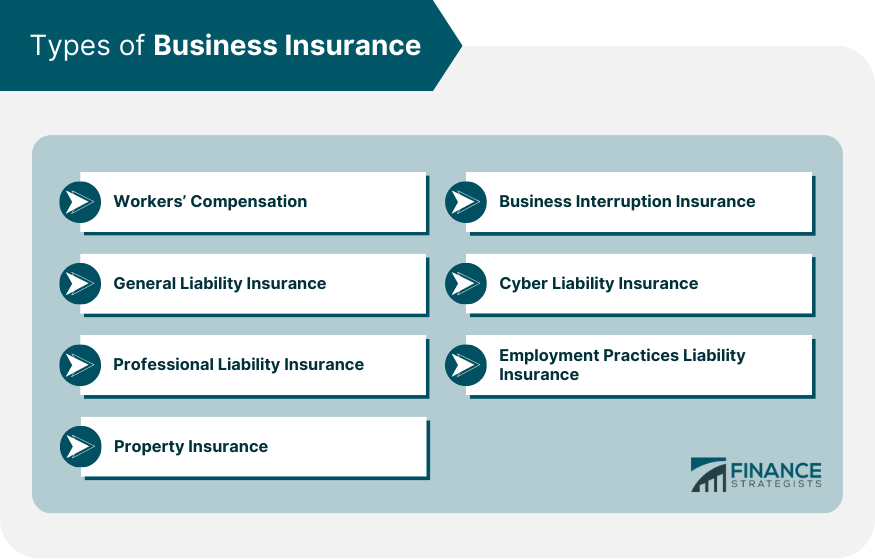

Aggregate stop-loss insurance is a form of insurance coverage that protects businesses or benefit plans from excessive losses due to high claims costs. It serves as a financial safety net by setting a maximum limit on the total claims expenses that a business or plan will bear in a specific policy period, typically one year. In the context of employee benefits, self-insured employers assume the risk of paying for their employees' healthcare expenses directly, rather than purchasing traditional fully-insured health insurance plans. To mitigate the financial risks associated with high claim costs, employers often opt for aggregate stop-loss insurance. With aggregate stop-loss insurance, the insurance provider reimburses the employer for claims costs that exceed a pre-established threshold known as the "attachment point" or "specific deductible." This threshold is set based on the employer's risk tolerance and the desired level of protection. Once the total claims expenses for all covered employees reach or exceed the attachment point, the aggregate stop-loss coverage kicks in, limiting the employer's financial liability. The aggregate stop-loss policy typically sets an additional limit called the "aggregate limit" or "maximum liability." This limit represents the maximum amount that the employer will be responsible for in claims costs within the policy period. If the total claims expenses exceed the aggregate limit, the insurance company assumes liability for the excess amount. Aggregate stop-loss insurance protects employers from the financial impact of catastrophic or unexpectedly high claims, ensuring that they are not solely responsible for covering all claims costs beyond a certain threshold. It provides a level of predictability and stability in managing healthcare expenses, especially for self-insured employers who bear the risk of large claim fluctuations. Before diving into the specifics of Aggregate Stop-Loss Insurance, it is important to understand the broader landscape of business insurance. Various types of coverage address different risks and liabilities that businesses may face, including: Workers' compensation insurance provides coverage for employees who suffer work-related injuries or illnesses, covering medical expenses and a portion of lost wages. General liability insurance protects businesses against claims for bodily injury, property damage, and personal and advertising injury resulting from business operations. Also known as errors and omissions insurance, professional liability insurance covers businesses against claims of negligence or failure to perform professional services. Property insurance safeguards businesses against damage to buildings and personal property due to events like fire, theft, or natural disasters. Business Interruption Insurance covers lost income and operating expenses when a business must temporarily close due to a covered event, such as a fire or natural disaster. Cyber liability insurance protects businesses against financial losses resulting from data breaches, cyberattacks, and other digital threats. Employment practices liability insurance covers businesses against claims arising from employment-related issues, such as discrimination, harassment, and wrongful termination. Stop-loss insurance is a crucial component of business insurance, particularly for companies that self-fund their employee health plans. There are two main types of stop-loss insurance: Specific stop-loss insurance covers individual claims exceeding a predetermined threshold, protecting businesses from high-cost claims made by a single employee. Aggregate stop-loss insurance, the focus of this article, protects businesses when the total amount of claims exceeds a predetermined threshold, known as the aggregate attachment point. Key components of aggregate stop-loss insurance include: The aggregate attachment point is the predetermined threshold at which the insurance coverage begins to pay for claims. The aggregate deductible refers to the amount a business must pay out-of-pocket before the insurance coverage starts to pay for claims. The aggregate limit is the maximum amount the insurance provider will pay for claims during the policy period. Aggregate stop-loss insurance offers several advantages for businesses, including: By covering excess claims, aggregate stop-loss insurance helps businesses maintain financial stability and manage risk more effectively. Aggregate stop-loss insurance allows businesses to better predict their healthcare costs, enabling more accurate budgeting and financial planning. Businesses can tailor their aggregate stop-loss insurance policies to meet their specific needs, including adjusting attachment points, deductibles, and limits. Aggregate stop-loss insurance is particularly beneficial for businesses with self-funded health plans, as it provides a safety net for unexpectedly high claims costs. Insurance brokers play a critical role in helping businesses navigate the complex world of aggregate stop-loss insurance. Their responsibilities include: Brokers work with businesses to evaluate their risks and insurance needs, ensuring they have the appropriate coverage to protect their financial interests. Insurance brokers research and compare various policies and providers to find the best fit for their client's needs and budgets. Brokers use their industry expertise to negotiate favorable terms and conditions on behalf of their clients, ensuring that businesses receive the best possible coverage at the most competitive rates. Insurance brokers provide ongoing support throughout the policy period, assisting with policy renewals, updates, and claims management. When exploring aggregate stop-loss insurance options, businesses and insurance brokers should consider the following factors: It is crucial to determine the right coverage levels for the aggregate attachment point, deductible, and limit to ensure adequate protection and financial stability. Businesses and brokers should be aware of any exclusions or limitations in aggregate stop-loss policies, as these can impact the effectiveness of coverage. The financial strength and stability of an insurance provider are critical, as this can affect the provider's ability to pay claims when needed. Businesses and brokers should stay informed about changes in regulations and industry trends that could impact their aggregate stop-loss insurance coverage and requirements. Aggregate Stop-Loss Insurance is essential coverage for businesses, particularly those with self-funded health plans, as it offers protection from catastrophic financial losses due to high claims costs. By understanding the different types of business insurance and the intricacies of aggregate stop-loss coverage, businesses can better manage risk, maintain financial stability, and predict healthcare costs. Insurance brokers play a pivotal role in helping businesses navigate this complex landscape, ensuring the right coverage levels are in place. Both businesses and brokers must consider factors such as appropriate coverage levels, policy exclusions, and the financial strength of insurance providers. Staying informed about industry trends and regulatory changes will help businesses and brokers make well-informed decisions and successfully navigate the world of business insurance.Definition of Aggregate Stop-Loss Insurance

Types of Business Insurance

Workers' Compensation

General Liability Insurance

Professional Liability Insurance

Property Insurance

Business Interruption Insurance

Cyber Liability Insurance

Employment Practices Liability Insurance

Understanding Stop-Loss Insurance

Specific Stop-Loss Insurance

Aggregate Stop-Loss Insurance

Aggregate Attachment Point

Aggregate Deductible

Aggregate Limit

Benefits of Aggregate Stop-Loss Insurance for Businesses

Risk Management and Financial Stability

Cost Predictability and Budgeting

Customizable Coverage

Support for Self-Funded Health Plans

Role of Insurance Brokers in Aggregate Stop-Loss Insurance

Assessing Business Risks and Needs

Comparing Policies and Providers

Negotiating Favorable Terms

Ongoing Policy Management and Claims Support

Key Considerations for Businesses and Insurance Brokers

Determining Appropriate Coverage Levels

Understanding Policy Exclusions and Limitations

Evaluating the Financial Strength of Insurance Providers

Monitoring Regulatory Changes and Industry Trends

Conclusion

Aggregate Stop-Loss Insurance FAQs

Aggregate Stop-Loss Insurance is a type of coverage that protects businesses, especially those with self-funded health plans, from catastrophic financial losses when the total amount of claims exceeds a predetermined threshold. This insurance helps businesses manage risk, maintain financial stability, and predict healthcare costs more accurately.

While both types of stop-loss insurance protect businesses from high claims costs, Specific Stop-Loss Insurance covers individual claims exceeding a predetermined threshold, while Aggregate Stop-Loss Insurance provides coverage when the total amount of claims exceeds a predetermined threshold, known as the aggregate attachment point.

Insurance brokers play a critical role in helping businesses navigate the complex world of Aggregate Stop-Loss Insurance. They assess business risks and needs, compare policies and providers, negotiate favorable terms, and provide ongoing policy management and claims support.

When exploring Aggregate Stop-Loss Insurance options, businesses and brokers should consider determining appropriate coverage levels, understanding policy exclusions and limitations, evaluating the financial strength of insurance providers, and monitoring regulatory changes and industry trends.

Yes, businesses can tailor their Aggregate Stop-Loss Insurance policies to meet their specific needs, including adjusting attachment points, deductibles, and limits. This allows businesses to achieve the right balance of coverage and cost to protect their financial interests effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.