A hardship exemption refers to special provisions that exempt individuals from certain financial obligations during periods of financial difficulty. The financial obligations can range from paying taxes, student loans, health insurance penalties or making mandatory withdrawals from retirement accounts. The importance of hardship exemptions is paramount in financial planning as they offer a lifeline to individuals experiencing financial hardship due to unforeseen circumstances such as job loss, sudden illness, or natural disasters. By granting temporary relief from specific financial obligations, hardship exemptions provide a buffer that can aid individuals in regaining financial stability. They are a crucial tool in navigating financial crises, making them an important aspect to understand and consider when facing challenging economic circumstances. The financial criteria for hardship exemptions usually involve income thresholds. If your income is below a certain level, you may qualify for a hardship exemption, but the exact threshold varies depending on the specific type of exemption. Your debt-to-income ratio – how much you owe compared to how much you earn – can also play a role. A high debt-to-income ratio can demonstrate that you are experiencing financial hardship and may qualify you for an exemption. Exemptions may also be granted based on life-altering events such as a serious illness, death in the family, or job loss. These events can have a profound impact on your ability to meet your financial obligations. An unexpected expense like an emergency medical bill or a major car repair can also qualify you for a hardship exemption, as it could significantly disrupt your budget. Natural disasters that lead to massive property loss or severe financial strain can also make you eligible for a hardship exemption. Health Insurance Hardship Exemption: These exemptions are for people who cannot afford to pay the penalty for not having health insurance. Student Loan Hardship Exemption: With student loan hardship exemptions, borrowers facing financial hardship can defer their loan payments or adjust their repayment plan. Tax Hardship Exemption: If you're unable to pay your tax bill, the IRS may consider your account as currently not collectible and delay collection until your financial condition improves. Retirement Account Hardship Exemption: This allows individuals facing severe financial hardship to withdraw funds from their retirement accounts without the usual penalties. To apply for a hardship exemption, you typically need to provide documents that prove your financial hardship, such as pay stubs, bank statements, or medical bills. Hardship exemption applications often have specific timeframes and deadlines. It's important to apply as soon as you realize you need the exemption. Your application may be accepted, denied, or require additional information. If accepted, you’ll be exempt from the financial obligation for a specified period. Short-Term Financial Impact: In the short term, a hardship exemption can provide immediate relief from financial strain. It can help free up resources to cover basic needs or other pressing debts. Long-Term Financial Impact: The impact of a hardship exemption can vary. It can provide a pathway to financial recovery, but it may also lead to future financial obligations, like repaying deferred debts or taxes. Impact on Credit Score: In some cases, a hardship exemption could affect your credit score. It depends on how the organization handling your exemption reports it to the credit bureaus. Different government agencies have policies regarding hardship exemptions. For instance, the IRS has detailed criteria for tax hardship exemptions, while the Department of Education covers student loan exemptions. Policies regarding hardship exemptions have changed over time, usually in response to economic conditions. For example, during the COVID-19 pandemic, many policies were adjusted to provide greater relief for those facing financial hardship. As economic conditions and government priorities change, we can expect ongoing adjustments to hardship exemption policies. It is vital to stay informed about these changes to take full advantage of available relief options. It's important to proactively manage your finances and have a solid plan in place if you need to apply for a hardship exemption. This includes building an emergency fund, reducing unnecessary expenses, and seeking professional advice. There are legal aspects to consider when applying for a hardship exemption, such as potential implications for future financial obligations or legal disputes. Therefore, it's recommended to consult with a legal advisor or a financial counselor familiar with hardship exemptions. Strategies may include negotiating with creditors, consolidating debts, budgeting effectively, and improving financial literacy. Financial counselors can play a crucial role in helping individuals understand and navigate the complexities of hardship exemptions. They can provide advice tailored to your specific circumstances and help you make informed decisions. Reliable financial counseling can be found through non-profit credit counseling agencies, government programs, or certified professionals. Ensure the counselor you choose has proper credentials and a good reputation. Financial counseling can help you understand your options, make a plan, and potentially negotiate better terms for your hardship exemption. It can be an invaluable resource during a difficult financial time. A hardship exemption can be a financial lifesaver for individuals in trying circumstances. It offers temporary relief from specific financial obligations like taxes, student loans, health insurance penalties, or retirement account withdrawals, providing a pathway to regain financial stability. Qualifying for such an exemption depends on various factors, such as income thresholds, debt-to-income ratios, and life-altering events. As these exemptions may impact your credit score and future financial obligations, strategic financial planning, legal considerations, and professional advice are essential. Government policies guide hardship exemptions, emphasizing the need to stay informed about policy changes. Reliable financial counseling can assist in understanding your options and potentially negotiating better terms, thereby being an invaluable resource in a difficult financial time. Hardship exemptions serve as a vital tool in managing financial crises, requiring careful consideration and proactive management.What Is a Hardship Exemption?

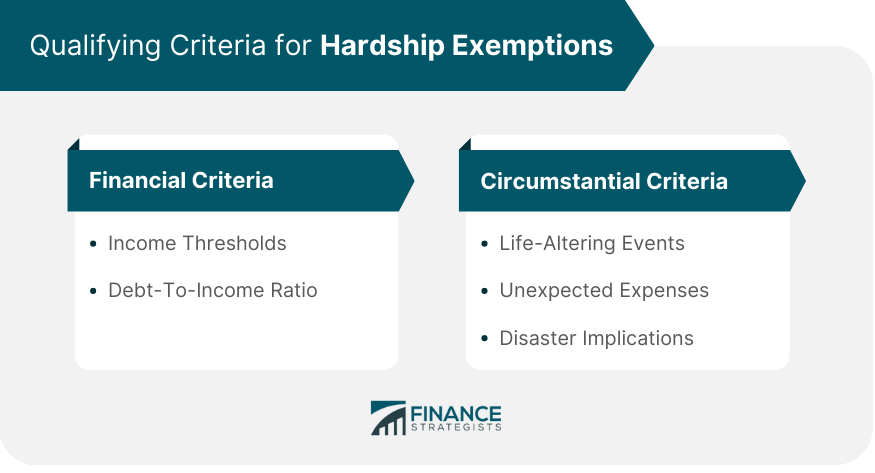

Qualifying Criteria for Hardship Exemptions

Financial Criteria

Income Thresholds

Debt-To-Income Ratio

Circumstantial Criteria

Life-Altering Events

Unexpected Expenses

Disaster Implications

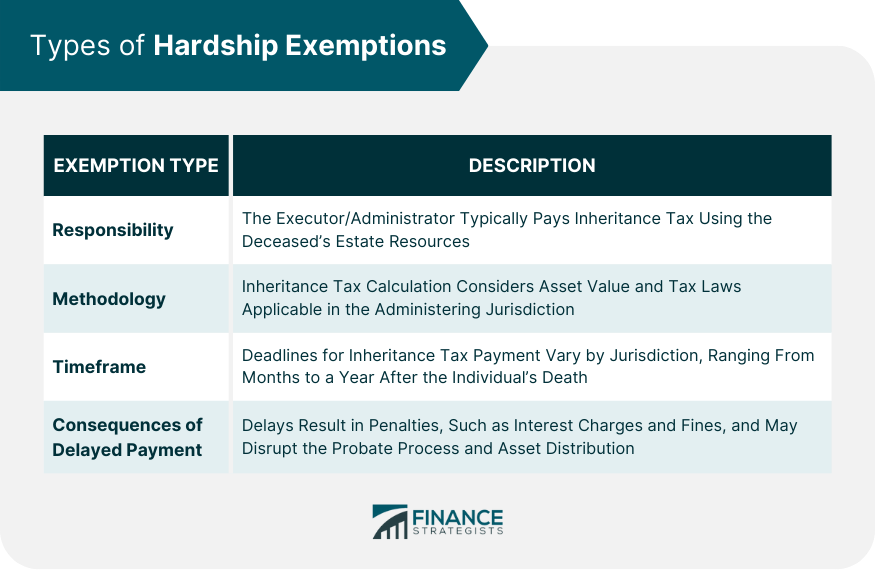

Types of Hardship Exemptions

Application Process for Hardship Exemption

Documentation Requirements

Timeframes and Deadlines

Possible Outcomes of an Application

Impact of Hardship Exemption on Individual Finances

Hardship Exemption and Government Policies

Current Policies Regarding Hardship Exemption

Past Changes in Policies

Potential Future Policies

Best Practices for Managing Hardship Exemption

Financial Planning Tips for Hardship Exemption

Legal Considerations

Strategies to Minimize Financial Impact

Hardship Exemption and Financial Counseling

Role of Financial Counselors in Hardship Exemption

How to Find Reliable Financial Counseling

The Benefit of Financial Counseling for Hardship Exemption

Final Thoughts

Hardship Exemption FAQs

A hardship exemption is a special provision that exempts individuals from certain financial obligations when they're facing financial difficulties. Benefits include temporary relief from payments such as student loans, tax bills, health insurance penalties, or early withdrawal penalties from retirement accounts.

The qualifying criteria for a hardship exemption can vary, but generally, they are based on financial and circumstantial criteria. Financial criteria include low-income or high debt-to-income ratios, while circumstantial criteria might include life-altering events, unexpected expenses, or natural disasters.

The impact of a hardship exemption on your credit score depends on how the organization handling your exemption reports it to the credit bureaus. In some cases, it could have a negative impact if the lender reports reduced or missed payments, while in others, it may have no impact if the hardship arrangement is not reported.

Government policies play a significant role in defining the rules and guidelines for hardship exemptions. These policies can dictate the qualifying criteria, application process, and potential financial impact of the exemption. They also adapt to changes in the economy and societal needs.

Financial counselors can help individuals navigate the complexities of hardship exemptions. They can provide advice tailored to your specific circumstances, help you understand your options, assist in the application process, and even potentially negotiate better terms for your hardship exemption.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.