Key person insurance, also known as key man insurance or key employee insurance, is a type of business insurance policy that provides financial protection to a company in the event of the death or disability of a key employee. A key person is someone whose skills, knowledge, experience, or leadership are crucial to the success of the business, and their loss could result in significant financial hardship for the company. Key person insurance is important because it helps mitigate the financial risks associated with the sudden loss of a key employee. The death or disability of a key person can have a significant impact on a company's operations, revenues, and overall stability. Key person insurance provides the company with funds to help cover expenses associated with the loss, such as hiring and training a replacement, temporary loss of revenue, or even settling outstanding debts. Key person insurance policies typically provide coverage for the death or disability of the insured key person. The policy's benefits are paid out to the company, rather than the key person's family or estate. The funds can be used by the company to cover expenses related to the loss, such as recruiting and training a replacement, compensating for lost revenue, or covering any additional costs associated with the transition. The coverage amount of a key person insurance policy is determined based on the estimated financial impact that the loss of the key person would have on the company. This may include factors such as the key person's contribution to the company's revenue, the costs associated with finding and training a suitable replacement, and the potential impact on the company's overall financial stability. Key person insurance policies may have certain limitations, such as exclusions for specific causes of death or disability, waiting periods before benefits are paid out, or maximum coverage amounts. It is important for businesses to carefully review their key person insurance policy to ensure that it adequately addresses their needs and potential risks. One of the main benefits of key person insurance is financial protection for the company in the event of the loss of a key employee. The death or disability of a key person can result in significant financial challenges for a company, including lost revenue, increased expenses, and potential disruptions to business operations. Key person insurance provides a financial safety net to help the company weather these challenges and maintain stability. Key person insurance also helps ensure business continuity by providing the necessary funds to quickly find and train a suitable replacement for the lost key employee. This can help minimize disruptions to the company's operations and maintain customer and client relationships, which can be crucial to the company's long-term success. Key Person Insurance provides financial protection to a company in the event of the loss of a key employee or leader. This coverage can create a sense of security among employees, knowing that the company has a plan in place to handle unexpected circumstances. This feeling of stability can positively influence morale, as employees may feel more confident about their own job security and the overall stability of the organization. One risk associated with key person insurance is the potential insolvency of the insurer. If the insurance company providing the key person insurance policy becomes insolvent, the company may not receive the policy benefits they expected. To mitigate this risk, it is important to choose a reputable and financially stable insurance provider. Another risk is overreliance on key person insurance as the sole means of addressing the loss of a key employee. While key person insurance can provide valuable financial protection, it is important for companies to also implement other strategies to manage the potential impact of losing a key employee, such as succession planning and cross-training of other employees. Failing to regularly review and update key person insurance coverage can also pose risks. As a company grows and evolves, the value of key employees may change, and the coverage amount may need to be adjusted accordingly. Regularly reviewing the key person insurance policy and adjusting coverage amounts as necessary can help ensure that the policy remains adequate and relevant to the company's needs. When considering key person insurance, it's important to evaluate the nature of the business and the specific risks associated with the loss of a key employee. Companies in highly specialized or competitive industries may be more vulnerable to the loss of a key person and may require higher coverage amounts or more comprehensive policies. The role of the key person within the company is another important factor to consider when choosing key person insurance. The greater the impact of the key person's loss on the company's operations, revenue, and overall stability, the more important it is to have an adequate insurance policy in place. The health and age of the key person can also influence the cost and availability of key person insurance. Older or less healthy individuals may be more expensive to insure or may require additional underwriting. Companies should take these factors into account when determining the appropriate level of coverage for their key person insurance policy. Key person insurance is distinct from general liability insurance, which provides coverage for claims arising from bodily injury, property damage, or personal and advertising injury. While general liability insurance can protect a business from certain legal claims, it does not address the financial impact of losing a key employee. Key person insurance is also different from traditional life insurance policies, which are typically purchased by individuals to provide financial protection for their dependents in the event of their death. While both types of insurance policies pay out benefits upon the death of the insured individual, key person insurance is specifically designed to protect the company's financial interests, whereas life insurance benefits are typically paid to the insured's family or estate. To apply for key person insurance, a company will typically need to provide information about the key person's role in the business, their health history, and the desired coverage amount. The insurance provider may also require financial documentation to help determine the appropriate coverage level, such as the company's financial statements, revenue projections, or valuation reports. Once the application is submitted, the insurance provider will review the information and conduct an underwriting process. This may involve a medical exam for the key person, a review of the company's financial health, and an evaluation of the potential risks associated with the loss of the key person. Based on the underwriting process, the insurer will determine the coverage amount, premium, and any exclusions or limitations for the policy. If the underwriting process is successful and the insurer approves the application, the company will receive a policy outlining the terms and conditions of the key person insurance. The company will then need to pay the required premiums to maintain the coverage, which may be due annually, semi-annually, or monthly, depending on the policy terms. A Key Person Insurance Policy provides financial protection to a business in case of the loss of a key employee. It is a type of life insurance policy that covers the business for the loss of the key employee's skills, knowledge, and experience, which are essential to the success of the business. Key Person Insurance Policy covers financial losses resulting from the death or disability of a key employee. The coverage amount depends on the key employee's value to the business, and the premium is calculated based on the employee's age, health, and job responsibilities. The benefits of Key Person Insurance Policy include financial protection, business continuity, and employee morale. In the event of a key employee's death or disability, the policy provides a lump-sum payment to the business, allowing it to cover expenses, pay off debts, and continue operating without significant disruptions. However, the risks associated with Key Person Insurance Policy include potential insurer insolvency, overreliance on the policy, and failure to update coverage. When choosing a Key Person Insurance Policy, several factors should be considered, including the nature of the business, the key employee's role in the business, and the employee's health and age. It is essential to work with a reputable insurance company and to ensure that the policy is regularly reviewed and updated to reflect any changes in the business's needs or circumstances.What Is Key Person Insurance?

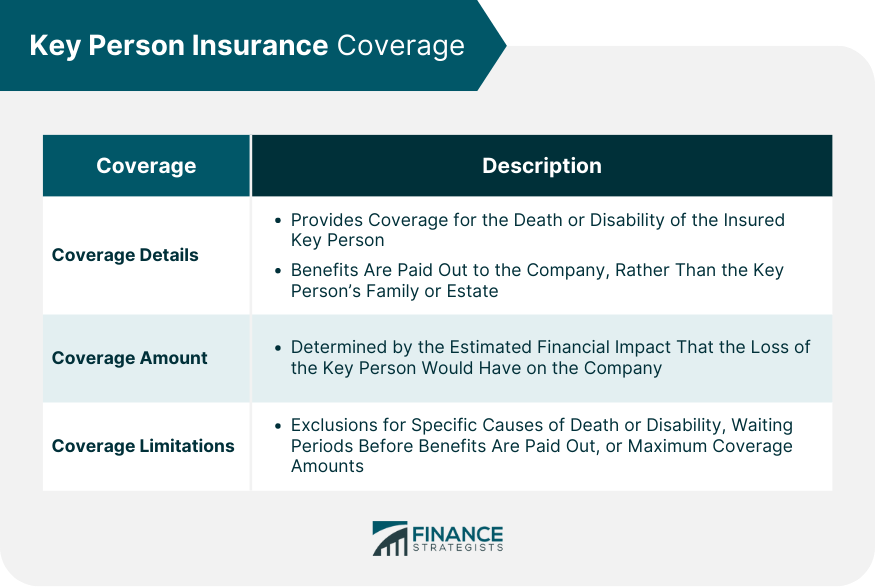

Key Person Insurance Coverage

Coverage Details

Coverage Amount

Coverage Limitations

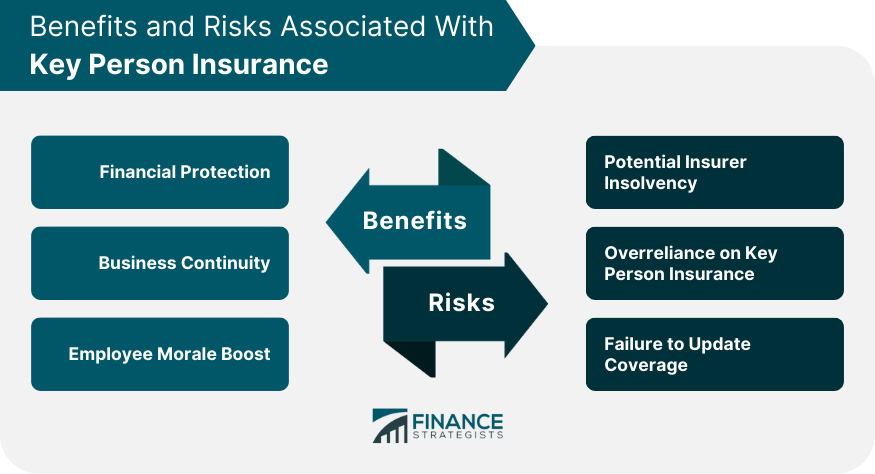

Benefits of Key Person Insurance

Financial Protection

Business Continuity

Employee Morale Boost

Risks Associated With Key Person Insurance

Potential Insurer Insolvency

Overreliance on Key Person Insurance

Failure to Update Coverage

Factors to Consider When Choosing Key Person Insurance

Nature of the Business

Key Person's Role in the Business

Key Person's Health and Age

Key Person Insurance vs Other Insurance Policies

Key Person Insurance and General Liability Insurance

Key Person Insurance and Life Insurance

Key Person Insurance Policy Application Process

Application Requirements

Underwriting Process

Policy Issuance

Final Thoughts

Key Person Insurance FAQs

Key Person Insurance is a policy that provides financial protection to a business in case of the loss of a key employee.

A "Key Person" in Key Person Insurance is someone whose contributions to the business are essential to its continued success.

Key Person Insurance covers financial losses resulting from the death or disability of a key employee.

Key Person Insurance provides financial protection, helps ensure business continuity, and boosts employee morale.

The risks associated with Key Person Insurance include potential insurer insolvency, overreliance on the policy, and failure to update coverage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.