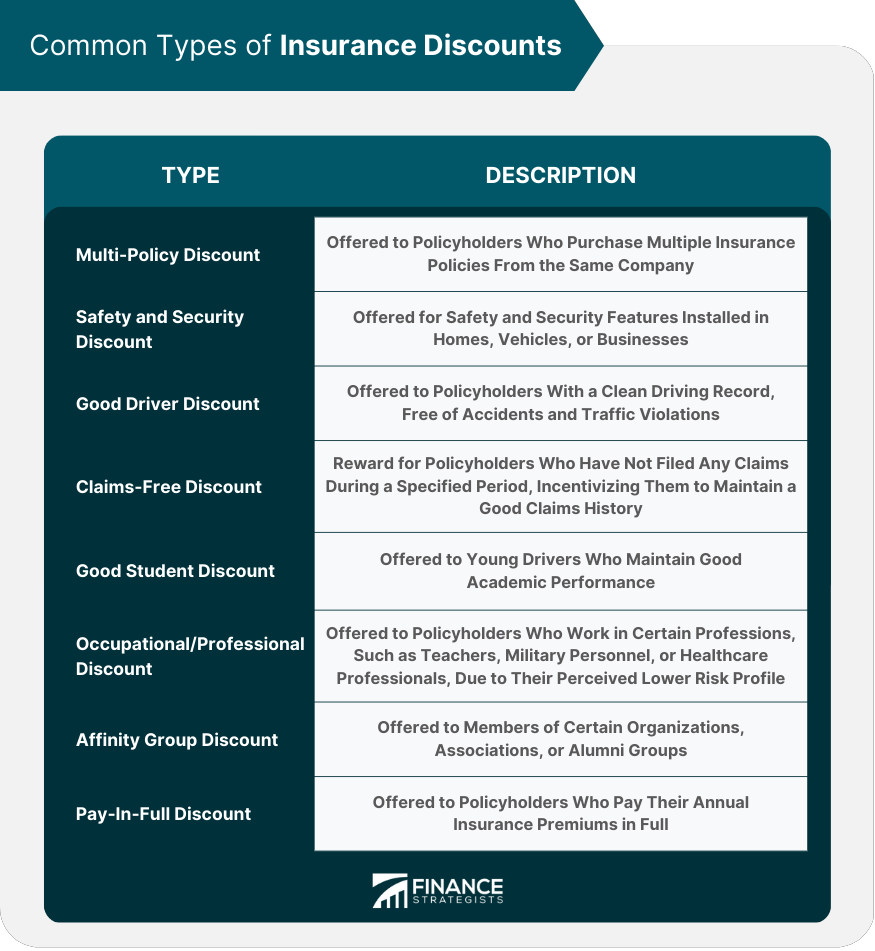

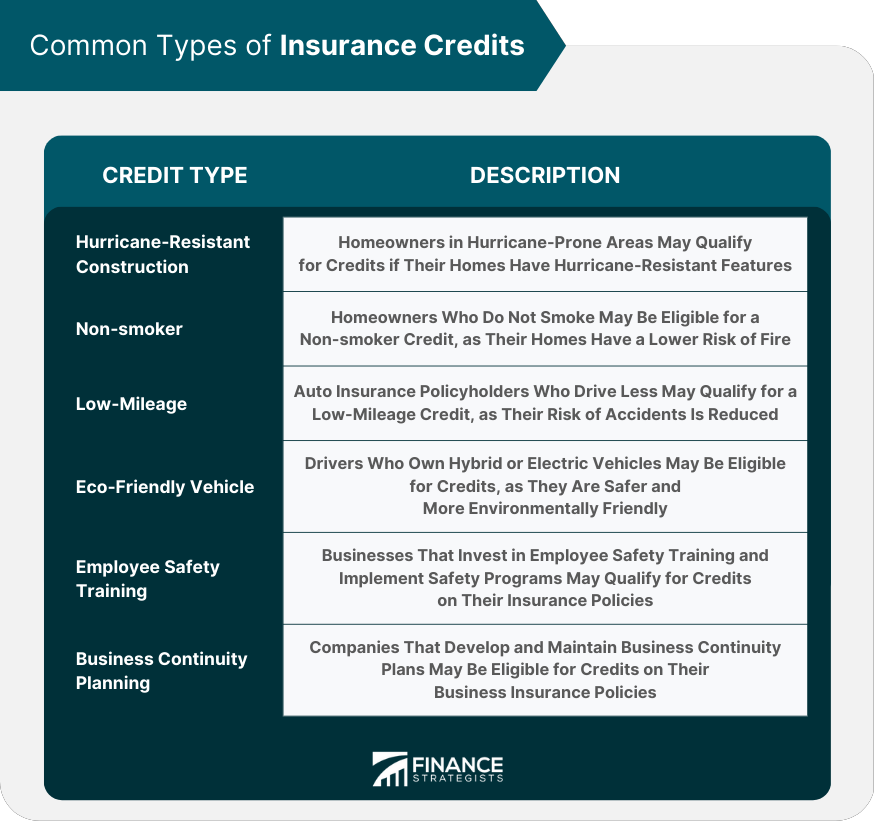

Insurance discounts and credits are reductions in premium costs offered by insurance companies to policyholders who meet certain criteria or exhibit specific behaviors. These incentives aim to lower insurance costs for policyholders while encouraging responsible risk management. Discounts and credits serve various purposes in insurance policies, such as promoting customer loyalty, rewarding responsible behavior, and encouraging the adoption of safety measures that help reduce claims. Most types of insurance policies, including auto, homeowners, and business insurance, offer discounts and credits to eligible policyholders. Multi-policy discounts are offered to policyholders who purchase multiple insurance policies, such as auto and homeowners insurance, from the same company. This discount encourages customers to consolidate their insurance needs with one provider. Insurance companies may offer discounts for safety and security features installed in homes, vehicles, or businesses. Examples include security systems, fire alarms, sprinkler systems, and anti-theft devices. Auto insurance providers often offer good driver discounts to policyholders with a clean driving record, free of accidents and traffic violations. Insurance companies may reward policyholders who have not filed any claims during a specified period with a claims-free discount. This discount incentivizes policyholders to maintain a good claims history. Young drivers who maintain good academic performance may qualify for a good student discount on their auto insurance policy. Insurance companies may offer discounts to policyholders who work in certain professions, such as teachers, military personnel, or healthcare professionals, due to their perceived lower risk profile. Members of certain organizations, associations, or alumni groups may be eligible for affinity group discounts on their insurance policies. Policyholders who pay their annual insurance premiums in full, rather than in installments, may be eligible for a pay-in-full discount. Homeowners in hurricane-prone areas may qualify for credits if their homes are built or retrofitted with hurricane-resistant features, such as reinforced roofs and impact-resistant windows. Homeowners who do not smoke may be eligible for a non-smoker credit, as their homes have a lower risk of fire damage. Auto insurance policyholders who drive fewer miles than the average driver may qualify for a low-mileage credit, as their reduced time on the road decreases their risk of accidents. Drivers who own hybrid or electric vehicles may be eligible for eco-friendly vehicle credits, as these vehicles are often considered safer and more environmentally friendly. Businesses that invest in employee safety training and implement safety programs may qualify for credits on their business insurance policies. Companies that develop and maintain business continuity plans, which help minimize disruptions and losses in the event of a disaster, may be eligible for credits on their business insurance policies. To qualify for discounts and credits, policyholders must first understand the eligibility criteria set by their insurance provider. This may include meeting specific requirements, such as installing safety features or maintaining a good driving record. Policyholders can increase their eligibility for discounts and credits by implementing safety and risk mitigation measures, such as installing security systems in their homes, taking defensive driving courses, or implementing workplace safety programs. Maintaining a good claims history, free of frequent or severe claims, can increase a policyholder's eligibility for discounts and credits, as it demonstrates responsible behavior and lower risk. Policyholders should ask their insurance agent or company representative about available discounts and credits, as some may not be automatically applied to their policy. Insurance discounts and credits can significantly reduce policyholders' premium costs, making insurance coverage more affordable and accessible. By offering discounts and credits for responsible behavior, insurance companies incentivize policyholders to adopt safety measures and maintain good risk management practices. Discounts and credits can help promote customer loyalty by rewarding policyholders for their continued business and responsible behavior. Policyholders should regularly review their insurance policies to ensure they are taking advantage of all available discounts and credits. By comparing different insurance providers and their policy offerings, policyholders can identify the best discounts and credits available to them. Policyholders should update their personal information and coverage needs with their insurance provider to ensure they are eligible for all applicable discounts and credits. Bundling multiple insurance policies with the same provider can often result in significant discounts, making insurance coverage more affordable. Insurance discounts and credits may vary by insurance provider, and eligibility requirements can differ between companies. Policyholders should carefully review their policy documents and consult with their insurance agent or company representative for information on available discounts and credits. Some insurance companies may impose limits on the total amount of discounts or credits that can be applied to a policy, which could affect the overall premium reduction. In some cases, discounts and credits may be contingent on the policyholder selecting specific coverage or deductible options. Policyholders should consider the overall impact of these choices on their insurance coverage and financial responsibilities. Understanding insurance discounts and credits is essential for policyholders seeking to lower their premium costs while maintaining adequate coverage. By familiarizing themselves with the various discounts and credits available, policyholders can make informed decisions about their insurance policies. Policyholders should actively seek out and take advantage of available discounts and credits by implementing safety measures, maintaining good risk management practices, and regularly reviewing their insurance policies. Ultimately, the goal is to find the optimal balance between cost and coverage by leveraging available discounts and credits without sacrificing necessary protection. By understanding the various discounts and credits available, policyholders can make educated choices that safeguard their assets and financial well-being.What Are Insurance Discounts and Credits?

Common Types of Insurance Discounts

Multi-Policy Discount

Safety and Security Feature Discount

Good Driver Discount

Claims-Free Discount

Good Student Discount

Occupational and Professional Discounts

Affinity Group Discounts

Pay-In-Full Discount

Common Types of Insurance Credits

Homeowners Insurance Credits

Hurricane-Resistant Construction Credit

Non-smoker Credit

Auto Insurance Credits

Low-Mileage Credit

Eco-Friendly Vehicle Credit

Business Insurance Credits

Employee Safety Training Credit

Business Continuity Planning Credit

How to Qualify for Insurance Discounts and Credits

Understanding Eligibility Criteria

Implementing Safety and Risk Mitigation Measures

Maintaining a Good Claims History

Inquiring About Available Discounts and Credits

The Impact of Discounts and Credits on Premiums

Reducing Insurance Costs

Encouraging Responsible Behavior

Promoting Customer Loyalty

Tips for Maximizing Insurance Discounts and Credits

Regularly Reviewing Insurance Policies

Comparing Insurance Providers and Policy Offerings

Updating Personal Information and Coverage Needs

Bundling Insurance Policies

Limitations and Restrictions of Insurance Discounts and Credits

Availability and Eligibility Requirements

Maximum Discount or Credit Limits

Potential Impact on Coverage and Deductible Options

Conclusion

Insurance Discounts and Credits FAQs

Common types of insurance discounts include safe driver discounts, multi-policy discounts, good student discounts, senior discounts, and loyalty discounts. These discounts can vary by insurance company and policy type.

To qualify for a safe driver discount, you typically need to have a clean driving record with no accidents or moving violations within a certain time frame. Some insurance companies may also require you to complete a defensive driving course.

Yes, many insurance companies offer discounts for home security systems, smoke detectors, and other safety features. These discounts can vary by insurance company and policy type.

A credit-based insurance score is a score that is based on your credit history and is used by some insurance companies to determine your insurance rates. This score takes into account factors such as your credit history, payment history, and debt-to-credit ratio.

Yes, some insurance companies offer discounts for being a member of certain organizations such as alumni associations, professional associations, or trade groups. Check with your insurance company to see if they offer any discounts for organizations you are a member of.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.