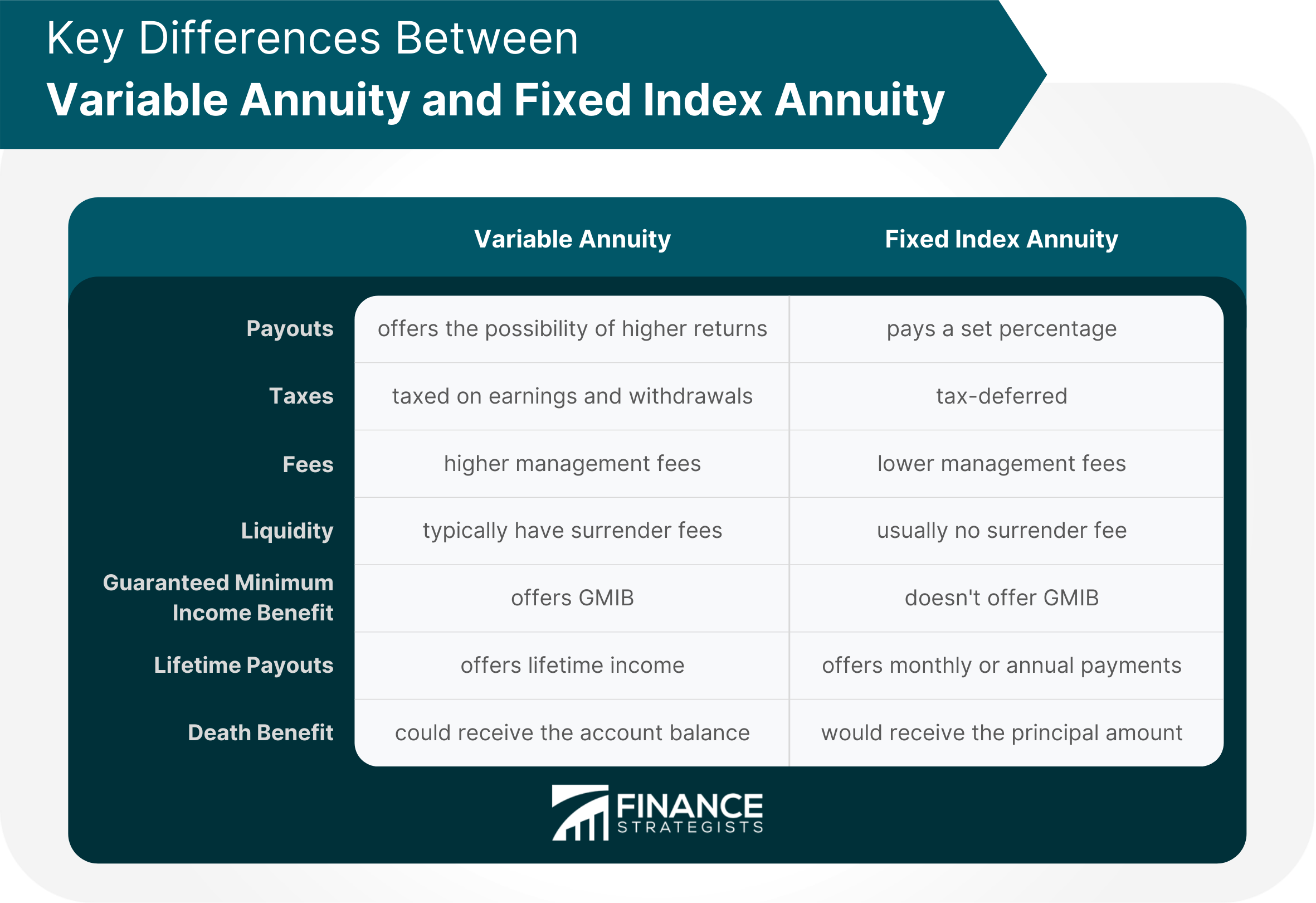

A variable annuity is an investment product that pays out a stream of payments to the investor, based on the performance of underlying investments. A fixed index annuity is very similar, but instead of investing in stocks or other assets, the FIA invests in a basket of indices that track a specific market segment. A variable annuity is an investment vehicle designed to provide retirement income for its investors who are ready to retire and looking for income that will provide a steady paycheck. This is also a good investment for those who have more money than they'll need imminently and want to set it aside for the future. It works by pooling the money of many investors and investing it in a variety of securities, such as stocks and bonds. The income generated by these investments is then paid out to the annuity's investors over time. Variable annuity payouts are determined by the performance of their investments. If they do well, investors can receive higher payouts, but if the market takes a downturn, investors will collect less. Generally, people who choose to purchase a variable annuity should be comfortable with taking on some risk, as their payouts will rise and fall with the market. Before you can decide if a variable annuity is right for you, it's important to learn how it works and the different features and fees to consider. You put money into your account either by making a one-time investment or making regular contributions, such as through payroll deductions. This money goes to the insurance company that issued the annuity. The insurance company then invests your money into one or more investment funds, which are run by managers. There are hundreds of annuity sub-funds to choose from, including stock funds, bond funds, balanced funds, and even options that use leverage. You're guaranteed a minimum return for your money based on the rate stated in your annuity contract. This is the "guaranteed minimum income benefit," or GMIB. The insurance company also has the right to keep a percentage of your money – typically around 5% – to cover their expenses. This leaves the rest of your money free to grow, and if it does well, you could see a nice return on your investment. Your money is invested for a set period of time, usually 10 or 20 years, and then it's paid out to you in monthly or annual payments for the rest of your life (or for a set number of years). Fixed index annuities are contracts between an insurance company and an investor that pay monthly or annual payments for the lifetime of the investor. They are similar to variable annuities in that they also provide a minimum guaranteed return, but there are some key differences. For example, you can't lose money with a fixed index annuity because your earnings are tied to an external index. However, you also can't earn more than the index. So, if the market performs well, your earnings will be capped at a certain percentage. Fixed index annuities usually come with lower fees than variable annuities, and they're a good choice for those who are risk-averse. When you buy a fixed index annuity, you're essentially investing in the stock market without all the risk. Your money is pooled with that of other investors and used to purchase securities, such as stocks and bonds. The insurance company then tracks the performance of an external index, and pays you a fixed amount based on how well that index did. For example, if the index gained 6% during one year, you would earn 6% of your annuity's value for that year. So, if you had $250,000 in your account throughout the year, you'd get an extra $15,000. Your return is also tied to how well the index performs. So, if it goes up by 6%, your payout will be 6%. But if the market falls by 6% in that same year, you'd get 6% less. That means there are no surprises when it comes to your earnings. You'll know ahead of time that your fixed index annuity doesn't offer the same upside as a variable annuity, but you're also guaranteed to get at least the minimum benefit. There are many differences between fixed index annuities and variable annuities: A fixed index annuity pays a set percentage, while a variable annuity offers the possibility of higher returns. In most cases, you will pay less in taxes with a fixed index annuity than you would with a variable annuity because the former is tax-deferred and the latter is taxed on earnings and withdrawals. Fixed index annuities tend to have lower management fees than variable annuities. You can usually withdraw a lump sum from a fixed index annuity without being charged a surrender fee. Variable annuities typically have surrender fees of up to 10% if you take out your money within the first seven to 10 years. The GMIB is a guaranteed minimum income benefit offered by most variable annuities, but not all fixed index annuities. Most variable annuities offer lifetime income, while fixed index annuities typically offer monthly or annual payments. With a variable annuity, your beneficiaries could receive the account balance remaining at the time of your death. With a fixed index annuity, they would only receive the principal amount you invested. Variable annuities and fixed index annuities each have their own benefits. Fixed index annuities usually offer lower fees, which is especially important given that there are no guarantees as to how much you'll actually earn over time. Variable annuities, on the other hand, give you more opportunity for growth but also come with the risk of losses. For those who are risk-averse, a fixed index annuity may be a better option. On the other hand, if you're looking for the potential for higher returns, a variable annuity may be a better choice. In the end, it's important to weigh your options and choose the annuity that's best for you. Fixed index annuities and variable annuities each have a number of benefits and drawbacks. A fixed index annuity may be a good fit for those who are risk-averse due to its guaranteed minimum returns, lower fees, and tax benefits. Variable annuities may be better suited to those who are risk-takers because the potential returns are greater and there is no lifetime payout guarantee. However, it should be noted that neither type of annuity offers guarantees as to how much you will earn overtime. With a fixed index annuity, your earnings will be tied to an external index and fluctuate depending on how that index performs. A variable annuity, on the other hand, offers the potential for greater returns but also comes with more risk. When making a decision about which annuity is right for you, it's important to weigh all the pros and cons carefully.What Is a Variable Annuity?

How Does It Work?

What Is a Fixed Index Annuity?

How Does It Work?

Key Differences Between Variable Annuity and Fixed Index Annuity

Payouts

Taxes

Fees

Liquidity

Guaranteed Minimum Income Benefit

Lifetime Payouts

Death Benefit

Which One Is Better?

Final Thoughts

Variable Annuity Vs Fixed Index Annuity FAQs

A variable annuity is a type of retirement savings plan that allows you to invest in securities, such as stocks and bonds. Your earnings are based on the performance of those investments.

A fixed index annuity is a type of retirement savings plan that offers a fixed rate of return based on market conditions.

A variable annuity offers the potential for higher returns, while a fixed index annuity pays a set percentage.

It depends on your needs and preferences. Variable annuities offer more opportunities for growth, but they come with the risk of losses. Fixed index annuities are a safer option, but they don't offer the same potential for gains.

Your age, risk tolerance, and investment goals are all important factors to consider when choosing an annuity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.