Unaffiliated investments refer to those assets that are not linked directly to a company's primary business operations or activities. They are considered "unaffiliated" because they are not associated with the core activities of a business entity. This broad term encapsulates an array of investments from stocks, bonds, and mutual funds to cryptocurrencies and real estate. Unaffiliated investments play a critical role in maintaining a diversified investment portfolio. They allow investors to spread their risk across different asset classes, industries, and geographical locations. When the primary affiliated investments suffer due to market volatility or industry-specific factors, unaffiliated investments can provide a buffer, reducing the potential loss. The types of unaffiliated investments are as varied as the investors themselves. These can include common stocks and bonds, mutual funds, real estate, tangible assets like precious metals, and even digital assets such as cryptocurrencies. At its core, unaffiliated investments comprise different types of assets not linked with a company's primary operations. These investments add diversity to a portfolio, helping spread out risk and potential return. They also bring liquidity to an investment portfolio, as they can be sold easily if cash is required. There are several essential terms in the world of unaffiliated investments. Market Capitalization: Refers to a company's total value in the stock market Yield: Pertains to the income return on an investment Liquidity: Is the ability to quickly convert an asset into cash Volatility: Refers to the degree of variation in an investment's trading price Diversification is a key investment strategy that involves spreading investments across various assets to reduce exposure to any single asset or risk. Unaffiliated investments play a pivotal role in this strategy by offering investors exposure to various industries and sectors, thereby spreading risk and potential returns. ROI is a common metric used by investors to gauge the efficiency of an investment. By comparing the profit or loss made from an investment with the cost of the investment, ROI can give a clear picture of the financial performance. In addition to ROI, other financial indicators like net profit margin and capital gains can be used. The net profit margin indicates the profitability of the investment, while capital gains reflect the rise in the investment's value. These measures provide additional layers of analysis for making informed investment decisions. Stocks and bonds are common forms of unaffiliated investments. Stocks offer an ownership stake in a corporation, while bonds are essentially loans made to a corporate or governmental entity. These investments provide a way to invest in different sectors and industries outside an investor's core business. Mutual funds pool money from various investors to create a large, diversified portfolio of stocks, bonds, or other securities. As unaffiliated investments, they offer diversification and professional management. They also enable small investors to gain access to professionally managed, diversified portfolios that would be difficult to create with a small amount of capital. Real estate can be a lucrative unaffiliated investment, providing potential returns through rental income and property appreciation. Other tangible assets, like precious metals and art, can also be good unaffiliated investments, offering a hedge against inflation and a safe haven during economic turmoil. Cryptocurrencies, such as Bitcoin and Ethereum, are digital or virtual currencies that use cryptography for security. Although they're high-risk investments due to their extreme volatility, they have also shown high returns, making them an interesting option for unaffiliated investments. However, due to their complex nature, they require a solid understanding and a high-risk tolerance. Unaffiliated investments can significantly diversify a retirement portfolio, which is crucial for mitigating risk. By spreading investments across different types of assets – from stocks and bonds to real estate and cryptocurrencies – you can create a buffer against volatility in any single asset class. Moreover, these investments often present opportunities for enhanced returns, potentially accelerating the growth of your retirement savings. Certain unaffiliated investments can offer a regular and reliable source of income. For example, bonds generally pay interest at regular intervals, and rental income from real estate investments can provide a steady cash flow. These income streams can be particularly beneficial during retirement when regular salary payments are no longer coming in. Some unaffiliated investments can be significantly more volatile than traditional retirement assets. Investments like stocks and cryptocurrencies, in particular, can experience rapid value fluctuations, which can pose a risk to retirement savings. Additionally, investors often have less control over unaffiliated investments, especially in the case of managed funds or Real Estate Investment Trusts (REITs). Unaffiliated investments can come with complex tax implications. Understanding and managing these can be challenging and may require the assistance of a professional tax advisor. This added complexity can be a drawback for those seeking simplicity in their retirement planning. Certain unaffiliated investments, such as real estate, are considered illiquid because they can't be quickly and easily converted into cash without a significant loss in value. This illiquidity can pose a problem for retirees who may need quick access to their funds. Before incorporating unaffiliated investments into your retirement plan, it's essential to understand your risk tolerance, investment time horizon, and financial goals. These factors will significantly influence the types of unaffiliated investments that will be most suitable for you. A balanced portfolio might include a mix of low-risk bonds for stability, high-return stocks for growth potential, and real estate for consistent income. Additionally, alternative investments like cryptocurrencies, while riskier, can offer high return potential. Given the complexity of unaffiliated investments, it might be beneficial to seek the advice of a financial advisor. These professionals can provide valuable insights and help create a strategy that aligns with your individual circumstances and retirement goals. Unaffiliated investments are governed by a range of laws and regulations. These aim to ensure transparency, protect investors, and maintain the integrity of the financial markets. Regulations may vary by investment type and jurisdiction, so it's crucial to understand the legal landscape before investing. Several regulatory bodies oversee unaffiliated investments. In the U.S., the Securities and Exchange Commission (SEC) supervises stocks, bonds, and mutual funds, while the Commodity Futures Trading Commission (CFTC) regulates commodities and futures. Real estate falls under state laws and local ordinances, and cryptocurrencies, while still a gray area, is increasingly under the scrutiny of various regulators. Investors must adhere to certain compliance requirements, from proper documentation and reporting of earnings for tax purposes to understanding and following the rules of securities trading. Non-compliance can result in penalties and even legal action, so investors should seek professional advice to ensure they meet all necessary requirements. Economic cycles can significantly affect unaffiliated investments. In a boom period, stocks, real estate, and other assets might appreciate in value. In a recession, however, they could lose value. Bonds, on the other hand, can often provide a safe haven during economic downturns. Inflation and deflation also impact unaffiliated investments. Inflation can erode the purchasing power of money, negatively affecting fixed-income investments like bonds. Conversely, deflation can hurt assets like stocks and real estate but may increase the value of money, benefitting savers and bondholders. Global economic events, such as geopolitical instability, pandemics, or changes in trade policies, can influence unaffiliated investments. For instance, an international crisis could lead to a stock market downturn, while a positive development in trade relations could boost certain sectors. Therefore, understanding the global economic landscape is crucial for managing unaffiliated investments. In the increasingly interconnected and dynamic financial world, unaffiliated investments play a critical role. They offer potential rewards and the ability to diversify, bolstering investment portfolios against market volatility. For investors, understanding and navigating the world of unaffiliated investments can open up new avenues for growth and financial security. Before diving into unaffiliated investments, several factors need to be considered. Investors should assess their financial goals and risk tolerance, understand the nature and risks of the investment, review the relevant regulations, and stay informed about economic factors that could influence the investment's performance. It is essential to remember that while unaffiliated investments can diversify a portfolio and potentially offer high returns, they also come with their own set of risks.What Are Unaffiliated Investments?

Understanding the Basic Concepts of Unaffiliated Investments

Core Elements of Unaffiliated Investments

Key Terms and Concepts Related to Unaffiliated Investments

Role of Unaffiliated Investments in a Diversified Portfolio

Measuring the Potential Returns From Unaffiliated Investments

Using Return on Investment (ROI)

Net Profit Margin and Capital Gains

Examining Different Types of Unaffiliated Investments

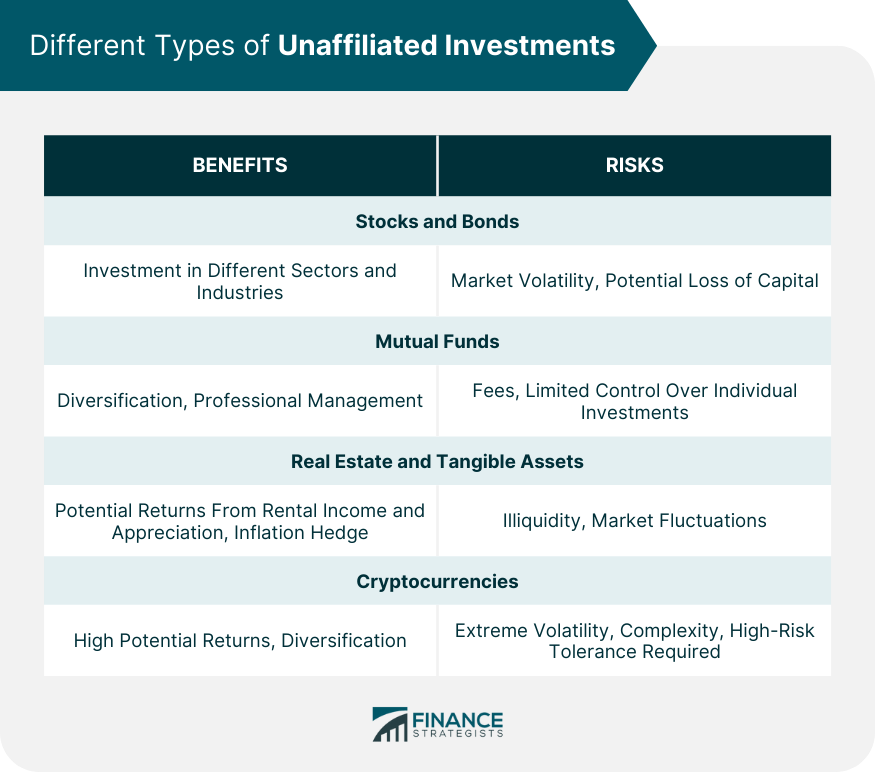

Stocks and Bonds

Mutual Funds

Real Estate and Other Tangible Assets

Cryptocurrencies

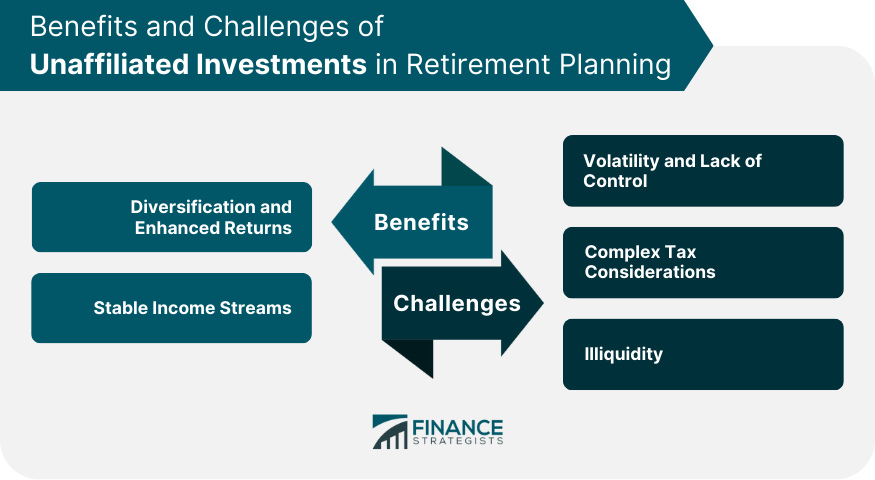

Benefits of Unaffiliated Investments in Retirement Planning

Diversification and Enhanced Returns

Stable Income Streams

Challenges of Unaffiliated Investments in Retirement Planning

Volatility and Lack of Control

Complex Tax Considerations

Illiquidity

Strategies for Incorporating Unaffiliated Investments in Retirement Planning

Understanding Your Investment Profile

Creating a Balanced Portfolio

Seeking Professional Advice

Regulatory Considerations for Unaffiliated Investments

Current Laws and Regulations

Regulatory Agencies

Compliance Requirements

Impact of Economic Factors on Unaffiliated Investments

How Economic Cycles Impact Unaffiliated Investments

Effect of Inflation and Deflation on Unaffiliated Investments

Impact of Global Economic Events on Unaffiliated Investments

Final Thoughts

Unaffiliated Investments FAQs

Unaffiliated investments are those investments that are not directly linked to a company's primary business activities. They include stocks, bonds, mutual funds, real estate, tangible assets, and cryptocurrencies.

Unaffiliated investments are vital for diversifying an investment portfolio, reducing risk, and potentially enhancing returns. They can provide a buffer against market volatility and industry-specific downturns.

Unaffiliated investments come with risks, including market volatility, regulatory changes, and economic downturns. It's crucial to understand these risks before making unaffiliated investments.

Economic factors such as inflation, deflation, and economic cycles can significantly influence the value of unaffiliated investments. Global economic events can also affect these investments.

Incorporating unaffiliated investments into a retirement plan requires understanding one's risk tolerance, time horizon, and financial goals. A balanced mix of stocks, bonds, real estate, and alternative investments can help create a diversified retirement portfolio.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.