Decreasing term insurance, a specific type of life insurance, offers coverage that declines in value over time. This coverage is designed to cater to the policyholder's changing financial needs, providing protection for a limited period. Affordability is a key advantage of decreasing term insurance. Premiums tend to be lower than those of whole-life or level-term insurance policies since the death benefit decreases over time. This makes it an attractive option for those on a tight budget or with specific financial needs. Another benefit of decreasing term insurance is its simplicity. Policyholders can easily understand and manage their coverage, as the policy terms and conditions are generally straightforward. Additionally, many decreasing-term insurance policies offer the option to convert to other types of insurance, such as whole life or universal life, providing flexibility for the insured. One of the primary uses of decreasing term insurance is mortgage protection. As homeowners pay off their mortgage over time, the outstanding balance decreases. A decreasing term insurance policy can be tailored to match the mortgage's declining balance, ensuring that the policy's death benefit would be sufficient to pay off the mortgage in the event of the policyholder's death. Business owners may also use decreasing term insurance to protect against outstanding loan balances. As the loan is paid off, the coverage amount decreases, providing the necessary financial protection for the business. Families with dependents may choose decreasing term insurance to cover the loss of income due to the death of a breadwinner. As the family's financial needs change over time, such as when children become self-sufficient, the coverage amount decreases accordingly. Parents can use decreasing term insurance to secure their children's future education expenses. As children grow older and the anticipated cost of education nears, the policy's death benefit decreases. The policyholder's age plays a significant role in determining the premiums for decreasing term insurance. Generally, younger individuals will pay lower premiums compared to their older counterparts. The policyholder's health is another important factor in premium calculation. Applicants with good health and no pre-existing medical conditions usually qualify for lower premiums. Engaging in high-risk activities or making lifestyle choices like smoking can have an impact on the premiums of decreasing term insurance. Insurers may increase premiums for individuals with riskier lifestyles. The policy term and coverage amount also influence premiums. Longer policy terms and higher coverage amounts typically result in higher premiums. The policy term is the duration of the insurance coverage. Decreasing-term insurance policies typically have terms ranging from 10 to 30 years. The policyholder pays premiums during the term, and the coverage amount decreases over time. If the policyholder dies during the policy term, the beneficiaries receive the death benefit according to the policy's coverage at the time of death. The coverage amount decreases either annually or monthly, depending on the policy. The coverage amount reaches zero at the end of the policy term, and the policy expires. If the policyholder outlives the term, there is no payout or cash value associated with the policy. Some decreasing term insurance policies offer a convertibility feature, allowing policyholders to switch to a different type of insurance policy, such as whole life or universal life, without undergoing additional underwriting or providing evidence of insurability. When converting a decreasing term insurance policy, policyholders may have several options, including converting the entire coverage amount or a portion of it. Reviewing the policy's specific terms and conditions is essential to understanding the available conversion options. Policyholders should evaluate their financial needs and goals before changing to a different policy. Factors to consider include the new policy's premiums, potential cash value accumulation, and the policyholder's age and health at the time of conversion. Comparing quotes from multiple insurance providers is crucial to find the best policy at the most competitive price. Online comparison tools and independent insurance agents can help simplify this process. When choosing a decreasing term insurance policy, consider factors such as the policy term, coverage amount, premium cost, and convertibility options. Select a policy that aligns with the policyholder's financial needs and objectives. Researching insurance companies' financial strength and reputation before purchasing a policy is essential. Independent rating agencies, such as A.M. Best and Standard & Poor's, provide ratings that assess insurance companies' financial stability and ability to meet their obligations. Financial advisors and insurance agents can provide valuable insights and guidance when selecting a decreasing-term insurance policy. These professionals can help assess an individual's financial needs and recommend suitable insurance products. Decreasing term insurance provides a death benefit that decreases over time, while level term insurance offers a fixed death benefit throughout the policy term. The choice between these two types of insurance depends on an individual's financial needs and goals. Premiums for decreasing term insurance are generally lower than those for level term insurance. This is because the death benefit in decreasing term insurance reduces over time, resulting in a lower overall risk for the insurer. When deciding between decreasing term insurance and level term insurance, individuals should consider factors such as their financial needs, budget, and the purpose of the insurance coverage. Each policy type has its advantages, and the right choice will depend on the individual's unique circumstances. Decreasing term insurance offers valuable benefits and uses for individuals seeking affordable and flexible coverage. With a declining death benefit over time, it caters to changing financial needs, making it suitable for those on a tight budget or with specific requirements. It is commonly used for mortgage protection, business loans, family income protection, and education funds for dependents. Premiums are influenced by age, health, lifestyle choices, policy term, and coverage amount. Understanding how decreasing term insurance works, including the policy term, decreasing coverage, and policy expiration, is crucial. The convertibility feature allows policyholders to switch to other policies without additional underwriting. Selecting the right policy involves comparing quotes, evaluating coverage options, researching insurance companies, and seeking professional advice. Lastly, the choice between decreasing term insurance and level term insurance depends on individual financial goals and needs, with varying coverage and premium structures.What Is Decreasing Term Insurance?

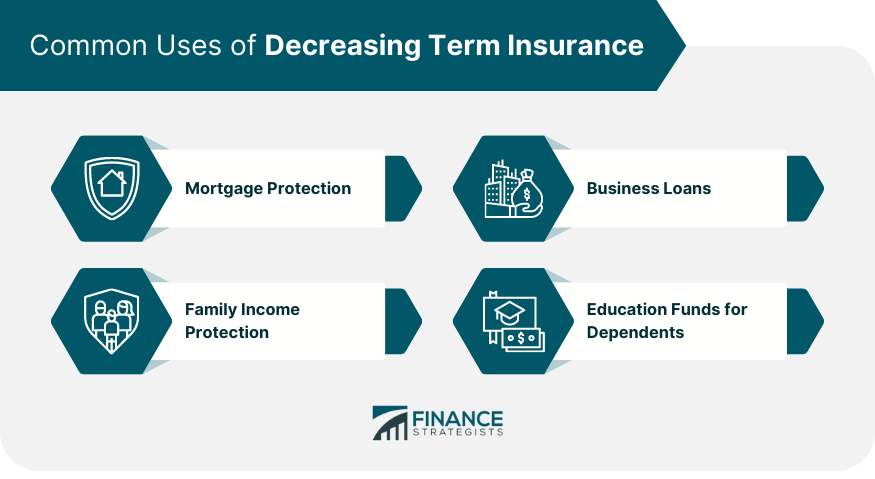

Common Uses of Decreasing Term Insurance

Mortgage Protection

Business Loans

Family Income Protection

Education Funds for Dependents

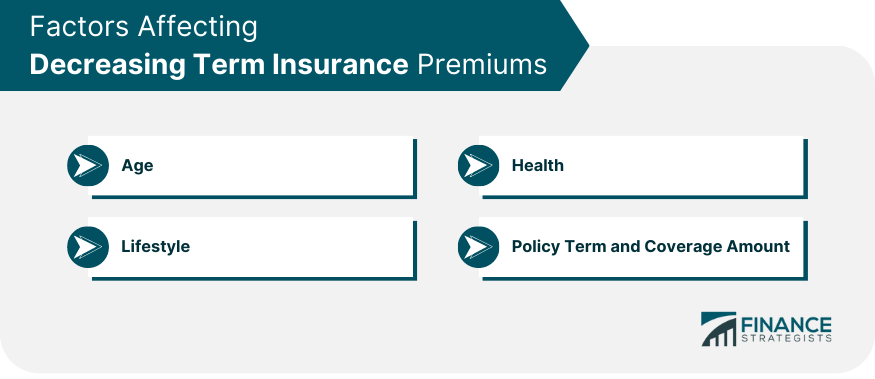

Factors Influencing Decreasing Term Insurance Premiums

Age

Health

Lifestyle

Policy Term and Coverage Amount

How Decreasing Term Insurance Works

Understanding Policy Term

Death Benefits and Decreasing Coverage

Policy Expiration

Converting Decreasing Term Insurance to Another Policy

Convertibility Feature

Conversion Options

Factors to Consider When Converting

Tips for Selecting Decreasing Term Insurance

Comparing Quotes

Selecting the Right Policy and Coverage

Evaluating Insurance Companies

Seeking Professional Advice

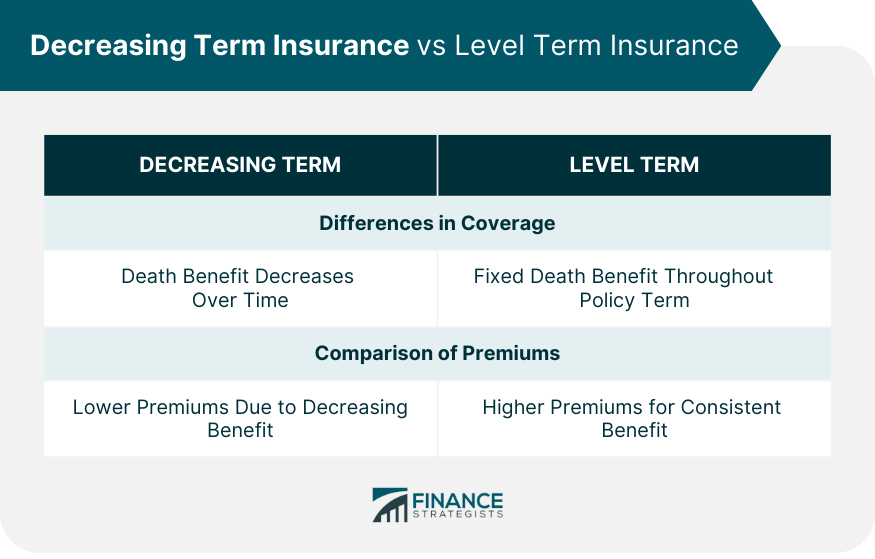

Decreasing Term Insurance vs Level Term Insurance

Differences in Coverage

Comparison of Premiums

Choosing the Appropriate Policy

Conclusion

Decreasing Term Insurance FAQs

Decreasing term insurance is a type of life insurance policy that provides a decreasing death benefit with a level premium over time. The policy is designed to cover the decreasing financial needs of policyholders as they age and their financial obligations decrease.

Decreasing-term insurance is suitable for individuals with financial obligations that decrease over time, such as mortgages or long-term loans. It's also an affordable option for those who want to ensure that their loved ones will be financially protected if they pass away unexpectedly.

Unlike other types of life insurance, decreasing term insurance provides a decreasing death benefit over time while the premiums remain level. It's also more affordable than other life insurance types, as the death benefit decreases over time.

The length of the policy can vary depending on the policyholder's needs. However, most policies are designed to cover the length of time for which the policyholder has financial obligations, such as a mortgage or other long-term loan.

No, decreasing term insurance cannot increase the death benefit. However, policyholders can purchase an additional policy or rider to provide additional coverage if needed. It's important to review and update the policy regularly to ensure it meets the policyholder's needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.