Burial insurance, also known as funeral insurance or final expense insurance, is a type of life insurance policy that is designed to cover the expenses associated with a funeral or burial. It is intended to help families cope with the costs of end-of-life expenses, such as funeral services, cremation, burial, and other final expenses. The coverage amount for burial insurance is usually much smaller than traditional life insurance policies, typically ranging from $5,000 to $25,000. Burial insurance is easier to qualify for, and the premiums are usually lower compared to traditional life insurance policies. Burial insurance offers several benefits, including: The death of a loved one can be emotionally challenging. Burial insurance can provide peace of mind to surviving family members, knowing that they will not have to worry about covering the expenses associated with a funeral and burial. Funeral and burial costs can add up quickly. Burial insurance covers these expenses, ensuring that beneficiaries are not burdened with financial obligations. By covering the costs of a funeral and burial, burial insurance can help reduce the financial burden on surviving family members. Burial insurance typically pays out within a few days of the policyholder's death, providing beneficiaries with the funds they need to cover the expenses associated with a funeral and burial. When choosing a burial insurance policy, several factors should be considered, including: Burial insurance policies typically do not require a medical exam. However, the policy's cost and coverage will depend on the policyholder's age and health. Policyholders should determine the coverage amount needed to cover funeral and burial expenses adequately. Premium rates will vary depending on the policyholder's age, health, and coverage amount. It's essential to understand any policy exclusions or limitations, such as waiting periods or restrictions on how the policy's funds can be used. Several types of burial insurance policies are available, including: Pre-need funeral insurance is a type of burial insurance that allows policyholders to prepay for their funeral and burial expenses. This policy allows individuals to plan their funeral and ensure that their wishes are carried out after their passing. Policyholders can choose the funeral home and services they want, and the costs are locked in at the time of purchase, ensuring that their family members will not be burdened with any unexpected expenses. One potential drawback of pre-need funeral insurance is that it can be inflexible. Policyholders may not be able to change their plans or choose a different funeral home after purchasing the policy. Additionally, if the funeral home goes out of business or is sold, the policy may not be honored, leaving beneficiaries with no recourse. Final expense insurance is another type of burial insurance that covers funeral and burial expenses, as well as any outstanding debts or medical expenses. This policy is designed to provide beneficiaries with a lump-sum payment that can be used to cover these expenses, ensuring that they are not burdened with financial obligations after the policyholder's passing. One potential benefit of final expense insurance is that it can be more flexible than pre-need funeral insurance. Policyholders can choose how the funds are used, and beneficiaries can use the money to cover any outstanding debts or medical expenses, in addition to funeral and burial expenses. Guaranteed issue life insurance is a type of burial insurance that does not require a medical exam or health questionnaire. Instead, applicants are guaranteed to be approved for coverage, regardless of their health status. This policy is ideal for individuals who may have pre-existing medical conditions or are unable to qualify for traditional life insurance policies. One potential drawback of guaranteed issue life insurance is that coverage amounts are often limited, and premiums can be expensive. Additionally, there may be waiting periods before the policy pays out, which could be a concern for individuals with terminal illnesses. Simplified issue life insurance is a type of burial insurance that requires a medical questionnaire but does not require a medical exam. This policy is designed for individuals who may have some pre-existing medical conditions but are still relatively healthy. One potential benefit of simplified issue life insurance is that premiums are typically lower than guaranteed issue policies. Additionally, coverage amounts are often higher, and there are fewer waiting periods before the policy pays out. To apply for burial insurance, follow these steps: The first step in applying for burial insurance is to research and compare different providers. Consider factors such as the provider's reputation, policy options, and premiums. Take the time to read customer reviews and research each provider's financial stability. Once you have chosen a provider, you will need to gather the necessary documentation. This typically includes personal and medical information, such as your name, date of birth, and any pre-existing medical conditions. You may also need to provide information about your income and employment status. Next, you will need to fill out the application and submit it to the burial insurance provider. The application will typically ask for information about your health, lifestyle, and family history. While burial insurance policies typically do not require a medical exam, the provider may ask for permission to review your medical records. Finally, you will need to choose a payment plan that works best for your budget. Burial insurance policies typically offer a range of payment options, such as monthly, quarterly, or annually. Consider your budget and how much you can afford to pay each month. Several factors will determine the cost of burial insurance, including age, health, and coverage amount. On average, burial insurance policies cost between $10 and $50 per month. Coverage amounts typically range from $5,000 to $25,000, with higher coverage amounts resulting in higher premiums. Policy riders, such as accidental death or dismemberment coverage, can also affect the cost of burial insurance. It's essential to manage your burial insurance policy to ensure that it meets your changing needs. Consider the following when managing your burial insurance policy: Review your coverage regularly to ensure that it meets your current needs. Keep your beneficiary information up-to-date to ensure that the policy's payout goes to the intended recipients. If you experience significant life changes, such as a marriage, divorce, or the birth of a child, review your policy to ensure that it still meets your needs. Keep up with your premium payments to ensure that your policy remains in force. Several alternatives to burial insurance are available, including: Traditional life insurance policies provide a lump-sum payment to beneficiaries after the policyholder's death. While burial insurance policies are specifically designed to cover funeral and burial expenses, traditional life insurance policies offer more flexibility in how the funds can be used. Beneficiaries can use the payout to cover not only funeral and burial expenses but also other financial obligations, such as mortgage payments or outstanding debts. One potential drawback of traditional life insurance policies is that they can be more expensive than burial insurance policies, especially for older adults or individuals with pre-existing medical conditions. Prepaid funeral plans allow individuals to prepay for their funeral and burial expenses. This type of plan can provide peace of mind by allowing individuals to make arrangements and pay for their funeral expenses in advance. Prepaid funeral plans typically include a package of services, such as casket, embalming, and funeral director services, but they may not cover all expenses. One potential drawback of prepaid funeral plans is that they can be inflexible. If you change your mind about the type of funeral or burial you want, it may be difficult or impossible to change the plan. Additionally, if the funeral home goes out of business or is sold, your plan may not be honored. Another alternative to burial insurance is to set aside funds in a savings account or trust to cover funeral and burial expenses. This option allows individuals to save for funeral expenses over time, rather than paying for a policy upfront. This can be a good option for individuals who want more flexibility in how they save for funeral expenses. One potential drawback of this option is that it may not provide as much financial security as a burial insurance policy or prepaid funeral plan. If you do not save enough money to cover all of your funeral expenses, your loved ones may need to pay out of pocket for the remaining costs. Burial insurance policies are regulated by both state and federal laws. It's essential to understand the legal and regulatory considerations associated with burial insurance, including: Burial insurance policies are subject to state and federal regulations. It's essential to understand these regulations when selecting a policy. Burial insurance policies are subject to consumer protection laws. It's important to understand these protections and your rights as a policyholder. Burial insurance policies can be subject to disputes between policyholders and beneficiaries. It's important to understand the claims process and how disputes are resolved. Burial insurance can provide peace of mind for individuals and their families by covering the costs associated with a funeral and burial. When choosing a burial insurance policy, it's essential to consider factors such as age, health, coverage amount, and policy exclusions. Several types of burial insurance policies are available, and it's important to research and compare different providers to find the best policy for your needs. Finally, it's essential to manage your burial insurance policy and understand the legal and regulatory considerations associated with burial insurance.What Is Burial Insurance?

Benefits of Burial Insurance

Peace of Mind for Loved Ones

Coverage of Funeral and Burial Expenses

Reduced Financial Burden

Quick Payout to Beneficiaries

Factors to Consider When Choosing Burial Insurance

Age and Health

Coverage Amount

Premium Rates

Policy Exclusions and Limitations

Types of Burial Insurance Policies

Pre-need Funeral Insurance

Final Expense Insurance

Guaranteed Issue Life Insurance

Simplified Issue Life Insurance

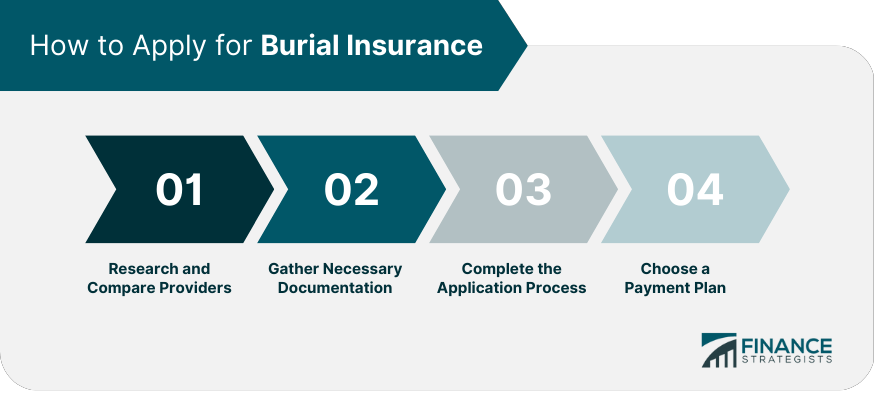

How to Apply for Burial Insurance

Research and Compare Providers

Gather Necessary Documentation

Complete the Application Process

Choose a Payment Plan

Costs of Burial Insurance

Managing Your Burial Insurance Policy

Regularly Reviewing Your Coverage

Updating Beneficiary Information

Addressing Changes in Your Life Circumstances

Maintaining Premium Payments

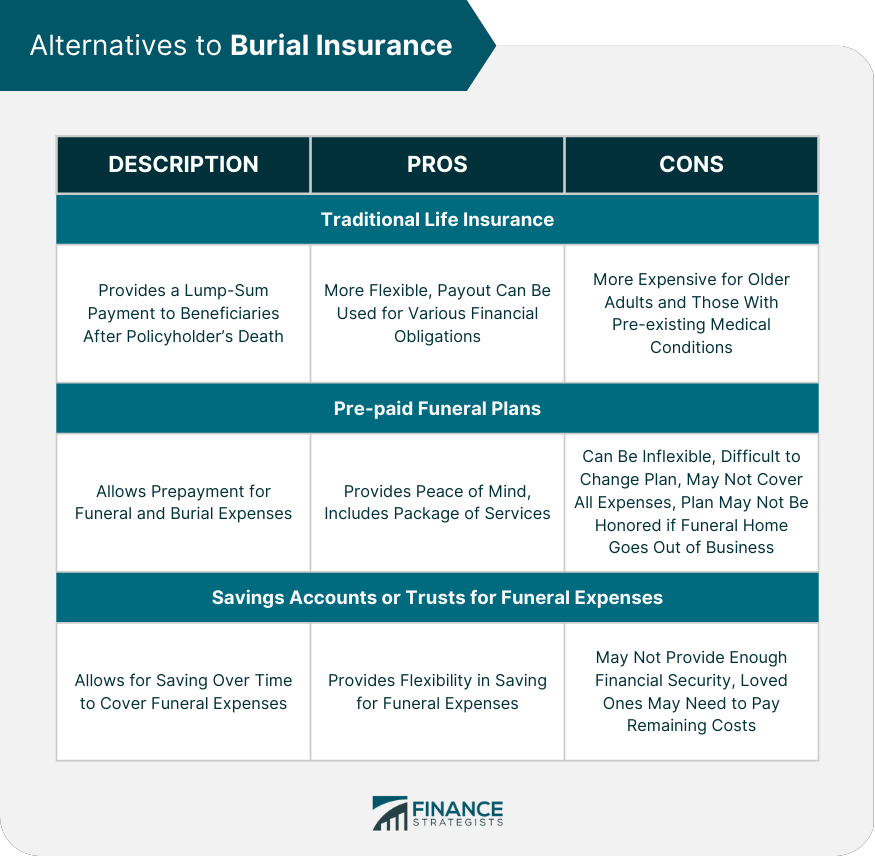

Alternatives to Burial Insurance

Traditional Life Insurance

Prepaid Funeral Plans

Savings Accounts or Trusts for Funeral Expenses

Legal and Regulatory Considerations

State and Federal Regulations

Consumer Protections

Claims Process and Disputes

Conclusion

Burial Insurance FAQs

Burial insurance is a type of life insurance designed to cover the expenses associated with a funeral or burial. It is also known as funeral insurance or final expense insurance.

Anyone can apply for burial insurance, regardless of age or health status. However, premiums may vary depending on the applicant's age and health condition.

Burial insurance typically provides coverage ranging from $5,000 to $25,000. The amount of coverage needed depends on the funeral or burial expenses and other final expenses.

Burial insurance differs from traditional life insurance in several ways. It provides a smaller amount of coverage and is easier to qualify for, and the premiums are typically lower. Burial insurance also pays out faster and is intended to cover only final expenses, while traditional life insurance is designed to provide financial support to beneficiaries in case of the policyholder's death.

If the policyholder passes away before paying all premiums, the insurance company will pay out the death benefit minus any outstanding premiums. If the policyholder has paid premiums for a certain period of time, the insurance company may offer a reduced death benefit or refund a portion of the premiums. It is essential to review the policy's terms and conditions to understand the options available in such a situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.