Wrap-Up insurance is a broad and comprehensive insurance policy that consolidates all the needed insurance coverage for a large-scale construction project into a single policy. This policy typically covers all or most of the entities involved in a project, including the project owner, general contractor, subcontractors, and in some cases, even architects and engineers. It is often utilized for large-scale construction projects with high anticipated insurance costs. In the financial industry, wrap-up insurance is significant due to its potential for cost savings and increased efficiency in risk management. With multiple parties involved in large projects, procuring individual insurance policies for each contractor and subcontractor can lead to duplicated coverage, high costs, and potential coverage gaps. Wrap-up insurance eliminates these problems by centralizing the insurance procurement process, and creating a uniform coverage approach that simplifies administration, reduces costs, and ensures all project parties are adequately covered. Wrap-Up Insurance comes in two primary forms: Owner Controlled Insurance Program (OCIP) and Contractor Controlled Insurance Program (CCIP). An OCIP is a wrap-up insurance program where the project owner controls the insurance policy. The owner typically procures this type of policy for all enrolled construction participants. In essence, the owner becomes the primary policyholder and manages all aspects of the insurance program. Unlike an OCIP, a CCIP is controlled by the general contractor. The general contractor procures the policy and extends coverage to all enrolled contractors and subcontractors. While a CCIP provides similar benefits to an OCIP, it has a distinct advantage in that contractors often have more experience and expertise in managing construction risks and insurance matters than project owners. While both OCIPs and CCIPs offer the benefits of wrap-up insurance, they differ in who controls the program and the relative level of control each participant has. The choice between an OCIP and CCIP depends on the specific needs and capabilities of the project owner and general contractor. Some factors to consider include the owner's familiarity with risk management, the contractor's ability to manage an insurance program, and the degree of control each party desires over the insurance process. Wrap-up insurance policies are complex instruments with multiple components. Here are some key aspects: Wrap-up insurance provides broad coverage that typically includes general liability, workers' compensation, excess liability, and builder's risk insurance. The specific coverage varies depending on the project's needs and risks, but the goal is to ensure all major project risks are insured. Policy limits denote the maximum amount the insurer will pay for covered losses. These limits need to be high enough to protect against the financial consequences of potential risks. Determining appropriate policy limits requires a thorough understanding of the project's risk profile and potential loss scenarios. The deductible is the amount the insured must pay out of pocket before the insurance coverage kicks in. Premiums are the cost of the insurance policy, typically paid on a monthly or annual basis. The level of deductibles and premiums often depends on the project's risk level, the amount of coverage needed, and the insurer's underwriting criteria. Policy exclusions are the specific conditions or events that are not covered by the insurance policy. These are critical to understanding as they identify the gaps in coverage that the insured must manage through other means, such as risk mitigation strategies or additional insurance policies. The wrap-up insurance process is an involved process that requires careful coordination and management. The enrollment process starts with the identification of the contractors and subcontractors who will be involved in the project. The policyholder (either the owner or contractor) must then enroll these parties in the wrap-up insurance program. This involves collecting underwriting information, providing insurance training and information, and confirming enrollment with the insurer. Managing claims under a wrap-up insurance program involves reporting losses to the insurer, coordinating with the insurer's adjusters, and managing the claims settlement process. It requires clear communication and collaboration between the policyholder, insurer, and enrolled parties. Once the construction project is completed, the wrap-up insurance policy must be closed out. This process involves conducting a final review of the policy, resolving outstanding claims, and finalizing insurance payments. Depending on the policy terms, a final audit may be necessary to confirm the accuracy of the policy's premium and deductible calculations. The complexity and distinct characteristics of wrap-up insurance make it a unique tool for managing construction project risks. By consolidizing coverage into a single, comprehensive policy, it offers significant advantages for large projects. However, its successful implementation requires a clear understanding of its key components and careful management of the insurance process. Wrap-up insurance offers several significant benefits, primarily for large-scale construction projects, which can make it an appealing choice despite its complexity. Wrap-up insurance offers a consistent scope of coverage for all participants in a construction project. This uniform coverage eliminates the gaps and overlaps that can occur when multiple parties procure separate insurance policies. By integrating all project-related insurance coverages into a single policy, wrap-up insurance also simplifies the claims process and reduces potential disputes among parties over responsibility for losses. When individual contractors and subcontractors obtain their insurance policies, the costs can quickly add up due to administrative duplication and inefficiencies. By consolidating the insurance into a single wrap-up policy, these inefficiencies can be eliminated, resulting in substantial cost savings. Furthermore, because a wrap-up policy covers a larger scale, it can often secure lower rates than individual policies, leading to additional cost savings. Wrap-up insurance programs usually incorporate a centralized safety and loss control program. This can lead to improved project safety, as the project owner or general contractor can enforce consistent safety standards across the project. Centralized management can also enable more effective responses to accidents and losses, reducing their impact. In a construction project with multiple insurance policies, liability disputes can arise among different insurers and policyholders. These disputes can delay the resolution of claims and increase legal costs. Wrap-up insurance helps prevent such disputes by defining a single point of insurance coverage for all project-related losses. Despite its many benefits, wrap-up insurance also has some limitations that project owners and contractors should consider. While wrap-up insurance can yield cost savings over the project's duration, it can also have high initial costs. These can include the costs of policy procurement, administration, and risk management services. It's essential to weigh these initial costs against the anticipated savings and benefits over the project's life. Managing a wrap-up insurance program can be complex and time-consuming. The program involves coordination among many parties, numerous administrative tasks, and significant risk management responsibilities. These challenges can be particularly daunting for project owners or contractors with limited experience in managing insurance programs. Wrap-up insurance policies typically have high coverage limits to accommodate the large scale of the projects they insure. However, these high limits can sometimes be insufficient for particularly severe losses. Additionally, like all insurance policies, wrap-up policies have exclusions that define what is not covered. These exclusions can create gaps in coverage that need to be filled through other means. Given the complexity of wrap-up insurance, the role of insurance brokers becomes crucial in navigating this type of coverage. Brokers can help project owners and contractors understand the ins and outs of wrap-up insurance. They can assist in evaluating the feasibility of a wrap-up program, estimating potential cost savings, and designing a program that fits the project's needs. Brokers can also help with the procurement process, liaising with insurers to secure favorable policy terms. In the event of a loss, brokers play a key role in managing claims. They can help report the loss to the insurer, coordinate with the insurer's adjusters, and advocate for a fair and prompt claim settlement. Given the significant role of brokers in wrap-up insurance, choosing the right broker is essential. Factors to consider include the broker's experience and expertise in wrap-up insurance, their understanding of the construction industry, their relationships with insurers, and their capacity to provide timely and effective service. A well-chosen broker can be a valuable partner in managing the risks of a large-scale construction project. Wrap-up insurance is a comprehensive policy designed for large-scale construction projects, offering two main types - the Owner Controlled Insurance Program (OCIP) and the Contractor Controlled Insurance Program (CCIP). The distinction between the two lies in who controls the insurance program. Critical elements of this policy encompass coverage, policy limits, deductibles, premiums, and exclusions, all vital for effective management and ensuring sufficient protection. Implementing this insurance involves a complex process requiring careful coordination, including enrolling contractors and subcontractors, managing claims, and handling the project's completion and close-out stages. Despite its benefits like comprehensive coverage, cost savings, improved safety measures, and dispute resolution, wrap-up insurance also presents challenges such as high initial costs, management complexities, and coverage limit issues. An insurance broker can navigate the complexities, manage claims, and offer critical advice on selecting the most suitable wrap-up insurance based on specific needs.What Is Wrap-Up Insurance?

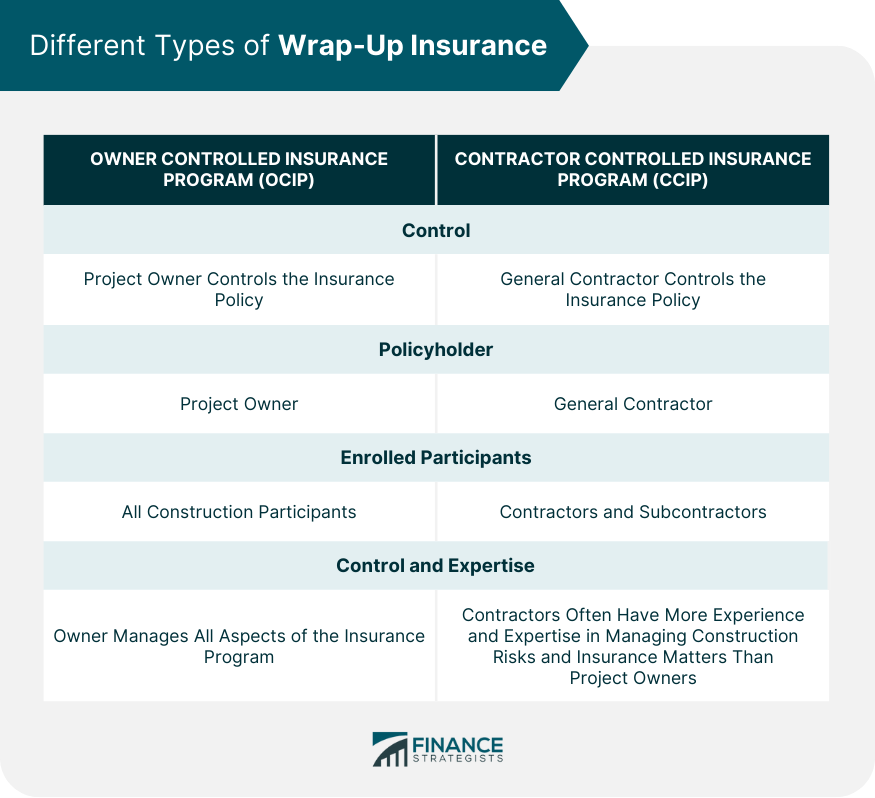

Different Types of Wrap-Up Insurance

Owner Controlled Insurance Program (OCIP)

Contractor Controlled Insurance Program (CCIP)

Comparison Between OCIP and CCIP

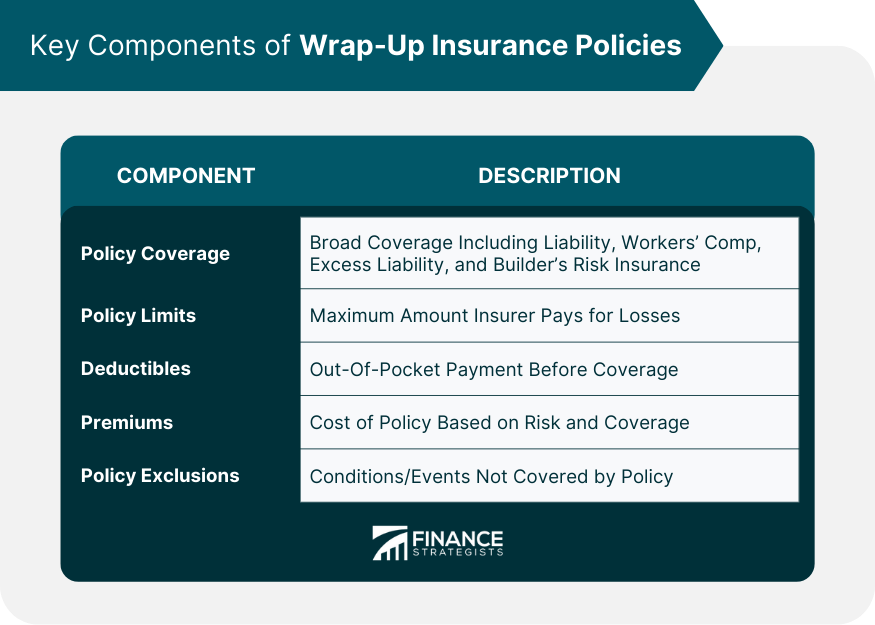

Key Components of Wrap-Up Insurance Policies

Policy Coverage

Policy Limits

Deductibles and Premiums

Policy Exclusions

Understanding the Wrap-Up Insurance Process

Enrollment Process for Contractors and Subcontractors

Claim Management Under Wrap-Up Insurance

Completion and Close-Out Process

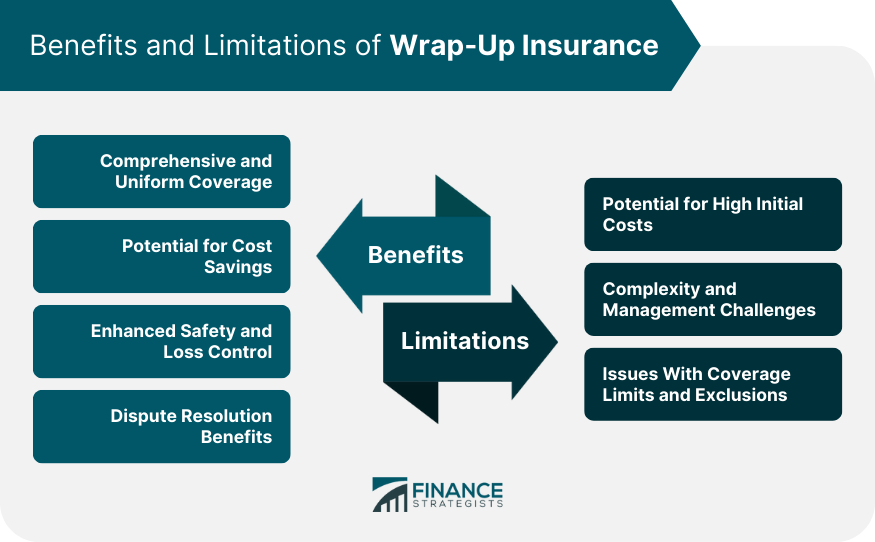

Benefits of Wrap-Up Insurance

Comprehensive and Uniform Coverage

Potential for Cost Savings

Enhanced Safety and Loss Control

Dispute Resolution Benefits

Limitations of Wrap-Up Insurance

Potential for High Initial Costs

Complexity and Management Challenges

Issues With Coverage Limits and Exclusions

Role of Brokers in Wrap-Up Insurance

How Brokers Can Help Navigate Wrap-Up Insurance

Role of Brokers in Managing Claims

Selection of Brokers for Wrap-Up Insurance

Final Thoughts

Wrap-Up Insurance FAQs

Wrap-up insurance is a comprehensive insurance policy that consolidates all necessary coverage for a large construction project into a single policy. It covers all parties involved in the project, such as the owner, general contractor, subcontractors, and sometimes architects and engineers.

The two main types of wrap-up insurance are Owner Controlled Insurance Program (OCIP) and Contractor Controlled Insurance Program (CCIP). The difference between the two lies in who controls and manages the insurance program.

Wrap-up insurance can save costs by eliminating duplications and inefficiencies in coverage that can occur when multiple parties secure their insurance policies. It also allows for lower rates due to the larger scale of the policy.

Managing wrap-up insurance can be complex and time-consuming. It requires careful coordination among all parties, numerous administrative tasks, and significant risk management responsibilities.

An insurance broker can help understand the complexities of wrap-up insurance, assist in evaluating its feasibility, estimate potential cost savings, design a suitable program, liaise with insurers for favorable terms, and help manage claims.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.