Business loan protection is a type of insurance policy designed to cover the outstanding amount of a business loan in the event of unforeseen circumstances, such as the death or disability of a key individual in the business. It helps businesses ensure continuity and protect the personal assets of owners, directors, or partners, reducing the overall financial risk associated with business loans. In today's competitive market, businesses often rely on loans to finance growth, expansion, or even day-to-day operations. However, unforeseen events can jeopardize the ability of a business to repay its loans, placing both the business and its stakeholders at risk. Business loan protection provides a safety net, ensuring that loan obligations can be met even in the face of adversity. There are several types of business loan protection available, each designed to address specific needs and circumstances. The most common types include life insurance, disability insurance, key person insurance, business interruption insurance, and business loan insurance. Business loan protection ensures that the business can continue operating smoothly even in the event of an unforeseen tragedy. By providing financial coverage for outstanding loan amounts, the business can maintain its operations and focus on recovery and growth. In some cases, business owners, directors, or partners may have personally guaranteed loans taken out by the business. Business loan protection shields these individuals from personal financial risk in the event that the business cannot repay the loan due to unforeseen circumstances. With the right business loan protection in place, businesses can minimize the financial risks associated with taking on loans. This can give the business peace of mind and allow it to focus on growth and development. A business with adequate loan protection in place is often seen as more creditworthy by lenders and investors. This can lead to better loan terms and increased access to capital, giving the business a competitive edge. Life insurance policies provide a lump-sum payment in the event of the policyholder's death. There are two main types of life insurance used for business loan protection: Term life insurance provides coverage for a specified term, usually between 10 and 30 years. If the policyholder dies during the term, the insurance provider pays the death benefit to the designated beneficiary. Permanent life insurance provides coverage for the entire life of the policyholder, as long as premiums are paid. This type of insurance typically includes a cash value component that grows over time, providing additional financial benefits. Disability insurance provides financial protection in the event that a key individual becomes disabled and is unable to work. There are two main types of disability insurance: Short-term disability insurance provides coverage for a limited period, typically between three and six months. It helps cover the immediate financial needs of the business in the event of a key individual's temporary disability. Long-term disability insurance provides coverage for an extended period, typically lasting several years or until the policyholder reaches retirement age. This type of insurance helps protect the business from the long-term financial impact of a key individual's disability. Key person insurance provides financial protection in the event of the death or disability of a key individual within the business. This type of insurance helps cover the costs associated with recruiting and training a replacement, as well as any loss of revenue or profits resulting from the absence of the key individual. Business interruption insurance provides financial protection in the event that a business is unable to operate due to a covered event, such as a natural disaster or fire. This type of insurance helps cover ongoing expenses, such as payroll, rent, and loan repayments, ensuring the business can survive until it is able to resume normal operations. Business loan insurance is specifically designed to cover outstanding loan amounts in the event of unforeseen circumstances. There are two main types of business loan insurance: Payment protection insurance covers the monthly loan repayments in the event that the business is unable to make the payments due to a covered event, such as the death or disability of a key individual. Business equity protection provides a lump-sum payment to the business in the event of the death or disability of a key individual, enabling the business to repay the outstanding loan amount in full. The appropriate type of business loan protection will depend on the structure and size of the business. For example, a small business with a sole proprietor may require different coverage than a large corporation with multiple key individuals. It is essential to consider the terms and conditions of the business loan when selecting a loan protection policy. This includes the loan amount, repayment schedule, and any penalties or fees associated with early repayment or default. The industry in which the business operates can also influence the type of business loan protection needed. For example, businesses in high-risk industries may require more comprehensive coverage than those in lower-risk industries. When choosing business loan protection, it is important to assess the financial stability of the business. A financially stable business may require less coverage than one that is struggling to meet its financial obligations. The individuals involved in the business, such as owners, directors, or partners, can also influence the type of business loan protection needed. Consider the roles and responsibilities of each key individual, as well as their personal financial situations. Before selecting a business loan protection policy, it is essential to research and compare various insurance providers. This will help ensure that the business selects the most appropriate coverage at the best price. A professional advisor, such as an insurance broker or financial planner, can help businesses navigate the complexities of business loan protection and select the best policy for their unique needs and circumstances. Before purchasing a business loan protection policy, it is crucial to thoroughly assess and understand the policy terms and conditions. This includes understanding the coverage limits, exclusions, and any additional benefits or riders available. When selecting business loan protection, it is important to consider the cost of the policy relative to the benefits it provides. This will help ensure that the business is making a sound financial decision. Businesses must ensure that their business loan protection policies comply with all applicable state and federal laws and regulations. This may include specific reporting requirements or minimum coverage amounts. Business loan protection policies may have tax implications for both the business and its stakeholders. It is important to consult with a tax professional to understand the potential tax consequences associated with purchasing a policy. In the event that a business needs to make a claim on its business loan protection policy, it is essential to understand the claim process and any associated requirements or deadlines. Understanding the renewal and cancellation guidelines for a business loan protection policy is crucial to maintaining adequate coverage. Be aware of any renewal deadlines, premium increases, and the process for canceling or modifying the policy, if necessary. In an increasingly competitive business environment, having the right business loan protection in place is essential for safeguarding a business's financial future. By providing a safety net in the event of unforeseen circumstances, businesses can better manage risk and focus on growth and development. Selecting the appropriate business loan protection requires careful planning and research. Businesses must consider factors such as the structure and size of the business, loan terms and conditions, industry risks, and key individuals involved in the decision-making process. Consulting with professional advisors and thoroughly evaluating policy options can help ensure that the right protection is in place. Ultimately, business loan protection is an investment in the financial security of the business and its stakeholders. By protecting against the risks associated with business loans, businesses can ensure a more stable and prosperous future, even in the face of adversity.What Is Business Loan Protection?

Reasons for Acquiring Business Loan Protection

Ensuring Business Continuity

Safeguarding Personal Assets

Reducing Financial Risk

Enhancing Business Reputation and Creditworthiness

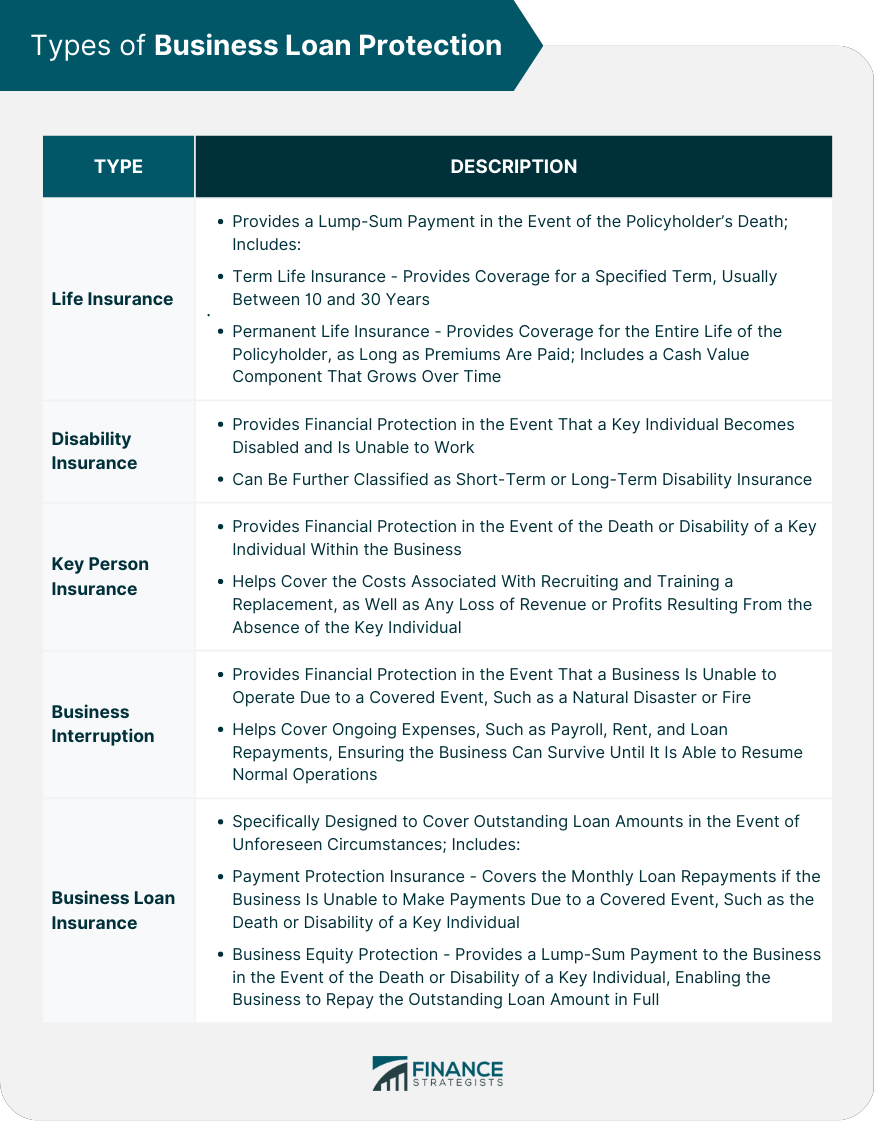

Types of Business Loan Protection

Life Insurance

Term Life Insurance

Permanent Life Insurance

Disability Insurance

Short-Term Disability Insurance

Long-Term Disability Insurance

Key Person Insurance

Business Interruption Insurance

Business Loan Insurance

Payment Protection Insurance

Business Equity Protection

Factors to Consider When Choosing Business Loan Protection

Business Structure and Size

Loan Terms and Conditions

Nature of the Industry

Financial Stability of the Business

Key Individuals Involved

How to Obtain Business Loan Protection

Researching and Comparing Insurance Providers

Consulting With a Professional Advisor

Assessing and Understanding Policy Terms and Conditions

Evaluating Cost-Effectiveness

Legal and Regulatory Considerations

Compliance With State and Federal Laws

Tax Implications

Insurance Claim Process

Policy Renewal and Cancellation Guidelines

Conclusion

Business Loan Protection FAQs

Business loan protection is a type of insurance that covers the outstanding balance on a business loan in the event of the death or disability of the business owner. It provides peace of mind to business owners knowing that their business loan will be taken care of if they are unable to make payments due to unforeseen circumstances.

Any business owner who has taken out a loan to start or expand their business should consider business loan protection. It is especially important for sole proprietors or small business owners who may not have a backup plan if something happens to them.

Business loan protection typically covers the business owner's death, disability, or critical illness. Some policies may also cover other events such as bankruptcy or default on the loan, but this can vary depending on the insurer and policy.

The cost of business loan protection depends on several factors such as the amount of coverage needed, the length of the loan term, and the business owner's age and health. Business owners should shop around and compare policies from different insurers to find the best coverage and rates for their needs.

Business loan protection can be obtained through an insurance broker or directly from an insurance company. Business owners should gather information about their loan amount and terms, as well as their personal health and financial situation, before shopping for policies. It's important to read the policy details carefully and ask questions before signing up for coverage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.