Insurance deductibles are the amount of money a policyholder must pay out-of-pocket before the insurance company covers the remaining costs of a claim. Deductibles are a crucial aspect of insurance policies and help determine the division of financial responsibility between the policyholder and the insurance company. Deductibles serve several purposes in insurance policies, including reducing the risk of moral hazard, encouraging policyholders to be more careful, and lowering the number of small claims filed. They also enable insurance companies to offer lower premiums by sharing some of the financial risk with policyholders. Deductibles are common in various insurance policies, such as homeowners, auto, health, and business insurance. When filing a claim, the policyholder is responsible for paying the deductible amount before the insurance company covers the remaining costs. The deductible amount can vary depending on the policy and the specific claim. Once the policyholder pays the deductible, the insurance company is responsible for covering the remaining costs of the claim up to the policy limits. There is generally an inverse relationship between deductibles and premiums: higher deductibles typically result in lower premiums, while lower deductibles usually lead to higher premiums. This is because policyholders who choose higher deductibles are taking on more financial risk, which reduces the insurance company's potential payout. A flat dollar amount deductible is a fixed amount that the policyholder must pay out-of-pocket before the insurance company covers the remaining costs of a claim. This is the most common type of deductible. A percentage deductible is based on a percentage of the insured property's value. For example, a homeowner with a 2% deductible on a $200,000 home would be responsible for the first $4,000 of a claim. A disappearing deductible is a type of deductible that decreases over time, provided the policyholder does not file any claims. This can be an incentive for policyholders to maintain a good claims history. When selecting a deductible, consider your financial resources and risk tolerance. Higher deductibles can result in lower premiums but may require more significant out-of-pocket expenses in the event of a claim. Consider the value of your insured assets when choosing a deductible. If your assets have a high value, you may want a lower deductible to ensure adequate coverage. Evaluate the likelihood of filing claims and the potential severity of those claims. If you anticipate frequent or severe claims, you may want to choose a lower deductible to minimize out-of-pocket expenses. Homeowners insurance deductibles typically apply to both property and liability coverage. Policyholders can choose between flat dollar amount and percentage deductibles. Auto insurance deductibles usually apply to collision and comprehensive coverage. Policyholders can choose from a range of deductible amounts based on their financial resources and risk tolerance. Health insurance deductibles are the amount policyholders must pay for covered healthcare services before the insurance company starts to pay. Deductibles can vary widely, and some policies may have separate deductibles for specific services or medications. Business insurance deductibles can apply to various coverages, such as property, liability, and workers' compensation. Deductibles for business insurance policies can be structured as flat dollar amounts or percentages, depending on the specific policy and the nature of the risk being insured. Creating an emergency fund can help policyholders cover deductible expenses in the event of a claim. This financial cushion can enable policyholders to choose higher deductibles and benefit from lower premiums. Policyholders can adjust their coverage limits to strike a balance between deductible amounts and the extent of coverage provided. Higher coverage limits may warrant a higher deductible, while lower limits may necessitate a lower deductible. Some insurance companies offer discounts for policyholders who bundle multiple insurance policies, such as homeowners and auto insurance. Bundling policies can result in lower overall premiums, making it more feasible to choose lower deductibles. Regularly reviewing and updating insurance policies can help policyholders ensure their coverage remains adequate and their deductibles are aligned with their current financial situation and risk tolerance. Deductibles do not always apply to every claim. Some insurance policies may have specific coverages with no deductible or a separate deductible structure. Deductibles are not the only out-of-pocket expenses policyholders may incur. Co-payments, co-insurance, and out-of-pocket maximums are other costs that may be associated with insurance policies, particularly health insurance. While there is generally an inverse relationship between deductibles and premiums, other factors, such as coverage limits, discounts, and the policyholder's claims history, can also impact premium costs. Understanding insurance deductibles is essential for policyholders to make informed decisions about their insurance coverage and financial responsibilities. By grasping the concept of deductibles and their role in insurance policies, policyholders can better navigate the insurance landscape. By considering factors such as financial resources, risk tolerance, and the value of insured assets, policyholders can make informed decisions about deductible amounts that strike the right balance between coverage and cost. Ultimately, the goal is to find the optimal balance between deductibles and premiums to ensure adequate coverage while minimizing financial risk. By understanding the relationship between deductibles and premiums, policyholders can make educated choices that protect their assets and financial well-being.What Are Insurance Deductibles?

How Insurance Deductibles Work

Policyholder's Financial Responsibility

Insurance Company's Financial Responsibility

Relationship Between Deductibles and Premiums

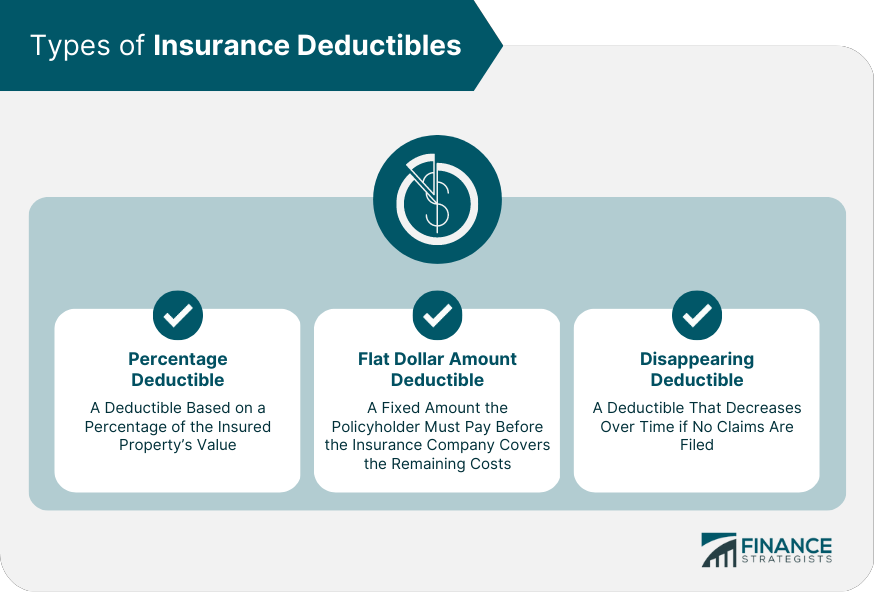

Types of Insurance Deductibles

Flat Dollar Amount Deductible

Percentage Deductible

Disappearing Deductible

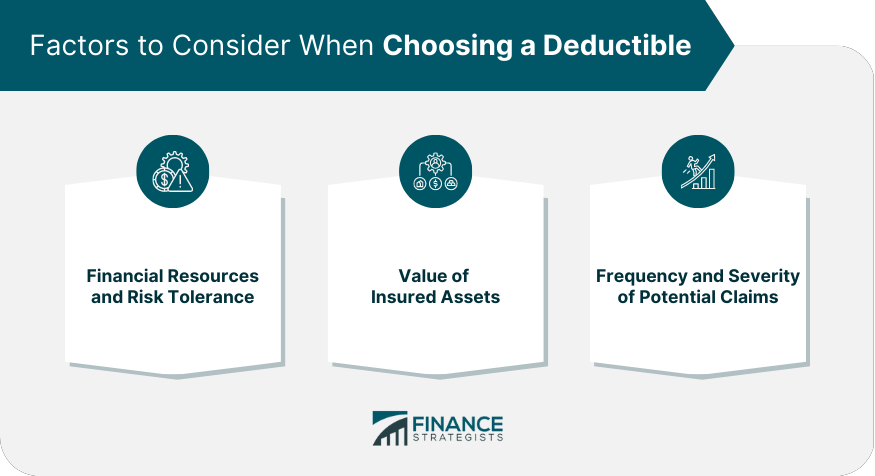

Factors to Consider When Choosing a Deductible

Financial Resources and Risk Tolerance

Value of Insured Assets

Frequency and Severity of Potential Claims

Deductibles in Different Types of Insurance Policies

Homeowners Insurance Deductibles

Auto Insurance Deductibles

Health Insurance Deductibles

Business Insurance Deductibles

Strategies for Managing Insurance Deductibles

Building an Emergency Fund

Adjusting Coverage Limits

Bundling Insurance Policies

Regularly Reviewing and Updating Insurance Policies

Common Misconceptions About Insurance Deductibles

Deductibles Apply to Every Claim

Deductibles Are the Only Out-Of-Pocket Expenses

Lower Deductibles Always Result in Higher Premiums

Conclusion

Insurance Deductibles FAQs

An insurance deductible is the amount that a policyholder must pay out of pocket before their insurance coverage begins to pay for a covered claim. For example, if a policy has a $500 deductible and the policyholder files a claim for $1,000 in damages, they would pay the first $500, and the insurance company would cover the remaining $500.

Generally, choosing a higher deductible will result in a lower insurance premium. This is because the policyholder is taking on a greater portion of the risk and potential costs associated with a claim. Insurance companies often offer various deductible options, and policyholders can choose the one that best fits their budget and risk tolerance.

No, insurance deductibles apply to each covered claim filed by the policyholder. For example, if a policyholder files two separate claims in a year, they will need to pay the deductible for each claim before the insurance company covers the rest of the expenses.

Some insurance policies may offer a zero-deductible option, but it may result in a higher insurance premium. Additionally, some types of insurance, such as health insurance, may have mandatory deductibles under federal law.

No, not all insurance policies have deductibles. For example, liability insurance policies typically do not have deductibles because they do not cover damages to the policyholder's own property or person. However, most property and casualty insurance policies, such as auto, home, and renters insurance, have deductibles.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.