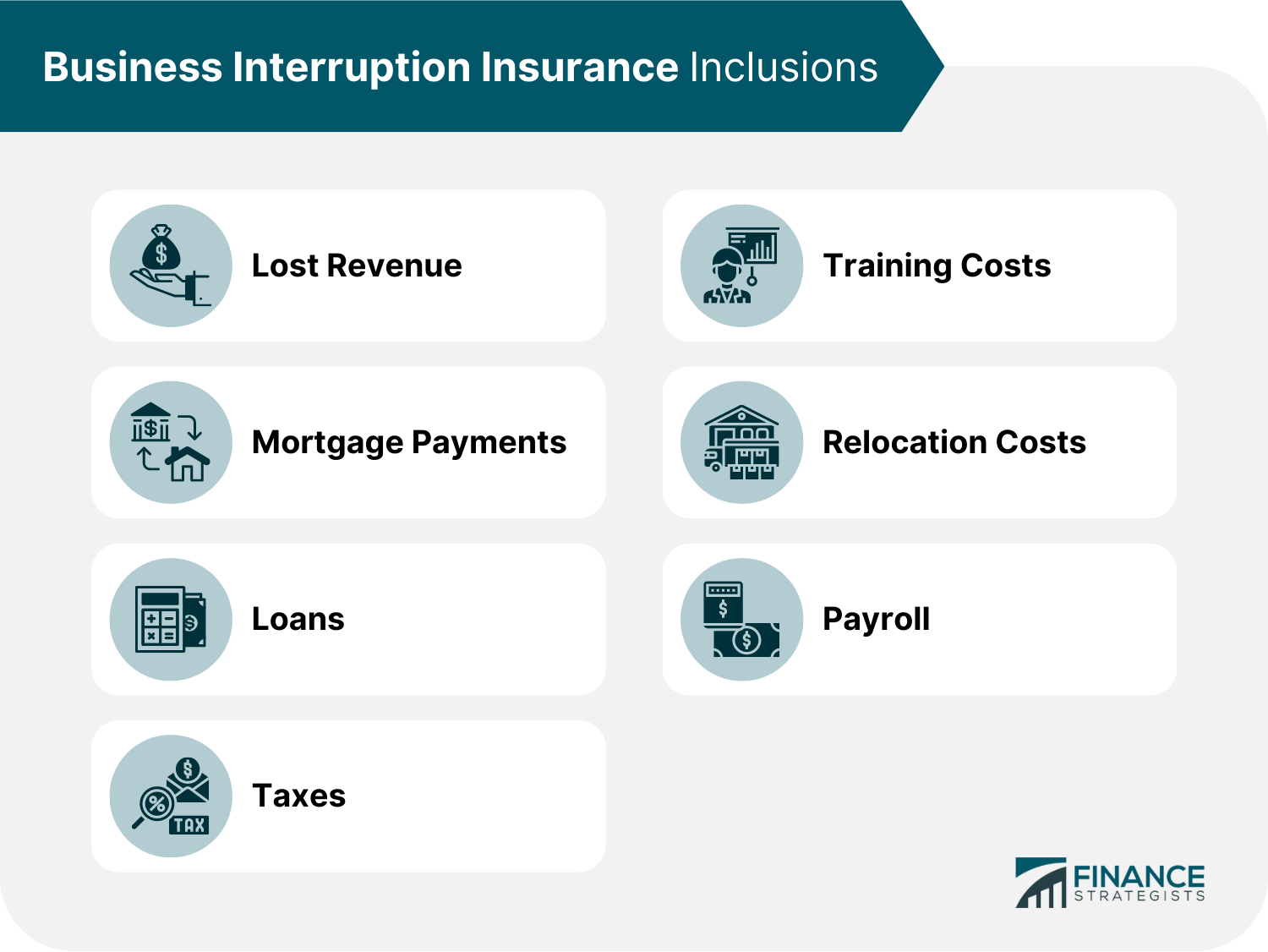

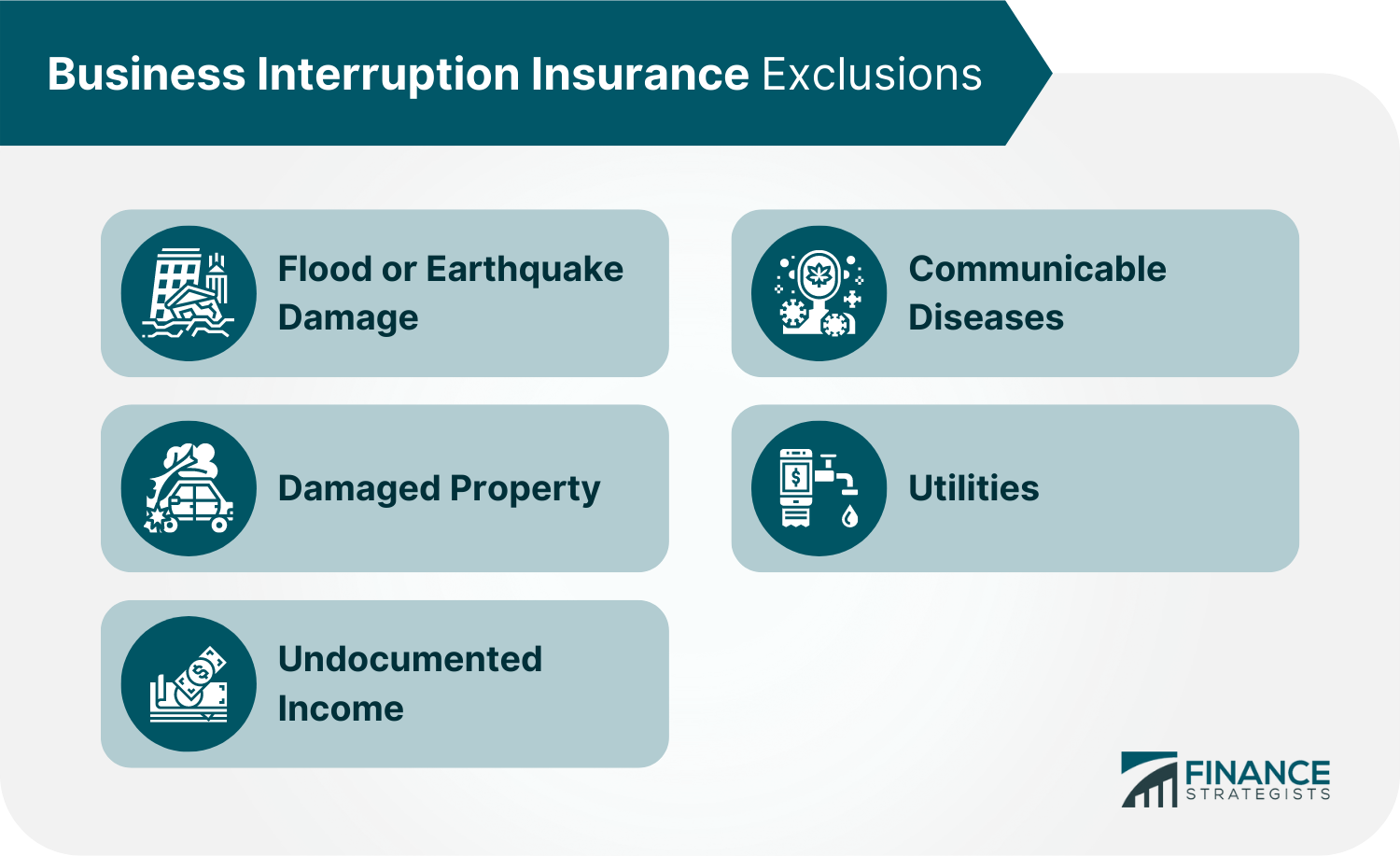

Business Interruption Insurance, also known as Business Income Insurance or Contingent Business Interruption Coverage, is a type of coverage that safeguards businesses from losses incurred when operations stop due to a disaster. It is never sold as a standalone policy, but it can be added to either a commercial property insurance policy or a commercial package policy. It may also be included in a Business Owner's Policy (BOP) bundle, along with general liability insurance and commercial property insurance. If an event that the policy covers, such as theft, fire, or severe weather conditions, forces the business to close temporarily, this income replacement insurance helps replace lost business earnings and other eligible expenses. Business interruption insurance bridges the gap between income and expenses during a business's restoration period, which begins several hours or days after a covered event forces a suspension of operations, and ends when the repairs from said damage are completed. Like any insurance policy, business interruption insurance has rules on what it does and does not cover. Below is a guide on its inclusions and exclusions: If a company is forced to close due to a covered loss, business interruption insurance can help pay some of the operating expenses to keep the business going, such as: Some expenses are not covered by business interruption insurance, and these are the following: The total amount a company’s business interruption insurance will cover during a claim is influenced by two significant factors: the restoration period and the coverage limit. Determining these details is very important because if the business interruption costs exceed the limits of the chosen policy, then the business owner will have to cover those expenses. The restoration period is the duration of time the business interruption coverage will help pay for lost income. It can last for as little as 30 days up to 12 months after the covered event occurred. For an extra fee, it can even be extended up to 24 months. In addition, most policies have a 48 to 72-hour waiting period before the restoration period kicks in. This means that any closures that occur only within the waiting period are not covered by business interruption insurance. Initially, the business owner chooses the amount covered in the business insurance policy. Before signing any contracts, they should consider if the coverage they wish to acquire will cover enough expenses to keep the company running smoothly if a claim needs to be made on the business interruption insurance. An excellent way to start thinking about this coverage amount is by factoring in the gross earnings and using that information to estimate future profits. That way, the business owner will be more likely to choose a policy with the proper coverage. In addition, here are some key points that business owners can consider when determining the coverage they need: The amount that small business owners pay for annual business interruption insurance premiums can range from $500 to $3,000. The exact price is based on multiple factors: Most small business owners should consider investing in business interruption insurance, especially if they rely on physical locations or assets that could be damaged by events such as fire, theft, or severe weather. This may include businesses like retail shops, coffee shops, restaurants, salons, spas, yoga studios, and pet groomers. Having a business interruption insurance policy in place can help businesses like these recover quickly from unforeseen incidents which might disrupt their regular operations. If you need to file a business interruption insurance claim, you may follow these steps: After a covered event, you need to contact your insurance company immediately. Once you complete that initial step, you will be assigned a claims adjuster by your insurance company. This individual will work with you closely throughout the claims process to evaluate what happened and explore ways to help your business generate revenue again as soon as possible. Be sure to know precisely what your business interruption policy covers. This way, you will be less likely to have any surprises. Most policies will outline this information on a "declarations page" that can typically be found near the beginning of the document. You will need to verify your past income and expenditure as part of claiming business interruption compensation. Acceptable documented proof can include the following: You must refrain from discarding financial documents even if they are partially damaged. Keep any documentation of extra expenses that your policy covers and that you would not have otherwise. Examples of these expenses include: The contentious question of whether business interruption insurance should cover losses due to the pandemic is still unresolved. The insurance industry argues that there is generally no coverage for pandemics, but many businesses have been fighting for their losses in court. The Insurance Journal mentions two such cases and in both situations, the judge was on the insurance company's side, which gives little hope to other such cases. In the case of Social Life Magazine v. Sentinel Ins. Co., which was tried in the Southern District of New York, the judge rejected a magazine publisher's request for the court to require its insurance company to cover losses from having to shut down due to government mandates. Even though the ruling favored the insurer, it only found that chances were slim that the publisher would win if tried under New York state law. The case of Gavrilides Management Company et al. vs. Michigan Insurance Co., gives more clarity on similar situations. The judge ruled that the insurance company was not liable for any financial compensation because the business incurred no physical damage. The plaintiff, who owned a restaurant in Michigan, said that the policy covered his losses based on the civil authority provision and that since the mention of virus exclusion was unclear, it should be considered null and void. The judge countered that the virus exclusion would have applied even if there had been physical damage. This is seen as the first dispositive motion ruling in the U.S. over a suit concerning business interruption insurance coverage because of the COVID-19 pandemic. Currently, a handful of states are attempting to expand business interruption insurance requirements to cover the coronavirus pandemic. However, it is essential to know that these policies rarely offer coverage for such things. Even if state legislatures manage to pass bills revising the rules, there is a strong likelihood that they would not be able to withstand a court challenge based on the precedence of the two previously mentioned cases. Business Interruption Insurance is a type of coverage that safeguards businesses from losses incurred when operations stop due to a disaster. It is never sold as a standalone policy but is often bundled with other types of insurance for business owners. It covers lost revenue, mortgage payments, loans, taxes, payroll, relocation expenses, and training costs during the restoration period, which begins 48 to 72 hours after a covered event and lasts while repairs are being made, which can be anywhere from 30 days to a year. It does not cover damaged property, flood or earthquake damage, utilities, undocumented income, and communicable diseases. Despite these exclusions, most small business owners should consider investing in business interruption insurance if they rely on physical locations or assets that could be damaged by events such as fire, theft, or severe weather. Business interruption insurance premiums can range from $500 to $3,000. However, the final price is based on factors such as the type of industry, geographic location, revenue range, the scope of coverage, and the choice of insurer. If you are interested in securing business interruption insurance for your company, you may consult an insurance broker to help you customize your policy according to your needs. What Is Business Interruption Insurance?

What Is and Is Not Covered in Business Interruption Insurance?

Business Interruption Insurance Inclusions

Business Interruption Insurance Exclusions

Business Interruption Insurance Coverage

Restoration Period

Coverage Limit

Business Interruption Insurance Cost

For example, a repair shop is more prone to fire damage than a sales office, so it will most likely spend more on business interruption insurance.

For example, standard policies do not include income losses resulting from power outages, but this can be added for an extra fee.

Who Should Get Business Interruption Insurance?

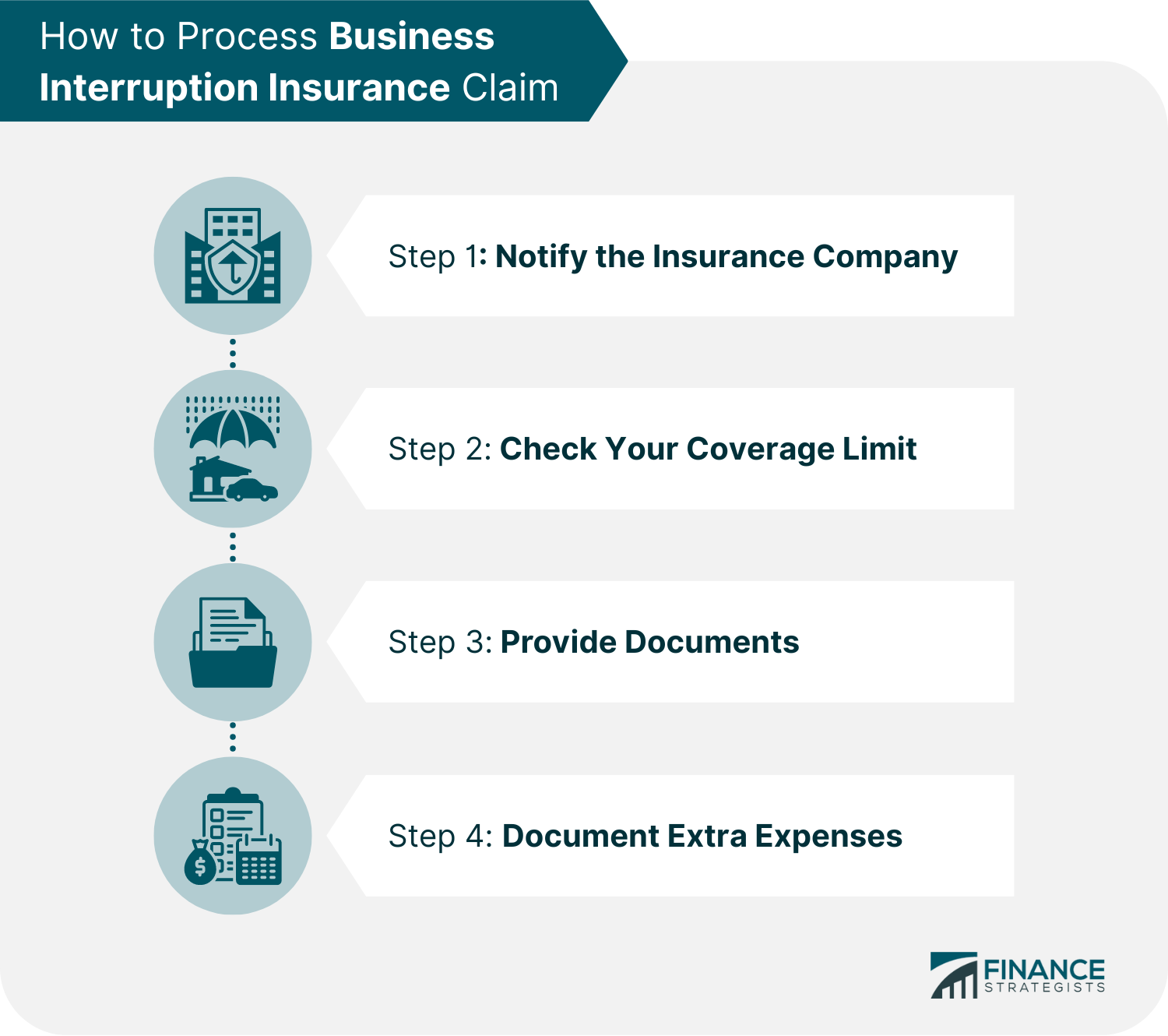

How to Process Business Interruption Insurance Claim

Step 1: Notify the Insurance Company

Step 2: Check Your Coverage Limit

Step 3: Provide Proof of Documents

Step 4: Document Extra Expenses

Final Thoughts

Business Interruption Insurance FAQs

This insurance is business coverage business professionals purchase to be able to get business income, expenses, and revenue loss repaid if business operations are interrupted.

Business interruption insurance is business protection business professionals can use in case business equipment failure or business operation disruption due to a power outage interrupts business income.

Business interruption insurance is business protection that business professionals can get by speaking with business insurance providers and asking questions about how business interruption claims are paid out.

Anyone who owns a small business or a large company, it is business coverage that applies to everyone in some way to make business property repairs or business equipment replacement easier.

It covers business income loss after a property loss, business operating expenses if business operations are suspended because of damage to business property, and lost business revenue due to business interruption caused by any intentional act.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.