An insurance underwriter is a professional responsible for evaluating the risks involved in insuring people and assets. They determine whether to provide insurance coverage, and if so, the terms and conditions of the policy, including the premium rates. Underwriters play a crucial role in the insurance industry, ensuring that insurers maintain a balance between writing policies and maintaining financial stability. Insurance underwriters use their expertise and analytical skills to assess applications for insurance coverage. By examining various factors, such as the applicant's health, age, and occupation, underwriters determine the likelihood of a claim being filed and calculate the appropriate premium to charge. This helps insurers maintain profitability while offering competitive rates to their customers. Insurance underwriting is a vital function in the insurance industry, as it helps insurers determine the risks they are willing to assume and the appropriate pricing for policies. This process enables insurers to offer coverage at competitive rates while ensuring they maintain financial stability. Underwriting is essential for the long-term success and viability of insurance companies, as it helps them avoid excessive losses and maintain a healthy balance sheet. Without proper underwriting, insurers would be unable to accurately assess the risks associated with insuring various individuals and assets. This could lead to significant financial losses, as they would not have a clear understanding of the potential costs associated with claims. In turn, this could jeopardize the financial health of the insurance company and its ability to pay claims to policyholders. One of the primary responsibilities of an insurance underwriter is to review and assess insurance applications. This involves examining the information provided by applicants, including personal details, financial history, and any other relevant factors that may impact their risk profile. Underwriters must carefully evaluate each application to determine the potential risks and whether the applicant meets the insurer's underwriting guidelines. In the assessment process, underwriters may also request additional information from the applicant or consult with other professionals, such as medical professionals or engineers, to gain a clearer understanding of the risks involved. Once the underwriter has a comprehensive understanding of the applicant's risk profile, they can make an informed decision about whether to offer coverage and under what terms. After assessing an insurance application, the underwriter must evaluate the risks associated with providing coverage to the applicant. This includes analyzing various factors, such as the applicant's age, occupation, medical history, and the value of the asset being insured. Based on this analysis, the underwriter will determine the appropriate coverage levels and policy terms to offer. Underwriters must strike a balance between offering competitive coverage options and ensuring that the insurer maintains financial stability. This involves making difficult decisions about whether to provide coverage to high-risk applicants, as well as setting appropriate limits and exclusions for each policy. Underwriters play a crucial role in managing the overall risk portfolio of the insurer, which is essential for maintaining profitability and long-term success. In order to effectively evaluate risks and make informed underwriting decisions, insurance underwriters must be adept at analyzing data and using various underwriting tools and techniques. This may include the use of statistical models, actuarial tables, and other quantitative methods to assess the likelihood of claims and potential losses. Underwriters must also stay up-to-date with industry trends, technological advancements, and emerging risks in order to make accurate risk assessments. This requires ongoing learning and professional development to ensure that underwriters have the most current knowledge and skills necessary to perform their job effectively. Once an underwriter has assessed an insurance application and evaluated the associated risks, they must make a final underwriting decision. This decision may involve accepting or rejecting the application, or offering coverage with specific terms and conditions. Underwriters must carefully consider the potential financial implications of their decisions, as well as the insurer's overall risk portfolio and underwriting guidelines. In some cases, underwriters may need to negotiate with insurance agents or brokers to find a mutually agreeable solution that balances the needs of the applicant with the insurer's risk management requirements. The underwriting decision-making process is a critical component of the insurance industry, as it helps insurers maintain profitability while offering competitive coverage options to their customers. Effective communication is an essential skill for insurance underwriters. They must regularly interact with insurance agents, brokers, and policyholders to obtain necessary information, clarify details, and explain underwriting decisions. Underwriters may also need to collaborate with other professionals, such as claims adjusters, risk managers, and legal experts, to ensure that policies are accurately written and comply with all relevant regulations. In addition, underwriters must be able to clearly explain their decisions and the reasoning behind them, as well as provide guidance on how applicants can improve their risk profile or secure more favorable coverage terms. Strong communication skills not only help underwriters perform their job more effectively but also contribute to building trust and maintaining positive relationships with agents, brokers, and policyholders. This ensures that the insurer's risk assessment and underwriting processes remain current, effective, and in compliance with industry standards and regulations. Underwriters may need to adjust guidelines to account for changes in the insurance market, emerging risks, or new legislation. Moreover, underwriters must continuously evaluate the effectiveness of their underwriting strategies and make adjustments as needed to maintain profitability and minimize losses. This involves analyzing claims data, identifying trends, and adjusting guidelines and procedures accordingly. Regularly updating underwriting guidelines and procedures is essential for maintaining the financial stability and long-term success of insurance companies. Insurance underwriters must ensure that their decisions and actions comply with all relevant legal and ethical standards. This includes adhering to industry regulations, privacy laws, and fair underwriting practices. Underwriters must be knowledgeable about the laws and regulations governing the insurance industry, as well as the ethical principles that guide their profession. Compliance with legal and ethical standards not only helps protect the insurer from potential legal issues but also promotes trust and confidence among policyholders and the general public. By adhering to these standards, insurance underwriters play a critical role in maintaining the integrity and reputation of the insurance industry. Life insurance underwriting involves assessing the risks associated with providing life insurance coverage to applicants. This typically includes evaluating factors such as the applicant's age, health, medical history, and lifestyle habits. Life insurance underwriters must determine the likelihood of the applicant passing away during the policy term and calculate the appropriate premium based on that risk. In some cases, life insurance underwriters may require applicants to undergo medical examinations or provide additional information to better assess their risk profile. The underwriting process for life insurance is crucial for ensuring that insurers can offer coverage at competitive rates while maintaining financial stability. Health insurance underwriting focuses on assessing the risks associated with providing health insurance coverage to applicants. This involves evaluating the applicant's medical history, current health status, and any pre-existing conditions. Health insurance underwriters must determine the likelihood of the applicant needing medical care and the potential costs associated with that care. Based on this risk assessment, health insurance underwriters will determine whether to offer coverage, and if so, the terms and conditions of the policy, including coverage limits and premium rates. Health insurance underwriting is essential for ensuring that insurers can provide affordable coverage options while managing the financial risks associated with medical claims. Property and casualty insurance underwriting involves assessing the risks associated with insuring various types of property, such as homes, vehicles, and businesses, as well as providing coverage for liability claims. Underwriters in this field must evaluate factors such as the value and condition of the property, its location, and the applicant's claims history. In addition, underwriters must consider the potential for liability claims, such as accidents, injuries, or property damage caused by the insured party. Property and casualty insurance underwriting plays a crucial role in ensuring that insurers can offer competitive coverage options while managing the financial risks associated with property and liability claims. A bachelor's degree is typically required for entry-level insurance underwriting positions. While there is no specific field of study required, degrees in finance, business, economics, or a related field are generally preferred. Some insurance companies may also consider applicants with degrees in mathematics or statistics, as these disciplines provide a strong foundation in the analytical skills necessary for underwriting. Additionally, taking coursework in insurance, risk management, or actuarial science can be beneficial for aspiring underwriters, as these subjects provide a solid understanding of the principles and practices of the insurance industry. On-the-job training is common for new insurance underwriters, allowing them to gain practical experience and develop their skills under the guidance of experienced professionals. This training may include learning about the company's underwriting guidelines and procedures, as well as gaining exposure to various types of insurance policies and coverage options. There are several professional certifications available for insurance underwriters, which can help demonstrate expertise and commitment to the profession. Some of the most recognized certifications include the Chartered Property Casualty Underwriter (CPCU), Associate in Commercial Underwriting (AU), and Associate in Personal Insurance (API) designations. Earning these certifications typically requires passing a series of exams and meeting continuing education requirements. Successful insurance underwriters possess a combination of analytical, communication, and decision-making skills. They must be able to carefully evaluate insurance applications, assess risk factors, and make informed underwriting decisions. Strong communication skills are also essential, as underwriters must be able to effectively interact with agents, brokers, policyholders, and other professionals. In addition to formal education and training, gaining experience in the insurance industry can be beneficial for aspiring underwriters. This may involve working in claims, customer service, or sales positions, which can provide valuable insight into the underwriting process and the overall functioning of the insurance industry. The first step in the insurance underwriting process is to assess the risks associated with providing coverage to an applicant. This involves reviewing the information provided on the insurance application, as well as any additional documentation that may be required, such as medical records or property appraisals. Underwriters must carefully analyze this information to determine the applicant's risk profile and the likelihood of a claim being filed. Risk assessment is a critical component of the underwriting process, as it helps insurers make informed decisions about whether to offer coverage and under what terms. When evaluating an insurance application, the underwriter goes beyond assessing the risks involved. They take into account the insurer's underwriting guidelines and overall risk portfolio to make an informed evaluation. This evaluation entails not only determining the coverage levels, policy terms, and premium rates suitable for the applicant's risk profile but also aligning them with the insurer's risk management requirements. Achieving this balance between competitive coverage options and maintaining the insurer's financial stability is crucial for underwriters. It necessitates meticulous consideration of the potential financial consequences associated with providing coverage. Additionally, it requires a deep understanding of the insurer's underwriting guidelines and risk management strategies to ensure that the overall risk exposure of the company remains within acceptable limits. Based on the risk assessment and evaluation, the underwriter will make a decision to either accept or reject the insurance application. If the application is accepted, the underwriter will determine the specific terms and conditions of the policy, including coverage limits, exclusions, and premium rates. In some cases, the underwriter may offer coverage with certain restrictions or modifications to the policy terms in order to better manage the risks associated with the applicant. If the underwriter decides to reject the application, they must provide a clear explanation for the decision and, if possible, offer guidance on how the applicant can improve their risk profile or secure more favorable coverage terms. Premiums are the cost of the insurance coverage and must be calculated based on the risk factors associated with the applicant and the coverage being offered. Underwriters use a variety of tools and techniques, such as actuarial tables and statistical models, to determine the appropriate premium rates for each policy. Setting accurate and competitive premiums is essential for ensuring the financial stability of the insurer and maintaining a balanced risk portfolio. By charging premiums that accurately reflect the risks associated with each policy, insurers can maintain profitability while offering coverage options that meet the needs of their customers. One of the significant challenges facing insurance underwriters is the emergence of new risks that may not be adequately addressed by existing underwriting guidelines and procedures. These emerging risks can arise from various sources, such as changes in demographics, social trends, or technological advancements. Underwriters must continually monitor and adapt to these emerging risks to ensure that their risk assessments and underwriting decisions remain accurate and effective. The rapid pace of technological advancements presents both opportunities and challenges for insurance underwriters. On one hand, advancements in data analytics, artificial intelligence, and machine learning can enhance the underwriting process by providing more accurate risk assessments and streamlined decision-making. However, these technologies also introduce new risks, such as cyber threats and the potential for increased liability associated with autonomous vehicles and smart devices. Insurance underwriters must stay informed about the latest technological developments and their potential implications for the insurance industry. They need to adapt their underwriting guidelines and procedures to address these evolving risks and capitalize on the opportunities presented by technological advancements. The insurance industry is becoming increasingly competitive, with new entrants and innovative business models challenging traditional insurers. This heightened competition puts pressure on insurance underwriters to offer more competitive coverage options and pricing while maintaining the financial stability of their companies. To stay competitive, underwriters must continually refine their risk assessment and underwriting strategies, as well as explore new tools and techniques to enhance their decision-making processes. This may include embracing data-driven approaches, leveraging advanced analytics, and exploring alternative risk transfer mechanisms. Insurance underwriters play a crucial role in the insurance industry, as they are responsible for assessing risks and making informed decisions about whether to offer coverage and under what terms. Their work involves a combination of analytical, communication, and decision-making skills, and they must adhere to strict underwriting guidelines and legal and ethical standards. Becoming an insurance underwriter typically requires a bachelor's degree, on-the-job training, and potentially professional certifications. Insurance underwriters face a range of challenges, such as emerging risks, rapid technological advancements, and increasing competition. To address these challenges and succeed in their roles, underwriters must continually adapt their approaches, stay informed about industry trends, and leverage new tools and techniques to enhance their risk assessment and decision-making capabilities.What Is an Insurance Underwriter?

Importance of an Insurance Underwriter

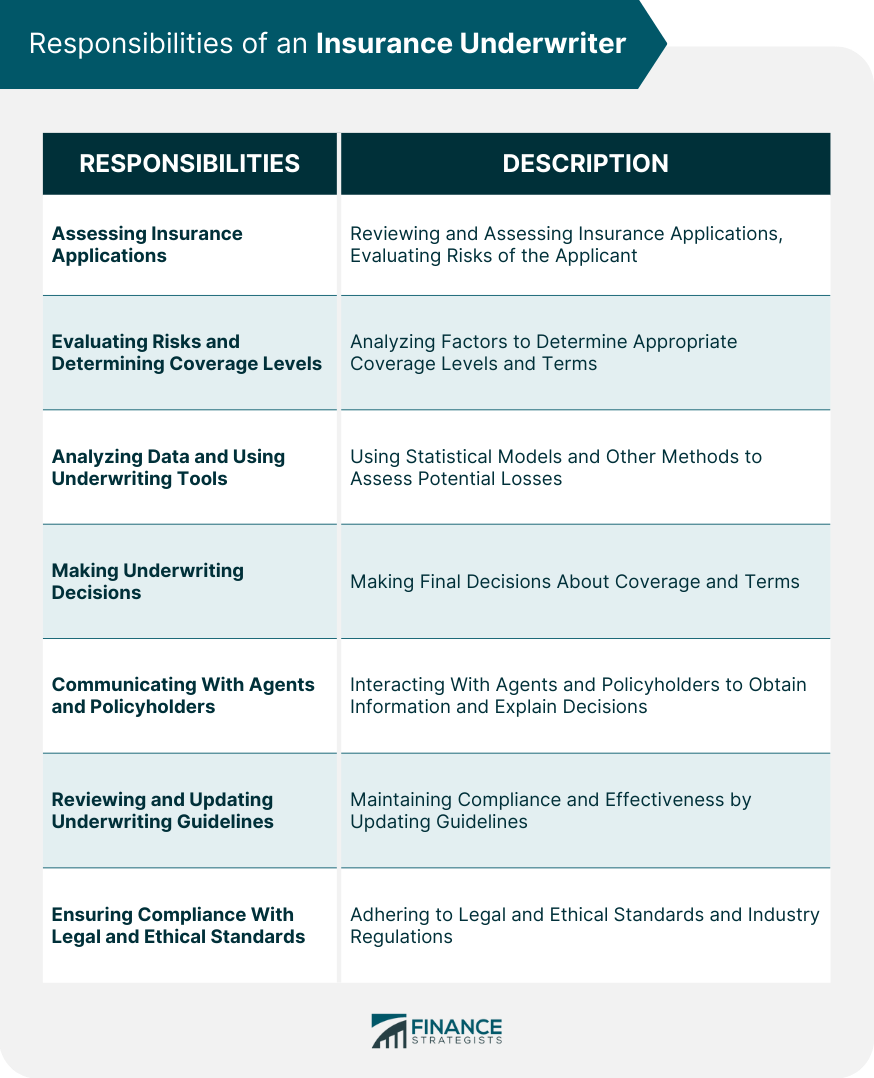

Responsibilities of an Insurance Underwriter

Assessing Insurance Applications

Evaluating Risks and Determining Coverage Levels

Analyzing Data and Using Underwriting Tools and Techniques

Making Underwriting Decisions

Communicating With Agents and Policyholders

Reviewing and Updating Underwriting Guidelines and Procedures

Ensuring Compliance With Legal and Ethical Standards

Types of Insurance Underwriting

Life Insurance Underwriting

Health Insurance Underwriting

Property and Casualty Insurance Underwriting

How to Become an Insurance Underwriter

Educational Requirements

Training and Certifications

Skills and Experience

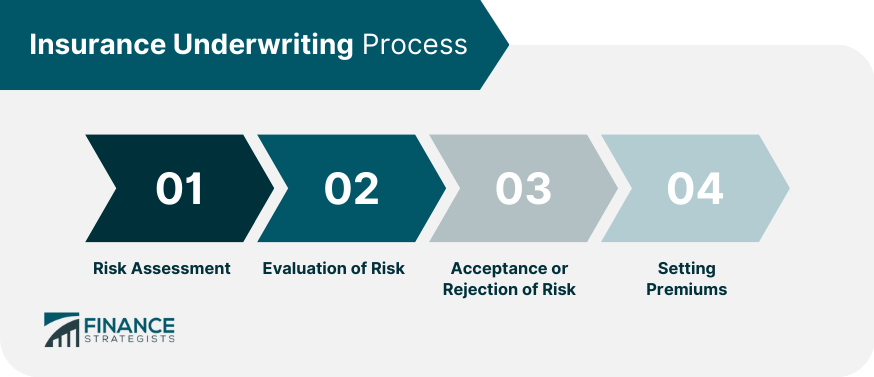

Insurance Underwriting Process

Risk Assessment

Evaluation of Risk

Acceptance or Rejection of Risk

Setting Premiums

Challenges Facing Insurance Underwriters

Emerging Risks

Rapid Technological Advancements

Increasing Competition

The Bottom Line

Insurance Underwriter FAQs

An insurance underwriter is a professional who assesses and evaluates insurance applications, determines the level of risk involved, and decides whether to accept or reject the application.

An insurance underwriter is responsible for assessing insurance applications, evaluating risks, using underwriting tools and techniques, making underwriting decisions, and communicating with agents and policyholders.

To become an insurance underwriter, you need a bachelor's degree in a relevant field such as business, finance, economics, or mathematics. You can also get on-the-job training through an insurance company or agency and earn professional designations such as CPCU or AU.

The types of insurance underwriting include life insurance underwriting, health insurance underwriting, and property and casualty insurance underwriting.

The challenges facing insurance underwriters include emerging risks, rapid technological advancements, and increasing competition. Underwriters must stay up-to-date on industry developments and adapt to changing circumstances to succeed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.