Critical illness insurance is a type of insurance policy designed to provide financial protection and assistance to policyholders who are diagnosed with a covered critical illness. The purpose of critical illness insurance is to help alleviate the financial burden that often comes with serious medical conditions, allowing the policyholder to focus on recovery without worrying about mounting expenses. Incorporating critical illness insurance into financial planning is crucial, as it provides an additional layer of protection against the financial impact of unexpected medical emergencies. Having this type of insurance can help cover costs not typically covered by traditional health insurance, such as lost income, out-of-pocket medical expenses, and other related costs. Standalone critical illness insurance policies are independent insurance plans that solely cover the policyholder for specified critical illnesses. These policies provide a lump-sum payment upon the diagnosis of a covered illness, regardless of any other insurance policies the individual may hold. Rider policies, or add-ons, are supplementary policies that can be added to an existing life or health insurance policy. These riders provide additional coverage for specific critical illnesses, enhancing the benefits of the primary insurance plan. Group critical illness insurance policies are often offered by employers as part of a comprehensive employee benefits package. These policies typically cover a predetermined set of critical illnesses and offer coverage to all eligible employees under a single contract. Most critical illness insurance policies cover a core set of critical illnesses, including: Cancer Heart attack Stroke Kidney failure Major organ transplant Many policies also cover additional illnesses and conditions, such as Alzheimer's disease, multiple sclerosis, and severe burns. It is important to carefully review the policy documents to understand the full scope of coverage. Critical illness insurance policies often come with exclusions and limitations, which may include pre-existing conditions, specific types of cancer, or illnesses resulting from risky behaviors. Be sure to read the policy terms and conditions to fully understand what is and is not covered. Age and gender are key factors that affect critical illness insurance premiums. Generally, premiums increase with age, and men may pay higher premiums than women due to differing risk profiles for certain illnesses. A person's health history plays a significant role in determining premium rates. Individuals with a history of serious medical conditions or a family history of critical illnesses may be subject to higher premiums or exclusions. The coverage amount, or the lump-sum benefit paid upon diagnosis of a covered illness, directly impacts premium rates. Higher coverage amounts typically result in higher premiums. The policy term, or the length of time the policy remains in force, also affects premium rates. Longer policy terms usually result in higher premiums. Lifestyle factors, such as smoking or engaging in high-risk activities, can lead to increased premiums due to the heightened risk of developing a critical illness. Notify the insurance company as soon as possible upon the diagnosis of a covered critical illness. Prompt notification can help ensure a smoother claim process. Gather all required documentation, such as medical records, diagnostic reports, and any other relevant information needed to support the claim. Submit the claim form along with the necessary documentation to the insurance company for processing. Keep copies of all documents and correspondence for your records. The insurance company will review the submitted claim and assess its validity. This process may include verifying the diagnosis, reviewing medical records, and confirming that the illness falls within the policy's coverage. Once the claim is approved, the insurer will inform the policyholder of the decision and provide information on the payout process. Critical illness insurance payouts are typically provided as a lump-sum payment, which can be used at the policyholder's discretion to cover medical expenses, replace lost income, or address any other financial needs. Depending on the jurisdiction, critical illness insurance payouts may be tax-free or subject to taxation. Consult a tax professional for guidance on the tax implications of receiving a critical illness insurance payout. Compare the coverage and benefits offered by various policies, including the specific illnesses covered, the amount of the lump-sum payout, and any additional benefits such as premium waivers or return of premium options. Evaluate premium rates across different insurers and policy options. Consider factors such as age, gender, health history, and coverage amount when comparing rates. Review the waiting periods and survival periods specified in the policy terms. Waiting periods refer to the time between policy inception and when coverage for certain illnesses becomes effective, while survival periods are the minimum number of days the policyholder must survive after the diagnosis of a critical illness to receive the payout. Examine the policy terms and conditions, including exclusions, limitations, and any specific requirements for claims. Be sure to understand the policy's renewal provisions and whether it offers guaranteed insurability or the option to increase coverage in the future. Choose a reputable insurer with a strong financial rating, as this can be an indicator of the company's ability to fulfill its claims obligations. Consider your own health and family medical history when evaluating the need for critical illness insurance. If you have a heightened risk of developing a critical illness, it may be prudent to invest in this type of coverage. Calculate the potential financial impact of a critical illness diagnosis, including medical expenses, lost income, and other related costs. This assessment can help you determine the appropriate coverage amount for your needs. Compare multiple policies and insurers to find the best combination of coverage, benefits, and premium rates for your needs. Consult with an insurance professional or financial planner to discuss your specific needs and receive personalized guidance on choosing the right critical illness insurance policy. As your life circumstances change, it is essential to review your critical illness insurance coverage and make adjustments as needed. Regular policy reviews can help ensure that your coverage remains aligned with your current needs and financial goals. A comprehensive understanding of critical illness insurance is essential for safeguarding one's financial future against the unpredictable nature of life-threatening illnesses. This type of insurance plays a crucial role in providing financial security during trying times, allowing policyholders to focus on recovery without the burden of mounting expenses. By exploring different policy types, coverage options, and premium factors, and comparing various insurers, individuals can make well-informed decisions that best suit their needs. It is also important to assess personal and family medical history, determine financial needs, and periodically review and update coverage to ensure continued alignment with evolving life circumstances. By carefully considering these key aspects and selecting the right policy, individuals can protect their financial well-being and shield their loved ones from the unforeseen consequences of a critical illness.What Is Critical Illness Insurance?

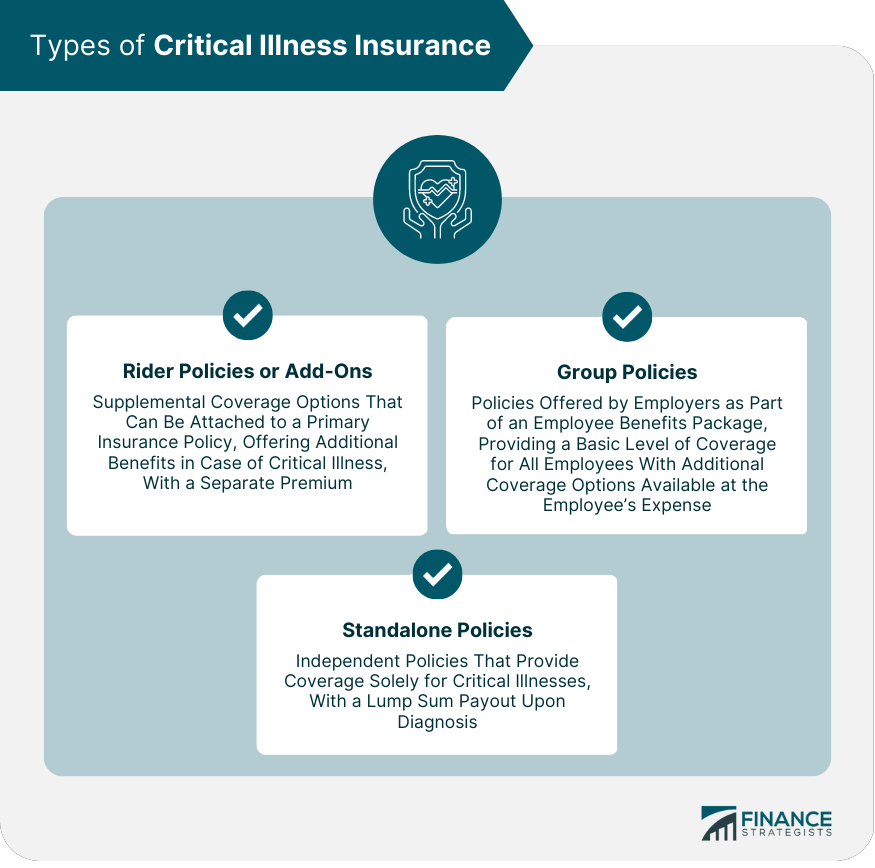

Types of Critical Illness Insurance

Standalone Policies

Rider Policies or Add-Ons

Group Policies

Coverage of Critical Illness Insurance

Common Critical Illnesses Covered

Additional Illnesses and Conditions

Exclusions and Limitations

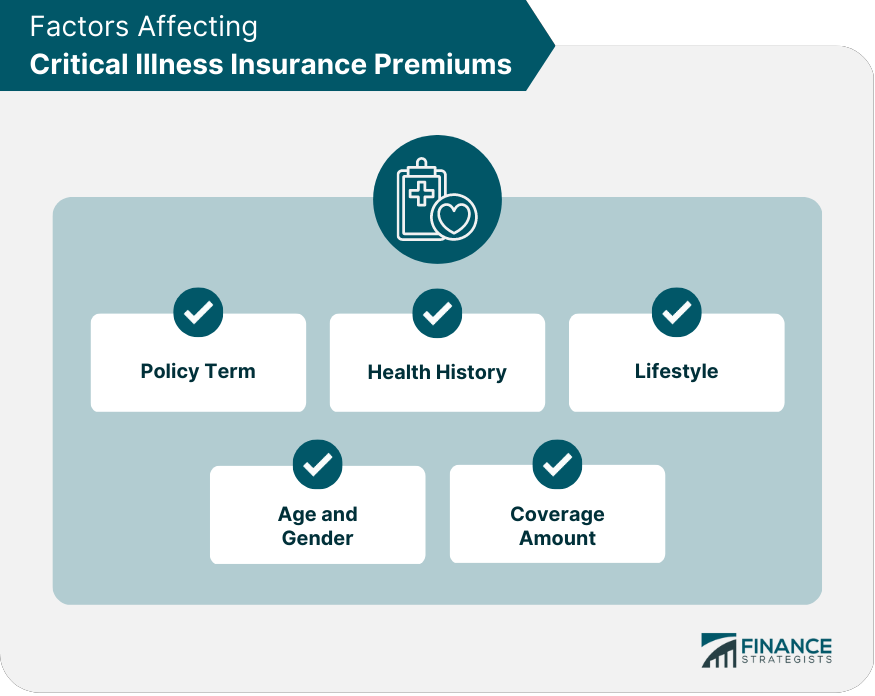

Factors Affecting Critical Illness Insurance Premiums

Age and Gender

Health History

Coverage Amount

Policy Term

Lifestyle

Critical Illness Insurance Claim Process

Filing a Claim

Notification

Documentation

Claim Submission

Assessment and Approval

Payout Options and Taxation

Comparing Critical Illness Insurance Policies

Coverage and Benefits

Premium Rates

Waiting Periods and Survival Periods

Policy Terms and Conditions

Financial Strength and Reputation of the Insurer

Tips for Buying Critical Illness Insurance

Assess Personal and Family Medical History

Determine Financial Needs

Shop Around and Compare Policies

Seek Professional Advice

Periodically Review and Update Coverage

Conclusion

Critical Illness Insurance FAQs

Critical illness insurance is a type of insurance that provides a lump sum payment to the policyholder in the event that they are diagnosed with a specific critical illness. The purpose of this insurance is to help cover the costs associated with treatment and recovery from the illness.

The specific illnesses covered by critical illness insurance can vary depending on the policy, but they typically include serious illnesses like cancer, heart attack, stroke, and kidney failure. The policy will specify which illnesses are covered and the criteria for making a claim.

Health insurance may cover some of the costs associated with a critical illness, but it may not cover all of them. Critical illness insurance can provide additional financial support to help cover the expenses that health insurance doesn't cover, such as lost income or non-medical expenses.

The cost of critical illness insurance can vary depending on a number of factors, such as the age and health of the policyholder, the coverage amount, and the specific illnesses covered. It's important to shop around and compare policies to find the one that offers the best value for your needs.

It's a good idea to consider getting critical illness insurance if you have a family history of serious illnesses or if you have a job or lifestyle that puts you at higher risk for certain illnesses. It's also a good idea to consider critical illness insurance if you have a limited emergency fund or if you would struggle to cover the costs associated with a critical illness.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.