Dependent Care Flexible Spending Accounts are tax-advantaged accounts that allow individuals to save pre-tax dollars for eligible dependent care expenses. These expenses may include costs associated with care for children under the age of 13, or care for a spouse or dependent of any age who is physically or mentally incapable of self-care and lives with the account holder more than half the year. DCFSA are usually established through an individual's employer as part of a benefits package. Contributions to a DCFSA are deducted from the employee's paycheck on a pre-tax basis, lowering the individual's taxable income. As a result, the individual may pay less in taxes over the course of the year. To participate in a DCFSA, an individual must be an eligible employee of an employer that offers this benefit. Eligibility criteria may vary by employer, but full-time and part-time employees are generally eligible to participate. Employees must review their employer's specific plan documents and consult with their human resources (HR) department to determine eligibility. In addition to being an eligible employee, the individual must also have qualifying dependents who require care. This leads us to the next section, where we will discuss the criteria for eligible dependents and the types of expenses that a DCFSA can cover. A qualifying dependent for DCFSA purposes is a child under the age of 13 or a spouse or other dependent who is physically or mentally incapable of self-care and lives with the employee for more than half the year. The care must be necessary for the employee (and spouse, if married) to work or look for work. It's important to note that the age limit for eligible children is strictly enforced. Once a child turns 13, they are no longer considered a qualifying dependent for DCFSA purposes, and their care expenses are no longer eligible for reimbursement. Eligible expenses for DCFSA reimbursement include the costs of care provided to a qualifying dependent while the employee (and spouse, if married) is working or looking for work. Examples of eligible expenses include payments to daycare centers, preschools, before- and after-school programs, and in-home caregivers such as nannies or babysitters. However, not all dependent care expenses are eligible for reimbursement. For example, expenses for overnight camps, educational tutoring, and care provided by a relative under the age of 19 are not eligible. Additionally, expenses must be substantiated with proper documentation, such as receipts or invoices, to be eligible for reimbursement. Employees can enroll in a DCFSA during their employer's open enrollment period, which typically occurs once a year. During this time, employees can elect to participate in the DCFSA and decide how much money they want to contribute to the account for the upcoming plan year. In addition to open enrollment, certain life events, such as the birth or adoption of a child, marriage, or a change in employment status, may qualify an employee for a special enrollment period. During a special enrollment period, employees can change their DCFSA elections outside of the regular open enrollment period. The Internal Revenue Service (IRS) sets annual contribution limits for DCFSA. The maximum annual contribution limit is $5,000 for individuals or married couples filing jointly and $2,500 for married individuals filing separately. It's important to note that these limits are subject to change, and employees should verify the current limits with their employer or the IRS. Contribution limits are applied on a per-household basis, meaning that if both spouses are eligible to participate in a DCFSA through their respective employers, their combined contributions cannot exceed the annual maximum limit. For example, if one spouse contributes $3,000 to their DCFSA, the other spouse can contribute no more than $2,000 to meet the $5,000 limit. One of the main benefits of a DCFSA is its tax advantages. Contributions to a DCFSA are made pre-tax, meaning that the money is deducted from the employee's paycheck before taxes are applied. This reduces the employee's taxable income, resulting in lower income taxes. In addition to the pre-tax contributions, the reimbursements received from a DCFSA for eligible dependent care expenses are also tax-free. This means that employees can use tax-free dollars to pay for qualifying dependent care expenses, providing significant tax savings. To receive reimbursement from a DCFSA, employees must submit claims for eligible dependent care expenses. Claims must include documentation, such as receipts or invoices, that clearly show the date of service, the type of service provided, the service's cost, and the care provider's name. Reimbursements are typically processed within a few business days after the claim is submitted, and employees can receive the funds through direct deposit or a check. It's important to note that employees can only be reimbursed up to the amount that is currently available in their DCFSA. For example, if an employee has contributed $1,000 to their DCFSA and submits a claim for $1,200, they will only be reimbursed for $1,000. A key aspect of DCFSA that employees should be aware of is the use-it-or-lose-it rule. This rule stipulates that any funds remaining in a DCFSA at the end of the plan year must be forfeited. In other words, employees must use all of the funds in their DCFSA by the end of the plan year, or they will lose the unused funds. Some employers may offer a grace period, typically up to 2.5 months after the end of the plan year, during which employees can incur and submit claims for eligible expenses. However, not all employers offer a grace period, so employees should check with their HR department to determine if this option is available. The consequences of forfeiting unused funds in a DCFSA can be significant, especially if the employee has contributed a large amount to the account. For this reason, it's important for employees to carefully estimate their anticipated dependent care expenses for the year and contribute an appropriate amount to their DCFSA. It's also important for employees to monitor their DCFSA balance throughout the year and make any necessary adjustments to their dependent care arrangements to ensure that they fully utilize the funds in the account. To avoid forfeiting unused funds, employees can employ several strategies. First, employees should carefully estimate their dependent care expenses for the year and contribute an amount that closely matches their anticipated expenses. This may involve reviewing past expenses and considering any changes in their dependent care needs. Second, employees should regularly review their DCFSA balance and track their expenses throughout the year. If it appears that they may have excess funds in their account, they can explore options for additional eligible expenses, such as enrolling their child in a summer camp or after-school program. Finally, employees should be aware of any grace period offered by their employer and take advantage of this additional time to incur and submit claims for eligible expenses. Changes in employment status can have a significant impact on an employee's DCFSA. For example, if an employee leaves their job, their participation in the DCFSA typically ends on their last day of employment. This means that the employee will no longer be able to contribute to the account, and any unused funds may be forfeited. However, employees may still be able to submit claims for eligible expenses incurred before their last day of employment. It's important for employees to review their employer's specific plan documents and consult with their HR department to understand the rules and deadlines for submitting claims after leaving their job. If an employee changes employers and the new employer also offers a DCFSA, the employee may have the opportunity to enroll in the new employer's plan. However, the funds from the previous employer's DCFSA cannot be transferred to the new employer's plan. Changes in family status, such as the birth or adoption of a child or a change in marital status, can also affect an employee's DCFSA. For example, the birth or adoption of a child may qualify the employee for a special enrollment period, during which they can enroll in the DCFSA or adjust their contribution amount to account for the additional dependent care expenses. Similarly, a change in marital status, such as marriage or divorce, may affect the employee's contribution limits and eligibility for the DCFSA. For example, if an employee gets married and both spouses are eligible to participate in a DCFSA, their combined contributions cannot exceed the annual maximum limit. It's important for employees to notify their HR department of any changes in family status and review their DCFSA elections to ensure they align with their current dependent care needs. The DCFSA is not the only option available to employees for managing dependent care expenses. The Child and Dependent Care Tax Credit is a federal tax credit that allows taxpayers to claim a credit for a portion of their eligible dependent care expenses. There are key differences between the DCFSA and the Child and Dependent Care Tax Credit. For example, the DCFSA allows employees to use pre-tax dollars to pay for eligible expenses, while the tax credit provides a credit against the taxpayer's income tax liability. Additionally, the DCFSA has higher contribution limits compared to the maximum amount of expenses that can be claimed for the tax credit. When choosing between the DCFSA and the Child and Dependent Care Tax Credit, employees should consider factors such as their income level, tax bracket, and anticipated dependent care expenses. In some cases, employees may be able to take advantage of both the DCFSA and the tax credit, but certain limitations apply. While both the DCFSA and the Health Savings Account (HSA) offer tax advantages, they serve different purposes and have different rules regarding eligible expenses and contribution limits. The DCFSA is specifically designed to help employees pay for eligible dependent care expenses, such as childcare or eldercare. In contrast, the HSA is designed to help individuals with high-deductible health plans save for and pay for qualified medical expenses. Unlike the DCFSA, the HSA allows funds to be rolled over yearly, and there is no use-it-or-lose-it rule. Additionally, the HSA offers investment options, allowing account holders to grow their funds over time potentially. Employees should carefully consider their individual and family needs when deciding whether to participate in a DCFSA, HSA, or both. A Dependent Care Flexible Spending Account (DCFSA) is a valuable benefit that can help employees manage dependent care costs for qualifying dependents. By allowing employees to set aside pre-tax dollars for eligible expenses, a DCFSA provides significant tax savings and financial flexibility. When considering participation in a DCFSA, employees should carefully estimate their anticipated dependent care expenses, understand the contribution limits, and know the use-it-or-lose-it rule. Additionally, employees should be mindful of how life changes, such as changes in employment or family status, may impact their DCFSA. It's also important for employees to understand how a DCFSA compares to other benefits, such as the Child and Dependent Care Tax Credit and Health Savings Accounts, and to make informed decisions based on their individual and family needs. Ultimately, a DCFSA can be a powerful tool for managing dependent care expenses and achieving greater financial well-being. Employees are encouraged to consult with their HR or benefits administrator for specific questions and to take full advantage of this valuable benefit.What Are Dependent Care Flexible Spending Accounts (DCFSA)?

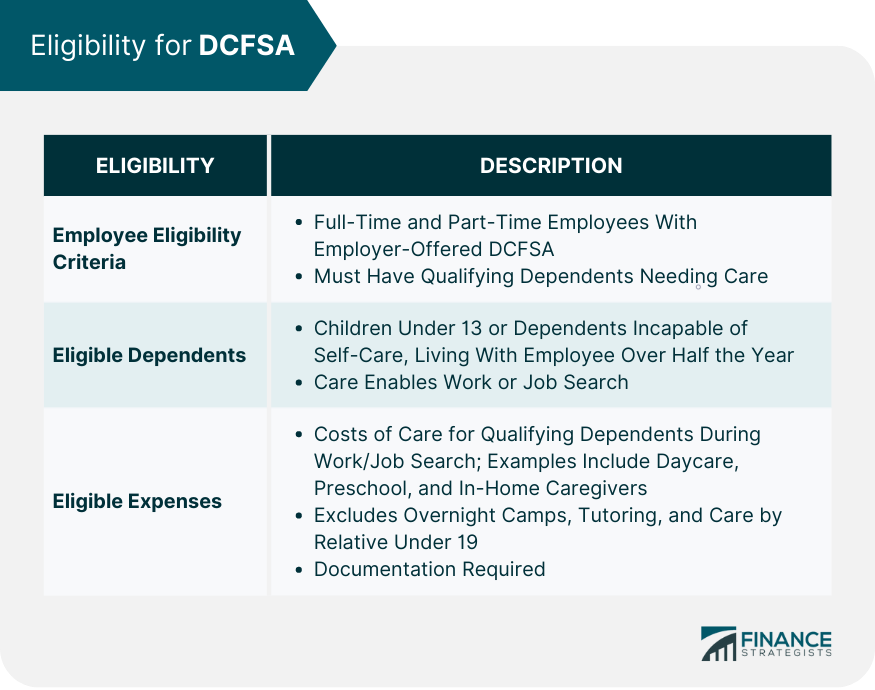

Eligibility for DCFSA

Employee Eligibility Criteria

Eligible Dependents

Eligible Expenses

How DCFSA Works

Enrollment Process

Contribution Limits

Tax Advantages

Reimbursement Process

Use-It-Or-Lose-It Rule

Explanation of the Use-It-Or-Lose-It Rule

Consequences of Unused Funds

Strategies to Avoid Forfeiting Unused Funds

Impact of Life Changes on DCFSA

Changes in Employment Status

Changes in Family Status

Comparison With Other Benefits

DCFSA vs Child and Dependent Care Tax Credit

DCFSA vs Health Savings Account (HSA)

Conclusion

Dependent Care Flexible Spending Accounts (DCFSA) FAQs

A Dependent Care Flexible Spending Account (DCFSA) is a pre-tax benefit account that allows employees to set aside a portion of their earnings to pay for eligible dependent care expenses. Contributions to a DCFSA are made through payroll deductions before taxes are applied, reducing the employee's taxable income and potentially saving them money on taxes.

Employees who work for an employer that offers a DCFSA plan are generally eligible to participate. Additionally, the employee must have qualifying dependents, such as children under the age of 13 or a disabled spouse or dependent who requires care while the employee is at work.

Eligible expenses for a DCFSA include costs associated with the care of qualifying dependents, such as daycare, preschool, before- and after-school programs, and summer day camps. Adult day care for a disabled spouse or dependent is also eligible. However, expenses for overnight camps, tutoring, or education costs are not eligible.

As of 2023, the maximum annual contribution limit for a DCFSA is $5,000 for individuals or married couples filing jointly and $2,500 for married individuals filing separately. Contribution limits may be subject to change, so it's important to check with your employer or plan administrator for the most current information.

DCFSA funds are subject to the "use-it-or-lose-it" rule, meaning that unused funds at the plan year's end are typically forfeited. However, some plans may offer a grace period that allows participants to incur eligible expenses for a certain period of time after the plan year ends. It's important to review your plan documents and check with your plan administrator for specific details about your DCFSA.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.