Life insurance is a financial contract between an individual, referred to as the policyholder, and an insurance company. It provides a lump sum payment, known as a death benefit, to the designated beneficiaries upon the death of the insured person. The purpose of life insurance is to provide financial security and support to the dependents and loved ones left behind after the policyholder's passing. Regarding whether an individual can get life insurance for their spouse, it's important to note that life insurance policies are typically purchased to protect against the financial loss that would occur in the event of the policyholder's death. In many cases, it's not only possible but also quite common for a person to get life insurance on their spouse. However, there are legal aspects and requirements to consider, and a critical concept known as 'insurable interest' underpins the entire process. According to insurance laws, anyone can purchase life insurance on another person as long as they can prove insurable interest – a legitimate reason to expect some financial loss or disadvantage in the event of the insured person's death. In the case of spouses, the insurable interest is typically clear due to shared financial responsibilities. To ensure your spouse, the insurance company will require their consent along with a completed application and health exam. It's crucial to note that secretively buying a life insurance policy on your spouse without their knowledge or consent is not ethical and typically illegal. Term life insurance provides coverage for a specific period, usually 10, 20, or 30 years. If the insured person dies within the policy term, the death benefit is paid out to the beneficiaries. This type of insurance is typically more affordable and may be suitable if you're looking to cover specific financial responsibilities that will decrease over time. Whole life insurance offers lifelong coverage with an added benefit of a cash value component that grows over time. The premiums are generally higher for this type of policy, but it can be a useful part of an estate planning strategy or if you want to provide a guaranteed death benefit to your heirs. Universal life insurance is a type of permanent life insurance that also offers a cash value component. However, it offers more flexibility than whole life insurance, allowing you to adjust your premium and death benefit amounts to better suit your changing needs. The first step is to discuss the idea with your spouse, ensuring they understand the reason behind it and agree with the decision. It's important to make this a collaborative process, focusing on the benefit to the family and the peace of mind it can offer. Next, it's crucial to choose the right policy type and coverage amount. This typically involves evaluating your financial needs, considering your debts, income, living expenses, future goals, and the lifestyle you'd want to maintain for your family should something happen. The application process typically involves filling out a questionnaire detailing the proposed insured's personal information, health history, lifestyle habits, and occupational risks. This information helps the insurer assess the risk and determine the policy terms. Most life insurance policies require a medical examination as part of the underwriting process. This exam, usually performed by a licensed paramedical professional, assesses the general health of the proposed insured and identifies any medical conditions that could affect their life expectancy. If your spouse contributes to the household income, their sudden demise could significantly impact the family's financial situation. Life insurance can help compensate for the loss of their income, thereby providing financial security. Life insurance can also cover the final expenses associated with the death of a spouse, such as funeral costs, medical bills, and estate settlement fees. Moreover, it can assist in paying off any outstanding debts that your spouse may leave behind, such as a mortgage or credit card balance. In the event of your spouse's death, life insurance can serve as an income replacement, helping to cover daily living expenses, childcare costs, and even future college expenses for your children. If your spouse plays a key role in childcare or intends to fund your children's education, life insurance can help cover these costs, providing a financial safety net for your family's future. One of the key risks involved in purchasing life insurance is the potential for non-disclosure or misrepresentation during the application process. If you or your spouse withhold vital information or present false information to the insurer, this can lead to the policy being voided, often precisely when it's needed most. Another risk is purchasing insufficient coverage. Many people underestimate the amount of money their family will need in the event of their spouse's death, leading to financial strain when the death benefit doesn't cover all the necessary expenses. Non-payment of premiums is another significant risk. If the premiums aren't paid on time, the insurer can cancel the policy, leaving your family without the coverage you counted on. While life insurance provides a financial safety net, overdependence on it can be a risk. It's important to remember that life insurance is just one aspect of comprehensive financial planning. The health and age of your spouse can significantly impact the insurance premium. Typically, younger, healthier individuals are offered lower rates as they pose a lower risk to the insurer. Lifestyle factors such as smoking, alcohol consumption, and high-risk hobbies can also influence premium rates. Similarly, occupations with higher risk factors may result in higher premiums. When determining the coverage amount, consider your existing financial obligations, such as a mortgage, car loan, or credit card debt. Consider future financial goals, such as your children's education expenses or retirement needs. These should factor into the coverage amount to ensure your family's financial security in the long term. Obtaining a life insurance policy on your spouse is both legal and common, provided there is a clear insurable interest and your spouse's consent. The variety of life insurance policies, including term, whole, and universal life insurance, cater to different needs and circumstances. The process requires careful consideration, open discussions, and informed decisions about policy types and coverage amounts. Benefits such as financial security, debt clearance, and income replacement underline the importance of such a move. However, potential risks, including misrepresentation of information, policy lapse, and overdependence on life insurance, warrant caution. Key factors such as your spouse's health, age, lifestyle, existing financial obligations, and future financial goals are essential to consider. Thus, while life insurance on a spouse provides a crucial financial safety net, understanding its process, benefits, risks, and key considerations ensures an effective protective strategy for your family.Overview of Life Insurance

What Is Insurable Interest?

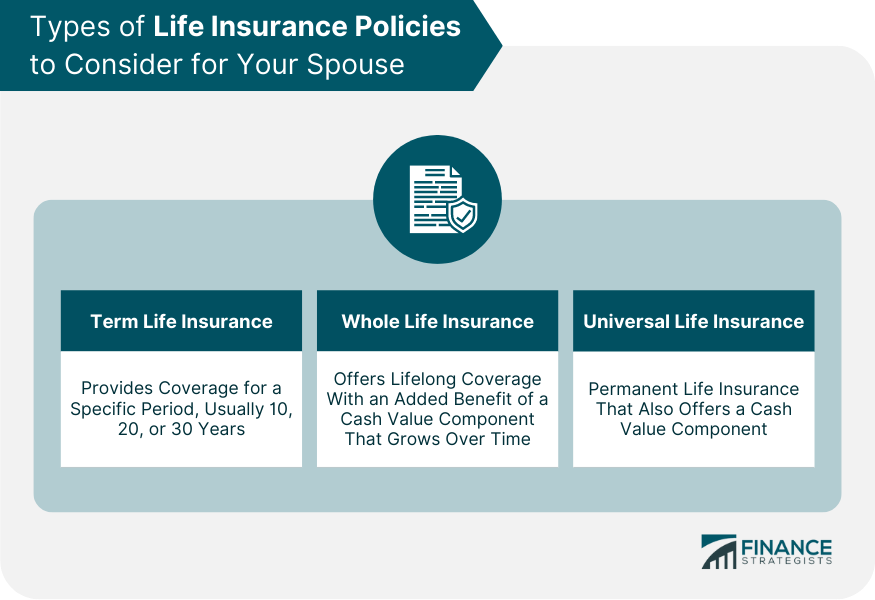

Types of Life Insurance Policies to Consider for Your Spouse

Term Life Insurance

Whole Life Insurance

Universal Life Insurance

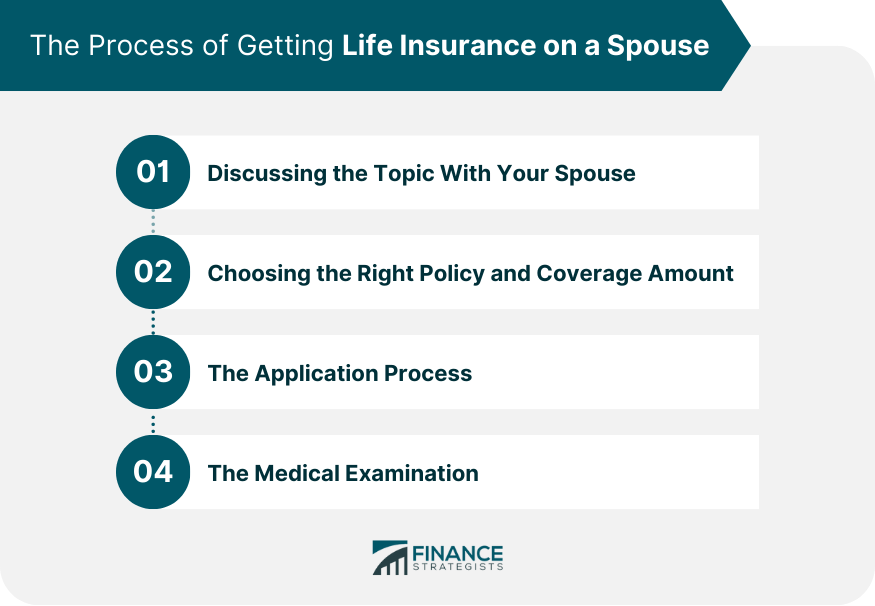

Process of Getting Life Insurance on a Spouse

Discussing the Topic With Your Spouse

Choosing the Right Policy and Coverage Amount

The Application Process

The Medical Examination

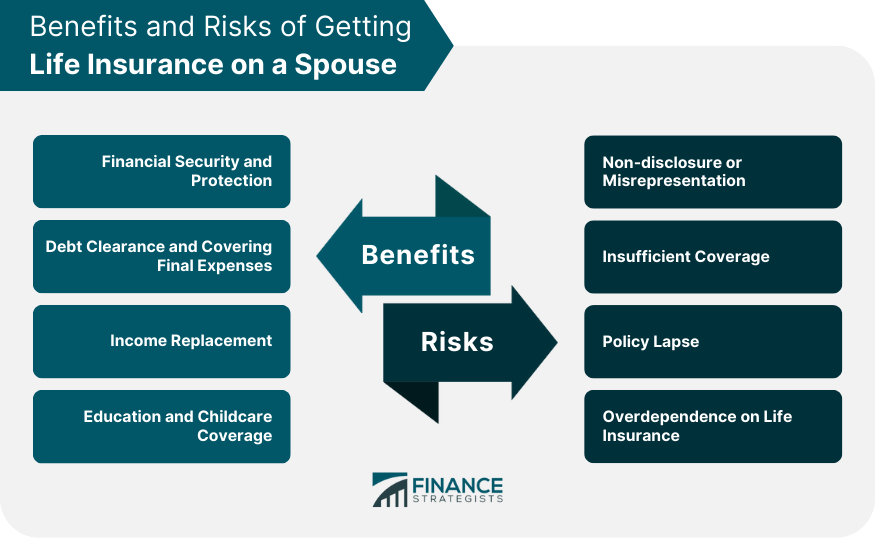

Benefits of Getting Life Insurance on a Spouse

Financial Security and Protection

Debt Clearance and Covering Final Expenses

Income Replacement

Education and Childcare Coverage

Risks of Getting Life Insurance on a Spouse

Non-disclosure or Misrepresentation

Insufficient Coverage

Policy Lapse

Overdependence on Life Insurance

Key Factors to Consider When Getting Life Insurance on a Spouse

Spouse's Health and Age

Lifestyle and Occupation

Existing Financial Obligations

Future Financial Goals

Conclusion

Can I Get Life Insurance on My Spouse? FAQs

No, it's not ethically acceptable or typically legal to get life insurance on your spouse without their knowledge. Consent is required during the application process, and open and honest communication is vital in this process.

When deciding on the coverage amount, consider your spouse's income, your shared financial responsibilities, existing debts, future financial goals, and the lifestyle you want to maintain for your family.

The risks include non-disclosure or misrepresentation of information during the application process, purchasing insufficient coverage, policy lapse due to non-payment of premiums, and overdependence on life insurance for financial security.

There are three main types: term life insurance, which provides coverage for a specific period; whole life insurance, which offers lifetime coverage and a cash value component; and universal life insurance, which also has a cash value component but provides more flexibility in terms of premium and death benefit amounts.

Getting life insurance on your spouse can provide financial security and protection, cover final expenses and outstanding debts, serve as an income replacement, and help with future costs like childcare and education. It's a critical part of comprehensive financial planning.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.