable annuity contract is optional and can be chosen based on the individual's preferences and financial goals.

Yes, variable annuities generally come with associated costs, such as fees. It is important to review and understand the specific terms and conditions of the contract to determine any potential costs related to the death benefit.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.