Flexible spending accounts (FSAs) are employer-sponsored benefit plans that allow employees to set aside pre-tax dollars from their paycheck to pay for eligible expenses such as medical and dental expenses, dependent care expenses, and certain other qualified expenses. The funds in the FSA account can be used to pay for eligible expenses throughout the plan year, reducing the employee's taxable income and leading to tax savings. Eligible expenses for FSA reimbursement typically include medical and dental expenses not covered by insurance, such as copays, deductibles, and prescription drug costs, as well as dependent care expenses like daycare costs for children or elder care expenses for a spouse or parent. To be eligible for an FSA, an individual must be an employee of a company that offers these accounts as part of their benefits package. Self-employed individuals and non-working spouses are not eligible for FSAs. Employees can enroll in an FSA during their company's open enrollment period or within 30 days of a qualifying life event, such as marriage, birth of a child, or loss of other health coverage. Enrollment typically involves completing a form or online application and selecting the desired contribution amount. Health FSAs are designed to cover eligible medical expenses not covered by insurance. These expenses may include copayments, deductibles, prescription medications, and certain over-the-counter items. The Internal Revenue Service (IRS) provides a list of qualified medical expenses that are eligible for reimbursement through a Health FSA. Some common examples include doctor visits, dental treatments, eyeglasses, and prescription medications. The IRS sets annual limits on the amount that employees can contribute to a Health FSA. For 2024, the maximum annual contribution was $3,200, but this amount may be adjusted for inflation in subsequent years. To receive reimbursement for qualified medical expenses, employees must submit a claim form and provide documentation, such as receipts or explanation of benefits statements, to the FSA administrator. Dependent Care FSAs are designed to help employees pay for eligible childcare or adult care expenses for qualifying dependents. Qualified dependent care expenses include costs related to care for children under 13 years old or disabled adults who are unable to care for themselves. Examples of eligible expenses include daycare, preschool, summer camps, and adult day care services. The maximum annual contribution for a Dependent Care FSA is $5,000 for individuals or married couples filing jointly and $2,500 for married individuals filing separately. Similar to Health FSAs, employees must submit a claim form and provide documentation of eligible expenses to receive reimbursement from a Dependent Care FSA. Limited Purpose FSAs are designed for employees who are also enrolled in a High Deductible Health Plan (HDHP) and a Health Savings Account (HSA). These FSAs can only be used for eligible dental and vision expenses. Examples of qualified dental and vision expenses include dental cleanings, orthodontics, contact lenses, and eyeglasses. The contribution limits for Limited Purpose FSAs are the same as those for Health FSAs. The reimbursement process for Limited Purpose FSAs is also similar to Health FSAs, requiring employees to submit a claim form and documentation of eligible expenses. FSAs are subject to a use-it-or-lose-it rule, meaning that employees must use the funds in their account by the end of the plan year, or they will forfeit the remaining balance. Some employers may offer a grace period or carryover option to help employees avoid losing unused funds. A grace period is an extension of time, usually up to 2.5 months after the plan year ends, during which employees can continue to use their FSA funds for eligible expenses. Alternatively, a carryover option allows employees to roll over a portion of their unused funds, typically up to $550, into the next plan year. Employers may choose to offer either a grace period or a carryover option, both, or neither. FSAs generally do not allow employees to change their contribution amount or terminate their participation mid-year, except in cases of a qualifying life event. Examples of qualifying life events include marriage, divorce, birth or adoption of a child, or a significant change in employment status. FSA contributions are made on a pre-tax basis, which means that the amount contributed is excluded from an employee's taxable income. This can help lower an individual's overall tax liability. In addition to reducing taxable income, FSAs can provide tax savings by allowing employees to pay for eligible expenses with pre-tax dollars, effectively reducing the out-of-pocket cost of these expenses. Employees do not need to report their FSA contributions or reimbursements on their federal income tax returns. However, they should retain documentation of eligible expenses and reimbursements in case of an IRS audit. HSAs are another type of tax-advantaged account designed to help individuals with High Deductible Health Plans (HDHPs) pay for healthcare expenses. Unlike FSAs, HSAs allow account holders to carry over their entire balance from year to year and have no use-it-or-lose-it rule. HRAs are employer-funded accounts that reimburse employees for eligible healthcare expenses. HRAs differ from FSAs in that they are solely funded by the employer, and unused funds may be carried over at the employer's discretion. While FSAs, HSAs, and HRAs all offer tax advantages for healthcare expenses, they differ in terms of eligibility, contribution limits, and rollover options. It is essential for individuals to understand the differences between these accounts to make informed decisions about their healthcare finances. To maximize the benefits of an FSA, employees should keep track of their eligible expenses and maintain organized records of receipts and other documentation. Submitting claims for FSA reimbursement should be done in a timely manner, following the guidelines and deadlines set by the FSA administrator. Employees should regularly monitor their FSA balances to ensure they are using the funds effectively and avoid forfeiting unused amounts at the end of the plan year. Flexible Spending Accounts offer significant benefits in managing healthcare and dependent care costs for individuals. By understanding the different types of FSAs, their rules and regulations, and the tax implications, employees can make informed decisions about how to use these accounts effectively. It is crucial for employees to be aware of the various FSA options available and determine which type best suits their unique needs and financial circumstances. To maximize the benefits of an FSA, employees should develop a system for tracking expenses, retaining receipts, and submitting claims promptly. Additionally, they should regularly monitor their FSA balances to ensure they are using the funds effectively and avoid forfeiting unused amounts at the end of the plan year. By staying organized and informed, employees can take full advantage of the tax savings and financial assistance provided by Flexible Spending Accounts.What Are Flexible Spending Accounts?

Eligibility and Enrollment in FSAs

Who Is Eligible for FSAs?

FSA Enrollment Process

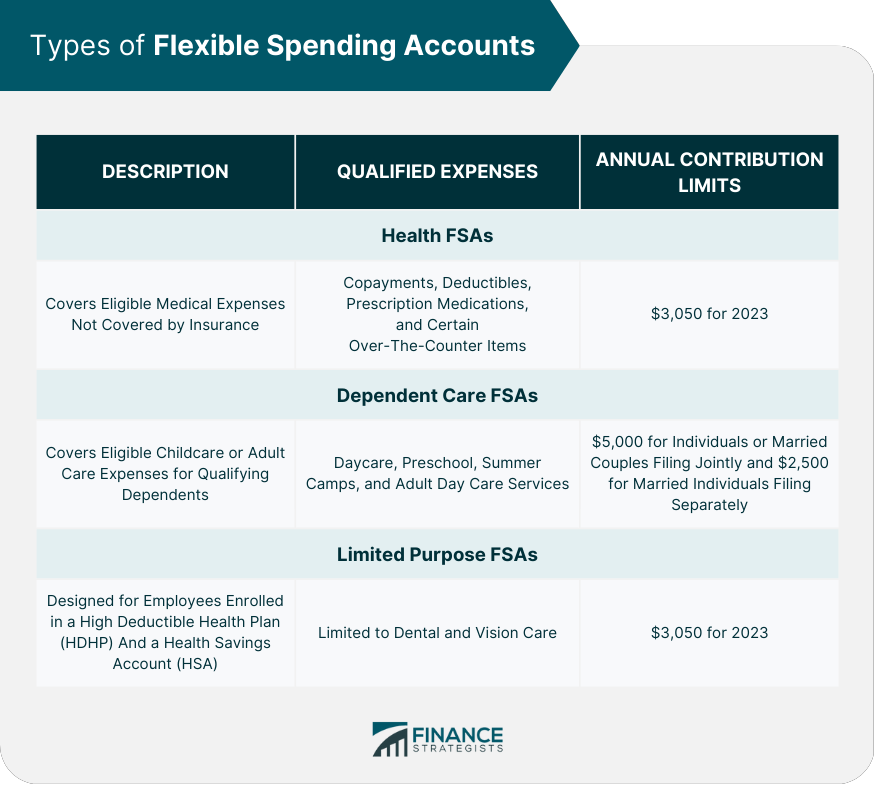

Types of Flexible Spending Accounts

Health FSAs

Qualified Medical Expenses

Health FSA Contribution Limits

Health FSA Reimbursement Process

Dependent Care FSAs

Qualified Dependent Care Expenses

Dependent Care FSA Contribution Limits

Dependent Care FSA Reimbursement Process

Limited Purpose FSAs

Qualified Dental and Vision Expenses

Limited Purpose FSA Contribution Limits

Limited Purpose FSA Reimbursement Process

FSA Rules and Regulations

Use-It-Or-Lose-It Rule

Carryover and Grace Period Provisions

Change in Election and Mid-Year Changes

Tax Implications of FSAs

Pre-tax Contributions

Tax Savings and Benefits

Reporting on Tax Returns

Comparison With Other Accounts

Health Savings Accounts (HSAs)

Health Reimbursement Arrangements (HRAs)

Differences and Similarities

Managing FSAs

Tracking Expenses and Receipts

Submitting Claims

Monitoring FSA Balances

Conclusion

Flexible Spending Accounts (FSAs) FAQs

A flexible spending account, or FSA, is a type of employer-sponsored benefit plan that allows employees to set aside pre-tax dollars to pay for eligible expenses such as medical and dental expenses, dependent care expenses, and certain other qualified expenses.

Employees can choose to have a portion of their pre-tax salary deducted and deposited into an FSA account. The funds in the account can then be used to pay for eligible expenses throughout the plan year. The advantage of an FSA is that the contributions are made pre-tax, which reduces the employee's taxable income and can lead to tax savings.

Eligible expenses for FSA reimbursement typically include medical and dental expenses not covered by insurance, such as copays, deductibles, and prescription drug costs. Other eligible expenses may include dependent care expenses, such as daycare costs for children or elder care expenses for a spouse or parent.

Some FSA plans have a "use-it-or-lose-it" rule, which means that any funds remaining in the account at the end of the plan year are forfeited. However, some plans offer a grace period or a carryover option that allows employees to use any remaining funds for a period of time after the end of the plan year.

Employees typically enroll in an FSA plan during the employer's open enrollment period. During this time, employees can elect to contribute a certain amount of pre-tax salary to the FSA for the upcoming plan year. It's important to carefully consider the amount to contribute, as any unused funds may be forfeited at the end of the plan year.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.