Adjustable life insurance is a type of permanent life insurance that provides policyholders with flexibility in adjusting the policy's coverage and premiums over time. It combines elements of both whole life insurance and term life insurance, offering the policyholder the ability to modify certain aspects of the policy to better align with their changing needs. Unlike traditional whole life insurance, adjustable life insurance allows policyholders to make changes to the death benefit amount and premium payments. This means that individuals have the option to increase or decrease the coverage amount based on factors such as financial circumstances, life events, or changes in personal goals. Adjustable life insurance policies typically have a cash value component that grows over time, similar to whole life insurance. The policyholder can use this cash value to pay premiums, take out loans, or even surrender the policy for a portion of the accumulated cash value. The cash value grows tax-deferred, meaning the policyholder does not pay taxes on the growth until they withdraw the funds. One of the main advantages of adjustable life insurance is the ability to adjust premium payments. Policyholders can increase or decrease their premiums based on their financial situation, without affecting their death benefit or policy coverage. This flexibility allows clients to maintain their policies even during financially challenging times. Adjustable life insurance policies offer clients the option to adjust their death benefits according to their needs. They can choose to increase or decrease the death benefit amount, depending on their evolving financial goals and family circumstances. Adjustable life insurance policies also provide a cash value component that grows on a tax-deferred basis. The policy's cash value can be accessed through loans or withdrawals, providing financial flexibility to the policyholder. Policyholders can access their cash value through loans and withdrawals, providing them with additional financial resources when needed. This feature offers liquidity and financial flexibility, making adjustable life insurance an attractive option for clients with diverse financial needs. Policyholders can adjust their premium payments based on their financial situation and needs. They can increase or decrease their premiums without affecting their death benefit or policy coverage, offering them financial flexibility throughout the life of the policy. Adjustable life insurance allows clients to change their death benefits according to their evolving needs. They can increase or decrease the death benefit amount to better align with their financial goals and family circumstances. The cash value component of adjustable life insurance policies can be accessed through loans or withdrawals, providing policyholders with financial flexibility and resources when needed. If a policyholder decides to discontinue their adjustable life insurance policy, they can surrender the policy and receive the surrender value, which is the cash value minus any applicable surrender charges. Before recommending an adjustable life insurance policy, insurance brokers should assess their client's financial goals and needs to ensure the policy aligns with their objectives. Adjustable life insurance policies involve investment risk, and clients should be comfortable with the potential fluctuations in the cash value component of their policy. Clients should have a long-term time horizon when considering an adjustable life insurance policy, as these policies are designed to provide coverage and accumulate cash value over an extended period. Clients should be aware of the tax implications associated with adjustable life insurance, including the tax-deferred growth of the cash value and potential tax liabilities upon withdrawal or surrender of the policy. Term life insurance provides coverage for a specified term, typically 10, 20, or 30 years. Unlike adjustable life insurance, term policies do not offer a cash value component or the ability to adjust premiums or death benefits. Whole life insurance provides permanent coverage with guaranteed death benefits and cash value accumulation. However, whole-life policies have less flexibility in terms of premium payments and death benefit adjustments compared to adjustable life insurance. Universal life insurance is another type of permanent life insurance policy that offers flexibility in premium payments and death benefits, similar to adjustable life insurance. However, universal life policies often have different investment options and fee structures. Variable life insurance policies also offer permanent coverage with a cash value component, but the cash value is invested in a variety of sub-accounts, such as stocks and bonds. This exposes the policyholder to investment risk, with the potential for higher returns but also greater fluctuations in cash value. While adjustable life insurance offers some flexibility in premium payments and death benefits, it does not provide the same level of investment control as variable life insurance. Insurance brokers play a crucial role in helping clients understand the features and benefits of adjustable life insurance policies. They must provide clear explanations of the policy's premium flexibility, death benefit options, cash value accumulation, and access to policy loans and withdrawals. Brokers should carefully assess their client's financial goals, needs, risk tolerance, and time horizon to determine if an adjustable life insurance policy is suitable for their situation. Based on the client's individual needs and goals, insurance brokers can recommend the most suitable adjustable life insurance policy, ensuring that clients receive tailored financial solutions. Insurance brokers should maintain ongoing communication with their clients to ensure that their adjustable life insurance policies continue to meet their evolving financial needs. Brokers can assist clients in making adjustments to their premium payments or death benefits as needed. Insurance brokers must identify their target audience for adjustable life insurance policies, focusing on clients who value flexibility and are comfortable with some level of investment risk. When marketing adjustable life insurance policies, brokers should emphasize the key benefits and features, such as premium flexibility, death benefit options, and cash value accumulation. Insurance brokers should be prepared to address common objections from clients, such as concerns about investment risk, policy fees, and the complexity of adjustable life insurance policies. To successfully market and sell adjustable life insurance policies, insurance brokers must establish trust and credibility with their clients. This includes providing accurate information, personalized advice, and responsive customer service. Insurance brokers selling adjustable life insurance policies must adhere to licensing and continuing education requirements, ensuring they remain knowledgeable about industry regulations and best practices. Brokers must uphold ethical standards when marketing and selling adjustable life insurance policies, prioritizing their client's best interests and providing accurate, unbiased advice. Insurance brokers must comply with all applicable state and federal regulations when selling adjustable life insurance policies, including disclosure and transparency requirements. Adjustable life insurance plays a vital role in providing clients with a flexible and customizable insurance solution, offering premium flexibility, death benefit options, and cash value accumulation. As insurance brokers, understanding the features and benefits of adjustable life insurance is essential to effectively serve your clients and help them achieve their financial goals. Opportunities for insurance brokers in the adjustable life insurance market include providing value-added services, such as personalized policy recommendations, ongoing policy management, and adjustments. With the right approach, brokers can build trust, credibility, and long-term relationships with their clients. As the life insurance industry continues to evolve, brokers must remain informed about emerging trends, challenges, and regulatory requirements. By staying up-to-date and adapting to changes, insurance professionals can ensure they continue to meet the needs of their clients and provide exceptional service in the adjustable life insurance market.Definition of Adjustable Life Insurance

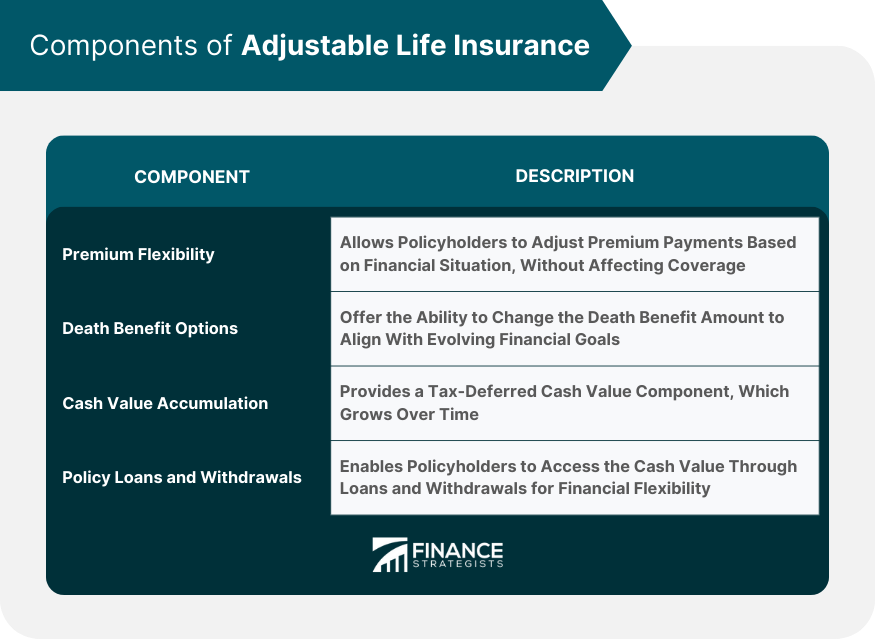

Components of Adjustable Life Insurance

Premium Flexibility

Death Benefit Options

Cash Value Accumulation

Policy Loans and Withdrawals

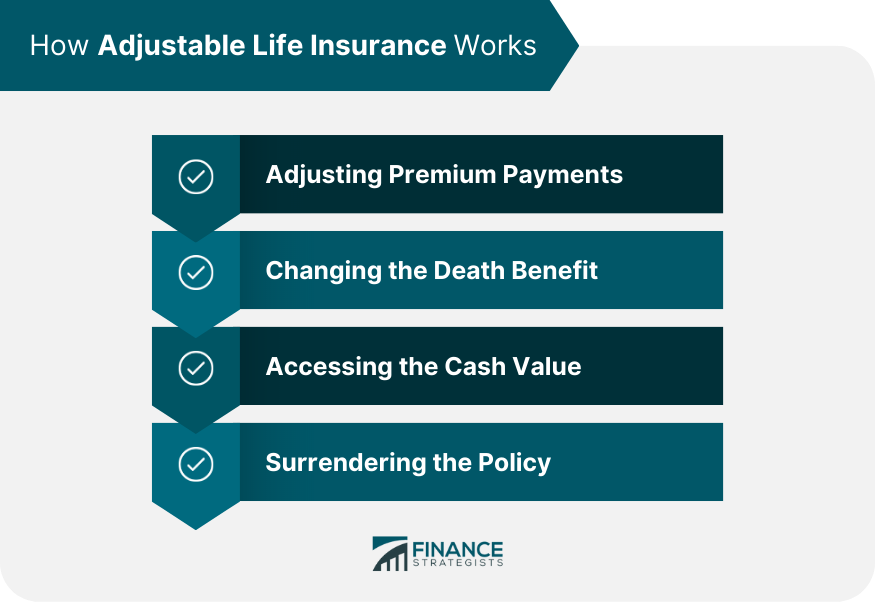

How Adjustable Life Insurance Works

Adjusting Premium Payments

Changing the Death Benefit

Accessing the Cash Value

Surrendering the Policy

Factors to Consider for Clients of Adjustable Life Insurance

Financial Goals and Needs

Risk Tolerance

Time Horizon

Tax Implications

Comparing Adjustable Life Insurance to Other Policies

Term Life Insurance

Whole Life Insurance

Universal Life Insurance

Variable Life Insurance

Role of Insurance Brokers in Adjustable Life Insurance

Educating Clients About Policy Features

Assessing Clients' Needs and Suitability

Providing Personalized Policy Recommendations

Ongoing Policy Management and Adjustments

Marketing and Selling of Adjustable Life Insurance

Targeting the Right Audience

Highlighting Key Benefits and Features

Overcoming Common Objections

Building Trust and Credibility

Regulatory and Compliance Considerations in Adjustable Life Insurance

Licensing and Continuing Education Requirements

Ethical Standards for Insurance Brokers

State and Federal Regulations

Conclusion

Adjustable Life Insurance FAQs

Adjustable life insurance is a flexible insurance product that combines elements of term and permanent life insurance policies. It offers premium flexibility, adjustable death benefits, and a cash value component. This type of policy differs from other life insurance policies, such as term life insurance, which has no cash value component, and whole life insurance, which has less flexibility in premium payments and death benefits.

Policyholders can adjust their premium payments in an adjustable life insurance policy based on their financial situation and needs. They have the option to increase or decrease their premiums without affecting their death benefit or policy coverage, providing financial flexibility throughout the life of the policy.

Yes, adjustable life insurance allows policyholders to change their death benefits according to their evolving financial goals and family circumstances. They can choose to increase or decrease the death benefit amount to better align with their needs.

The cash value component in adjustable life insurance policies grows on a tax-deferred basis. Policyholders can access their cash value through loans or withdrawals, providing financial flexibility and additional resources when needed. It's important to note that accessing the cash value may impact the death benefit and have tax implications.

When recommending adjustable life insurance, insurance brokers should consider clients' financial goals, needs, risk tolerance, and time horizon. It's also essential to discuss the tax implications associated with adjustable life insurance, including the tax-deferred growth of the cash value and potential tax liabilities upon withdrawal or surrender of the policy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.