Disability insurance is a type of coverage that replaces a portion of your income if you become unable to work due to illness or injury. Disability insurance is designed to provide financial support to individuals who are unable to work due to illness or injury. The purpose of this insurance is to replace a portion of lost income, helping policyholders maintain their financial stability and meet their financial obligations. It's an essential safety net that can provide peace of mind in the event of unexpected health challenges. There are two primary types of disability insurance: short-term and long-term. Short-term disability insurance typically covers periods of disability lasting from a few weeks to several months, whereas long-term disability insurance provides coverage for longer periods. Disability insurance is crucial for several reasons, including financial security, peace of mind, and protection against unexpected events. Understanding these reasons can help you appreciate the value of having a comprehensive policy in place. Disability insurance provides financial security by replacing a portion of your income if you become unable to work due to illness or injury. This coverage allows you to maintain your standard of living and continue meeting essential expenses, such as housing, utilities, and healthcare. Without disability insurance, you could face significant financial hardship in the event of a disabling condition. Having disability insurance can provide peace of mind, knowing that you are protected against financial strain if you become unable to work. This reassurance can help reduce stress, allowing you to focus on recovery and treatment rather than worrying about how to pay your bills. Disability insurance can also protect your family and loved ones from the financial impact of your disability. Disability insurance is an essential component of a comprehensive financial plan, providing protection against unforeseen health issues that could impact your ability to work. By including disability insurance in your financial strategy, you can ensure that you are prepared for the unexpected and safeguard your financial future. When selecting a disability insurance policy, it's essential to consider several factors, such as coverage amount, elimination period, benefit duration, and policy riders. These factors can help you find the right policy for your unique needs and circumstances. The coverage amount refers to the percentage of your income that the disability insurance policy will replace if you become disabled. Typically, policies replace between 60% and 80% of your pre-disability income. It's crucial to select a policy with an appropriate coverage amount to ensure that you can maintain your financial stability during a period of disability. The elimination period is the waiting period between the onset of a disability and when the insurance benefits begin. Elimination periods can range from a few weeks to several months, and choosing a longer elimination period can result in lower premium costs. However, it's essential to consider your financial situation and whether you can afford to wait for benefits to start. Benefit duration refers to the length of time that the disability insurance policy will pay benefits. Policies can offer a range of benefit durations, from a few years to the remainder of your working life. It's crucial to select a policy with a benefit duration that provides adequate coverage for your needs, taking into account factors such as your age, occupation, and financial obligations. Riders are optional add-ons that can customize your disability insurance policy to meet specific needs. Examples of common riders include cost-of-living adjustments (COLA), which increase benefits to keep pace with inflation, and partial or residual disability benefits, which provide coverage if you can work part-time but not at your full pre-disability capacity. It's essential to evaluate which riders may be beneficial for your situation and consider the additional costs associated with adding them to your policy. There are several sources of disability insurance, including employer-provided coverage, private policies, and government programs. Each source has its own set of benefits, limitations, and eligibility requirements, so it's crucial to understand the options available to you. Many employers offer disability insurance as part of their employee benefits package. This coverage is often more affordable than purchasing an individual policy and may include both short-term and long-term disability insurance. However, employer-provided policies may not be as comprehensive as private policies, and coverage typically ends when you leave the company. Private disability insurance policies are available through insurance companies and can be customized to fit your needs. These policies often provide more comprehensive coverage than employer-provided plans and remain in effect regardless of your employment status. However, private policies can be more expensive and may require a more extensive underwriting process, including a medical exam. Several government programs provide disability insurance, including Social Security Disability Insurance (SSDI), Supplemental Security Income (SSI), and state disability insurance programs. These programs have specific eligibility requirements and may provide lower benefit amounts than private policies. However, they can be a valuable safety net for those who do not have access to other forms of disability insurance. To receive disability insurance benefits, you must meet specific eligibility requirements and go through the claiming process. Understanding these requirements and the process can help you navigate a claim more smoothly. Eligibility for disability insurance benefits depends on your policy or program. Generally, you must demonstrate that you have a qualifying medical condition that prevents you from performing your job duties. Additionally, you may need to meet requirements related to your work history, income, or the length of time you have been disabled. The application process for disability insurance benefits typically involves submitting documentation to support your claim, including medical records, employment information, and proof of income. Depending on the policy or program, you may need to complete additional steps, such as a functional capacity evaluation or an independent medical examination. A medical evaluation is often required to assess the severity of your disability and determine your eligibility for benefits. This evaluation may include a review of your medical records, a physical examination, and consultations with specialists. The results of the medical evaluation can have a significant impact on your claim's outcome. Once your claim has been reviewed, you will receive a decision regarding your eligibility for benefits. If your claim is approved, you will begin receiving benefits according to your policy's terms. If your claim is denied, you may have the option to appeal the decision, which may require additional documentation or evaluations. Understanding the tax implications of disability insurance is essential for managing your finances during a period of disability. The taxation of disability insurance benefits depends on the source of the policy and how the premiums were paid. Generally, if you paid the premiums with after-tax dollars, the benefits are not taxable. However, if your employer paid the premiums or you paid them with pre-tax dollars, the benefits are typically considered taxable income. In some cases, you may be able to deduct the premiums you pay for disability insurance from your taxable income. This deduction typically applies to self-employed individuals and business owners who purchase disability insurance policies to protect their income. However, for most employees, disability insurance premiums are not tax-deductible. Effectively managing your disability insurance involves regularly reviewing your coverage, updating information as needed, and understanding the appeals process. These steps can help you ensure that your policy continues to meet your needs and provides adequate protection. It's essential to review your disability insurance coverage periodically, especially when you experience significant life changes, such as a change in employment, income, or health status. Regular reviews can help you determine whether your current policy provides sufficient coverage and identify any potential gaps in protection. If your personal or financial circumstances change, it's crucial to update your disability insurance policy accordingly. This may include updating your income information, adding or removing riders, or changing your elimination period or benefit duration. Keeping your policy up-to-date ensures that you maintain appropriate coverage and receive the benefits you're entitled to in the event of a disability. If your disability insurance claim is denied, it's important to understand the appeals process and your rights as a policyholder. Familiarize yourself with the specific procedures and timelines for appealing a denial, and gather any additional documentation or evidence that may support your claim. Consulting with a legal professional or disability advocate may also be helpful in navigating the appeals process. Disability insurance plays a crucial role in financial planning, providing protection against the financial impact of illness or injury that prevents you from working. By understanding the importance of disability insurance, the factors to consider when choosing a policy, and the various sources of coverage, you can make informed decisions about your disability insurance needs. Additionally, by effectively managing your policy and staying informed about the eligibility and claiming process, you can ensure that you and your loved ones are adequately protected in the event of a disability.What Is Disability Insurance?

Importance of Disability Insurance

Financial Security

Peace of Mind

Protection Against Unexpected Events

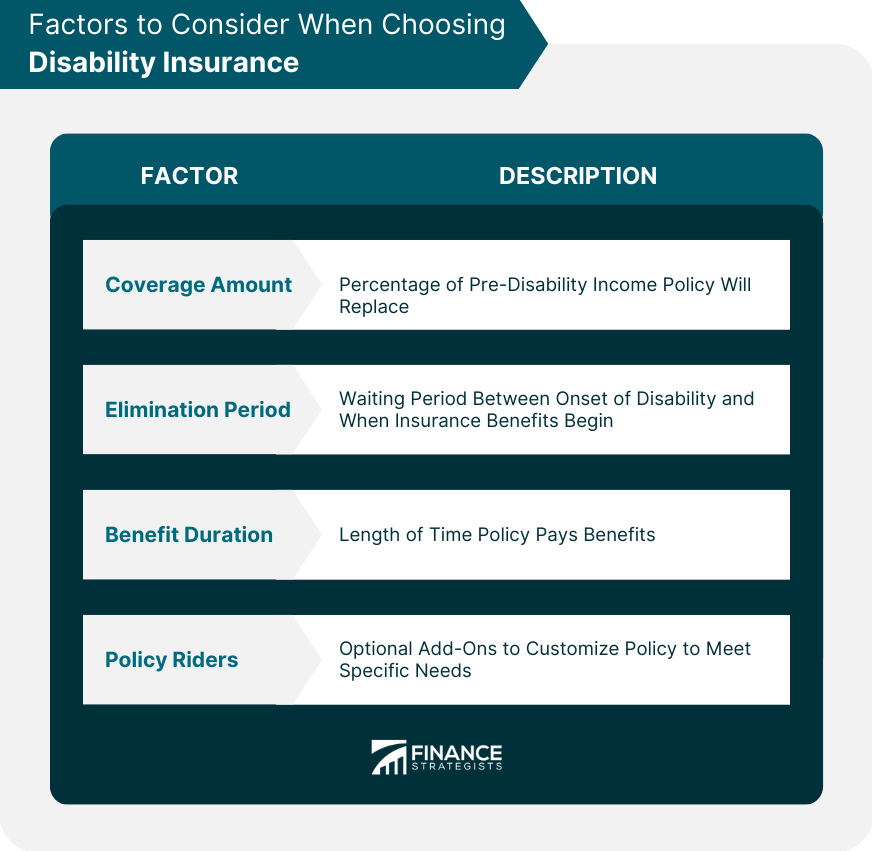

Factors to Consider When Choosing Disability Insurance

Coverage Amount

Elimination Period

Benefit Duration

Policy Riders

Sources of Disability Insurance

Employer-Provided Disability Insurance

Private Disability Insurance

Government Disability Insurance Programs

Eligibility and Claiming Process

Eligibility Requirements

Application Process

Medical Evaluation

Approval and Denial

Disability Insurance and Taxes

Taxation of Disability Insurance Benefits

Tax Deductibility of Premiums

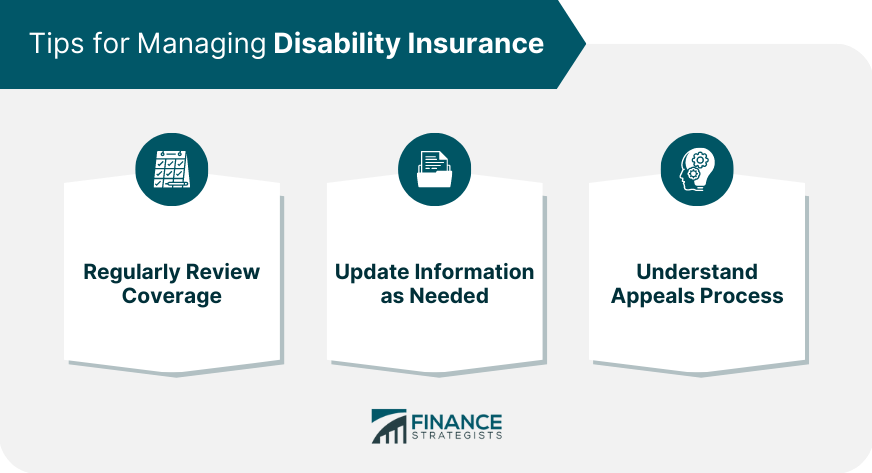

Tips for Managing Disability Insurance

Regularly Review Coverage

Update Information as Needed

Understand Appeals Process

Conclusion

Disability Insurance FAQs

Disability insurance is a type of insurance that provides income replacement in the event that you are unable to work due to a disability.

Eligibility criteria may vary by policy, but generally, individuals who are employed and have a regular income can qualify for disability insurance.

Disability insurance can cover both physical and mental disabilities that prevent an individual from being able to work.

Disability insurance can be obtained through private insurance companies, employers, or government programs such as Social Security Disability Insurance (SSDI).

Disability insurance is managed by the policyholder or their designated representative, who must submit a claim to the insurance company in the event of a disability. The insurance company will then review the claim and make a determination on whether benefits will be paid out.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.