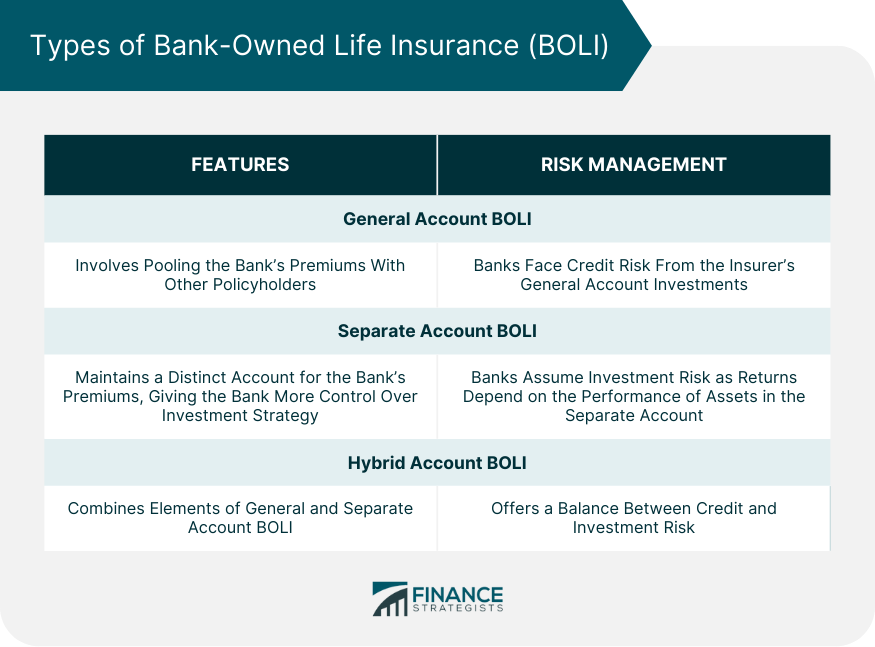

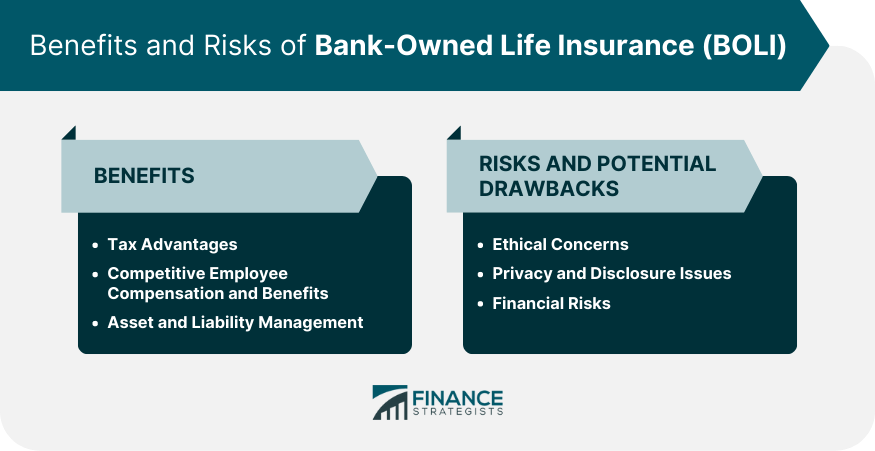

Bank-Owned Life Insurance (BOLI) refers to a specialized form of life insurance purchased by banks to insure the lives of their key employees. The bank serves as the owner and beneficiary of these policies, receiving tax-free death benefits upon the insured employee's death. BOLI offers various benefits to banks, including tax advantages, competitive employee compensation and benefits, and improved liability and asset management. These factors make BOLI an attractive investment tool for banks to help offset the costs of employee benefits and enhance their financial position. There are three main types of BOLI: General Account BOLI, Separate Account BOLI, and Hybrid Account BOLI. Each type has distinct features and investment structures that cater to the specific needs and risk tolerance levels of the purchasing banks. General Account BOLI is a type of BOLI where the insurance company pools the bank's premiums with those of other policyholders. The bank's investment is held in the insurer's general account, and the insurer is responsible for managing the assets and guaranteeing a minimum return. In General Account BOLI, banks face credit risk from the insurer's general account investments. The insurer's ability to meet guaranteed returns and death benefits depends on its financial strength and the performance of the general account assets. Separate Account BOLI involves the insurance company maintaining a separate account for the bank's premiums, distinct from the insurer's general account. This structure provides the bank with more control over the investment strategy and asset allocation, offering potential for higher returns. With Separate Account BOLI, banks assume more investment risk, as the policy's returns depend on the performance of the assets held in the separate account. However, this structure reduces credit risk exposure to the insurer's general account, providing a trade-off in risk management. Hybrid Account BOLI combines elements of both General Account and Separate Account BOLI. In this structure, the bank's premiums are split between the insurer's general account and a separate account, providing a balance between guaranteed returns and potential for higher yields. Hybrid Account BOLI offers banks a balance between credit and investment risk. While a portion of the bank's investment is subject to the insurer's credit risk, the separate account component provides the opportunity for enhanced returns with an increased level of control over the investment strategy. BOLI policies offer tax-deferred growth, allowing banks to accumulate earnings within the policy without incurring taxes until the funds are withdrawn. This tax treatment results in higher effective returns compared to taxable investments with similar yields. Upon the death of an insured employee, banks receive tax-free death benefits from the BOLI policy. These proceeds help offset the costs of employee benefit plans and can be used for other corporate purposes without tax implications. Banks use BOLI to finance employee benefit plans, such as retirement, health, and disability benefits. By offsetting these costs, banks can provide competitive compensation packages to their employees, improving retention and attracting top talent. BOLI-funded benefit plans allow banks to offer attractive compensation packages to key employees. This competitive advantage helps to retain and attract top talent, contributing to the overall success and stability of the bank. Additionally, these benefits can serve as an incentive for key employees to remain with the bank long-term, reducing turnover costs. Investing in BOLI policies allows banks to diversify their asset portfolios, reducing risk and improving financial stability. BOLI investments often have low correlations with other bank assets, such as loans and securities, helping to mitigate overall portfolio risk. BOLI policies are typically long-term investments, aligning with the banks' long-term liabilities, such as employee benefit obligations. This alignment enables banks to better manage their asset and liability positions, reducing interest rate risk and enhancing overall financial stability. One ethical concern surrounding BOLI is the concept of insurable interest. Critics argue that banks may not have a legitimate insurable interest in the lives of their employees, raising questions about the appropriateness of banks profiting from the death of their workers. Privacy and disclosure concerns may arise when banks purchase BOLI policies on their employees. Some argue that employees should have the right to know if their bank has purchased a policy on their life and be provided with information about the policy's terms and benefits. Banks that invest in BOLI face credit and counterparty risk from the insurance companies issuing the policies. If the insurer experiences financial difficulties or fails, the bank may not receive the expected death benefits or investment returns, negatively impacting its financial position. BOLI investments are subject to market and interest rate risk. Market fluctuations can affect the value of the assets backing the policies, while changes in interest rates may impact the returns on the investments. Banks must carefully manage these risks to ensure the stability of their BOLI portfolios. BOLI policies are generally long-term, illiquid investments. Banks may face liquidity risk if they need to access the funds invested in BOLI policies before the insured employees pass away or if they need to terminate the policies early, potentially incurring surrender charges or other penalties. The OCC is one of the main regulatory bodies overseeing BOLI policies. It issues guidelines and regulations to ensure the safe and sound operation of national banks and federal savings associations that purchase BOLI. The Federal Reserve also plays a role in the regulation of BOLI, providing guidance and supervision to state-chartered banks that are members of the Federal Reserve System. These banks must adhere to the Federal Reserve's regulations and guidelines when purchasing and managing BOLI policies. The FDIC is responsible for regulating and supervising state-chartered banks that are not members of the Federal Reserve System. These banks must comply with FDIC guidelines and regulations concerning BOLI purchases and risk management practices. The Interagency Statement, issued by the OCC, Federal Reserve, and FDIC, outlines regulatory expectations for banks that purchase BOLI. This statement provides guidance on risk management practices, pre-purchase analysis, and ongoing monitoring of BOLI policies. Before purchasing a BOLI policy, banks must conduct a thorough pre-purchase analysis and due diligence process. This analysis should evaluate the appropriateness of the BOLI investment, the insurer's financial strength, and the bank's ability to manage the risks associated with the policy. Banks are required to have a comprehensive risk management framework in place to monitor and manage their BOLI investments. This includes periodic reviews of policy performance, assessment of the insurer's financial condition, and evaluation of the bank's overall BOLI risk exposure. Bank-Owned Life Insurance (BOLI) offers several benefits to banks, such as tax advantages, competitive employee compensation and benefits, and improved asset and liability management. However, BOLI also presents some potential drawbacks and controversies, including ethical concerns and various financial risks. Banks must carefully weigh the advantages and disadvantages of BOLI investments and adhere to regulatory requirements and risk management practices. BOLI has become an essential component of the banking industry, providing banks with an effective means to finance employee benefit plans and manage their long-term liabilities. The use of BOLI has grown in popularity, particularly among larger banks, as they recognize the financial and competitive advantages offered by these policies. The future of BOLI will likely be influenced by changes in regulation, market conditions, and the evolving needs of banks and their employees. Increased regulatory scrutiny, changing demographics, and the continued evolution of employee benefit plans may all contribute to shaping the role of BOLI in the banking industry. Banks must stay informed and adapt to these changes to maximize the benefits and minimize the risks associated with their BOLI investments.What Is Bank-Owned Life Insurance (BOLI)?

Types of Bank-Owned Life Insurance

General Account BOLI

Description and Features

Investment and Risk Management

Separate Account BOLI

Description and Features

Investment and Risk Management

Hybrid Account BOLI

Description and Features

Investment and Risk Management

Benefits of BOLI for Banks

Tax Advantages

Tax-Deferred Growth

Tax-Free Death Benefits

Competitive Employee Compensation and Benefits

Funding for Employee Benefit Plans

Retaining and Attracting Talent

Asset and Liability Management

Diversification of Bank Assets

Long-Term Investment Horizon

Controversies and Potential Drawbacks

Ethical Concerns

Privacy and Disclosure Issues

Financial Risks

Credit and Counterparty Risk

Market and Interest Rate Risk

Liquidity Risk

Regulatory Framework and Compliance

Key Regulations and Guidelines

Office of the Comptroller of the Currency (OCC)

Federal Reserve

Federal Deposit Insurance Corporation (FDIC)

Risk Management and Reporting Requirements

Interagency Statement on the Purchase and Risk Management of BOLI

Pre-Purchase Analysis and Due Diligence

Ongoing Risk Management and Monitoring

Final Thoughts

Bank-Owned Life Insurance (BOLI) FAQs

Bank-Owned Life Insurance (BOLI) is a specialized form of life insurance that banks purchase to insure the lives of their key employees. Banks serve as the policy owner and beneficiary, receiving tax-free death benefits upon the insured employee's death. BOLI offers various benefits to banks, including tax advantages, competitive employee compensation and benefits, and improved asset and liability management.

There are three main types of BOLI policies: General Account BOLI, Separate Account BOLI, and Hybrid Account BOLI. Each type has distinct features and investment structures that cater to the specific needs and risk tolerance levels of the purchasing banks.

BOLI provides tax advantages for banks through tax-deferred growth and tax-free death benefits. The earnings within the policy accumulate on a tax-deferred basis, resulting in higher effective returns compared to taxable investments with similar yields. Additionally, the death benefits received by the bank upon the insured employee's death are generally tax-free.

The key regulatory bodies overseeing BOLI are the Office of the Comptroller of the Currency (OCC), the Federal Reserve, and the Federal Deposit Insurance Corporation (FDIC). These agencies issue guidelines and regulations to ensure the safe and sound operation of banks that purchase BOLI policies and to promote effective risk management practices.

Controversies and potential drawbacks of BOLI include ethical concerns, such as insurable interest and privacy and disclosure issues, and financial risks, such as credit and counterparty risk, market and interest rate risk, and liquidity risk. Banks must carefully consider these issues and manage the associated risks to ensure the success of their BOLI investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.