A long-term care rider is an optional add-on to a life insurance policy that provides coverage for long-term care expenses, such as nursing home care or in-home care, in the event of a chronic illness or disability. It allows policyholders to access a portion of their life insurance benefits to pay for long-term care expenses, helping to protect their assets and financial well-being. A long-term care rider typically covers a range of care services, including: Nursing home care: Assistance with daily living activities and medical care in a skilled nursing facility. Assisted living facility care: Support with daily living activities in a residential setting that offers a combination of housing, personal care services, and healthcare. Home health care: Professional medical and non-medical care provided in the individual's home. Adult day care: Community-based programs that offer social, health, and therapeutic services in a group setting during daytime hours. Long-term care riders offer various options for the duration of benefits and benefit amounts: Benefit period options: The length of time that benefits are payable, typically ranging from two to six years or a lifetime benefit. Daily or monthly benefit amounts: The amount of money paid out for covered long-term care services, either on a daily or monthly basis. Maximum lifetime benefits: The total amount of money that the policy will pay for long-term care services over the lifetime of the insured. Insurers often have age and health requirements for individuals to qualify for a long-term care rider. Generally, applicants must be within a certain age range, such as between 40 and 85 years old. Additionally, applicants must meet certain health criteria, as determined by the insurer's underwriting process. The underwriting process for a long-term care rider typically involves a review of the applicant's medical history and may include a medical exam, cognitive assessment, or telephone interview. The underwriter may also request medical records from the applicant's healthcare providers. Long-term care riders may have exclusions and limitations, such as pre-existing condition exclusions or waiting periods for certain conditions. It is essential to review the policy's terms and conditions to understand any potential coverage limitations. To activate the benefits of a long-term care rider, the insured must experience a qualifying event, such as: Cognitive impairment: A decline in cognitive function, such as Alzheimer's disease or dementia, which requires supervision or assistance with daily activities. Activities of daily living (ADL) limitations: The insured is unable to perform a certain number of ADLs without assistance, such as bathing, dressing, eating, transferring, toileting, or continence. Many long-term care riders include a waiting period, or elimination period, before benefits are paid. This period typically ranges from 30 to 180 days, during which the insured must receive qualifying long-term care services. Long-term care rider benefits may be coordinated with other insurance policies, such as Medicare or private long-term care insurance. Additionally, benefits may be coordinated with government programs, such as Medicaid, to ensure that the insured does not receive duplicate benefits. The cost of a long-term care rider depends on several factors, including: The insured's age The insured's age and health status at the time of application The benefit period and amount selected The waiting period before benefits are paid Any additional features or riders included in the policy There are various premium payment options for long-term care riders, such as: Level premiums: The insured pays a fixed premium amount for the life of the policy or until a specified age. Single premium: The insured pays a one-time lump sum for the long-term care rider. Limited pay: The insured pays premiums for a specified number of years, such as 10 or 20 years. Long-term care rider premiums may be tax-deductible, depending on the insured's age and the policy's qualification as a tax-qualified long-term care insurance contract. Additionally, long-term care benefits received from the rider are generally tax-free, up to certain limits established by the Internal Revenue Service (IRS). Some of the advantages of adding a long-term care rider to a life insurance policy include: Financial protection against the high costs of long-term care services Flexibility in choosing the type, duration, and amount of long-term care coverage Potential tax benefits for premium payments and benefits received Preservation of the insured's assets and estate for beneficiaries Some potential disadvantages of a long-term care rider include: Additional premium costs for the rider Limited coverage options compared to standalone long-term care insurance policies The possibility that the insured may not need long-term care services, resulting in unused benefits A standalone long-term care insurance policy offers more comprehensive coverage options than a rider attached to a life insurance policy. These policies often provide greater flexibility in benefit amounts, durations, and inflation protection options. A chronic illness rider is another option for individuals seeking long-term care coverage. This rider allows the insured to access a portion of their life insurance death benefit to pay for qualified long-term care expenses. Some individuals may choose to self-fund their long-term care expenses by saving and investing throughout their working years. This approach requires careful financial planning and disciplined saving habits to ensure sufficient funds are available to cover potential long-term care costs. Medicaid is a government program that provides health coverage for low-income individuals, including long-term care services. However, qualifying for Medicaid requires meeting strict income and asset limits, and coverage may be limited in terms of available services and providers. In conclusion, a long-term care rider is an optional add-on to a life insurance policy that provides coverage for long-term care expenses in the event of a chronic illness or disability. This rider offers various options for the duration of benefits and benefit amounts, and eligibility requirements include age and health criteria. The activation of benefits requires the occurrence of qualifying events such as cognitive impairment or limitations in activities of daily living. The cost of a long-term care rider depends on factors such as the insured's age and health status, benefit period, and waiting period. Adding a long-term care rider to a life insurance policy offers financial protection against the high costs of long-term care services, flexibility in coverage options, and potential tax benefits. However, it also involves additional premium costs and limited coverage options compared to standalone long-term care insurance policies. Standalone long-term care insurance or life insurance with a chronic illness rider are alternative options for individuals seeking long-term care coverage.What Is a Long-Term Care Rider?

Features of Long-Term Care Riders

Types of Long-Term Care Coverage Provided

Duration and Benefit Amounts

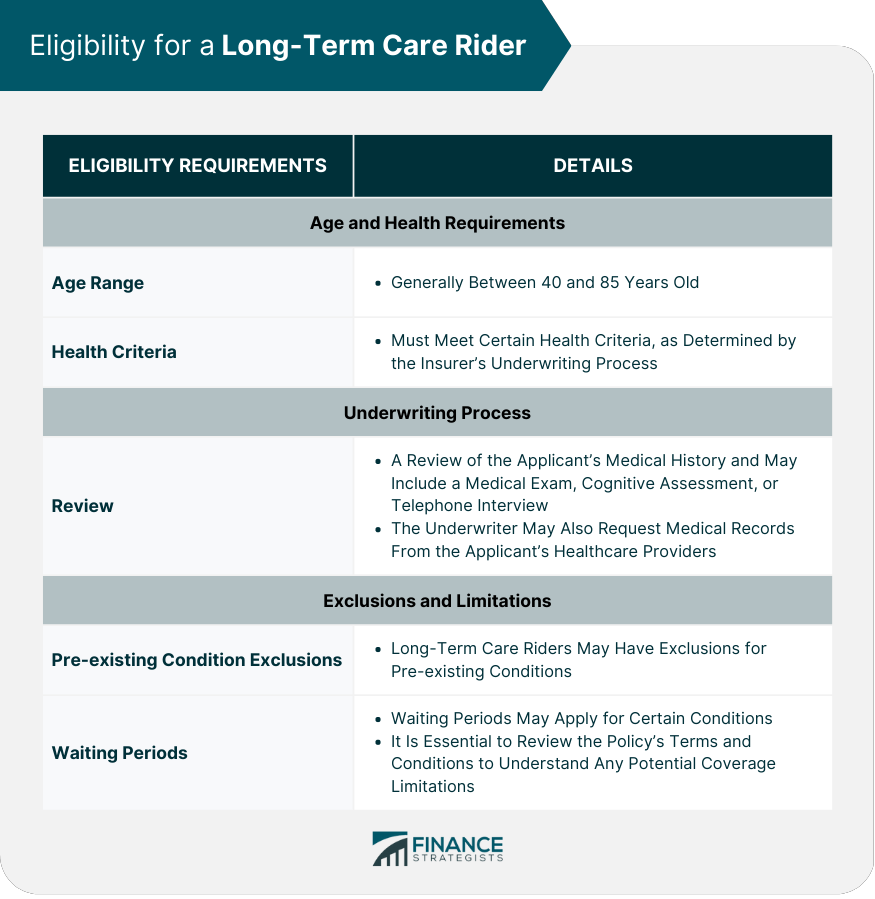

Eligibility for a Long-Term Care Rider

Age and Health Requirements

Underwriting Process

Exclusions and Limitations

Activation of Long-Term Care Rider Benefits

Qualifying Events

Benefit Waiting Period

Coordination With Other Insurance Policies and Government Programs

Cost of Long-Term Care Riders

Factors Affecting the Cost of the Rider

Premium Payment Options

Tax Implications

Pros and Cons of Adding a Long-Term Care Rider

Advantages of a Long-Term Care Rider

Disadvantages of a Long-Term Care Rider

Alternatives to Long-Term Care Riders

Standalone Long-Term Care Insurance

Life Insurance With a Chronic Illness Rider

Self-Funding Long-Term Care Expenses

Government Programs, Such as Medicaid

Conclusion

Long-Term Care Rider FAQs

A long-term care rider is an optional add-on to a life insurance policy that provides coverage for long-term care expenses, such as nursing home care or in-home care, in the event of a chronic illness or disability.

If the policyholder becomes unable to perform certain activities of daily living, such as bathing or dressing, or if they are diagnosed with a chronic illness, the long-term care rider can be activated. It provides benefits to cover long-term care expenses, up to a certain limit.

Anyone who purchases a life insurance policy that offers a long-term care rider as an optional add-on can choose to include it in their policy. However, eligibility requirements may vary among insurance companies.

A long-term care rider is not necessary for everyone, but it can be a valuable addition to a life insurance policy for individuals who want to plan ahead for potential long-term care expenses. It provides an additional layer of financial protection and can help prevent the depletion of personal assets.

The cost of a long-term care rider can vary depending on the policyholder's age, health status, and the amount of coverage they choose. Typically, adding a long-term care rider to a life insurance policy will increase the overall cost of the policy, but the benefits of having long-term care coverage can outweigh the added expense.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.