Facultative reinsurance is a form of reinsurance in which the reinsurer and the ceding insurer enter into a reinsurance agreement for a specific risk or policy on a case-by-case basis. Unlike treaty reinsurance, where a reinsurer automatically accepts all risks within a predetermined scope, facultative reinsurance allows both parties to negotiate and customize the terms and conditions for each individual risk. The primary purpose of facultative reinsurance is to help insurers manage large or complex risks that may exceed their risk appetite or capacity. By transferring a portion of the risk to a reinsurer, the ceding insurer can maintain solvency, stabilize its financial position, and better manage its overall portfolio. Facultative reinsurance can also provide ceding insurers with access to the reinsurer's specialized expertise, resources, and underwriting capabilities. Facultative reinsurance can be classified into two main types based on the structure of the reinsurance agreement: In proportional facultative reinsurance, the ceding insurer and the reinsurer agree to share the premiums and losses of the reinsured risk in proportion to their respective shares in the policy. The reinsurer's share of the risk can be determined by a fixed percentage or by a quota share arrangement, where the reinsurer assumes a specified percentage of each risk. Non-proportional facultative reinsurance, also known as excess of loss reinsurance, provides coverage to the ceding insurer for losses that exceed a specified limit or attachment point. In this type of reinsurance, the reinsurer's liability is not proportional to its share of the premiums but is instead based on the amount of loss that exceeds the predetermined threshold. The process of placing facultative reinsurance typically involves several steps, including: The ceding insurer identifies a specific risk or policy that requires facultative reinsurance due to its size, complexity, or potential impact on the insurer's overall risk exposure. The ceding insurer and the reinsurer engage in a negotiation process to determine the terms and conditions of the facultative reinsurance agreement, including the scope of coverage, premium rates, and loss-sharing arrangements. Once the terms and conditions have been agreed upon, the ceding insurer formally places the facultative reinsurance with the reinsurer, who then assumes a portion of the risk in accordance with the reinsurance agreement. In the event of a claim, the ceding insurer and the reinsurer work together to manage the claim and settle any losses in accordance with the terms of the facultative reinsurance agreement. Although both facultative and treaty reinsurance serve to transfer risk from a ceding insurer to a reinsurer, there are several key differences between the two approaches: Facultative reinsurance offers greater flexibility and selectivity, as it allows both the ceding insurer and the reinsurer to evaluate and negotiate the terms and conditions for each individual risk. Treaty reinsurance, on the other hand, involves a more standardized approach, with the reinsurer automatically accepting all risks within a predetermined scope. In facultative reinsurance, the reinsurer has the opportunity to evaluate each risk individually, which can result in more accurate pricing and risk assessment. In treaty reinsurance, the reinsurer may have less information and control over the individual risks being assumed. Facultative reinsurance may involve higher pricing and administrative costs due to the case-by-case nature of the agreements and the need for more detailed risk evaluations. However, it can also provide the ceding insurer with additional capacity to underwrite larger or more complex risks that may not be covered under a treaty reinsurance arrangement. Facultative reinsurance typically involves a closer working relationship between the ceding insurer and the reinsurer, as the two parties collaborate to negotiate terms, manage claims, and share expertise. In treaty reinsurance, the relationship may be more transactional and less collaborative, as the reinsurer automatically assumes the specified risks. Facultative reinsurance offers several benefits for ceding insurers and reinsurers alike: By transferring a portion of large or complex risks to a reinsurer, ceding insurers can better manage their overall risk exposure and maintain financial stability. Facultative reinsurance can provide ceding insurers with additional underwriting capacity, enabling them to take on larger or more complex risks that may exceed their internal risk appetite or capacity. Ceding insurers can benefit from the specialized expertise, resources, and underwriting capabilities of their reinsurer partners, which can help them better assess and manage complex risks. By diversifying their risk portfolios and sharing losses with reinsurers, ceding insurers can enhance their financial stability and solvency, which is essential for maintaining a strong market presence and meeting regulatory requirements. Despite its benefits, facultative reinsurance also presents some challenges and limitations: The case-by-case nature of facultative reinsurance can result in higher administrative costs and complexity compared to treaty reinsurance, as each agreement requires individual negotiation and risk evaluation. The negotiation and placement process for facultative reinsurance can be time-consuming, as both the ceding insurer and reinsurer must carefully evaluate and agree upon the terms and conditions for each risk. The customized nature of facultative reinsurance agreements can sometimes lead to disputes between the ceding insurer and the reinsurer, particularly in cases where the terms and conditions are not clearly defined or understood. Ceding insurers must carefully consider the creditworthiness and financial strength of their reinsurer partners, as they may be exposed to counterparty risk if the reinsurer is unable to meet its obligations under the reinsurance agreement. Facultative reinsurance can be utilized across various insurance lines, including: In property insurance, facultative reinsurance can be used to manage risks associated with high-value properties or properties exposed to unique or severe hazards, such as natural disasters or terrorism. Casualty insurance, may seek facultative reinsurance for risks with high loss potential, such as large-scale construction projects, environmental liabilities, or complex liability exposures. Life insurance can utilize facultative reinsurance to manage risks associated with high face amount policies, policies with unusual underwriting characteristics, or policies issued to individuals with significant health or lifestyle risks. Facultative reinsurance can also play a role in specialty lines of insurance, such as aviation, marine, or cyber insurance, where the risks may be highly specialized or complex, and the expertise of a reinsurer can be particularly valuable. Facultative reinsurance plays a crucial role in the risk management strategies of insurance companies. As a flexible and customizable approach to risk transfer, it allows insurers to manage large or complex risks more effectively, expand their underwriting capacity, and access the specialized expertise and resources of reinsurers. This collaborative approach enables ceding insurers and reinsurers to create tailored solutions that address their unique needs and risk profiles, ensuring financial stability and regulatory compliance for both parties. As the insurance landscape continues to evolve rapidly, with emerging risks and changing market dynamics, facultative reinsurance will likely become even more vital for insurers. By staying informed about technological advancements, market trends, and regulatory developments, insurers and reinsurers can ensure that facultative reinsurance remains a valuable and effective tool for managing risk in the future. Embracing innovation and collaboration will be key to successfully navigating the challenges and opportunities presented by the ever-changing world of risk management and insurance.What Is Facultative Reinsurance?

Types of Facultative Reinsurance

Proportional Facultative Reinsurance

Non-proportional Facultative Reinsurance

The Facultative Reinsurance Process

Identifying Risk

Negotiating Terms and Conditions

Placing Facultative Reinsurance

Claims Management and Settlement

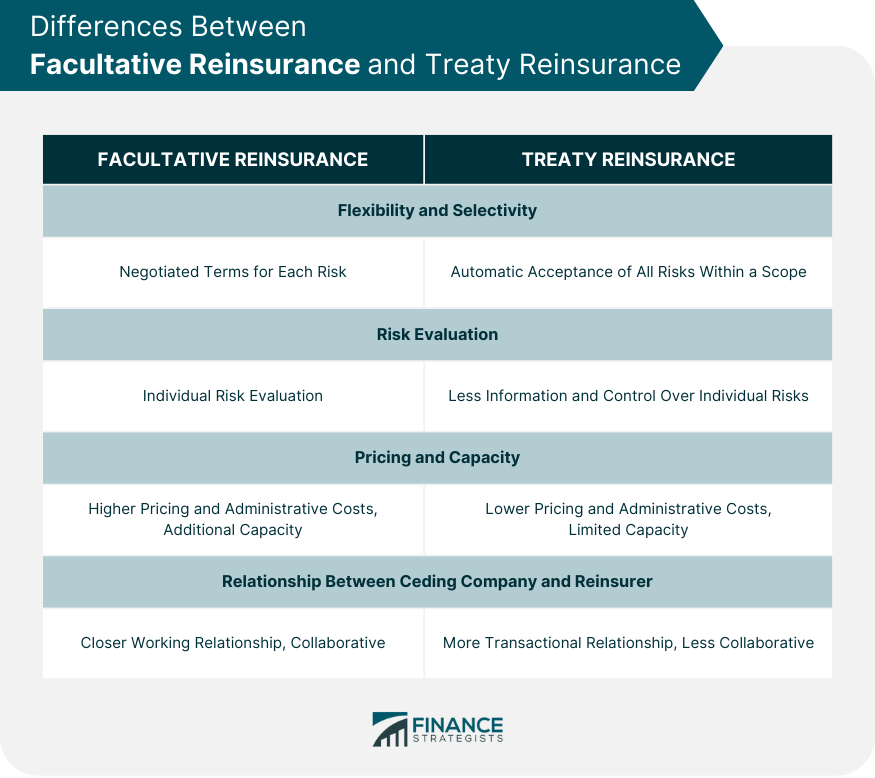

Differences Between Facultative Reinsurance and Treaty Reinsurance

Flexibility and Selectivity

Risk Evaluation

Pricing and Capacity

Relationship Between Ceding Company and Reinsurer

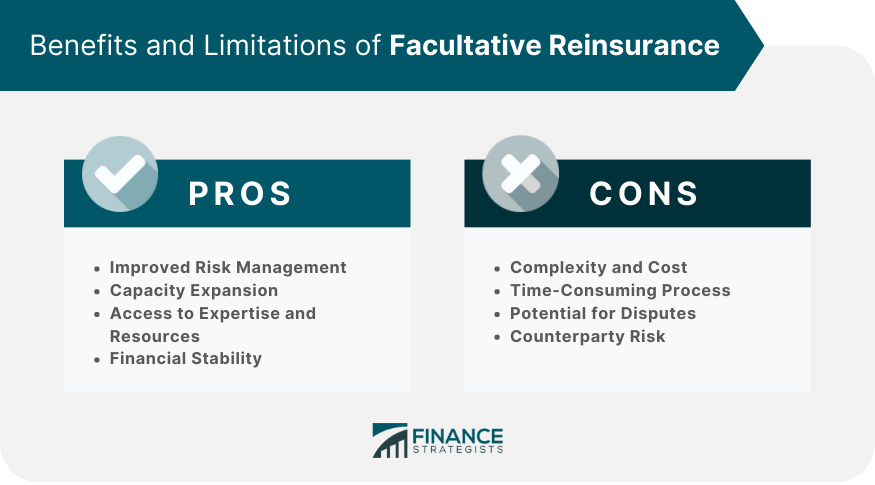

Benefits of Facultative Reinsurance

Improved Risk Management

Capacity Expansion

Access to Expertise and Resources

Financial Stability

Challenges and Limitations of Facultative Reinsurance

Complexity and Cost

Time-Consuming Process

Potential for Disputes

Counterparty Risk

Facultative Reinsurance in Different Insurance Lines

Property Insurance

Casualty Insurance

Life Insurance

Specialty Lines

Conclusion

Facultative Reinsurance FAQs

Facultative Reinsurance is a type of reinsurance where a reinsurer provides coverage to a primary insurer for a single risk or a group of risks that the primary insurer wants to transfer to the reinsurer.

The primary insurer approaches the reinsurer to offer them the opportunity to assume part or all of the risk of a particular policy or policies. The reinsurer then decides whether to accept the risk or not, based on factors such as the underwriting standards, risk appetite, and financial stability of the primary insurer.

Facultative Reinsurance provides the primary insurer with the ability to transfer some or all of the risk associated with a particular policy or policies, thereby reducing the primary insurer's exposure to risk. The reinsurer, in turn, earns premiums for assuming the risk, which helps to diversify their portfolio.

Facultative Reinsurance can be used to cover any type of risk, including property, liability, and life insurance risks.

The premium for Facultative Reinsurance is typically calculated based on the risk involved, the type of coverage required, and the insurer's underwriting standards. The premium may also be affected by factors such as the reinsurer's financial stability, the insurer's claims history, and market conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.